Trade ideas

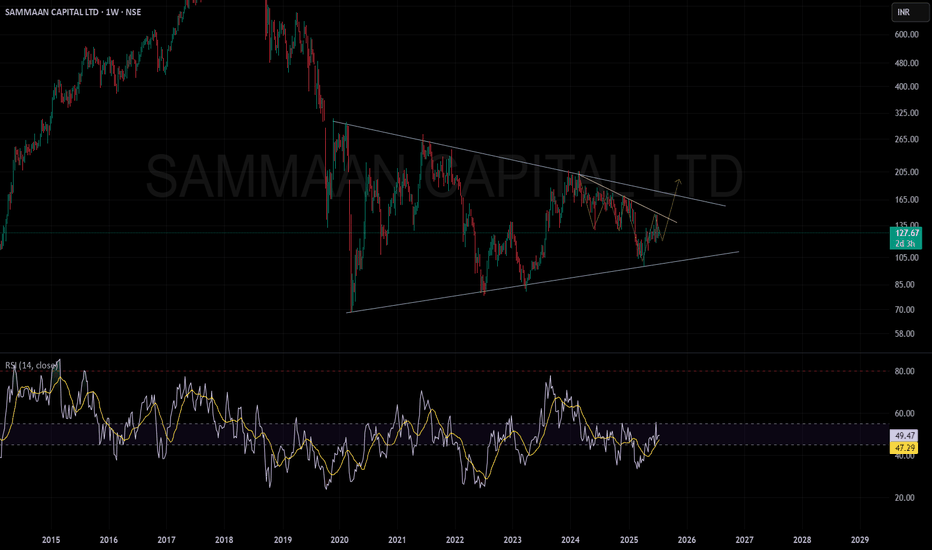

Amazing breakout on WEEKLY Timeframe - SAMMAANCAPCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the breakout levels as per the chart shared and track it yourself to get amazed!!

#No complicated chart patterns

#No big big indicators

#No Excel sheet or number magics

TRADE IDEA: WAIT FOR THE STOCK TO BREAKOUT IN WEEKLY TIMEFRAME ABOVE THIS LEVEL.

Checkout an amazing breakout happened in the stock in Weekly timeframe.

Breakouts happening in longer timeframe is way more powerful than the breakouts seen in Daily timeframe. You can blindly invest once the weekly candle closes above the breakout line and stay invested forever. Also these stocks breakouts are lifelong predictions, it means technically these breakouts happen giving more returns in the longer runs. Hence, even when the scrip makes a loss of 10% / 20% / 30% / 50%, the stock will regain and turn around. Once they again enter the same breakout level, they will flyyyyyyyyyyyy like a ROCKET if held in the portfolio in the longer run.

Time makes money, GREEDY & EGO will not make money.

Also, magically these breakouts tend to prove that the companies turn around and fundamentally becoming strong. Also the magic happens when more diversification is done in various sectors under various scripts with equal money invested in each N500 scripts.

The real deal is when to purchase and where to purchase the stock. That is where Breakout study comes into play.

LET'S PUMP IN SOME MONEY AND REVOLUTIONIZE THE NATION'S ECONOMY!

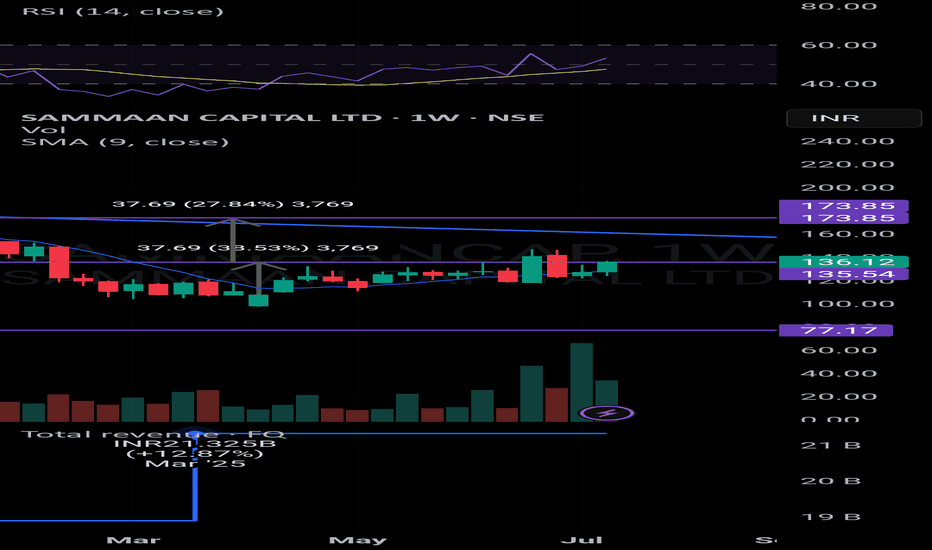

Sammaan Capital Ltd - Weekly Breakout📊 Sammaan Capital Ltd – Major Trendline Breakout with Volume Spike 🚀

📅 Chart Date: October 2, 2025 | Timeframe: Weekly

📍 CMP: ₹169.58 (+23.04%)

📈 Symbol: NSE:SAMMAANCAP

🔍 Technical Analysis

📉 Multi-Month Downtrend Broken

Stock has been consolidating under a falling trendline since late 2023.

This week, price gave a clean breakout above the trendline with a strong bullish candle.

💥 Volume Confirmation

Current Weekly Volume: 359.94M vs Avg 81.78M 🔥

Indicates strong institutional participation.

🟡 Key Resistance

Next major hurdle is ₹204.38 (previous swing high).

Sustained closing above this zone can open doors for higher levels.

📌 Key Levels

Immediate Support (Breakout Retest): ₹142–₹150

Resistance Zone: ₹204.38

Potential Next Targets: ₹220 / ₹250

Stop loss for Swing Trades: ₹135

SAMMAAN CAPITAL LTD. trading in a consolidation zone.Sammaan Capital Ltd. is currently in a decisive zone on the weekly charts. For a trend change confirmation:

Short-term traders: Wait for a weekly close above ₹145.

Long-term investors: Look for a sustainable breakout above ₹175 to target the ₹280–₹300 zone.

Bearish bias: A close below ₹100 can signal further weakness.

Given the weekly timeframe, these moves may take time to materialize. Closely monitor weekly closes and volumes for early indications of a trend shift.

outperformance in price action and fundamentalsNSE:SAMMAANCAP

previously known as indiabulls housing finance now has been outperforming and management giving good guidance for future outlook in concall rest one should analyse themselves i am already invested in this stock and minimum targets for me are atleast 100 rs above from cmp

and will be holding this stock for long term until there is an ipo coming of its subsidiary sammaan finserve this has been a recent investment if any one wants to know the reasons for investment grade qualities i will be haapy to share them in comments if a question is asked