EXIDEIND trade ideas

EXIDE INDUSTRIESExide Industries Ltd. (currently trading at ₹419) is India’s largest manufacturer of lead-acid batteries and a growing player in lithium-ion energy storage solutions. With a legacy of over seven decades, the company serves automotive, industrial, submarine, solar, and e-mobility segments. Its wholly owned subsidiary, Exide Energy Solutions Ltd., is spearheading the lithium-ion battery cell manufacturing initiative in Bengaluru, targeting both EV and stationary storage markets.

Exide Industries Ltd. – FY22–FY25 Snapshot

Sales – ₹16,770 Cr → ₹17,238 Cr → ₹18,420 Cr → ₹19,850 Cr Growth driven by automotive battery recovery, inverter demand, and initial lithium traction

Net Profit – ₹882 Cr → ₹800 Cr → ₹920 Cr → ₹1,050 Cr Dip in FY23 due to capex absorption capacities stabilize

Operating Performance – Strong → Moderate → Strong → Strong Margins normalizing post greenfield

Dividend Yield (%) – 0.50% → 0.55% → 0.60% → 0.65% Progressive payout aligned with cash-flow visibility

Equity Capital – ₹85 Cr (constant) No dilution; lean capital structure

Total Debt – ₹1,200 Cr → ₹1,350 Cr → ₹1,420 Cr → ₹1,480 Cr Leverage rising with lithium-ion expansion

Fixed Assets – ₹6,850 Cr → ₹7,420 Cr → ₹8,100 Cr → ₹9,200 Cr Capex focused on Bengaluru lithium plant, automation, and backward integration

Institutional Interest & Ownership Trends

Promoter holding stands at 46.04%, with no pledging.. FIIs and DIIs maintain strong exposure due to Exide’s leadership in energy storage and EV transition.. Delivery volumes reflect long-term accumulation by ESG, infra, and auto-linked funds.

Business Growth Verdict

Exide is scaling across legacy lead-acid and new lithium-ion verticals. Margins are stabilizing as cell-making operations ramp up. Debt levels are rising but in line with strategic growth investments. Capex supports long-term competitiveness and energy-transition roadmap

Management Con Call

Management confirmed a fresh ₹100 Cr infusion into Exide Energy Solutions Ltd., taking total investment to ₹3,802 Cr. Bengaluru lithium cell plant on track for 12 GWh capacity across two phases. EESL reported FY25 turnover of ₹116.9 Cr and net loss of ₹209.1 Cr, typical of early-stage ramp-up. Focus remains on EV battery modules, stationary storage packs, and backward integration of key battery chemicals. FY26 outlook includes mid-teen revenue growth and margin recovery; meaningful lithium-ion contribution expected from FY27 onward

Final Investment Verdict

Exide Industries Ltd. offers a compelling energy-storage play built on a heritage lead-acid franchise and aggressive lithium-ion expansion. Its disciplined capital structure, rising cash flows, and strategic capex make it suitable for accumulation by investors seeking exposure to India’s mobility electrification and renewable storage themes.

EXIDE INDUSTRIES-EMA GOLDEN CROSS OVER-DAILY&WEEKLY CHARTEXIDE IND:Trading above all its Moving average in daily and weekly charts.Golden cross over of DEMA in long term suggests a move towards 450,If it holds above 425 levels,my short term tgt would be 425 and mid term tgt is 450(for educational purpose only)

Exide Industries good reversalor the last 2.5 months, Exide Industries was stuck in a tight range between 370 and 400. Every time it tried to cross 400, sellers pushed it back down. This zone had become a big barrier for the stock.

But in the last few sessions, something changed. The stock finally managed to hold comfortably above 400–405, which was not happening earlier. This move is important because it not only cleared the neckline resistance but also confirmed a consolidation breakout after months of sideways action.

Now, as long as Exide stays above 395–400, the trend looks positive. The breakout has opened the path for the stock to test 425 first, and if buying momentum continues, we could see levels of 435–440 in the coming days.

To stay safe, traders can keep a stop-loss below 390.

✨ In short: After months of waiting, Exide has broken free from its range. Sustaining above 400 is a bullish sign, and the stock now looks set for 425–440 levels.

BOOM BOOM share Trend Overview

Exide Industries' share price showed some volatility from July to August 2025. After touching a low around ₹374 in mid-August, prices rebounded strongly, closing at ₹396.30 on August 20, 2025. There were surges of over 4% on individual trading days, indicating momentum driven by volume spikes and possibly news, such as quarterly results and growth in EV battery segments.

Price Action Highlights

Support Level: Immediate support at ₹370-374 has held firm, preventing a deeper sell-off.

Resistance Level: Resistance around ₹379-384 was breached, allowing for an upward run.

Volume Surge: Notably high volume accompanied positive price movement on August 19 (up 4.38%), signaling buyer interest.

Predictive Outlook

Short-Term: The technical breakout above recent resistance and increased volumes suggest the uptrend may continue unless profit-taking sets in. Watch for retests of the ₹374-384 zone as support.

Medium- to Long-Term: Renewal in EV and renewable energy battery demand could push prices higher, with price targets for late 2025 estimated at ₹425-665 if sector growth continues robustly.

Fundamental Note: Intrinsic value analytics show Exide is trading at a premium (+56%), reflective of growth optimism.

Graphical Representation

A chart could not be displayed due to technical issues but is recommended for visualizing the daily closes and momentum.

Conclusion

Exide Industries exhibits bullish trends, with technical and fundamental factors signaling further upside potential if current momentum and sector expansion persist. Keep monitoring volume spikes and technical levels for actionable trade signals.

Exide Ltd is currently trading near its 200-day moving averageExide Ltd – Technical Outlook

Exide Ltd is currently trading near its 200-day moving average, which is acting as a key resistance level. A decisive breakout above this level could trigger a positional upmove of approximately 15%, making it a strong candidate for a medium-term long trade.

Additionally, the stock has been consolidating within a narrow 5% range, indicating a phase of accumulation. A breakout from this sideways range could present a short-term swing trading opportunity.

Actionable Insight:

Keep Exide Ltd on your watchlist for both positional and swing long trades, contingent on a breakout above key resistance levels.

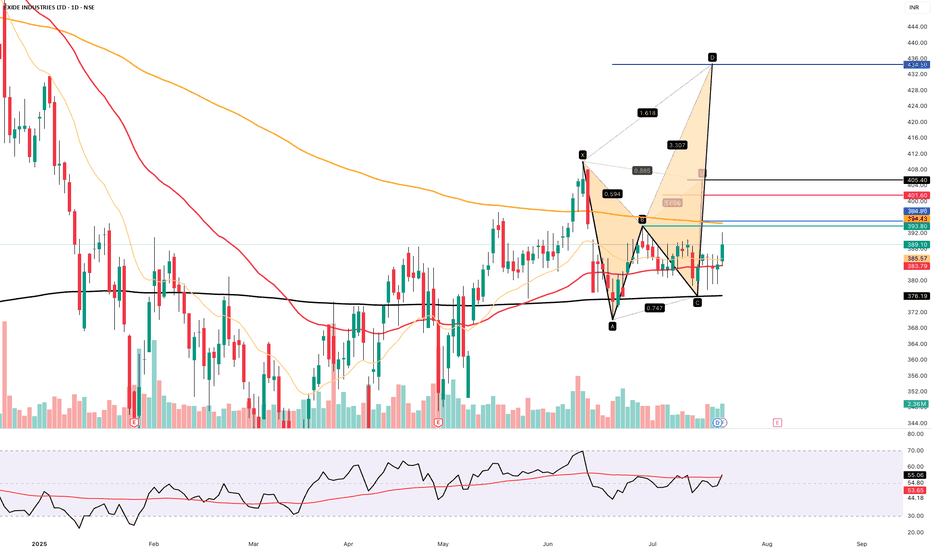

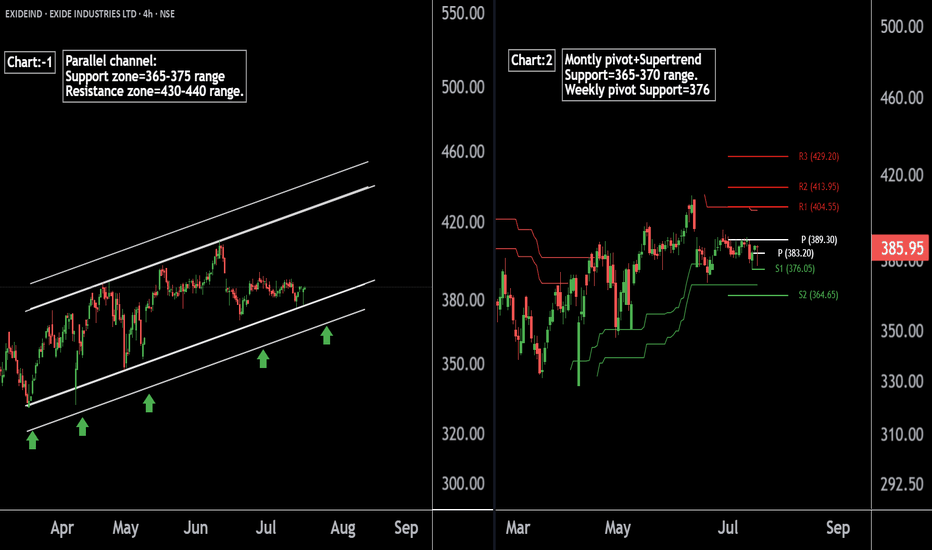

Exide Industries Ready for the Next Bull Run !! Powering Up !!there are two chart of Exide Industries.

In a first chart: EXIDEIND is moving in a well defined parallel channel and currently trading near at support 365-375 range

In the second chart,EXIDEIND is respecting support at both the monthly pivot and the supertrend indicator, with the support zone positioned between ₹365-₹370.

EXIDEIND is currently sustaining below both the monthly and weekly pivot levels at ₹290. As long as the stock does not break above this pivot zone, the momentum is expected to remain weak.

If this level is suatin then ,we may see higher prices in EXIDEIND.

Thank you !!

EXIDEIND Weekly Chart AnalysisEXIDEIND Weekly Chart Analysis – Breakout Brewing?

Published: 7th June 2025

Current Price: ₹393.30 | +0.55% Today

⸻

Key Chart Highlights:

• 1D FVG Zone Cleared: Price has broken out above the fair value gap, hinting at strength

• Downtrend Broken: Price action has closed above descending resistance

• PE Target Done: ₹336.65 (Previous Put target) successfully hit

• New Target: ₹620.35 (Weekly chart target zone)

⸻

Market Bias:

As long as the price sustains above the ₹375–₹385 range (FVG base), bullish momentum is likely to continue.

If holding longs:

Trail SL below ₹372

Targeting next swing high zones: ₹472 → ₹520 → ₹620+

If rejected back below ₹375:

Wait for confirmation, as a drop may retest ₹336 again.

Summary:

A solid technical setup for positional traders – price attempting a trend reversal from the base with clear upside levels mapped.

Disclaimer: Educational purpose only. Not a recommendation. Do your own research.

12:26 PM

EXIDE INDUSTRIES SWING TRADE SETUP 📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

Exide Charging Up for a Breakout?RSI Cross + Rounding Base = Bullish Setup! 🔋🚀

🔍 Technical Breakdown

Pattern: Rounding bottom formation after prolonged downtrend.

Momentum Trigger: RSI breakout above 60 indicates fresh buying momentum.

Volume: Steady build-up in volume—accumulation phase might be over.

📈 Trade Setup

Entry: ₹372–₹373 (current breakout zone)

Stop Loss: ₹350.80 (just below recent swing low/support)

Target: ₹432.90 (previous supply zone)

📊 Indicators

RSI: 61 – strong bullish momentum

Volume: Healthy participation visible

Structure: Price curling up with consistent higher lows—indicative of strength

⚖️ Risk-Reward

RRR: ~1:3 — attractive setup for swing traders

Exide Industries xide Industries Ltd is primarily engaged in the manufacturing of storage batteries and allied products in India.

Key Points

Products

The company manufactures batteries for automotive sector like 2 wheeler, 4 wheeler, 3 wheeler, E-rickshaws and H-UPS. It manufactures batteries from 2.5 Ah for 2-wheelers to 260 Ah for Non vehicular. It also manufactures for industrial use from 7 Ah to 3200 Ah for multiple applications and for submarine uses too.

Storage Batteries Segment

The company is the leading storage batteries manufacturer in India with leader in almost all categories in Automotive, Industrial, and submarine sectors.

Lithium-ion foray

The company has forayed into this segment through:

Exide Energy Solutions Limited (ESSL): It is a WOS set-up in FY22 for lithium-ion cell manufacturing with a total project capacity 12 GWh and project cost of Rs.6,000 crore to be completed in 2 phases. It is engaged in manufacturing of advanced chemistry cells (cylindrical, pouch, prismatic). Also engaged in manufacturing, assembly and sale of battery modules and battery packs. Exide Energy Private Limited (EEPL) WoS of company, carrying the business of developing and manufacturing Li-ion based modules and packs with Battery Management System for e-mobility (EV) as well as stationary power application and having its plant at Prantij, Gujarat amalgamated with EESL with effect from Mar'24.

Company invested ~Rs. 75 Cr. (in May'24) in ESSL on rights basis. With this investment, the total investment made by the Company in EESL (including investment made in erstwhile merged subsidiary EEPL) stands to Rs. 2,377.24 Crs. till May'24 . Have a order book of ~Rs 600 - Rs 700 Crs.

Mr. Arun Mittal was appoointed as MD & CEO of EESL in May'24.

Lithium-ion cell manufacturing facility

The company is in the process of setting up a plant for lithium-ion cell production. For which it has collaborated with SVOLT (China), set up a WOS and purchased 80 acres of land at

the Hi-Tech Defense & Aerospace Park Phase 2, Bengaluru. Phase 1 to be completed by 2025.

Distribution Network

Company has a wide distribution network with warehouses and sales offices and 115,000+ direct & indirect dealers across India as of FY24. Exide has 1700+ Exide Care outlets and 300+ SF batteries Power Bay outlets.

Customer Base

The company has almost all 4 wheeler, 3 wheeler and 2 wheeler automotive companies as its customers in India.

Its industrial customers include emerson, ericsson, hitachi, Cipla, General electric, mitsubishi, godrej, BSNL, finolex, BHEL, Tata, NTPC, Indus Towers and others.

Subsidiaries & Associates

Company has 6 subsidiaries and 3 associates.

Collaborations

Company has 5 overseas technical collaborations. It has short/ long term collaborations with Furukawa from Japan; Advanced Battery, East Penn from USA; Moura (Brazil), SVOLT (China).

**Manufacturing Capabilities

Company has 13 plants (10 manufacturing & 3 lead recycling) in India with production capacity of 66 million units p.a. of automotive power, 6.7 billion ah of industrial power and 346 KMT p.a. capacity of 3 Lead Recycling Plants as of FY24. Its plants are located at Ahmednagar, Bawal, Chinchwad, Haridwar, Roorkee, Taloja, Haldia, Hosur, Prantij, Malur, Supa & Shamnagar (Cities in India).

R&D

The company has its R&D centre at Kolkata since 1976.

**Recent Developments

1. The company Launched Absorbent Glass Mat (AGM) batteries, which have higher efficiency for 4Ws in the domestic & international market

2. Extending the punched plate technology to entire range of 2W batteries, for higher quality & efficiency

3. Company designed and introduced specially optimized batteries for solar photovoltaic generation and storage applications

4. Battery energy storage systems (BESS): R&D team developed a costeffective AGM battery storage solution for BESS application

Major Updates

1. EESL(WoS) signs a non-binding MoU with Hyundai Motors and Kia for the strategic cooperation in Indian EV market.

2. Company invested ~Rs 110 Crs. in Chloride Metals Ltd(WoS) on right basisi in Mar'24.

Acquisitions

1. Company accquired 26% in Clean Max Arcadia Pvt. Ltd (a SPV) in Apr'24 for ~Rs.5.34 Cr. for genaeration and supply of solar power at Bawal factory.

KMP

1. Mr. Avik Kumar Roy was appointed as MD & CEO of the company in May'24 after retirement of Mr. Subir Chakraborty.

EXIDE NSEEXIDE has corrected from its ATH by 36%, now bouncing back from the 50% FIBO has cloded above 38.2% FIBO. Early entry can be taken with 25% quantity now and safe Traders on Day close above 515. Maintain SL at 454 the current Swing Low.

The EMAs have indicated a reversal, price currently above 50EMA and add Quantities when 20EM crosses above 50EMA.

Hold up to Target