Positional setup for JSW Infrastructure (JSWINFRA)🔍 Fundamentals (from Screener & other sources)

Market Cap: ~ ₹69,000 Cr.

Revenue / Profit: Last reported revenue ~₹4,690 Cr, Profit ~₹1,614 Cr.

5-Yr Profit Growth: ~51.5% CAGR.

Valuation:

P/E is very high (in some sources ~186×) which suggests heavy premium pricing.

P/B ≈ 13.3×.

Returns: ROE ~14.5%, ROCE ~13.3%.

Dividend Yield: Very low (~0.24-0.3%) indicating most return is from capital appreciation.

Pros: Good profit growth, infrastructure tailwinds, improving operational metrics.

Cons: Rich valuation, high expectations priced in. Any weakness in cargo volumes or macro slowdown could hurt sentiment.

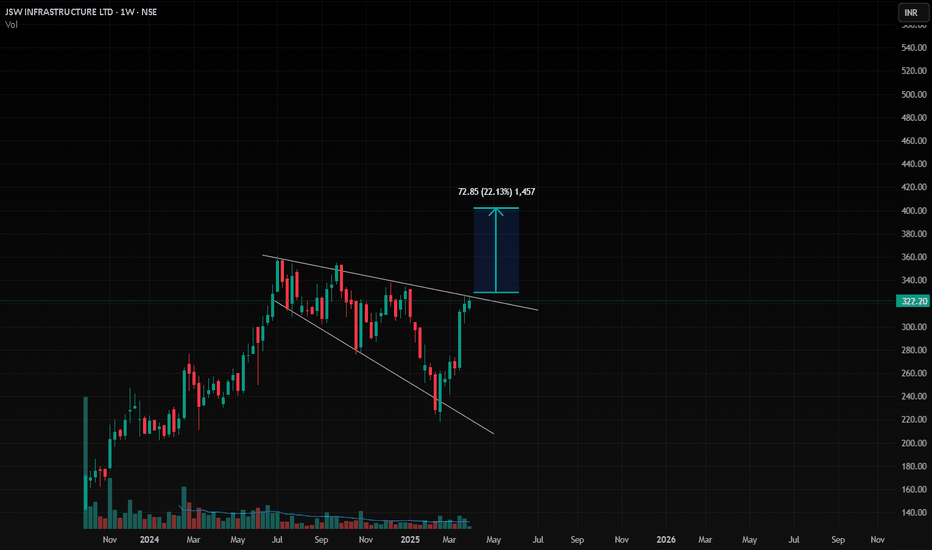

📈 Technical / Positional Setup

Based on the chart shared and corroborated with external technicals:

Resistance Zone: ~₹330-₹335 seems to be a critical resistance level (multiple past highs around that).

Support Zones: ~₹300-₹310 (recent pivot), deeper support around ₹280-₹290 if weakness.

Moving Averages: Short term EMAs seem aligned bullishly (from chart), price pushing above resistance, indicating breakout attempt.

Macd / Momentum: External sources show moving averages giving “Buy” signals; momentum indicators generally positive.

🎯 Trade Plan

Parameter Value

Entry On clean breakout above ~₹335 with confirmation (strong volume)

Stop-Loss Below support ~₹300 - ₹305 zone

Target 1 ~₹370-₹400 (next resistance zones)

Target 2 ~₹430-₹450 (extended if trend continues)

Risk Profile High: because valuation is stretched and driver (cargo volumes, infra spending) needs to sustain

JSWINFRA trade ideas

Review and plan for 17th September 2025 Nifty future and banknifty future analysis and intraday plan.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

JSW INFRAJSW Infrastructure Ltd. (currently trading at ₹326) is India’s second-largest private port operator and a key logistics arm of the JSW Group. It operates 12 port concessions across India and a liquid storage terminal in Fujairah, UAE, with a total cargo-handling capacity of 170 MTPA. The company offers end-to-end maritime services including cargo handling, storage, rail connectivity, and logistics parks. JSW Infra is expanding aggressively through brownfield acquisitions, mechanization projects, and multi-modal logistics hubs.

JSW Infrastructure Ltd. – FY22–FY25 Snapshot

• Sales – ₹1,603 Cr → ₹2,950 Cr → ₹3,850 Cr → ₹4,476 Cr Growth driven by cargo volume expansion

• Net Profit – ₹284 Cr → ₹890 Cr → ₹1,240 Cr → ₹1,521 Cr Earnings surge supported by operating leverage and tariff optimization

• Operating Performance – Strong → Strong → Strong → Strong EBITDA margins consistently above 50%; high asset utilization

• Dividend Yield (%) – 0.00% → 0.27% → 0.30% → 0.35% Initiated payouts post listing; reinvestment remains priority • Equity Capital – ₹2,000 Cr (constant) No dilution; strong balance sheet post IPO

• Total Debt – ₹3,200 Cr → ₹3,000 Cr → ₹2,850 Cr → ₹2,700 Cr Gradual deleveraging supported by internal accruals

• Fixed Assets – ₹6,800 Cr → ₹7,500 Cr → ₹8,200 Cr → ₹9,000 Cr Capex focused on berth mechanization, rail siding, and logistics parks

Institutional Interest & Ownership Trends

Promoter holding stands at 85.00%, with no pledging. FIIs and DIIs have actively accumulated post IPO, citing long concession tenures and high-margin infra assets. Delivery volumes reflect long-term positioning by infra, logistics, and ESG-focused funds.

Business Growth Verdict

JSW Infra is scaling across port terminals, logistics parks, and rail connectivity Margins remain robust due to mechanization and operating efficiency Debt is declining steadily with strong operating cash flows Capex supports long-term competitiveness and cargo diversification

Management Con Call

• Q1 FY26 revenue rose 21.2% YoY to ₹1,223 Cr; PAT up 31.4% YoY to ₹390 Cr • Signed 30-year concession with Kolkata Port for ₹740 Cr berth modernization24 • Acquired 86-acre rail siding in Ballari, Karnataka for ₹57 Cr; ₹380 Cr logistics park planned5 • FY26 outlook: 18–20% revenue growth, 5–7% volume CAGR, and margin retention above 50%

Final Investment Verdict

JSW Infrastructure Ltd. offers a high-quality infra compounding story built on long-tenure port assets, operating efficiency, and strategic expansion. Its improving profitability, zero pledging, and multi-modal logistics integration make it suitable for accumulation by investors seeking exposure to India’s trade infrastructure and supply chain modernization.

JSWINFRA - Daily time frame StudyFollowing are my Inputs for above chart reading -

1. MACD cross over

2. High volume Breakout of Symmetrical Triangle Pattern - Daily Time frame

3. It may go till weekly resistance line 330-340

This chart is only for educational purpose, Please contact your financial advisor for any trading or investment decisions.

JSW Infra Set to Rise After Strong Results and Key Support..!JSW Infrastructure has released its financial results for the December quarter, showcasing a remarkable 32.35 percent surge in consolidated net profit, reaching an impressive Rs 335.62 crore. This substantial increase marks a significant rise from Rs 253.57 crore in the same quarter last year, fueled by a notable boost in income, as highlighted in the company's official statement.

Looking at the technical chart, the stock is currently positioned at a critical support level of Rs 260. It is making a determined effort to hold above this threshold, indicating a potential opportunity for investors. Given this scenario, traders might consider taking long positions or executing a buying strategy for swing trading, as a sustained performance above this level could signal further upward momentum.

JSWINFRA Weekly InvestingBuy when CLOSE between 322 -334

Stoploss - 307

Target Price : 358

Reward: Risk - 2:1

% Profit : 10%

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

JSW INFRASTRUCTURE LTD S/RSupport and Resistance Levels:

Support Levels: These are price points (green line/shade) where a downward trend may be halted due to a concentration of buying interest. Imagine them as a safety net where buyers step in, preventing further decline.

Resistance Levels: Conversely, resistance levels (red line/shade) are where upward trends might stall due to increased selling interest. They act like a ceiling where sellers come in to push prices down.

Breakouts:

Bullish Breakout: When the price moves above resistance, it often indicates strong buying interest and the potential for a continued uptrend. Traders may view this as a signal to buy or hold.

Bearish Breakout: When the price falls below support, it can signal strong selling interest and the potential for a continued downtrend. Traders might see this as a cue to sell or avoid buying.

MA Ribbon (EMA 20, EMA 50, EMA 100, EMA 200) :

Above EMA: If the stock price is above the EMA, it suggests a potential uptrend or bullish momentum.

Below EMA: If the stock price is below the EMA, it indicates a potential downtrend or bearish momentum.

Trendline: A trendline is a straight line drawn on a chart to represent the general direction of a data point set.

Uptrend Line: Drawn by connecting the lows in an upward trend. Indicates that the price is moving higher over time. Acts as a support level, where prices tend to bounce upward.

Downtrend Line: Drawn by connecting the highs in a downward trend. Indicates that the price is moving lower over time. It acts as a resistance level, where prices tend to drop.

Disclaimer:

I am not a SEBI registered. The information provided here is for learning purposes only and should not be interpreted as financial advice. Consider the broader market context and consult with a qualified financial advisor before making investment decisions.

JSWINFRALooks Supergood on Charts.

Near All Time High.

Above all Key EMA.

Good for Shortterm.

Do Like ,Comment , Follow for regular Updates...

Keep Learning ,Keep Earning...

Disclaimer : This is not a Buy or Sell recommendation. I am not SEBI Registered. Please consult your financial advisor before making any investments . This is for Educational purpose only.

GO LONG JSWINFRACMP: 220;

NEAR TERM TARGET: 240-245

RSI:52.76

SL:210

4W SUPPORT ZONE:175

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance

JSW INFRA - SHORT TERM & LONG TERM SEEMS GOODCan enter at CMP 224

If falls again you need to average at 200 level

Targets - 245,280+

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.

Request your support and engagement by liking and commenting & follow to provide encouragement

HAPPY TRADING 👍