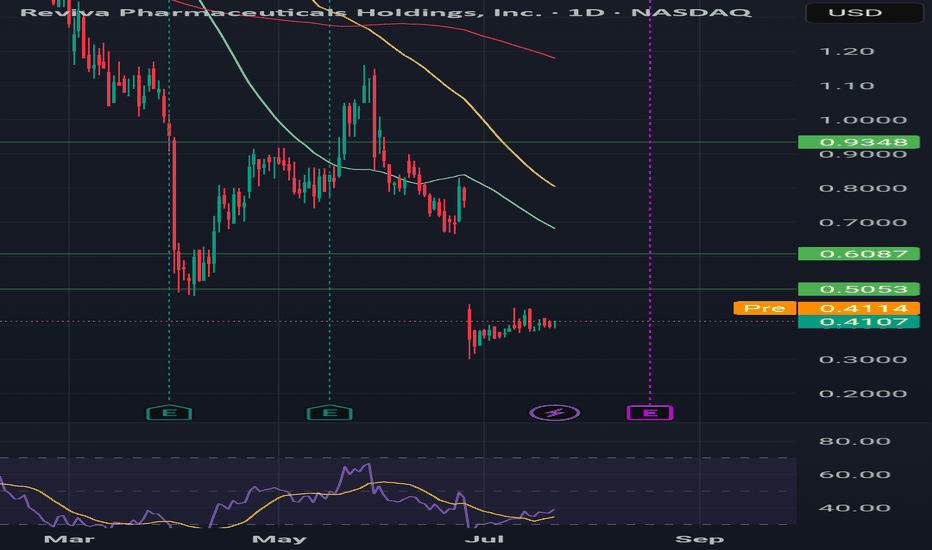

Simple long thesis into earningsRecapturing historic .53 on historic volume, breaking a ~1yr structure. Simple AVWAP return, lines up with 2.00 psych plus a test of a previous high. Small position size, great entry, tight RR, 16R long trade setup. Probably won't hold through earnings. Likely 2x trade at least.

Reviva Pharmaceuticals Holdings, Inc.

No trades

Market insights

$RVPH back to $2+?RVPH looks strong on higher timeframes and looks like we could see a large move higher.

We broke out of a downtrend, retested the trend line as support and now it looks set to be going up.

I entered this morning at $.572 as a trade looking for $2+ resistance levels.

Let's see if it plays out over the coming weeks.

PUMP N DUMPGrabbed shares at .41 just looking for a gap fill see what happens if we get there i believe a PnD group has sent this on an impressive rally before and are looking to do it again, tight stop recommended. Daily and weekly rsi look good for a move only thing that would crush this further right now is a reverse split as I belive they've already completed a couple offerings recently.

RVPH 1WReviva Pharmaceuticals Holdings, Inc. is a clinical-stage biopharmaceutical company, which engages in the discovery and development of therapeutics for the central nervous system, respiratory, and metabolic diseases. It uses chemical genomics driven technology platform and proprietary chemistry to develop new medicines. It focuses on RP5063 (Brilaroxazine) and RP1208 pipelines. The company was founded on December 11, 2020 and is headquartered in Cupertino, CA.

RVPH - Possible Short IdeaRVPH, another possible short idea similar to CGC. Essentially, both charts present a H&S pattern; however, RVPH is not in a supply zone. This affects the strength of my thesis. In all honesty, I see this stock retracing to that 1.83 range I highlighted. No news as of today to justify the 68% rally. I'll be averaging around the current range, my average at the moment is 2.5. Not the best entry but at the same time my position size is very minimal, so averaging would move my cost basis significantly.