IWM trade ideas

IWM Appears Due for a Minimum 40-60% Downside CorrectionOn the lower timeframes IWM has been treating $223 as short term support with much sold put leverage building at $220 and recently IWM has begun to retrace back down into those levels putting those sold puts at risk of expanding the volatility and of squeezing through these short puts as a result.

The short term the loss of this zone could likely squeeze down to $200.

However in the longer term we have been trading within this much larger parallel channel since the peak and bottom of 2008-2009 GFC and have started to form a potential peak paired with a Bearish Shark. I think that if we were to start to see some serious downside the IWM could trade back down to not just the bottom of the channel but down to one of the 3 major horizontal supports I have plotted on the cart down at $121, $85.74, or even $41.11 if things get real bad.

Personally I will be targeting one of the 2 upper horizontal supports in the longer dated positioning while targeting the $210-$200 levels in the short term.

I'd suspect this decline to come especially as Fed Rate cut expectations are completely priced out of the market, it is worth mentioning that fed funds futures around the start of the month dropped their expectations of rate cuts for the September meeting down to 0 and we may now be on the path to pricing in rate hikes as seen in the chart below.

Alternatively the expectations for rates going into the end of December has been on a fast trajectory of pricing out rate cuts as well, starting at 90BPS of rate cuts at the start of the year, now pricing in only 37.5BPS in rate cuts:

This ongoing shift in these fed futures spreads from positive to negative signifies the amount that Fed Funds Futures are expecting the Fed to hike rates with both the instance of rate hikes and rate cuts likely to cause a collapse in credit spreads as the bond market yield shift higher leaving the interest rate sensitive IWM to be one of the most negatively affected.

IWM Looks like 240 is incoming, most likely this move comes with a cool Core PCE this Friday and if not then, then most likely on next month job numbers .

Weekly trendline resistance from 2010 has resistance at around 240ish.

That's only another 3% upside

In an extreme move we could see price momentarily push above 240 and tag 245

From 245 I can't see price heading higher going into Seasonality of Sept.. so I'd be looking for a top signal above 240 and a correction from there to 210.00

Here's the price action from April lows..

Simple channel..

I don't think we tag support again until 240 is tested, we could just grind mid channel all the way back to ATH like that Green circle of price I highlighted.. let's see if we get more of a dip towards 230-232 before Friday's core pce , IMO that would be the entry for a final leg up.

IWM is ready to make a larger move out of this wedge📈 IWM Technical Outlook – Wedge Break Imminent

Ticker: IWM (Russell 2000 ETF)

Timeframe: 30-minute candles

🔍 Current Setup

IWM has formed a symmetrical wedge, with price compressing between a descending resistance line (~227) and an ascending support line (~223.65). This pattern reflects a balance of buyers and sellers — and it’s nearing its apex, signaling that a decisive breakout is likely very soon.

📊 Breakout Levels

🚀 Upside (Bullish Scenario)

Trigger: Close above 227.00 with volume

Intermediate Targets:

231.50–232.00 → Prior swing high resistance

235.00–236.00 → Momentum continuation zone

Measured Move Target: 237.00

🔻 Downside (Bearish Scenario)

Trigger: Close below 223.65 with volume

Intermediate Supports:

221.00 → Local demand area

217.00 → Previous consolidation base

Measured Move Target: 213.50

📈 Volume Analysis

Recent candles show a pickup in volume, a classic sign that markets are preparing for a strong move.

Whichever side breaks first is likely to carry momentum, with follow-through expected.

⚖️ Probability Bias

Current price action suggests buyers are defending the rising trendline, but momentum has slowed since the last rally.

A strong close above 227 would put bulls firmly in control.

Conversely, failure to hold 223.65 opens the door for a deeper correction.

✅ Takeaway

The wedge is tight, and the breakout is imminent:

Bullish Break > 227: Look for 231.50 → 235 → 237

Bearish Break < 223.65: Look for 221 → 217 → 213.50

Stay alert — volume will confirm the true direction.

IWM (Russell 2000 ETF) Update - Bearish Analysis. IWM (Russell 2000 ETF) Update

Price rejected from the 226–227 zone (Fib 0.786) and failed to reclaim the breakout structure. Currently consolidating below resistance, which opens room for a possible leg lower.

🔹 Key resistance: 225.7 – 226.0

🔹 Target support: 219.0 zone

🔹 Bias: Short-term bearish unless buyers reclaim above 226

Watching if price accelerates into the 219 demand zone for a potential reaction. Risk management is key in this environment.

IWM Weekly Setup – Long OpportunitySpotted a promising long setup on the iShares Russell 2000 ETF (IWM) weekly chart. The price action is showing bullish momentum supported by volume and trend indicators.

🔹 Entry Zone: Current levels

🔹 Stop Loss: 196$ – below super trend line

🔹 Target: 260$

Technical indicators and moving averages are aligning for a potential breakout. Risk management is key – keep an eye on volume and macro sentiment.

Let me know your thoughts or if you're watching IWM too!

#IWM #Russell2000 #ETF #TechnicalAnalysis #SwingTrade #TradingSetup #Finance

$IWM Analysis, Key Levels & Targets

WOW - look at this crazy move today after CPI. IWM gapped o er the 1hr 200MA and the 30min 200 combo and rallied like crazy. It blew passed all of the levels and filled the bear gap from last month 😳

Spread traders - wait until we are closing within the trading range consistently again.

224 tomorrow?

(HIT GRAB THIS CHART - UNDER THE CHART NEXT TO THE 🚀)

Is iShares Russell 2000 ETF Setting Up for a Bullish Breakout?Current Price: $220.32

Direction: LONG

Targets:

- T1 = $226.04

- T2 = $231.21

Stop Levels:

- S1 = $218.54

- S2 = $216.78

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in iShares Russell 2000 ETF.

**Key Insights:**

The iShares Russell 2000 ETF (IWM), a benchmark for U.S. small-cap stocks, is in consolidation mode after modest underperformance compared to large-cap indices like the S&P 500. Technical signals suggest a potential bullish setup as long as key support levels hold. Breakouts above resistance might reintroduce momentum for long-term gains. This setup comes at a time when large-cap movements may create spillover opportunities for the broader market.

The ETF is currently navigating a support zone, where the behavior of price action will determine its trajectory. Experienced traders emphasize watching for an ascending wedge pattern, signaling upward momentum as long as the $218 support holds firmly.

**Recent Performance:**

IWM has faced short-term bearish pressure despite maintaining its position above significant long-term moving averages. The ETF is trading in a neutral-to-bearish zone with sideways movement, reflecting investor uncertainty around small-cap stocks. While the past few months have seen moderate dips, the ETF has managed to remain resilient, stabilizing within a consolidation range.

**Expert Analysis:**

Financial analysts cite that current technical patterns favor a cautious approach but highlight potential upside if resistance levels near $225.69 are breached. This move could trigger a bullish continuation rally within the small-cap sector. Conversely, a close below $218.72 may signal deeper bearish trends. Experts also note that small-cap stocks could benefit from the so-called "January Effect," where historically, small-cap equities tend to outperform at the beginning of the year, a seasonality factor worth considering.

**News Impact:**

Broader macroeconomic concerns, including inflation and interest rate uncertainty, continue to dampen sentiment in the small-cap market. Additionally, weaker earnings reports from companies within the Russell 2000 Index have dampened enthusiasm. However, the release of positive economic data, including improved employment numbers and GDP growth, along with progress in diplomatic discussions, could spark renewed interest in U.S. smaller-capitalization equities.

**Trading Recommendation:**

The iShares Russell 2000 ETF is poised for potential upside as long as support levels at $218 are defended. Traders are encouraged to take a longer-term bullish stance with targets at $226.04 and $231.21. However, it is crucial to manage risks, with stop levels placed at $218.54 and $216.78 to safeguard positions in case bearish pressure resumes. Continued monitoring for breakout signals will be key for successful execution.

IWM LongOn the 15-minute IWM chart, the broader market structure recently shifted from bearish to bullish after printing a Change of Character (CHoCH) at 226.71, breaking above a prior lower high and signaling a potential reversal. This came after a strong rally from the 212.34 BOS point, where price had previously broken down and set a lower low. The current structure suggests buyers are attempting to reclaim control, and the higher-low pattern forming supports a continuation bias.

Demand is clustered between 217.80–218.80 and a deeper zone at 214.50–215.50. In both areas, buyers stepped in decisively in the past, causing swift upward moves, which marks them as strong zones. Supply is layered between 222.80–224.00 and 226.00–227.00. Price dropped sharply from both these regions previously, showing that sellers were aggressive there, with the upper zone being the key resistance tied to the CHoCH level.

In the marked region, price is consolidating just above the 218s demand zone, holding structure while failing to break higher immediately. This suggests a likely short pullback into the 218.00–218.80 area to reload buy orders before pushing toward the 224.00 mid-supply and possibly retesting the 226.71 high.

Trade bias: Bullish

Expected direction: Higher after a shallow pullback into demand

Invalidation level: A break below 217.80 would undermine the bullish setup

Momentum condition: Slightly favors buyers, with price maintaining higher lows despite stalling at resistance

Candle behavior: Small-bodied candles in consolidation, indicating accumulation rather than heavy selling

$IWM 30min200 & 1hr200 resistance // Last Friday reviewAMEX:IWM 30min200 & 1hr200 resistance // Last Friday review

Look at how the 1hr 200 and then the 30min 200 have been acting as resistance - and then how they potentially cross in tomorrow’s trading range, with the 35EMA (red line) underneath both of them.

We did start the week gapping up off of the 50Day moving average and we held that!!

The Ghost of 1986-1987 Stock Market Overlay onto $IWMThe 1986-1987 stock market advance was 48% as measured by the S&P500 Index SP:SPX from the low in late 1986 which peaked in August 1987 and crashed into October 19th's spectacular 20% decline in one day.

The advance in the Russell 2000 Index from the low in 2023 to the high in 2024 was 51%, topping the 48% gain in the SP:SPX and the meltdown wasn't as spectacular, but it was similar.

There were similar patterns in fears of trade wars, US dollar declines, new tax laws going into effect back then and tax laws sunsetting this time. Those you can go into by reviewing my other charts I have published over the years here.

I stretched the 1987 pattern to fit the low to the high, so it isn't "exactly" the same time day-to-day for this pattern.

I found it interesting because the chart of AMEX:IWM all by itself had the same "look" to me as the 1987 bull market and crash so I decided to put it together for you all here to see.

I would expect a choppy market from here on as people adjust to the new uncertainties. Sellers of this decline will be shy to reinvest anytime soon and buyers are likely afraid to step up and get aggressive with so much uncertainty.

Sentiment as measured by AAII shows an extremely fearful and reluctant investor class, which is typical to see at major market bottoms.

Wishing everyone peace and prosperity!

Tim West

11:17AM EST April 24, 2025

IWM is Overbought### ⚠️ \ AMEX:IWM Bearish Setup Alert — Weekly PUT Trade (Aug 3, 2025)

> **Momentum breakdown + institutional volume = high-probability short play**

📉 **Market Breakdown:**

* **📉 Daily RSI:** 34.9 → Bearish momentum under key 45 level

* **📊 Weekly RSI:** 53.0 → Neutral but slipping = trend weakening

* **📈 Volume Spike:** 1.4x → Institutional moves hint at potential sell-off

* **⚖️ Options Flow:** 1.00 C/P ratio → No bias = wait for price action

* **💀 Max Pain:** \$222.50 → Downward price magnet

* **🌪️ VIX:** 20.38 → Normal vol zone, good for option plays

---

### 💥 Trade Setup – 5D Weekly PUT

| Entry | 🎯 Target | 🛑 Stop Loss | ⚖️ R/R Ratio | 📅 Expiry |

| ------ | ------------- | ------------- | ------------ | ---------- |

| \$0.92 | \$1.35 (+50%) | \$0.45 (-50%) | 1:1.5 | 2025-08-08 |

🔻 **Strike:** \$208.00

💼 **Type:** Naked PUT

⏰ **Timing:** Enter at market open

📈 **Confidence:** 70%

🧠 **Logic:** Bearish RSI + volume surge + neutral flow = downside edge

---

### 🔍 Summary

> “IWM is losing grip. Momentum says down. Big players are already positioning.”

> 🔸 Short-term PUTs offer attractive R/R

> 🔸 Low volatility improves pricing

> 🔸 Weekly RSI still neutral → stay nimble

---

📊 **TRADE DETAILS**

🎯 Instrument: **IWM**

🔀 Direction: **PUT (SHORT)**

🎯 Strike: **\$208.00**

💵 Entry: **\$0.92**

🎯 Target: **\$1.35**

🛑 Stop Loss: **\$0.45**

📅 Expiry: **2025-08-08**

📈 Confidence: **70%**

🕒 Entry Timing: **Open**

---

### 💡 Tag It:

\#IWM #PutOptions #WeeklyTrade #BearishMomentum #RSIAlert #OptionsFlow #MaxPainTheory #VolatilityTrading #MarketOutlook #TradingView #OptionsAlert

IWM Stock Chart Fibonacci Analysis 080125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 214/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Quantum's Missed IWM Short 8/1/25Well had a moment where I backed out of a A+++ setup. IWM had a ton of -gex pull down to 206. Would have been a massive short to end the week. I canceled my order instantly for no reason at all and missed it. Overall had a great day but this is what separates the elite from the average trader. Will work on this next week.

IWM Short1. Broader Market Structure 📉

1.1 Change of Character (CHoCH)

Occurred near the top (~226.70), breaking the prior higher low—signaling a shift from bullish to bearish momentum.

1.2 Break of Structure (BOS)

Confirmed by a move below that level, validating the bearish change and underlining a downtrend in progress.

2. Supply & Demand Zones

2.1 Demand Zones (Support)

Price zones where buyers have previously stepped in, marking potential reversal points:

Zone A (~223.00–223.50) – First layer of support; price tested this zone after the BOS.

Zone B (~221.80–222.20) – Mid-range demand area with historical buyer activity.

Zone C (~220.00–220.50) – Deeper support zone; last line before structural lows.

Key Takeaway: These zones represent probable stops for a short-term pullback and are ideal for long-entry decisions.

2.2 Supply Zone (Resistance)

~226.70–226.75 – Located at the level where BOS occurred; acts as near-term resistance where sellers may reassert control.

3. Price Action Inside the Bordered Area

Current Price (~224.55): Hovering between the supply and first demand zone.

Expected Movement:

A pullback into Zone A (~223.00–223.50).

If demand holds, look for a bullish reaction—forming a higher low, potentially pushing price back toward 226.70+.

Bearish Risk: A break below Zone A increases downside risk into Zone B or C, reinforcing the bearish structure.

4. Momentum & Structure Outlook

Bullish Scenario: A bounce from demand with structure preserved (~higher low) could lead to short-term upside into resistance.

Bearish Scenario: A drop below the bordered demand zone would confirm continuation of the downtrend.

Watch: Price structure around the 224–223 area and reversal cues (e.g., rejection candles, volume spikes).

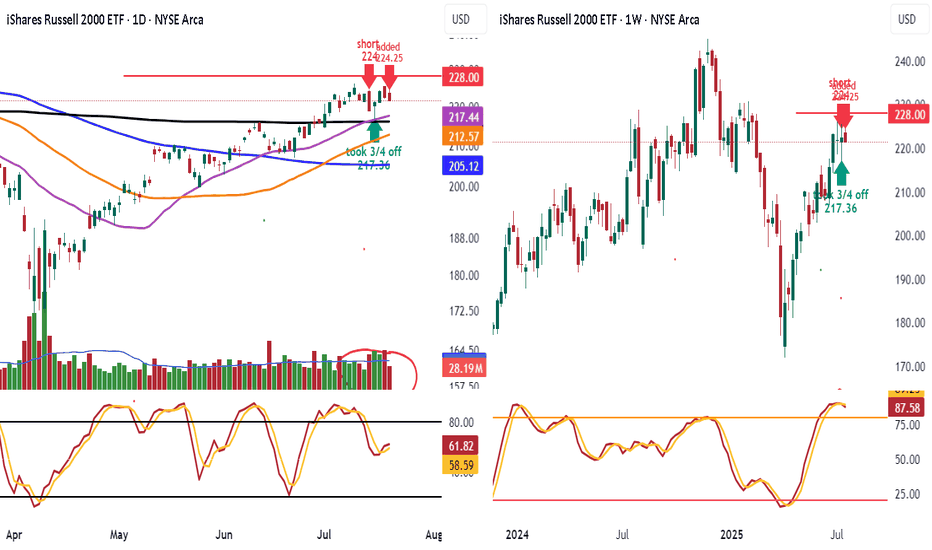

IWM short 224 and 224.25Shorted IWM going into resistance

on daily. Target is 216 I will take 3/4 off re add when breaks

the 50 day 212.57 and 100 day 205.12 watch daily stoch see they roll over

Look weekly rolling over but needs break 68%. Look weekly making lower highs

See we can get a follow thru selling today with more selling vol

Have trailing stop in place