SPT - SPLITIT After todays announcement, I think Splitit is heading for 86c. I’ll be selling a portion of my position at that point.

STTTF trade ideas

Short Term Price Regression before upwards movement Splitit has fallen beyond 90% from all time highs. In respect to fibbonacci re-tracement and extension going downwards, I'm hoping to add more positions at 15c and 9c.

Splitit longSplitit at previous bottom yet reporting record revenue for this quarter. ~100 mil market cap is low so don't think there is much downside left. Not sure if this thing will still move lower but I think the potential R:R of another explosion upward on record Christmas season revenue is too good to pass up. Can be 10x like previous moves upward. I have bought some long positions at 0.220.

Note: This is more for my own records. Do your own research.

SPT - Trade PlanSPT has clearly broken out of its descending wedge with very high volume indicating that the downward trend may have changed. The current price action shows that price is pulling back and any bullish price action may get me involved. I would be a buyer after it prints bullish price action and I will be targeting the Resistance level of $0.850, a good potential reward of 45-50%.

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

SPT Possible reversal play High-risk trade as my general rule is if the price is below the 200 ema, only look for shorts and vice versa.

This is only a bit of fun for me and practice

Please refer to the chart,

Possible reversal of down channel, bullish divergence on both RSI, MACD CROSS and TSV with OBV ticking up + volume slowly increasing.

Ideally would like to see a break/close above the 50 EMA on a lower time frame for a better entry, however as noted just abit of fun after looking at the chart for 15 minutes.

Expected short positionDouble Top formation followed by declining RSI peaks. I would expect to see further drop off

SPT - Looks very InterestingBullish Confirmation Indications

Recent price action may have confirmed a reversal as we can see that price came down to the trendline and has since moved up.

Price has also moved out of the downtrend line (triangle) which indicates that Buyers are strong.

1. Price has been supportive at the support level of $1.00 - $1.30 zone

2. There also lies a trendline which has acted as good support

3. There also lies 200 day Moving Average trending upward and has provided Dynamic Support (Confluence)

4. Price has been failing to continue up because of the Resistance Zone of $1.430 - $1.470 range

5. I believe that price may come down again to give a buying opportunity and backtest the trendline and continue up

6. I will be confident to buy in the $1.120 - $1.20 region (Buy Zone) after proving some Bullish Price Action

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

SPT | 4 HR trend continuation hey traders,

looking at SPT having completed a daily pattern showing more upside. we have entered into this stock last week

SPT | 4 HR trend continuation hey traders,

looking at this 4hrly flat being complete and we now have a 15min impulse & correction signaling continued upside.

trade safe.

regards,

MIC

Splitit ready yet to take over the IPO high? 2+The high that was created by the hype during its IPO is ready to get taken over by the hype that's created from a cashless society.

TA,

- MACD daily golden cross

- MACD volume increasing

- Demand volume increasing

- Broke out of bullish pennant

- Bullish Moving averages

Hoping for some consolidation at this level due to 2 massive supply tails at 1.915.

Watch for the break of 1.915 and 2.00

FA,

- BNPL hype

- Pent up demand over the weekend. No, really that's a thing now. People hate weekends cause the casino is only open from Monday-Friday.

- Visa, Mastercard, Stripe partnerships

- Founder Brad Paterson :Former VP marketing at Intuit, Director for emerging products ANZ for Visa, Head of new ventures for Paypal

- 460% revenue growth

- MSV 260% (Creating win-win situations for merchants and SPT)

- Gives the customer more options with 3,6,12,24 months unlike other BNPL's.

- Allows the use of existing credit without interest rates. Less credit risk and easier to integrate with Visa/Mastercard ?

$SPT.ASX creeping up $SPT.ASX creeping up and the chart looks good however I think it is Overvalued

Splitit Payments Ltd (SPT) is a technology company providing cross-border credit-card based instalment solutions to businesses and retailers. Splitit enables merchants to offer their customers to pay for purchases in instalments.

I will buy between $0.93 - $1.00 zoneDoesn't look like as good as Afterpay, ZIP and OpenPay but still BNPL market is growing, I think I can have a little investment in this one.

Also, looking at historic data it jumps pretty drastically up & down - doesn't look very stable.

I will buy and hold between $0.93 to $1.00 range.

P.S: Please note these are my own notes for future reference. By no means trading advise to anyone.

Split Payment(SPT) - Price chart analysisSplit Payment(SPT) fell below critical support at 1.350 in yesterday's trades but bounced back in today's opening trades. Today's turnaround will only be sustainable if it holds above 1.350, else support remains at 1.180

Splitit Payments: SPT.AXLong term downtrend

Price moved out of downtrend

Base forming

Price above 20MA

Break of 54c

Splitit's BNPL keep your eyes on this little gem #bloodbathSplitit in the Visa firing line

Splitit's BNPL service differs from that of its competitors in that it allows customers to use their existing credit limits to pay off purchases in interest-free instalments. With Splitit, there is no need for additional registrations or applications — buyers can make use of the platform through their existing credit cards.

While Splitit touted this unique payment solution in its annual report as a window into an "under-served and large global market opportunity", it may leave it more vulnerable than its competitor's to Visa's plans to break into the BNPL world.

The credit card giant announced its plans to join the BNPL party in late June 2019, and in December released a new set of guidelines for U.S. consumers that rivals the Splitit offering.

When Visa announced its BNPL plans in June, Splitit's share price fell by 25 per cent in three days.

And since Visa's new policies came into effect on January 25, Splitit shares have fallen over 42 per cent.

SPT | volatile penny stock a move to $2hey traders,

i have a position in this stock. on monday they have a 25min webinar showcasing their FY2019 performance and objective outcomes. allow this to break the low and reverse. daily abc. This is a penny stock. volatility is to be expected. my position is at 50c. i will hold this pair to break $2.

regards,

a ballsy fucking trader.

SPT | longs valid on this penny stockhey traders

looking at longs for SPT we've got good potential for upside. this could be a nice buy

SPT potentially ditching to the 0.4 levels againSPT has been falling since the recent highs of 1.15. From TA point of view, the stock has broken key structure points. We may see it heading to the 0.4 levels again which would be a good point to buy more.

Self ExplanatoryAfter a big push SPT has retraced nicely on the fibs. Bolinger is over-sold, RSI is oversold on most time frames, MACD ready to cross. First target 30%

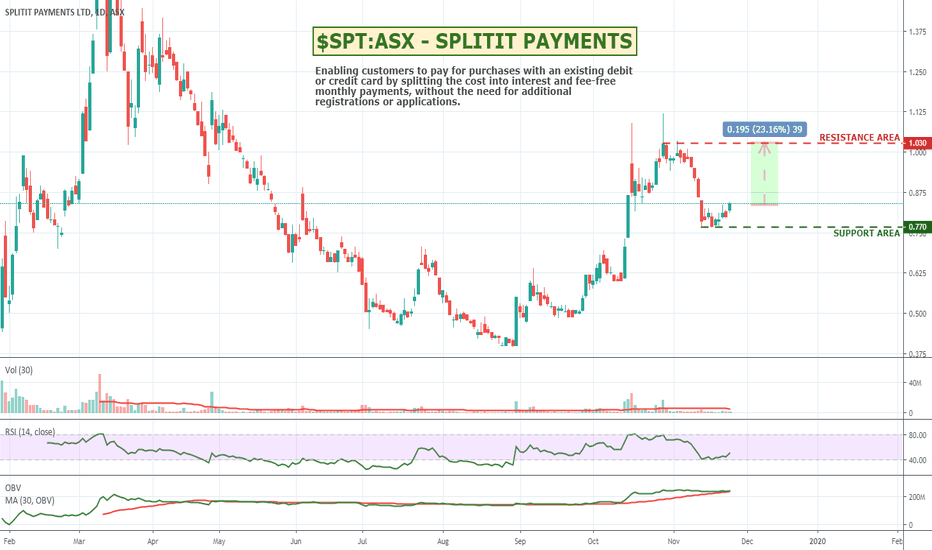

$SPT:ASX - SPLITIT PAYMENTS - Good upside on APT newsWith some of the pressure possibly coming off ATP, SPT and other payment processors might get a bit of an association bump. SPT is up 5% today and looks like it has quite a bit of upside if it can rally. Could be worth a watch especially with the gifting season right upon us.

Splitit Ltd is an Israel-based company that offers payment solutions. It offers Splitit, a payment method solution enabling customers to pay for purchases with an existing debit or credit card by splitting the cost into interest-free monthly payments, without the need for additional registrations or applications. Splitit enables online retailers to offer their customers a way to pay for purchases in installments with instant approval, decreasing cart abandonment rates. The Company serves approximately 800 merchants in more than 20 countries.

SPT has been coiling for weeksVolume proceeds price and we have seen incremental inflows for this BNPL, suggesting that there are some extremely bullish buyers lining up to take these shares from your hands.

We can see the RSI coiling for the 3rd time in the past few weeks suggesting we should see some upside today in price action, and hopefully another day close higher.

Happy Trading.