GAIL trade ideas

Gail - BullishGail CMP - 132.75

Looking bullish and range breakout in higher time frame. One can go for Short Term Trade setup with the following entry, exit & targets

Buy Range 129 - 130 / Stop Loss 120

Target 1 - 150

Target 2 - 165

Target 3 - 180

Disclaimer: This is my view and for educational purpose only.

Gail { short 15 m }Nested IB formed , as per charts .

Note :-

Entry - At the break of mentioned candle's low/high

Stop Loss -

In a Short Trade, I always use Previous Candle High ( PCH ) as a stop loss while entering the trade. Sometime I might use 15 M tf SL & trade in 30M tf which I'll mention. Vice Versa for long trades

Trailing Stop Loss ( TSL ) - Mostly I trail stop loss by PCH as price falls . I exit as PCH breaks & vice versa

Use of PSAR as TSL :- TSL get's hit in trend following due to noise, In such cases I use PSAR to be in trend & exit if PSAR direction change

You can use any one of above mentioned or your own way to manage risk

Time Frame :- I take ~ 90% of my intraday trades in 15m tf. Where my analysis might come from higher frames like W , D or 1hr chart pattern which will be mentioned.

Target :- I do set target line based on support / resistance slightly above/ below it . Please pay attention to it

Gail- CMP 120.15GAIL- CMP 120.15, It is in bullish trend. EMA cross overs have happened at 90 levels which is good indicator for rise. After recent correction its RSI is crossing the trend line above and which is also bullish in nature. In short time it may go up to 132 levels and may face resistance at that price. This is for educational purpose and any investment shall be done by experts.

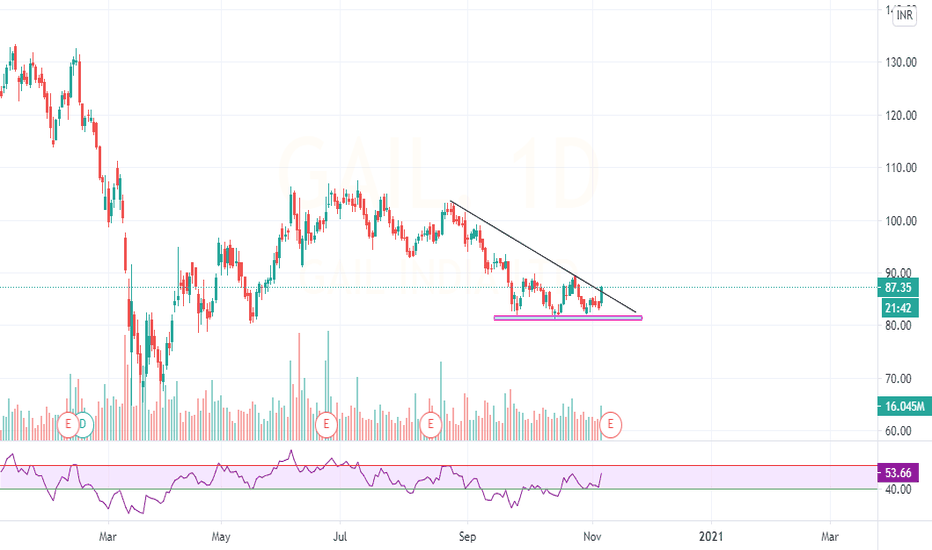

GAIL INDIA LTD getting ready for a bull ride?GAIL INDIA LTD has settled up by 4.28 percent at 90.20 paisa on Tuesday. Stock has today broken through a 50 days rectangular consolidation along with MACD developing bullish divergence with a bullish cross. Stochastic is also above its signal line and sloping upward favouring bullish momentum. A tweezer bottom combination is formed near 85.50 that was also near the mid of a bullish trend. Based on structure developed on daily chart one can look for long opportunities in this stock around 88.50-87.50 zones with a stop loss below 85.50 for targeting 98-104 in coming days.