DVN exchange rate before 39% rise... The analysis shows that the exchange tests a MA (50) axis symmetrically. This is similar to the symmetrical backtest of the previous fractal. I look forward to completing this correction tomorrow and turning north again. In the event that the price copied the previous fractal sequence (which I see the greatest chance of), it could repeat itself around the MA (100) axis. From there, I'm expecting a higher rate of climb. The price of this target is 30.16 usd.

1DY6 trade ideas

DVN before rising 28%... The exchange rate moves in a triple falling wave pattern. Each wave is half of the leading wave structure. Currently, the exchange rate is building a rising wave structure. A fractal appeared in it, and its repetition now appears. If the theory is correct, the target price for the exchange is US $ 33.57

DVN before 15% gain... The exchange rate reached its correct level. From this level, we can see a "double bottom" turn. Strong signal to prepare for a further rise. If we examine the ATR axis, it appears to form a rising channel. These two indications strongly suggest that a steady and sustained rise is expected. The target price is the top of the channel 36USD.

DVN Rate Before Increasing...The exchange rate reached the bottom of the correction level. This level was around 30.5usd. We expect a definite increase from this level. The exchange rate increases in a triple wave structure. The peak of the first wave structure is 40.48usd. Then correction can be around 2-3 usd. Then rising second and third wave structures. Our target price is 48.4usd.

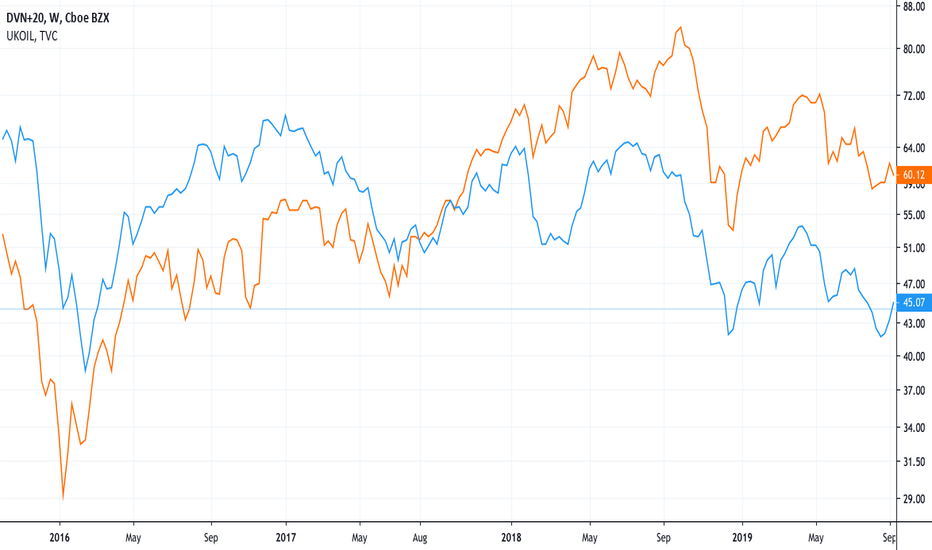

DVN has completed its decreasing movement... In the previous analysis, we assumed the formation of a new decreasing wave structure, but the structure of the ATR axis of recent days has not confirmed this. Therefore, we strongly assume that it has reached the bottom of the exchange rate. You can now build a rising wave structure. The size and structure of which is a double fractal structure. The figure shows a good visible fractal, as well as the fractal structure of the double fracture. Which peak points or valley levels can be given by the ATR axis or its parallel axes. If the place of the theory of exchange rate rise is 55 usd level environment. The current level is a 35% rise in yield.

The DVN rate is still falling... The exchange rate is based on the last drop of wave. Its bottom is 37usd. From this level, a small wave structure and a slow motion can be sustained. The turn can start with an ABC wave. Then with the emergence of the triple wave structure, Where growth can accelerate. The target price of the exchange rate is 53.2 usd. Which can be a profit of 43% of the planned entry level.

DVN stay long...DVN stay long. The exchange rate moves in the third rising elliot wave structure. The size of the motion, following elliot rule, is equal to the size of the first wave. If the finding is correct, the next target price for the exchange is 55 usd. From this level I will again expect an ABC correction wave motion.

DEVON ENERGY CORP long ...DEVON ENERGY CORP long ... The exchange rate moves in a dual wave motion. The ATR (D1) is 1.66 times the previous value. This means that the distance of the exchange rate movement can be greater than 1.66 times the wave (BC) wave period as in the (0A) wave period. This may also have the consequence that the wave (BC) is twice as large as the wave structure (0A). The (BC) wave periodus target price is 56usd.