VNET | IT Services in China on the Rise | LONGVNET Group, Inc. operates as a carrier- and cloud-neutral internet data center services provider in China. It provides hosting and related services, including IDC services, cloud services, and business VPN services, to improve the reliability, security, and speed of its customers' internet infrastru

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.29 USD

23.36 M USD

1.15 B USD

253.49 M

About VNET Group, Inc. Sponsored ADR

Sector

Industry

CEO

Sheng Chen

Website

Headquarters

Beijing

Founded

1999

ISIN

US90138A1034

FIGI

BBG001M32Y18

IPO date

Apr 21, 2011

IPO offer price

15.00 USD

VNET Group, Inc. operates as a carrier- and cloud-neutral internet data center services provider in China. It provides hosting and related services, including IDC services, cloud services, and business VPN services, to improve the reliability, security, and speed of its customers' internet infrastructure. The firm serves numerous industries, ranging from internet companies to government entities, blue-chip enterprises to small- and mid-sized enterprises. VNET Group was founded by Sheng Chen and Jun Zhang in 1999 and is headquartered in Beijing, China.

Related stocks

VNET 1W - second wave or second life?On the weekly VNET chart, the price has held above the 6.25–6.05 support zone, which previously triggered an impulsive rally. The current structure remains bullish: the MA50 is positioned above the MA200(golden cross) and ema below price(buyers control situation), and recent volume spikes indicate a

Technical Analysis & Breakout Potential – $VNETTechnical Analysis & Breakout Potential – NASDAQ:VNET

1. Technical indicators show a "Strong Buy"

According to TipRanks, VNET scores strongly across several technical indicators such as RSI, MACD, and multiple moving averages—all signals point toward buy recommendations Investing.com also conclu

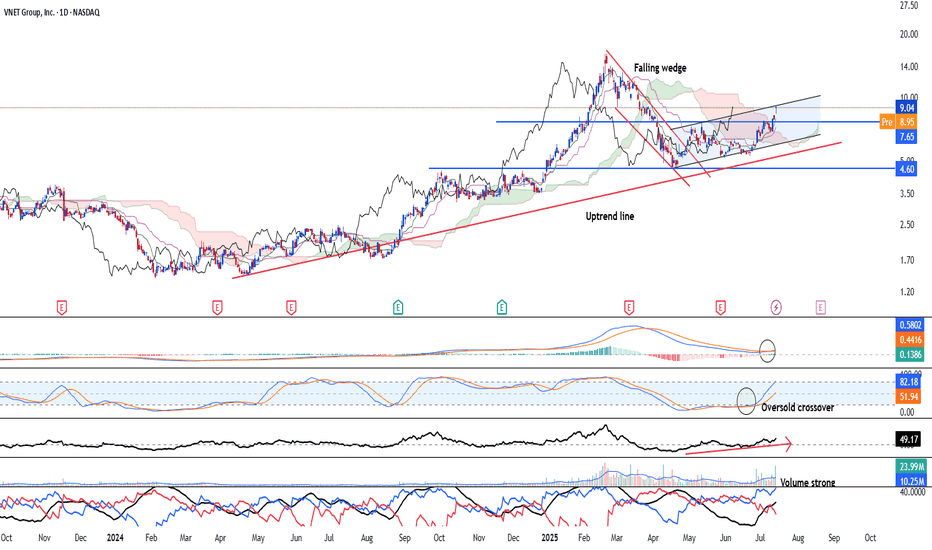

Vnet Group - Bullish trend in an early stage NASDAQ:VNET is looking at an early bullish trend continuation after the stock has broken out of the falling wedge and forms a pair of higher high and higher low. Uptrend remain intact since April 2024. Stock is likely to see strong upside going forward.

Long-term MACD just see a crossover. and hi

VNET – Watching for a Pullback Buy OpportunityWhy It's on My Radar:

Just broke out of a downward channel with solid volume

MACD curling up — bullish crossover setting up

Not trying to catch a falling knife here — waiting patiently for a clean pullback.

Key Level I’m Watching:

~$6.60 → lines up closely with the 0.50 fib retraceme

VNET, price exceeded its 50-day Moving Average on Oct 08, 2020This price move could indicate a change in the trend, and may be a sell signal for investors. Tickeron A.I.dvisor found 46 similar cases, and 42 were successful. Based on this data, the odds of success are 90%. Current price $23.07 crossed the support line at $22.76 and is trading between $23.52 sup

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

VPNG

Global X Data Center REITs & Digital Infrastructure UCITS ETF Accum USDWeight

3.36%

Market value

2.27 M

USD

Explore more ETFs