TSLA nearing breakout TSLA’s been winding tighter for weeks, and we’re finally pressing right up against the top of this symmetrical triangle on the 4H chart. Sitting at $333 price level after breaking out of that $315 area with some momentum behind it. Volume’s picking up, RSI’s pushing north of midline, and the MACD just flipped bullish.

If we can get a clean break and hold above that $335–$340 range, there’s room to stretch toward $367–$370, basically a retest of those June highs. But if we get rejected here, we probably stay stuck in this coil a bit longer. This is one of those decision point moments for TSLA where the next few candles could tell the story.

TL0 trade ideas

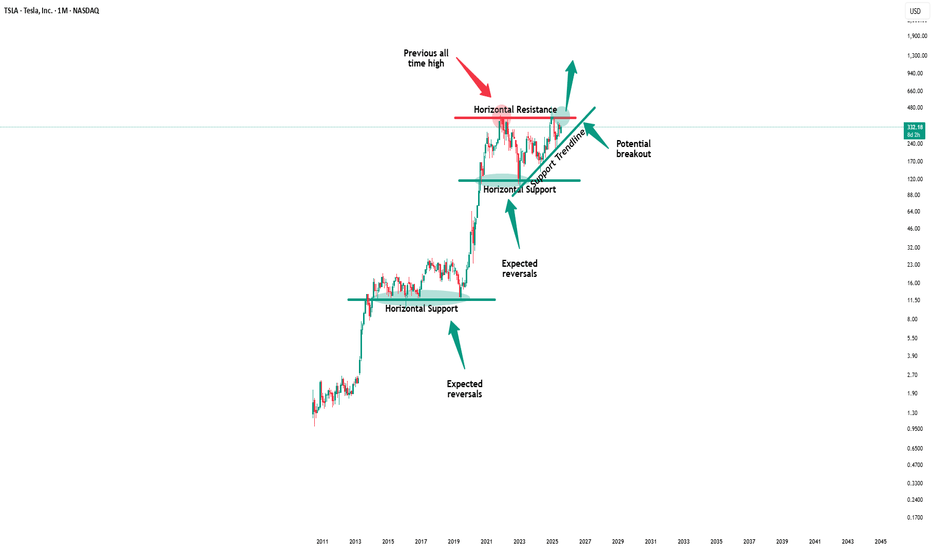

Tesla - The all time high breakout!🚗Tesla ( NASDAQ:TSLA ) will break out soon:

🔎Analysis summary:

For the past five years Tesla has overall been consolidating between support and resistance. But following the recent bullish break and retest, bulls are slowly taking over control. It is actually quite likely that Tesla will soon break above the previous all time highs.

📝Levels to watch:

$400

🙏🏻#LONGTERMVISION

SwingTraderPhil

TSLABased on the provided 4-hour chart of TSLA, here is a brief summary and outlook.

Tesla's stock price has been consolidating within a symmetrical triangle pattern since late May. The price is currently trading near the upper boundary of this triangle, which is a critical resistance level. The stochastic indicator is showing a bullish crossover and is trending upwards, but it is not yet in the overbought territory.

The chart presents two potential scenarios for the immediate future. A bullish breakout (green arrow) would occur if the price successfully breaks above the upper trendline and the resistance around $320. This could lead to a significant move towards the next target, potentially around $355, as indicated by the length of the triangle's base. Conversely, a bearish scenario (red shaded area) would see the price fail to break out and instead fall back towards the lower support trendline, possibly testing the support level around $303.

The key to the next move is a decisive breakout from the current pattern. Traders should monitor for a clear break above or below the trendlines with increased volume to confirm the direction. A successful breakout to the upside would signal a continuation of the previous uptrend, while a breakdown to the downside would suggest a potential bearish reversal. The support and resistance levels marked on the chart are key reference points for managing risk and setting targets.

TESLA Sellers In Panic! BUY!

My dear friends,

TESLA looks like it will make a good move, and here are the details:

The market is trading on 302.63 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 310.73

Recommended Stop Loss - 298.19

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Tight Squeeze in TeslaTesla rallied sharply in late 2024, followed by a drop in the first quarter. Now, after a long period of consolidation, some traders may think the EV maker is getting ready to move again.

The first pattern on today’s chart is the series of higher lows and lower highs since May. That converging triangle may give TSLA breakout potential.

Second, Bollinger Bandwidth has squeezed to a 13-month low. Will that price compression give way to expansion?

Third, the rising 200-day simple moving average may suggest a longer-term uptrend remains in effect.

Next, prices are trying to push above the 21-day exponential moving average. That may be consistent with increasing bullishness in the short term.

Finally, TSLA is a highly active underlier in the options market. (Its average daily volume of 2.3 million contracts ranks behind only Nvidia in the S&P 500, according to TradeStation data.) That may help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Tesla Breakout? For the majority of the calendar year TESLA has been in a range between $220 - $365 with a clear midpoint of $295.

From March to the beginning of May TESLA bounced between range low and the midpoint until finally breaking through into the upper half of the range where it has stayed ever since. However, there is a clear diagonal resistance level that is preventing higher highs.

So will TESLA breakout, or will it lose the midpoint? Structurally it is clear that the bulls have a set level they are happy to buy at (Midpoint) but the bears are getting more aggressive with their selling, hence the lower highs. This compression inevitably leads to an impulse move but the direction is not so clear.

Bullish scenario: A clean breakout with volume that makes a new higher high, signaling a shift in structure. A pullback and retest of the breakout would be an ideal opportunity to go long and aim for that range high before expecting resistance.

Bearish scenario: The lower highs keep printing until the midpoint is lost and price accepts below it, that would then signify to me the new trading range is between Range Low and Midpoint.

The fakeout scenario is a risk but with price so close to the midpoint already it follows the same invalidation criteria as the bullish scenario, the midpoint is vital to both sides.

Tesla Stock Gains After Musk Gets $30 Billion Award — What Now?Tesla board is hoping that the pile of shares would be enough to pin down the CEO and lock down his focus. But challenges are there. Here’s one — $30 billion might not be enough to keep Musk around.

💰 $30 Billion Retention Bonus

Tesla stock NASDAQ:TSLA is up about 4% since the start of the week after the board of directors handed Elon Musk a gift-wrapped, legally-contingent $30 billion stock package .

What’s inside? A cool 96 million shares — nearly enough to buy a small country or, at the very least, keep Musk’s wandering focus in the Tesla lane.

In a letter to shareholders, the board didn’t mince words: “We are confident that this award will incentivize Elon to remain at Tesla. Retaining Elon is more important than ever.” Translation: “Please don’t leave, here’s money.”

This isn’t just about stock awards or executive compensation. It’s about bringing back lost focus and whether the most famous CEO on the planet can be convinced to stop juggling a handful of companies and pay full attention (ok, more attention) to the one that’s public, highly volatile, and still kinda trying to figure out self-driving and robotaxis .

🎢 If the Stock Could Talk

The market’s response? Pretty bullish. Traders seem to like the idea of Musk staying inside the Tesla factory gates — or at least not moonlighting in so many side quests.

After all, Elon’s presence — erratic tweets, spontaneous product reveals, and all — is a core part of Tesla’s brand value. The stock has often behaved more like a crypto coin than a traditional automaker.

Musk already owns over 400 million shares, around 13% of Tesla, worth roughly $125 billion. But he’s gunning for more: his long-stated ambition is 25% voting control (equal to $250 billion in shares based on the current $1 trillion market valuation. This new package edges him closer to that goal. If he can’t own a country, a quarter of Tesla might do.

⚖️ A Legal Complication Worth $56 Billion

There’s one tiny footnote here: if Elon wins back his 2018 $56 billion pay package — the one struck down by a Delaware court — he might have to forfeit this new batch.

So yes, Tesla may have just given the richest man in the world a “Plan B” golden parachute. Or a “Plan A” depending on how Delaware judges are feeling when they decide on it.

🤖 AI, Robots, and Attention Deficits

Let’s not forget what lit the fire under this latest move. Back in January, Elon posted on X that he was “uncomfortable growing Tesla to be a leader in AI & robotics” without more control. It was a public shakedown — and apparently it worked.

Tesla’s ambitious AI goals — full self-driving software, Optimus the humanoid robot, and a suite of other sci-fi-sounding visions and promises — are largely tied to Musk’s personal involvement. Investors know that without him, these projects could end up shelved… or sold to xAI, his other pet project and owner of X (former Twitter).

🧮 The Math of Mega-Pay

Tesla says the accounting value of the package — after subtracting what Musk would have to pay to exercise the options and adjusting for restrictions — sits at about $23.7 billion. That's about the GDP of Malta and only slightly smaller than the SEC’s collective headache every time Musk tweets.

In return, Musk has to stick around for five years — or at least not officially leave. The board hopes that’s enough to keep him engaged. But the question is: How much is enough to counteract everything else going on?

The man’s worth $350 billion to $400 billion (depending on volatility) and if he wants to build Martian houses or dig tunnels under Paris, a few billion dollars aren’t going to make a difference.

🔀 A Shifting CEO, A Shaky Business?

It’s not just about Elon’s attention span. Tesla’s business hasn’t exactly been smooth sailing. The EV market is more crowded than ever. Sales are dropping in Europe. Tariff threats are buzzing in the background.

On top of that, it’s the earnings season and the Earnings calendar is hot to the touch. In recent quarters, Elon’s perceived absence from the factories have coincided with slumping revenue and nervous investors.

Add in the fact that Elon just exited the Trump administration after a brief stint and dramatic fallout — yes, that happened — and Tesla investors are understandably hoping for a little more focus in the months ahead. Not to mention his new Washington gig — his “America party” political party .

🚗 Is Tesla Still a Growth Story?

Tesla is still the largest EV maker in the US, but the shine has worn off a bit. The Cybertruck’s still not mainstream, Model 3s are getting old, and margins are being squeezed by global competition and pricing wars.

If Musk is serious about staying and building, this could be Tesla’s opportunity to pivot — from hype-driven volatility to sustained, AI-powered growth. But if not, well... there’s SpaceX. Or xAI. Or Neuralink. Or The Boring Company. Or the next startup he tweets into existence.

Off to you : Do you feel like Tesla is paying Elon to stay interested — or rewarding him for prior (and future?) performance. And is that the way to buy loyalty and dedication? Share your thoughts in the comments!

TSLA pivot points suggesting imminent breakoutTSLA is in a tightening pattern, which can of course break either bullish or bearish. given the overall trend and market conditions, I have a bullish lean on it. After doing some pivot point analysis this evening I have shifted the bull break odds even higher in my mind, and not only that, I believe the bull break may be imminent this week.

TSLA Facing Key Resistance – Short Setup Targeting 301 SupportTesla is currently testing a key resistance area formed by the intersection of a descending trendline and a previously tested supply zone around 321.

Price action in this region may lead to a potential rejection.

**Forecast:**

If the rejection is confirmed, I expect a move toward the 301–300 support zone.

This area aligns with prior demand and a technical timing window from my harmonic model.

Trade idea based on trend structure, liquidity zones, and time-based forecast methodology.

📅 Watch price behavior around 321 for confirmation.

📉 Target: 301 support area

TSLA to $450-$500 this year Technicals:

Big Picture: Huge wedge breakout, followed by retest and bounce, and now we are flagging.

2Month Chart: Every time TSLA has had a hammer candle on the 2M chart, we have rallied hard within 2-7 months.

100 SMA on the daily: Everytime TSLA’s daily 100 SMA has gone from an extended downslope to upsloping (with the addition of some wedge breakout or Inverted H&S), it’s been the beginning of a rally.

Fundamentals: While this analysis is primarily technical, Tesla’s long-term prospects, its strong base of loyal investors, and the high level of short interest believing its already over priced- suggests to me that the technicals are signaling a huge run this year to $450-$500+.

TSLA Breaking Out — But Can It Hold Above $320? Aug. 7📊 Technical Analysis (1H + 15-Min Confluence)

TSLA has surged out of its $308–$312 consolidation range with strong bullish momentum. It's now pressing against the key resistance zone just under $320, with clean price structure and a rising trendline.

* Trend: Higher lows with a breakout above structure = bullish continuation bias

* MACD: Bullish crossover + expanding histogram = momentum building

* Stoch RSI: Overbought at 88+ = short-term cooling possible, but not a sell signal on its own

* Volume: Strong breakout volume confirms interest — now needs follow-through above $320

Key Levels to Watch:

* Support Zones:

* $317.50 (micro support)

* $312.35 (breakout base / trendline confluence)

* $308.72 (former top of range)

* Resistance Zones:

* $319.85 (current high)

* $322.50 (major gamma wall)

* $325 → $330.39 (stacked supply above)

Scalping Setup (15-Min View):

* Entry (CALLs): Break and hold above $320

* Target: $322.50 then $325

* Stop: Below $317.50

* Bias: Momentum continuation as long as price holds trendline + VWAP

🔬 GEX-Based Option Sentiment (1H GEX Map)

The options market is now showing significant gamma resistance overhead, making this a crucial inflection zone:

* CALL Walls:

* $319.85 = 2nd CALL Wall (95.21%) — this is where price is currently pausing

* $322.50 = 3rd CALL Wall (86.55%)

* $325–$330 = GEX10/GEX7 cluster — potential fade zone

* PUT Support:

* $305 = HVL + strong buyer interest

* $300 = -26.58% PUT Wall

* $297.83 = 3rd PUT Wall — major dealer de-hedging zone

* Net GEX Bias:

* Positive GEX above $312.50 → bullish momentum slows as dealers hedge

* Below $305 = faster downside risk (gamma unwind)

* IVR 5.5, IVx Avg 51.4 → IV drop = favorable for buying options, not selling them

🎯 Options Trade Ideas:

* Bullish Swing (Speculative Breakout):

* Entry: Break > $322.50

* Target: $325 / $330

* Stop: < $317.5

* Bearish Fade (Gamma Cap Reversal):

* Entry: Reject below $320 with stalling momentum

* Target: $312.5 / $308

* Stop: Close > $322.5

⚠️ My Thoughts:

TSLA is at a key gamma inflection point. Price structure supports more upside, but dealer positioning above $322.5 may cap momentum unless volume forces a squeeze. Use trendline and VWAP confluence as your confirmation anchors — and watch for failed breakout traps into overhead gamma zones.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

TSLA – Testing Key Gamma & Structure Levels. TA for Aug. 6TSLA – Testing Key Gamma & Structure Levels

Technical Overview

TSLA has been consolidating just under a key resistance zone at 310–312, which also aligns with the highest positive GEX / gamma resistance area. Price is forming a higher-low structure off the 303–305 support trendline, suggesting buyers are still defending key levels despite recent selling pressure.

MACD is flattening out and Stoch RSI is cycling near mid-range, indicating a potential momentum build but no confirmed breakout yet.

GEX / Options Sentiment

* Gamma Resistance: Heavy call wall at 312 with 52% concentration, and further stacked resistance into 320–325. This creates a ceiling unless strong bullish momentum steps in.

* Gamma Support: Large put positioning at 300 (-64% concentration) and 295 acting as a key defensive floor.

* Dealer Positioning: Above 312, gamma flip could drive momentum toward 320–325 quickly. Below 300, dealer hedging could accelerate selling into 295 and possibly 290.

Trade Scenarios

Bullish Case

* Trigger: Break & hold above 312 with volume.

* Target 1: 320

* Target 2: 325

* Stop: <305

Bearish Case

* Trigger: Close below 300 with momentum.

* Target 1: 295

* Target 2: 290

* Stop: >312

Options Thoughts

* Bullish: Consider short-term calls if price breaks above 312 with strong volume and momentum confirmation.

* Bearish: Consider puts targeting 300 if rejection occurs at 310–312 and sellers regain control.

* Neutral / Premium Selling: Selling an iron condor around 295–325 could work if expecting continued range trading until a catalyst emerges.

📌 My Take: TSLA is coiling for a decisive move. GEX shows a tight battle between 312 call resistance and 300 put support. A break in either direction could lead to a fast expansion move. I’m leaning neutral-to-bullish as long as 305 holds, but I’ll switch bearish if 300 breaks.

Disclaimer: This analysis is for educational purposes only and not financial advice. Always do your own research and manage risk accordingly.

TSLA Don't Miss Out

### 🔥 TradingView Viral Post Format 🔥

---

### 📢 **Title:**

**TSLA Options Surge? \$330 Call Could Double in 3 Days — Here's the Setup** 🚀📈

---

### 📝 **Description:**

Tesla’s options market is flashing **moderate bullish signals** this week! 📊

✔️ Call/Put Ratio: **1.39** (Bullish)

✔️ RSI (Daily & Weekly): **Rising**

⚠️ Volume is light, but sentiment leans bullish.

🎯 **Trade Idea:**

Buy TSLA \$330 Call (Exp: Aug 8)

💰 Entry: \$0.85

🎯 Target: \$1.70

🛑 Stop: \$0.43

⏱️ Confidence: 65%

⚡ Gamma risk rising with time decay — tight execution is key.

Is this the breakout or a bull trap? Let’s watch it play out 👀

👇 Drop your thoughts or setups in the comments!

---

### 🏷️ **Tags (for TradingView):**

```

#TSLA #Tesla #OptionsTrading #CallOptions #BullishSetup #TSLAOptions #StockMarket #WeeklySetup #TradingStrategy #TechnicalAnalysis #TradeIdea #MomentumTrade #UnusualOptionsActivity #TradingView

Tesla wedge and volatilityTesla has been riding this wedge downward after a false breakout on terrible earnings. BBWP has flashed blue, which has not happened since 2017, which is a signal for me. Stochastic has reset, and a stall candle is forming. Volume is generally up.

My plan:

TSLL shares, possible cash secured puts

Sitting Right on the 200-Day EMATSLA is sitting right on the 200-Day EMA here while holding this wedge for quite some time. TSLA's Bollinger Bands are starting to squeeze, indicating a significant move is forthcoming, and moving averages (MA 5/10/30/60) are flattening, indicating a loss of bullish momentum. It will be interesting to watch from here.

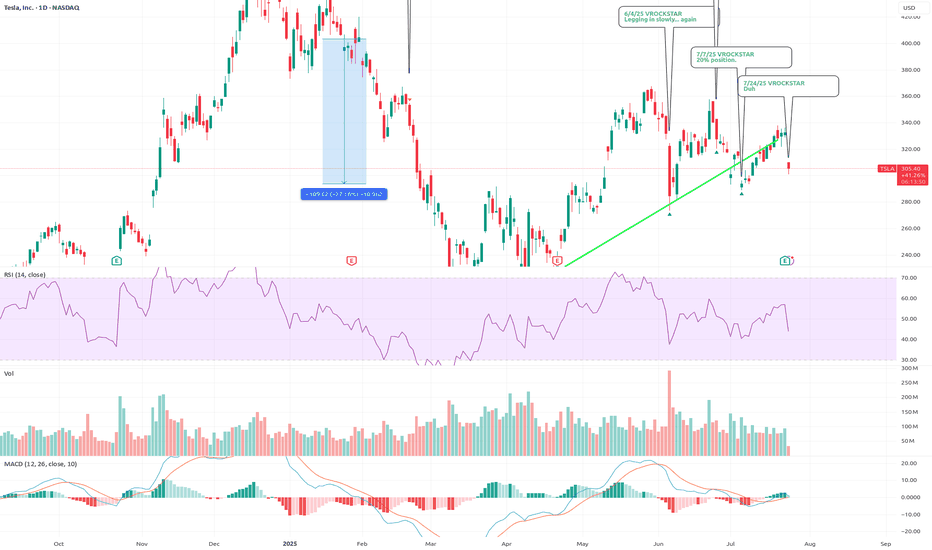

7/24/25 - $tsla - Duh 7/24/25 :: VROCKSTAR :: NASDAQ:TSLA

Duh

- ppl focused on ST FCF (all over X!) is 100% of the reason why when you put the pieces together, you realize that while ST this might not behave like anyone expects... LT, TSLA is v likely going to in, elon's own words, be the largest cap in the history of capital markets

- two leading robots with leadership position in IRL AI

- profitable, is all that matters

- have not yet hit the S-curve

was super lucky to trim some of this last week

now i'm back to sizing into a full position, not yet there like on that silly political dump, but i'm nearly 10% (20% is my max size).

V