Trade ideas

VODAFONE IDEA BEARISH WAVE 5The chart is showing a clear Elliott Wave structure. After completing a 5-wave bullish move, the price looks to be entering a corrective phase.

Current move suggests we are in Wave 4 correction, with Wave 5 downside still pending.

Key support levels: 7.91 / 7.64 / 7.44

Resistance zone: 8.30–8.37 (if broken, the bearish count may get invalidated).

This setup indicates further downside is possible if resistance holds, aligning with Elliott Wave theory.

⚠️ Disclaimer: I am not SEBI registered. This analysis is shared for educational purposes only. Please consult your financial advisor before making any investment decisions.

Idea : Breached the major Red Band Resistance Idea: Breached the Red Band Resistance. There was another Red Band Resistance at 9 to 10, which has vanished. So the only major resistance is the one that has just been cleared. Hoping to close above it today.

Momentum has picked up.

It's been closing above the 200 SMA for the past few sessions, which is a very important milestone. Already in a buy trajectory.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

Idea : Major Red Band Resistance Levels

Idea : Major Red Band Resistance Levels .

Although in a Buy trajectory , " Red band Resistance " Levels must be cleared to progress further.

It is under 200 SMA ( White line ) since September 2024 for almost a year and failed to close above it which is also another important test for the script.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

VI Stock(India) Looking for bullish Rally! {5/07/2025}Educational Analysis says that VI Stock (India) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

Vodafone Idea: Moving to a Buy trajectory

Vodafone Idea: Moving to a Buy trajectory

Recovered quite well from the support with back to back Greens as displayed on the Chart

Tough road ahead with multiple Red Band Resistances.

MACD is positive almost approaching an important level of 0.

( Not a Buy / Sell Recommendation

Do your own due diligence ,Market is subject to risks, This is my own view and for learning only .)

IDIA Range Accumulation – Bullish Only With Fundamental TriggerThe stock is currently trading inside a tight range, indicating a phase of consolidation.

📉 Buy Zone: ₹6.38

I’m planning to accumulate if price drops near this zone. From a technical view, it’s a strong demand area. However, for the bullish breakout to sustain, we’ll need strong fundamental support — like earnings, news, or sector momentum.

🔍 If fundamentals align, this could become a long-term multibagger setup.

✅ Strategy:

Wait for ₹6.38 zone

Accumulate small quantities

Hold for long-term with regular news tracking

💬 What do you think?

Would you wait for breakout or buy inside the range?

#TechnicalAnalysis #SwingTrade #LongTermView #SupportZone #BreakoutSetup #StockMarketIndia

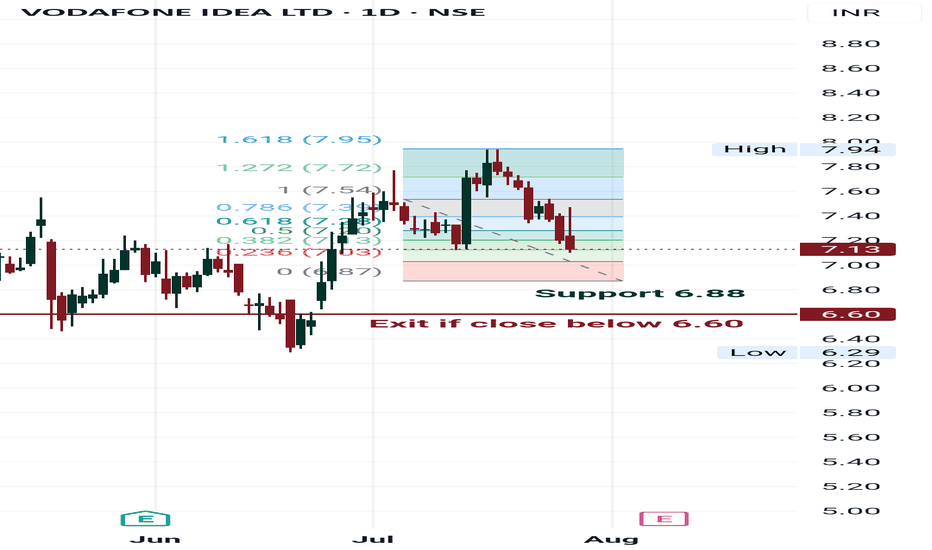

IDEA LONG TRADE SETUP📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.