MDB: at mid-term resistancePrice has reached a key mid-term resistance level, moving in line with the trend structure outlined in the September update.

As long as price remains below the 410 resistance, I expect selling pressure to start building — potentially initiating a pullback that could form a new base before a more s

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.85 EUR

−124.61 M EUR

1.94 B EUR

78.52 M

About MongoDB, Inc.

Sector

Industry

CEO

Chirantan C. J. Desai

Website

Headquarters

New York

Founded

2007

ISIN

US60937P1066

FIGI

BBG01TNY11H3

MongoDB, Inc. engages in the development and provision of a general-purpose database platform. The firm's products include MongoDB Enterprise Advanced, MongoDB Atlas, and Community Server. It also offers professional services including consulting and training. The company was founded by Eliot Horowitz, Dwight A. Merriman, Kevin P. Ryan, and Geir Magnusson Jr. in November 2007 and is headquartered in New York, NY.

Related stocks

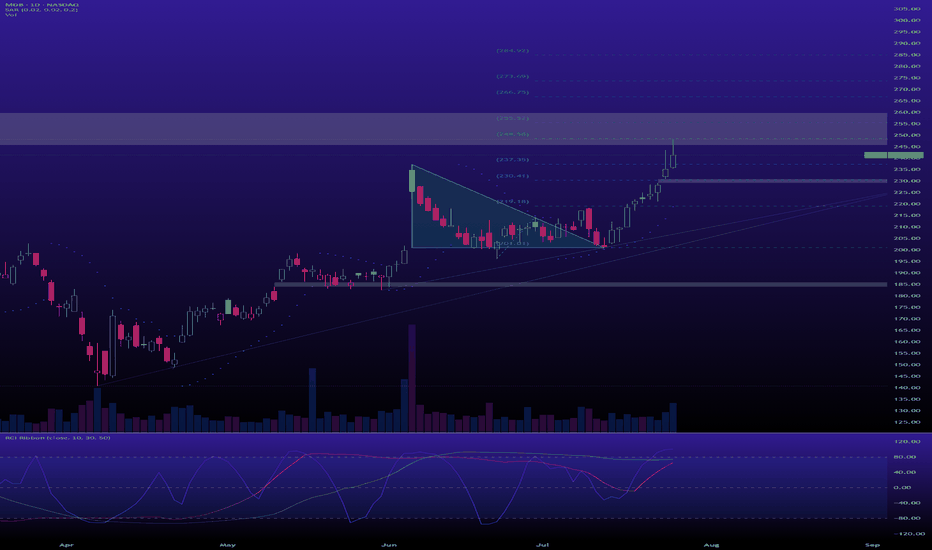

A classic 3-week sideway on $MDBThe earnings-driven breakout was a massive Sign of Strength (SOS) that initiated the Markup Phase (Phase E). The three-week sideways channel is a textbook re-accumulation pattern—a "stepping stone" on the way up. The low volume confirms a lack of selling pressure; there is simply no supply hitting

MDB - Short thesis: Data Dump/MongoDB-bye! :-)

Potential short case based on technical analysis patterns and trendline analysis.

The analysis is based on two timeframes: the Weekly (1W) and the 4-Hour (4h) charts.

Technical Analysis for MDB Short Case

1. Head and Shoulders Pattern (4h Chart)

The most prominent feature is the potential formatio

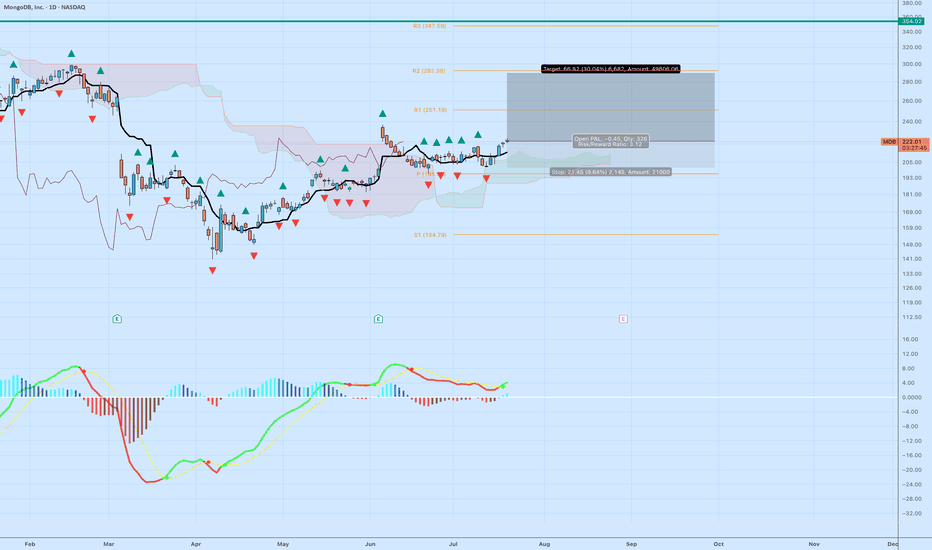

MDB – Clean Ichimoku Breakout with MACD + Fractal ConfirmationMongoDB (MDB) is setting up for a high-probability swing trade. Price has cleanly broken above the Ichimoku cloud, supported by bullish structure and a MACD crossover. This move is reinforced by upward fractal confirmations just below recent highs.

Why I like this trade:

Price broke above the clou

MDB: pull-back to the 300 zone before testing the 360 zoneThe company reported total revenue of $488.5 million, a 25% increase year-over-year, surpassing analyst expectations. A significant portion of this growth was driven by its database-as-a-service offering, Atlas, which saw its revenue climb 32% year-over-year to $332.2 million and now constitutes 68%

$MDB: MongoDB Inc. – Data Dynamo or Overreaction Bust?(1/9)

Good evening, tech fiends! 🌙 NASDAQ:MDB : MongoDB Inc. – Data Dynamo or Overreaction Bust?

MongoDB’s Q4 crushed it with $548.4M revenue, but a soft FY2026 outlook tanked the stock. Is this a market meltdown or a golden buy? Let’s unpack the chaos! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Q4 FY202

MDB Earnings Setup | \$230C Aug 29 | 200–400% Potential

# 🔥 MDB Earnings Setup | \$230C Aug 29 | 200–400% Potential 🚀

📊 **Bias**: Moderate Bullish (72% confidence)

✅ **Fundamentals**: 100% beat streak (last 8 Qs), 21.9% YoY revenue growth, strong FCF + cash buffer.

✅ **Options Flow**: Heavy OI at \$230C (2,028) + balanced 200P hedge. IV elevated → big

$MDB is currently in a mark-up phaseAfter spending months buying up every share the sellers would give him, the composite man has finally launched the rocket; it would be rude not to hop on for the ride.

Support & Resistance Levels

Next Week (August 4 - August 8, 2025):

Support: A healthy pullback would find support in the $230 - $2

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where 1MDB is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 1MDB is 276.20 EUR — it has decreased by −6.89% in the past 24 hours. Watch MongoDB, Inc. Class A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange MongoDB, Inc. Class A stocks are traded under the ticker 1MDB.

1MDB stock has fallen by −9.83% compared to the previous week, the month change is a −0.63% fall, over the last year MongoDB, Inc. Class A has showed a 82.84% increase.

We've gathered analysts' opinions on MongoDB, Inc. Class A future price: according to them, 1MDB price has a max estimate of 381.40 EUR and a min estimate of 216.71 EUR. Watch 1MDB chart and read a more detailed MongoDB, Inc. Class A stock forecast: see what analysts think of MongoDB, Inc. Class A and suggest that you do with its stocks.

1MDB reached its all-time high on Nov 12, 2025 with the price of 326.60 EUR, and its all-time low was 150.80 EUR and was reached on Apr 30, 2025. View more price dynamics on 1MDB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1MDB stock is 0.00% volatile and has beta coefficient of 1.78. Track MongoDB, Inc. Class A stock price on the chart and check out the list of the most volatile stocks — is MongoDB, Inc. Class A there?

Today MongoDB, Inc. Class A has the market capitalization of 22.69 B, it has decreased by −3.29% over the last week.

Yes, you can track MongoDB, Inc. Class A financials in yearly and quarterly reports right on TradingView.

MongoDB, Inc. Class A is going to release the next earnings report on Dec 1, 2025. Keep track of upcoming events with our Earnings Calendar.

1MDB earnings for the last quarter are 0.88 EUR per share, whereas the estimation was 0.59 EUR resulting in a 49.22% surprise. The estimated earnings for the next quarter are 0.70 EUR per share. See more details about MongoDB, Inc. Class A earnings.

MongoDB, Inc. Class A revenue for the last quarter amounts to 518.04 M EUR, despite the estimated figure of 485.33 M EUR. In the next quarter, revenue is expected to reach 514.80 M EUR.

1MDB net income for the last quarter is −41.21 M EUR, while the quarter before that showed −33.22 M EUR of net income which accounts for −24.04% change. Track more MongoDB, Inc. Class A financial stats to get the full picture.

No, 1MDB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Nov 24, 2025, the company has 5.56 K employees. See our rating of the largest employees — is MongoDB, Inc. Class A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MongoDB, Inc. Class A EBITDA is −117.36 M EUR, and current EBITDA margin is −9.43%. See more stats in MongoDB, Inc. Class A financial statements.

Like other stocks, 1MDB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MongoDB, Inc. Class A stock right from TradingView charts — choose your broker and connect to your account.