Wild Intersection for Growth in SaaS and Cybersecurity!### 🚀 Wild Intersection for Growth in SaaS and Cybersecurity! 📈

Hey there! I see a massive opportunity for growth at the crossroads of SaaS and cybersecurity. 😎

9 days ago, I already started highlighting the appeal of investing in SaaS.

The main expectations are that the prime time for SaaS will come after the Fed's rate cuts and when interest in semiconductors starts to fade.

On one hand, we've seen a rotation over the last few days from overheated semiconductors into MAG7, and suddenly this wave has caught SaaS too. 🌊

**A few key theses:**

- There's an opinion that interest in SaaS this year will be temporary. ⏳

- Growth stocks will be more appealing when the 10-year Treasury yield drops below 4.2%. 📉

- Recently, we were below that level, and you saw small-cap and growth companies skyrocketing. 🚀

- When the 10-year Treasury yield spiked again due to political tensions, there was a slight pullback in value stocks. ⚠️

- But the last 2 days have brought the 10-year Treasury yield back close to 4.2%, and "the water is starting to boil" again. 🔥

SaaS is also a big beneficiary of low rates, and right now, with semiconductors looking overheated, they appear visually attractive based on multiples. 💡

The main driver for SaaS sector growth should be the NASDAQ:MSFT report. MSFT's results for the first quarter of FY2026 already showed revenue growth of 18% to $77.7 billion, with strong performance in SaaS segments. If the second quarter beats forecasts (e.g., due to higher cloud demand), it'll boost the momentum. The report is already on January 28! 📅

And finally, this year expects explosive growth in cybersecurity investments, amid the rise of AI, creating interest in fallen cybersecurity stocks. 🤖🔒

Two days ago, the puzzle came together, and stocks surged upward. 📈

Stocks at the intersection of cybersecurity and SaaS have become super interesting. 🌟

That's why companies like Datadog and CrowdStrike look very appealing for investments, if the bond yield stays at this level or lower.

I've also added my favorite Cloudflare to this list—it'll benefit from this flow too. ❤️

Now, let's look at the technical picture of these stocks. 🔍

**Rotation.**

NASDAQ:CRWD

Although rotation adjusts ratios for each stock's volatility, the lower boundary is almost never reached—this means they're starting to buy it back earlier, considering it more valuable. This time, it's following the same plan: they're buying it back without hitting the Buy line. So, we'll have to start buying here. Buy, $CRWD. In any case, the growth potential is incredible. 💥

NASDAQ:DDOG

NASDAQ:DDOG stocks are handling the rotation much cleaner, though not perfectly. But there's clear oversold conditions and emerging momentum. ⚡

NYSE:NET

In September 2024, it was impossible to buy stocks using rotation—the volatility was too low. A great moment was April 2025, but back then, you could buy almost anything. Now, almost a year later, a new buying opportunity for NYSE:NET has finally appeared.

I really like this company—wishing everyone successful investments! 👍

**Buy NASDAQ:CRWD ** 🛡️

**Buy NASDAQ:DDOG ** 📊

**Buy NYSE:NET ** ☁️

---

**Disclaimer**

This information is provided for informational purposes only. It is not financial advice, recommendation, or an offer to buy/sell any assets.

I am not a licensed investment advisor, broker, or financial expert. Investments involve the risk of capital loss. Conduct your own analysis and consult a qualified professional before making decisions.

I bear no responsibility for any losses arising from the use of this information. ⚠️

Market insights

$NET: The $464 Vision - Betting on the Edge AI Supercycle🌐🚀

Most analysts are looking at $249, but they are missing the forest for the trees.

Cloudflare isn't just protecting websites anymore; it’s the operating system for global AI inference.

The Setup: We are currently consolidating after a massive 3X run from the April 2025 lows.

I’m looking for a reclaim of $215 to confirm the move back to the ATH $260 range.

The Target: If the $5B ARR target is pulled forward by AI demand, a $464 price point represents a realistic 2027/2028 'blue sky' valuation.

Entry: $185 - $195 zone. Invalidation: A weekly close below $168 (200-day SMA).

#NET #Cloudflare #AIStocks #Breakout #TechStocks #CloudComputing

NETCloudflare’s latest performance confirms its massive pivot from a CDN provider to a foundational enterprise platform for security, networking, and AI computation.

Key Financial Highlights (Q3 2025)

Revenue: $562M (+31% YoY).

Enterprise Shift: 4,009 large customers (>$100k/year) now contribute 73% of total revenue, up from 67% last year.

FCF reached $75M (13% margin), supporting the path to a $5B annual revenue goal by 2028.

Strategic Transformation:

🔎

Cloudflare (NYSE: $NET) Pops After Bullish Barclays CallCloudflare (NYSE: NYSE:NET ) jumped in premarket trading after Barclays initiated coverage with an Overweight rating and a $235 price target. Shares rose roughly 3% as analysts led by Saket Kalia outlined a strong multi-year growth roadmap supported by Cloudflare’s expanding product ecosystem and accelerating market share gains.

Barclays highlighted Cloudflare’s unique homogeneous global network, which currently supports nearly 20% of the internet. Because the entire network can run any Cloudflare service at any time, the company is able to scale new offerings quickly and capitalize on secular trends such as cybersecurity expansion, AI inference, cloud adoption, and emerging “no-click” search.

Cloudflare organizes its business into four product suites, or “Acts.” According to Barclays, Act 1 delivered about 85% of FY24 revenue, while Acts 2 and 3 contributed the remaining 15%. However, Acts 2 and 3 are growing materially faster and tapping into large, rapidly expanding markets where Cloudflare continues to take share. Analysts believe this evolving mix will strengthen revenue durability as the company moves deeper into security, AI, and developer tooling.

Barclays expects 27%–30% annual growth through FY28, driven by continued share gains and broader adoption of Cloudflare’s enterprise contracts. While valuation is elevated relative to peers, analysts argue that sustained 30% growth rates are rare in large-cap software — and historically, markets have rewarded companies able to maintain this trajectory. Cloudflare’s focus remains on the Rule of 40, balancing high growth with improving profitability over time.

Technicals

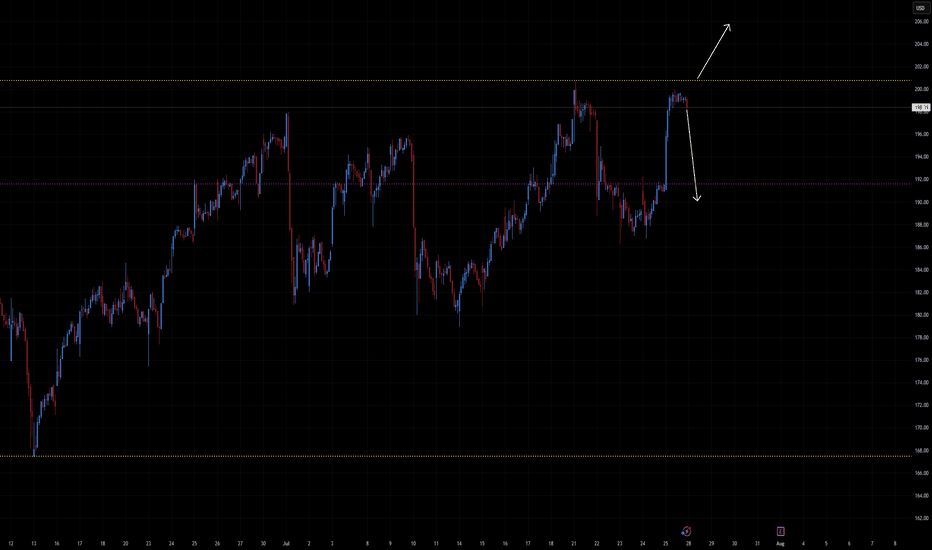

NET remains in a strong bullish structure. After hitting the $260 resistance, price retraced toward the $180 support zone, where buyers quickly stepped in. The rejection at support confirms bullish momentum, with upside targets now pointing back toward $260. As long as price holds above $180, bulls remain firmly in control.

Cloudflare poised for upside despite limited social sentiment da

Current Price: $191.94

Direction: LONG

Confidence Level: 58%

Targets:

- T1 = $196.50

- T2 = $200.00

Stop Levels:

- S1 = $189.00

- S2 = $186.50

**Wisdom of Professional Traders:**

This analysis combines the perspectives of multiple professional traders whose recent discussions touched on the tech growth space that includes companies like Cloudflare. Even without a flood of trader commentary squarely aimed at Cloudflare, the wider trader consensus around high-growth infrastructure tech this quarter has skewed to cautious optimism. Drawing on the wisdom of professional traders, I'm looking at how similar momentum names have been treated, where demand for robust internet and AI-enabled services remains a strong theme.

**Key Insights:**

Here's what's standing out: cloud infrastructure names have been under the microscope as traders assess which of these high-multiple plays can still deliver. In recent professional trader discussions, there was a recognition that large-cap tech and growth stocks have caught fresh bids into year-end as portfolio managers rotate back into names with clear growth stories. Cloudflare, with its position in security, CDN, and edge computing, still sits in the sweet spot of this theme.

What's interesting is that while broader market chatter is dominated by AI chipmakers and mega-cap software giants, some traders have been quick to lump Cloudflare into the list of "overlooked beneficiaries" of AI and security spend accelerations. That’s kept sentiment more positive than not, even without blockbuster headlines. When I compare this to similar market darlings, buying near-term dips has proven a favored tactic among this group.

**Recent Performance:**

This all played out in the price action over the last month, with Cloudflare rallying sharply off its early-November lows near the mid-$180s, reclaiming the $190 handle and holding it into resistance zones. The stock has respected a rising short-term trendline and hasn't broken key supports, printing higher highs and higher lows on the daily chart. The lack of aggressive selling in a choppy market suggests underlying demand.

**Expert Analysis:**

Traders are taking notice – several noted in their broader tech overviews that company fundamentals in the segment remain intact and technical structures are still constructive. The consensus for similar stocks has been to watch for follow-through buying once a name reclaims resistance and turns it into support. Applying that lens here, the $189-$190 zone seems to be acting as a floor. Multiple professionals assessing tech growth charts have been leaning toward "buy the retest" setups into this kind of base.

**News Impact:**

Although there hasn’t been a major Cloudflare-specific headline this week, the overall environment is supportive. Market participants are rotating into tech after digesting recent earnings in the sector, and macro fears have been muted to start the week. The absence of negative catalysts leaves room for momentum trades to work in the direction of the prevailing trend. Sector sympathy moves can quickly carry Cloudflare higher if large-cap peers keep rallying.

**Trading Recommendation:**

Putting it all together, I’m leaning LONG here with moderate confidence. The rising base, sector rotation flows, and lack of selling pressure make this a reasonable risk-reward bet for the week. I’d look to pick up shares around current levels with a short-term target at $196.50, and push for $200 if momentum broadens. Stops should be placed below $189 for tighter risk control, with a secondary protective level at $186.50. If the market holds its tone, Cloudflare could easily tag those upside levels before week’s end.

NET — AI Infrastructure Leader Launches Stablecoin InnovationCompany Overview:

Cloudflare, Inc. NYSE:NET is a global leader in cloud connectivity and cybersecurity, delivering secure, scalable, and high-performance infrastructure for the modern internet. The company is evolving into a key enabler of AI-driven applications, with its Workers platform gaining strong enterprise traction to power large-scale intelligent workloads.

Key Catalysts:

Fintech breakthrough: The launch of the NET Dollar stablecoin bridges AI, cloud, and financial infrastructure, enabling automated machine-to-machine (M2M) payments and introducing new recurring revenue models.

Enterprise growth: Added 219 new large customers in Q2 2025, highlighting accelerating adoption and market leadership.

AI ecosystem expansion: Increasing integration of Cloudflare’s edge computing network within enterprise AI frameworks positions it at the core of the next-generation digital economy.

Investment Outlook:

Bullish above: $188–$190

Upside target: $380–$390, supported by AI infrastructure dominance, fintech innovation, and accelerating enterprise demand.

#Cloudflare #AI #Stablecoin #Cybersecurity #Fintech #DigitalInfrastructure #EdgeComputing #Investing #NET

TradeUSAsignals Recommendations NET - It shows clear technical strength with indicators supporting continued upward movement in the coming period, backed by improved financial results and business expansion in the cloud services market. The presence of strong price supports and dominance above moving averages enhances the prospects of sustained growth.

$NET Morning Star Reversal PatternI have been looking to take a position in NYSE:NET after earnings. I have waited for a pullback which has happened. On Wed, Thurs, and Fri of last week it formed a Morning Star Reversal pattern. So, I have put on a half size position pre-market. My risk reward is exceptionally good here as my stop can be just below the previous low or a close under the rising 50 DMA. I managed to get a fill at $200.00.

Citigroup has also raised the PT to $255.

If you like this idea, please make sure it fits your trading plan. Remember, it is your money at risk.

Will this stock ""NET"" you a nice return?📰 Cloudflare (NET) — Technical Overview & Breakout Strategy

Ticker: NET | Sector: Cybersecurity / Edge Computing

Date: July 26, 2025

Current Price: ~$198

⚠️ Context: Past Red‑Candle Sell-Offs

NET has experienced sharp downward reversals often signaled by large bearish engulfing candles, especially during pullbacks from the $200–$205 range.

These sell-offs typically occurred with elevated volume, triggering destruction of short-term support and dragging price toward $185–$190, followed by consolidation and eventual bounce.

Those breakdowns often led to retests of the $190 support zone, with range bottoming and short-covering rallying price back toward $200+.

🧰 Current Technical Set-Up

Price is consolidating just below its 52-week high near $200.8, forming a tight range between $190 support and $200 resistance.

Moving averages:

50-day MA ~$193, 200-day MA ~$188 — all indicating bullish trend alignment.

Investing.com

Technical ratings classify NET as a Strong Buy on both daily and weekly timeframes.

🔍 Support & Resistance Levels

Support Zones:

Primary: $190–$192 (recent consolidation base)

Secondary: $185 (recovery low after last drop)

Resistance Zones:

Immediate: $200–$202 — near all-time highs

Major Breakout Target: Above $205–$207 opens upside extension

✅ Bullish Breakout Scenario

Trigger: Clear close above $202, especially with strong volume

Targets:

Short-term: $210 → $215

Extended: $220+ if breakout sustains and earnings beat arrives

Supportive Thesis: Rising demand for cyber‑security, expanding AI tools (e.g. pay-per-crawl, bot protection), and expansion into media and content creator segments. Cloudflare maintains strong institutional accumulation metrics.

❌ Bearish Breakdown Scenario

Trigger: Fall below $190–$192 zone

Targets:

First: $185

If momentum continues: $180 → $175

Risk Drivers: Overbought pullback after extended run-up, profit-taking, or broader tech selloff. Large red candles in the past preceded rapid downward moves.

📊 Summary Table

Outlook Trigger Level Target Zones Technical Notes

Short-Term Bull Above $202 $210 → $215 Breakout from high consolidation zone

Short-Term Bear Below $190 $185 → $180 Overbought exhaustion, volume decline

Long-Term Bull Sustained > $205 $220 → $230 Continued AI/protection tailwinds

Long-Term Bear Clear break under $190 $180 → $175 Broad rotation, failed breakout

🧠 Viewpoint Summary

Cloudflare is currently consolidating just below all-time highs after a strong year-to-date rally. The stock remains technically strong, but recently stretched indicators suggest potential for near-term pullbacks. A breakout above $202+ could unlock further upside, while a drop below $190 might trigger a retest toward lower support zones.

Given Cloudflare’s expanded role in AI infrastructure and cybersecurity, its trend remains attractive—but price action will be key to confirm direction.

$NET — Ascending-Base BreakoutNYSE:NET — Ascending-Base Breakout

• Seven-month ascending base resolving through $184-186 supply

• Volatility contracting; RS already at 52-w highs

• Cloud-security group remains a leadership pocket

📈 Trigger = daily close > $188.50 on strong volume

🛑 Risk line = < $175 (1.5 × ATR, below shelf)

🎯 Measured move targets $194 → $204, scope to $208-210

Keeping this front-row for follow-through.

#NET #BreakoutWatch #BaseBreakout #TechnicalAnalysis #Stocks #trading

An Internet Disaster - NET & GOOGL FallAs of Thursday, June 12, 2025, a significant internet outage has disrupted services across multiple major platforms, including Google, Amazon Web Services (AWS), Spotify, YouTube, Discord, and Shopify. Cloudflare acknowledged experiencing intermittent failures and noted that some services were beginning to recover, though users may continue to encounter errors as systems stabilize.

The root cause of the disruption has been identified as an issue with Google Cloud's Identity and Access Management (IAM) service, which affected various services globally. While Cloudflare's core services were not directly impacted, some of its services relying on Google Cloud experienced issues.

Imagine how far Net could've fallen if IGV / Cloud stocks weren't strong today.

Will Tomorrow’s Secrets Remain Safe?The financial world stands at a critical juncture as the rapid advancement of quantum computing casts a shadow over current encryption methods. For decades, the security of sensitive financial data has relied on the computational difficulty of mathematical problems like integer factorization and discrete logarithms, the cornerstones of RSA and ECC encryption. However, quantum computers, leveraging principles of quantum mechanics, possess the potential to solve these problems exponentially faster, rendering current encryption standards vulnerable. This looming threat necessitates a proactive shift towards post-quantum cryptography (PQC), a new generation of encryption algorithms designed to withstand attacks from both classical and quantum computers.

Recognizing this urgent need, global standardization bodies like NIST have been actively working to identify and standardize quantum-resistant algorithms. Their efforts have already resulted in standardizing several promising PQC methods, including lattice-based cryptography (like CRYSTALS-Kyber and CRYSTALS-Dilithium) and code-based cryptography (like HQC). These algorithms rely on different mathematical problems believed to be hard for quantum computers, such as finding the shortest vector in a lattice or decoding general linear codes. The finance industry, a prime target for "harvest now, decrypt later" attacks where encrypted data is stored for future quantum decryption, must prioritize adopting these new standards to protect sensitive financial transactions, customer data, and the integrity of financial records.

The transition to a quantum-safe future requires a strategic and proactive approach. Financial institutions need to conduct thorough risk assessments, develop phased implementation roadmaps, and prioritize crypto agility – the ability to switch between cryptographic algorithms seamlessly. Early adoption not only mitigates the looming quantum threat but also ensures regulatory compliance and can provide a competitive advantage by demonstrating a commitment to security and innovation. As technology leaders like Cloudflare begin to integrate post-quantum cryptography into their platforms, the financial sector must follow suit, embracing the new cryptographic landscape to safeguard its future in an era defined by quantum capabilities. Adopting post-quantum cryptography is essential, as merely using a different mathematical method does not ensure protection against quantum computing threats.

Cloudflare: ProgressCloudflare has demonstrated impressive upward pressure, surging more than 40% in just a few days. In response, we now consider waves 3 and 4 in green as finished and locate the stock in the final stretch of this impulse move, which should ultimately complete the orange wave iii. Given that key expansion levels have already been reached, we expect the wave iii high to form soon. Afterward, we anticipate a sharp wave iv correction, with downside potential toward the $122.68 support.

Cloudflare, Inc. Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Cloudflare, Inc. Stock Quote

- Double Formation

* ABC Flat Feature | Entry Bias & Subdivision 1

* (Consolidation Argument)) At 101.00 USD

- Triple Formation

* Trendline & Pennant Structure | Subdivision 2

* Numbered Retracement | Uptrend Bias | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

2/6/25 - $net - I'll fade on a pop, sidelines2/6/25 :: VROCKSTAR :: NYSE:NET

I'll fade on a pop, sidelines

- deepseek reflex pump indexer

- this company is impressive. underlying trends strong. will eventually grow into these mutliples

- but this mkt is getting a bit long in the tooth with 25-30x sales plays growing in the 20s. i'm in the mkt long enough to know... enjoy... but don't take your eye off the momo ball bc any miss, any change in risk appetite sends these things down 20-25% fast, and they're even hard to buy there, initially.

- so while i'm not fading a co where expectations/ beats are the norm... any pop of say >10%, ideally larger... i'm fading you as a hedge to stuff that's legit growing just as fast and valued at like 1/10th (*ahem* uber, *ahem* uber... and i'll even throw in btc, tho that's a different discussion).

so. hope you're right. but better be ready to face me on the otherside if this pops AH, otherwise on a dip, i won't be buying and just look to play elsewhere.

V