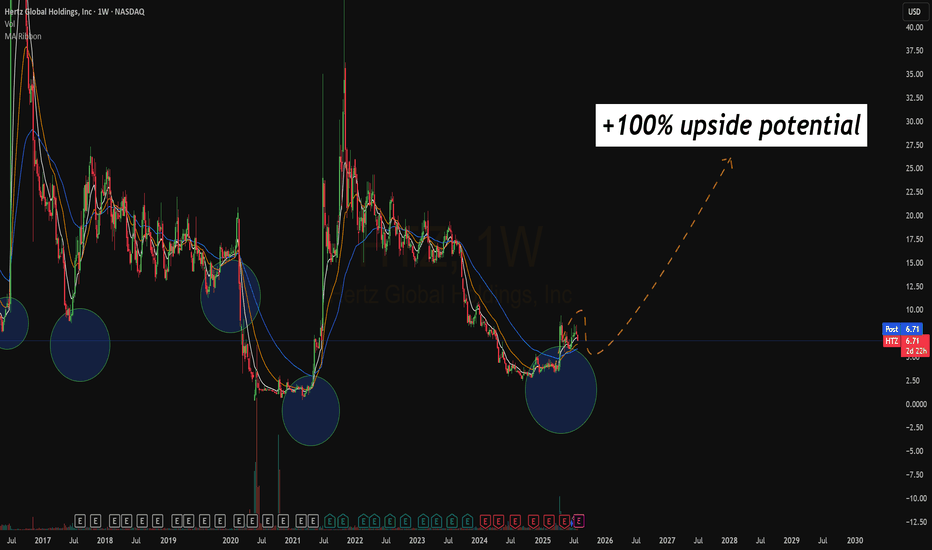

Its hurtz papa it hurtzzzzzzz... MAS MAS MASSSSSSGreat result last Q, sold off like a bitch. But all I am seeing is higher lows and higher highs

We got a nice tight candle last Friday and I think its about time it pushes through green

I'm already in but I bought on 7 Jan. I sold on Jan 14 but bought back straight away when it was pushing back through yellow. Maybe dumb maybe smarty pants but lets see my papa

I'll add through green and Friday high. But what I am seeing is a fuck load of higher highs, more importantly, higher lows, and all while it looks like a textbook bear wedge, which I think is not going to happen

Where I think I'm wrong? Close below yellow on the daily I'm out and back in when it gets back above as long as it's still looking hot like tamale. Just like I did on 14. It's not going to be a easy ride and linear like the ones that we like to eat. But... These are the spots that start big and long moves. I don't have stock, I have leaps and for the slower, weirder and not close to highs stockalinos.... I want less money taken up and if I think it's hitting highs and moving, I'll sell the options and move to stock

What traders are saying

Hertz (HTZ) — Back-to-Basics Turnaround Gaining TractionCompany Overview

Hertz NASDAQ:HTZ is executing a credible turnaround, returning to EPS profitability in Q3’25 on disciplined fleet management, record utilization, and stronger remarketing/vehicle sales as travel demand normalizes.

Key Catalysts

Operational Reset: Lower depreciation per unit, tighter fleet mix, and better pricing → margin rebuild underway.

Leadership & Strategy: New management’s back-to-basics focus (utilization, residuals, cost) improves consistency and cash generation.

Investor Confidence: Pershing Square / Bill Ackman support signals conviction in multi-year recovery.

Demand Setup: Stabilizing leisure/corporate travel + improved supply discipline support rate integrity.

Investment Outlook

Bullish above: $4.80–$5.00

Target: $9.50–$10.00 — driven by utilization strength, normalized depreciation, and continued pricing discipline.

📌 HTZ — rebuilding margins the old-fashioned way: fleet discipline, utilization, and cash flow.

HTZ | Falling Wedge Reversal Setup - Breakout Toward $10Hertz Global Holdings (HTZ) is currently trading at the lower boundary of a well-defined falling wedge pattern, a structure that often signals a potential bullish reversal. The price has once again touched the wedge’s support line, showing early signs of reacting from this level. This repeated defense of support suggests that sellers may be losing momentum as the range continues to narrow.

If HTZ maintains support at this lower trendline and begins to push higher, the next key level to monitor is the upper wedge resistance. A confirmed breakout above that level may trigger a shift in trend, opening room for a measured move toward the $10 target area, which aligns with previous highs and the projected wedge breakout objective.

While the trend is still technically down, the structure of the wedge combined with the current bounce setup provides a constructive environment for a possible reversal. Confirmation and healthy volume on the breakout will be essential to validate the move.

(This idea is for educational purposes only, not financial advice.)

HTZ:From Breakdown to Breakout,Bullish Reversal Gaining TractionHertz Global Holdings, Inc. (NASDAQ: HTZ)

Technical Outlook: Potential Reversal Following Structural Breakout

Date : 5 November 2025

Summary

Hertz Global Holdings (HTZ) has exhibited signs of a potential medium-term trend reversal following a prolonged downtrend since mid-2023. Multiple bullish technical signals — including a breakout from key continuation patterns, RSI divergence, and sustained support retests — point toward a possible shift in market sentiment.

Price Action and Technical Developments

1. Downtrend continuation : Since July 2023, HTZ has been in a persistent downtrend, reinforced by a breakdown below major horizontal support.

2. Symmetrical triangle breakdown (Feb 2024) : The stock failed to hold within a consolidation structure, confirming bearish momentum at that stage.

3. Bullish divergence (Sept 2024) : Despite registering new price lows, the RSI formed higher highs, suggesting weakening downside momentum and potential for reversal.

4. Falling wedge breakout (Nov 2024) : Price action reversed from a classic bullish pattern, followed by a strong rally through the end of November.

5. Symmetrical triangle breakout (Apr 2025) : HTZ broke out of consolidation on elevated volume, coinciding with a break above the long-term descending trendline — a key technical inflection point.

6. Current setup (Nov 2025) : The share price is consolidating within a falling channel. On 4 November 2025, it rebounded from a confluence of supports — including the uptrend line from September 2024 and prior resistance turned support — reinforcing near-term bullish bias.

Trading Idea

Entry Zone: 4.71 - 5.50

Target: 10.50 and 15.00

Support: 4.71

Conclusion

After a long downtrend, HTZ is showing a clear shift in momentum. With multiple bullish patterns confirmed and strong support holding, the stock may be entering a new uptrend phase toward USD 10.50 and USD 15.00.

HTZ | Falling Wedge Formation — Watching for Bullish Breakout ToHertz Global Holdings ( NASDAQ:HTZ ) is currently trading within a well-defined falling wedge pattern, a classic bullish setup that often precedes a reversal or breakout to the upside. After a period of consistent lower highs and lower lows, the price appears to be compressing near the wedge’s lower boundary, suggesting a potential exhaustion of selling pressure. The narrowing structure indicates that volatility is contracting, typically a prelude to a decisive move. If price action confirms a breakout above the upper trendline with solid volume, the pattern projects a potential upside target near $10, aligning with prior resistance levels and measured-move expectations from the wedge height. I’m monitoring closely for a daily close above the wedge resistance as a confirmation signal. Until then, the pattern remains in play, offering a constructive technical setup for bullish continuation.

GLASS CEILING - HTZTHIS IS NOT FINANCIAL ADVISE.... BUT I LIKE TO GAMBLE

ACQUIRE IN GREEN.

SHORT INTEREST 42.85% BUT HONESTLY... PEOPLE STILL NEED TO RENT CARS SO UHH?

MOST RECENT EARNINGS HAD A 13% BEAT...

im sure its because targets were eventually revised and it can turn itself around

and recently they apparently got in bed with amazon to move their used car inventory which is also part of their business

ULTIMATELY!

I THINK THIS CAN MEME RUN

$HTZ Hertz - Second Leg UpMassive move after Ackman’s 20% stake news sent NASDAQ:HTZ flying over +100%. Price filled the gap and looks ready to retest the previous resistance zone near $9 (marked).

I’m staying cautious into May 12 earnings (after market). Historically, Hertz tends to fade post-earnings. Safer to wait for the dust to settle.

Potential setup:

Entry: Watch for a breakout + retest of $7.20–$7.50

First target: $9 zone

Risk level: Below $5.50 (invalidates setup)

Confidence: Medium (depends on post-earnings reaction)

RSI recovering from neutral, but no FOMO here. Patience wins. I’ll update if conditions change.

HTZ short idea?NASDAQ:HTZ HTZ is underperformjng the market In a large way today.

With interest rates falling & the IWM rallying to the upside this is a bearish divergence occurring for this ticker.

If HTZ can't rally with the positive conditions it likely means this stock will continue to see some selling pressure.

Understand this is a high risk high flying stock that can have outsized moves.

Anti-Ackman trade HTZNot only is it technically a wrong move, but fundamentally stupid! Does stupid Ackman really think that with other countries protesting tourism to the US because of sanctions, and every US Customs POE agent turning global citizens away only because they found some bad remarks about Tucker Frump, we will have a summer travel explosion so HTZ will benefit?? How dumb is he?

Charging Stations, Reduced Rates and Politics.With the future of the car industry looking dark and bright at the same time, HTZ has been over sold and bullied hard since its last pump with tesla ect.

My long term target I know it will hit is $8 over the next year.

I rarely call on meme stocks but no one is seeing this one coming ;)

HTZ UP AROUND 22% TODAY. ACTIVIST INVESTOR BOUGHT $46.5M SHARES!HERTZ (HTZ) Surged nearly 22% today. A recently report revealed "Activist" Investor Bill Ackman had acquired $46.5 million shares . Should you hop on the bullish trend? Or will price cool off once the hype is over? What are your thoughts?

Disclaimer: Not Financial Advice

HAPPENING NOW?! HERTZ CUP AND HANDLE BREAKOUT 1D CHART?HERTZ (HTZ) Price rose significantly to $4.26 on the 1 Day chart. Is this a sign of an impending bullish breakout? My personal target opinion for bullish movement is $5.50. Will this be a major bullish turning point for Hertz? Or will it be a easy grab for traders running short positions?

HERTZ (HTZ) Rental Company Bullish Today Despite Tariff FearsHertz (HTZ) was up +12% before falling slightly before closing. It appears the rental company, known for their rental cars may be keeping investors interested even with President Trump's "Liberation Day". Could this be a bullish pick for 2025?