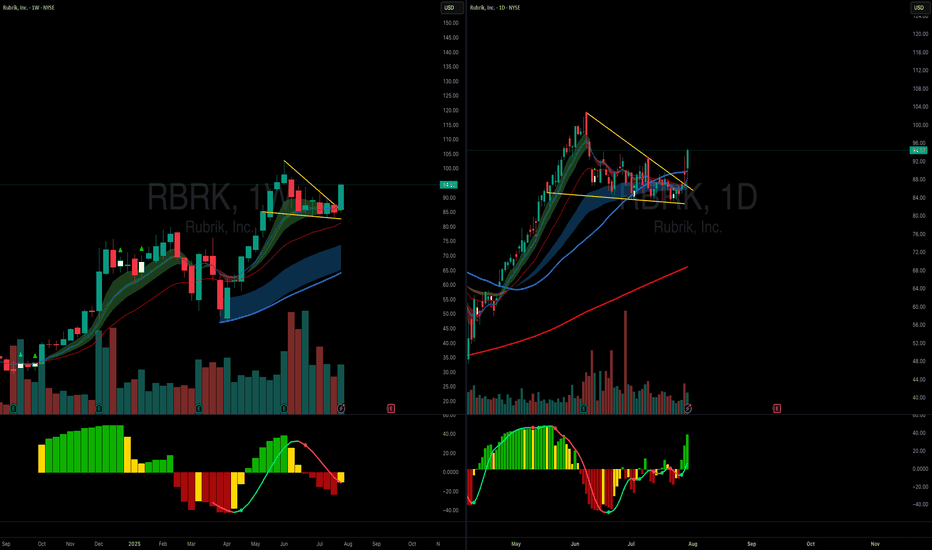

RBRK - Good R:R TradeRBRK has been pulling back into the discount zone for a while.

This is a good area to start building a long position.

There is an unfilled gap below, may fill it aggressively to shake out the longs.

Have a wide stop or build the position over the time instead of jumping into it.

- IPO VWAP holding well

- Earnings gap filled

- In the discount zone

Target 1 - 100

Target 2 - 120

Stop loss - 48, very wide.

Rubrik, Inc.

No trades

What traders are saying

RBRK Surge Potential – Call Options in Focus!RBRK Buy Calls Trading Info (Hypothetical/Attention-Grabbing)

Instrument: RBRK

Trade Type: BUY CALLS

Strike Focus: $70.00

Entry Range: $4.00

Target 1: $6.00 (50% gain)

Target 2: $8.00 (100% gain)

Stop Loss: $2.80 (30% loss)

Expiry: 2025-12-05 (1 day)

Confidence: 58%

Flow Intel: Bearish Put/Call Ratio 1.63 (high smart money bearish positioning)

Implied Move: $9.65 (13.5%)

24h Move: +4.10%

Analysis Highlights:

Pre-earnings rally: +4.10% in 24h

Strong revenue growth: +326%

Mixed analyst sentiment (Overweight/Buy ratings)

Technical: Resistance at $72.30, support at $67.48

Risk: HIGH due to earnings uncertainty, 0% beat history

Strategy Notes:

Tight stop-loss recommended

Position size small (2% of portfolio) due to mixed signals

Earnings release can trigger volatility, watch for directional movement

RBRK Earnings Alert: High-Volatility Put Setup (Katy Conflict InRBRK QuantSignals V3 Earnings — 2025-12-04

Earnings Signal: NEUTRAL | Confidence: 58%

Expiry: 2025-12-05 (1-day)

Strike Focus: $70.00 | Entry Range: $4.00

Target 1: $6.00 | Target 2: $8.00

Stop Loss: $2.80 | Implied Move: $9.65 (13.5%)

24h Move: +4.10%

Flow Intel: Bearish (High P/C Ratio) | PCR 1.63

⚠️ High Risk Warning: Use small position size due to low confidence and high uncertainty.

Earnings Date: 2025-12-04 | Estimate: $-0.17

Trade Recommendation

Direction: BUY PUTS

Confidence: 58%

Conviction Level: LOW

Katy-LLM Conflict:

LLM Recommendation: BUY CALLS

Katy Prediction: BUY PUTS (-1.96% predicted move)

Katy Confidence: 50%

⚠️ Proceed with caution due to mixed directional signals.

Analysis Summary

Katy AI shows bearish bias with price target ~$70.28, predicting consistent downward movement (as low as $68.11 by Dec 5).

Technicals: Stock rallied +4.10% pre-earnings; trading range $67.48–$72.30. Strong trending regime (88.4%) suggests momentum continuation. MACD histogram bullish but mixed with price action.

News Sentiment: Mixed; analysts maintain buy/overweight ratings with targets ~$105–108. Revenue growth 326% supports long-term fundamentals.

Options Flow: Bearish, PCR 1.63; max volume at $72 puts, high IV 315% implies strong volatility.

Risk Level: HIGH — 0% earnings beat rate, large historical misses, speculative with tight stops recommended.

Trade Setup

Expiry Date: 2025-12-05

Strike: $70.00 | Delta: -0.418

Entry Price: $3.80–$4.20

Target 1: $6.00 (58% gain)

Target 2: $8.00 (100% gain)

Stop Loss: $2.80 (30% loss)

Position Size: 2% of portfolio

Competitive Edge

Katy AI bearish trajectory overrides mixed fundamental signals.

High PCR (1.63) shows smart money bearish positioning.

Earnings release provides volatility catalyst for short-term move.

Tight stop mitigates extreme volatility risk; balanced delta selection.

Important Notes

Katy AI confidence only 50% — speculative trade.

Stock may surprise positively due to strong revenue growth (326%).

1-day expiry exposes trade to extreme time decay risk — monitor closely.

Trade Details

Instrument: RBRK

Direction: PUT

Entry Price: $4.00

Profit Target: $6.00

Stop Loss: $2.80

Expiry: 2025-12-05

Size: 2% of portfolio

Confidence: 58%

Signal Time: 2025-12-04 13:59:36 EST

It's a time for RBRK - 50% potential profit - 108 USDOn the 4-hour chart, we can see that after a prolonged period of decline, Rubrik’s share price has entered a zone of local support from which dynamic rebounds have occurred in the past. The current price is oscillating around 71–72 USD, where the first signs of a slowdown in the downward movement have appeared, which may suggest the formation of a potential bottom.

Although the moving averages are still slightly downward-sloping, they are starting to show signs of flattening, which often precedes a trend reversal. The RSI indicator at the bottom of the chart is in the oversold area, which historically has favored bullish rebound movements.

A projected upward move toward the 108 USD level has been marked on the chart, which would represent an increase of roughly 50% from current prices. This level aligns with previous highs and a strong resistance zone that has stopped the price in the past. If the stock defends the current support level and stronger buying volume appears, such a bullish scenario could become realistic.

The current price structure — low RSI, slowing decline, and flattening moving averages — provides grounds to expect a potential upward wave in the near future, with the 108 USD area as a possible target.

Potential TP: 108 USD

This analysis is for informational and educational purposes only. It does not constitute investment advice, financial guidance, or an encouragement to buy or sell any financial instruments. Investing in capital markets involves the risk of losing capital. All investment decisions are made solely at your own responsibility.

10/28/25 - $rbrk - okay. i'm convinced. small... 4 now10/28/25 :: VROCKSTAR :: NYSE:RBRK

okay. i'm convinced. small... 4 now

- thanks to @livedbackwards i had to take a closer look

- and the momentum these guys have esp after the last earnings is basically undeniable

- i still have to hold my nose w/ valuation, but take the point that inflection on cash isn't necessarily the focus here

- how many other one-of-one cyber names can you buy that are doing >30% growth for near 10x sales; an AI disruptor, not the other way around

- i'd like to own more, but i'm keeping it small for now bc i'd still like to hold a high cash balance, more on my sizing for a follow up but for now it's about a 2% position (and LT meriting more deep dive on my part).

- so for now the 2026 cyber portfolio is $S (larger) and NYSE:RBRK

V

RBRK eyes on $76.30: Golden Genesis fib to HOLD or CRASHRBRK has been retracing from its AllTimeHigh.

Testing a proven Golden Genesis fib at $76.30

Looks like it will fail so looking at fibs below.

.

Previous Plot that called a PERFECT TOP:

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

RBRK bullish 🚀 **Bullish on $RBRK!** Rubrik's stock is bouncing off the 200 EMA like clockwork—multiple touches in recent sessions scream strong support. Uptrend intact with EMAs stacked bullishly & volume kicking in. Targeting upper channel ~$85-90 short-term, eyeing $100+ ATH. 📈 *Not financial advice—DYOR, not advisable for buy/sell decisions.* #RBRK #Stocks

Looking for $181I'm considering taking a stab at Rubrik as an idea getting over $107 resistance to become the new support. From there my target is $181. I'm not betting it would definitely make it there before the nasdaq pulls back next year, but I'm speculating it's a good trade just betting on it getting well over $107. If it does then depending on timing $181 might be in the cards.

Curious what anyone else is thinking.

Good luck!

RBRK $97.50 CALL — Earnings Beat Setup You Can’t Miss!

# 💻🔥 RBRK Earnings Play: 200%+ Upside Setup!

📊 **Earnings Analysis Summary (2025-09-08)**

💡 **Trade Idea:**

👉 Buy **1x RBRK \$97.50 CALL** (exp. 2025-09-19) at **\$7.60** (pre-earnings close).

This is a **single-leg naked call** designed for a tactical earnings pop.

---

### 🧩 Why This Trade?

* 📈 **Revenue Growth:** +48.7% TTM 🚀 (SaaS momentum).

* 💰 **Gross Margin:** 76.4% → world-class unit economics.

* ✅ **Beat Machine:** 100% beat rate last 5Q, avg surprise +37%.

* 🛡 **Balance Sheet:** \$762M cash + FCF positive → de-risked growth.

* 📊 **Technical Setup:** Price \$90.93 > 20d/50d/200d MAs, RSI 65 (bullish).

* 🌎 **Macro Tailwinds:** Low VIX (15.4) + risk-on environment.

---

### 📊 Scores (1–10)

🔻 Fundamentals: 9

📈 Options Flow: 6

📊 Technicals: 8

🌎 Macro: 8

✅ Overall Conviction: **78% MODERATE BULLISH**

---

### 📌 Trade Plan

🎯 Entry: \$7.60 limit (pre-earnings close)

🛑 Stop Loss: \$3.80 (–50%)

💰 Profit Targets:

* +100% = \$15.20

* +200% = \$22.80

📆 Exit: within 2 hrs post-earnings to avoid IV crush

---

### ⚖️ Risk/Reward

* Max Loss: **\$760**

* Breakeven: \$105.10 (needs +15.6% move)

* Upside: +200% possible if earnings beat + guidance pop

---

📊 **TRADE DETAILS**

* 🟢 Instrument: RBRK

* 🟢 Direction: CALL

* 🎯 Strike: 97.50

* 💵 Entry: 7.60

* 🛑 Stop: 3.80

* 📅 Expiry: 2025-09-19

* 📈 Confidence: 78%

* ⏰ Earnings Entry: Pre-close

---

🚀💎🙌 This is a **high-conviction growth SaaS earnings bet**: risk \$760, aim for \$1,520–\$2,280 upside if history repeats with another big beat.

6/5/25 - $rbrk - I don't get it... lol6/5/25 :: VROCKSTAR :: NYSE:RBRK

I don't get it... lol

- looks like they listed it to sell someone's bags

- didn't understand the valuation at $20... much less $100

- beyond tempted to short this

- but the lower risk way is to let a pop happen, if does... and play accordingly or move on

- buying this would be the smooth brain choice, though, and a lot of times eliminating the low IQ option is what allows us to keep the book trending well over time

- also note the green line... it's literally straight. that's so beyond unnatural and for a sus-AF valuation company that it just gives me the shivers. beware of the straight lines.

- anyway... perhaps someone knows something. google trends solid. they spend SO much on marketing... to create their fake sales growth... that perhaps they "beat" lol. but reality is that w/ negative ebitda mgns, and bought sales growth, this stock will eventually find it's home back toward that IPO price. i'd be happy to short it once it cracks or on one last thrust higher

good luck to holders. might be worth another look if u have this thing as some sort of LT buy. do you know what u own?

V

RBRK Rubrik Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RBRK Rubrik prior to the earnings report this week,

I would consider purchasing the 90usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

RBRK watch $76.xx: Golden Genesis + Local 4.236 may give a DIPRBRK got a nice strong boost from the last earnings report.

Now at a tight confluence of Golden Genesis plus local 4.236

Look for a dip to buy or a Break-n-Retest of $76.30-76.41 range.

=======================================================

.

Breaking: Rubrik, (NYSE: RBRK) Surge 18% In Premarket TradingRubrik, Inc. (NYSE: RBRK) a company providing data security solutions to individuals and businesses worldwide, offering enterprise data protection, unstructured data protection, cloud data protection, and SaaS data protection solutions; data threat analytics; data security posture; and cyber recovery solutions saw its stock surged about 18% on Friday's premarket session amidst fourth quarter and fiscal Year 2025 financial results.

Earnings Highlight

Results exceeded all guided metrics

Fourth quarter subscription ARR grew 39% year-over-year to $1,092.6 million

Fourth quarter revenue grew 47% year-over-year to $258.1 million

2,246 customers with $100K or more in Subscription ARR, up 29% year-over-year

First Quarter and Fiscal Year 2026 Outlook

Rubrik is providing the following guidance for the first quarter of fiscal year 2026 and the full fiscal year 2026:

First Quarter Fiscal 2026 Outlook:

Revenue of $259 million to $261 million.

Non-GAAP Subscription ARR contribution margin of approximately 4.0% to 5.0%.

Non-GAAP EPS of $(0.33) to $(0.31).

Weighted-average shares outstanding of approximately 192 million.

Full Year 2026 Outlook:

Subscription ARR between $1,350 million and $1,360 million.

Revenue of $1,145 million to $1,161 million.

Non-GAAP Subscription ARR contribution margin of approximately 4.5% to 5.5%.

Non-GAAP EPS of $(1.23) to $(1.13).

Weighted-average shares outstanding of approximately 198 million.

Free cash flow of $45 million to $65 million.

Technical Outlook

As of the time of writing, NYSE:RBRK shares are up 18.56% on Fridays premarket session forming a gap up pattern which is a strong bullish reversal pattern. NYSE:RBRK shares closed Thursday's session with a weak momentum as highlighted by the Relative Strength Index (RSI) at 35 but this 18% premarket surge could place NYSE:RBRK on the cusp of a bullish campaign with eyes set on the $88 pivot point.

Similarly, should NYSE:RBRK shares consolidate the 65% Fibonacci retracement point is well capable of acting as s support point before it picks momentum up.

RBRK: Runaway gap followed by a flag pattern NYSE:RBRK Runaway gap followed by a flag pattern.

Tailwinds: AI, Data, Cybersecurity

My price levels:

Entry Levels: 65-71

Stop Loss: 59

These are my price levels. Not recommendations. Decide your own price levels based on your personality, timeframe and risk.

Pricing pressure across sector= extreme caution warranted

11:32 AM EST, 12/02/2024 (MT Newswires) -- CrowdStrike (CRWD) and Palo Alto Networks (PANW) are increasing discounts to accelerate market share gains in cybersecurity, creating potential broader pricing pressures across the sector, Morgan Stanley said in a report on Monday.

The firm said it remains positive on long-term trends in cybersecurity, driven by expanding technology industry with generative artificial intelligence and public cloud adoption.

However, a tougher spending environment, pricing pressures, uncertain US fiscal policies, and high valuations necessitate a more selective approach for 2025.

Morgan Stanley downgraded SentinelOne (S) and Tenable (TNB) to equal-weight from overweight and upgraded Okta (OKTA) to overweight from equal-weight. Okta's price target was raise to $97, while Tenable's price target was lowered to $47.

The brokerage also raised price price target for Fortinet (FTNT), CrowdStrike and CyberArk Software (CYBR) to $113, $390 and $316, respectively.

Price: 346.98, Change: +1.01, Percent Change: +0.29

www.mtnewswires.com Copyright © 2024 MT Newswires. All rights reserved. MT Newswires does not provide investment advice. Unauthorized reproduction is strictly prohibited.