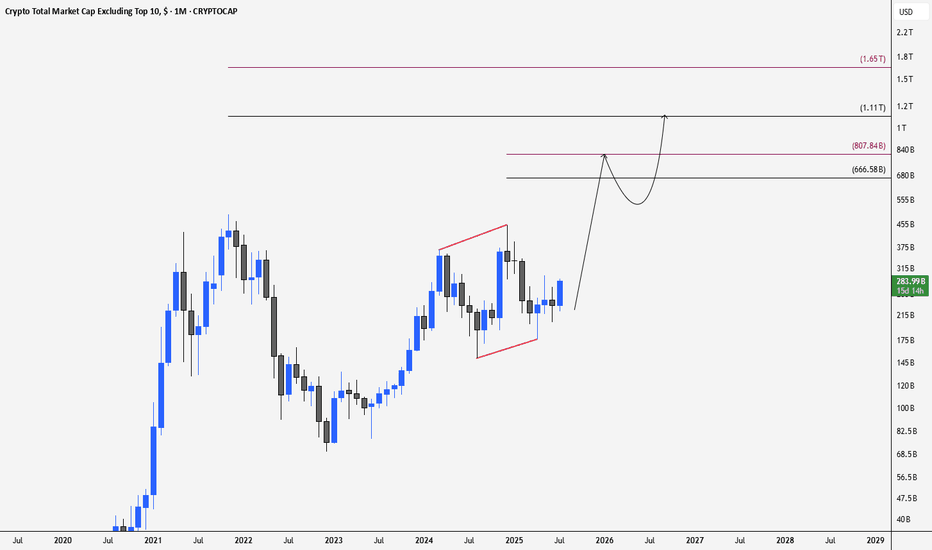

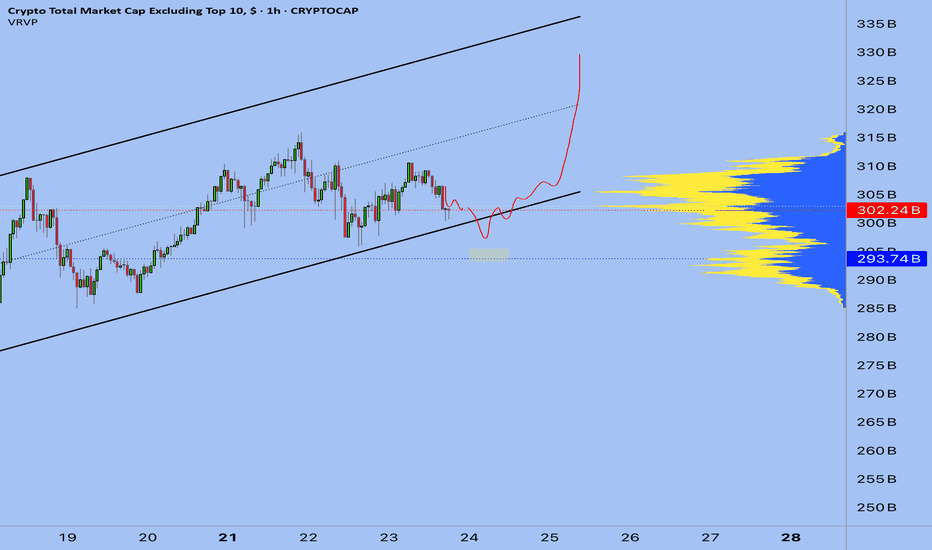

When to be confident again about altcoins On the short term we see a clear down trend with multiple lower highs and lower lows. The last pump can be just a leg up in the same down trend.

I will be waiting of one of two scenarios to start going long again :

1- breaking of the bearish trend and by waiting for higher low then higher high and wait for the pullback to enter.

2- if you are a more conservative trader you can wait for the breakout above the major high (308) wave the happened before the lowest point (major low) and enter on first pullback after

The big picture is still strongly bullish but this analysis is for the short term traders

OTHERS trade ideas

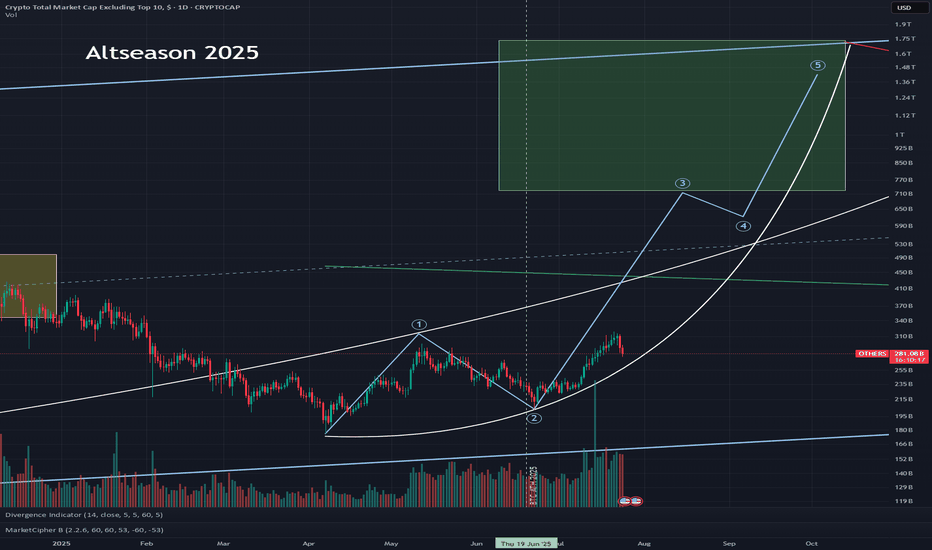

ALTS Season is coming Hello, I hope you are all well

Today I'm going to share this idea with you. This chart shows the liquidity of altcoins below the top 10

I expect to see an upward trend from these areas and targets, as depicted in the chart.

Don't forget to manage your risk. This is not investment advice. Altcoins are highly risky, and you could lose all your money

Good luck to everyone 🤍

short zora! Party over!!zora is about to go over the first ema, u could enter BTC/ZORA rv bet or half eth half btc and 0.9 times the btc and eth longs short Zora.

Looks like the excitement was over coinbase integration

creator coins? just hype? dunno but you could set a tight stoploss

zora is underperforming the average alt 10% today

open interest will probably go down and move to the next thing

ALT SEASON ???An altcoin season (altseason), characterized by strong performance of cryptocurrencies other than Bitcoin, is not guaranteed to occur in any specific month, and its timing is influenced by various market factors. It typically follows a period of Bitcoin dominance and stabilization after a significant price increase, when investors seek higher returns elsewhere

THE MARKET IS MATURING! 550B Market cap for OTHERS coming?The altcoin market cap (excluding the Top 10) has broken out it's retest structure and is holding above key ascending support. Price is currently retesting the 0.618 Fib (~313B) — historically the last technical confirmation before alt season acceleration!!

🔍 Key Observations & Cycle Timing:

Green Arrow → Marks the last correction before alt season. In the previous cycle, it took 25 days from this point to peak.

Using that logic and understanding that markets mature over time, 35 days from our most recent correction lands on 7th September, which also aligns with the bearish lunar eclipse — potentially marking the end of alt season.

White Arrow → Represents the last retest before alt season begins. This retest is now confirmed! :)

This cycle has shown longer consolidation on its second pattern completion, with higher highs and higher lows holding for an extended period. This reflects a more mature and structurally stronger market.

Yellow Bar → Highlights a recurring rejection trendline that has capped rallies in previous attempts. 550 billion market cap is where I believe we will top out.

BTC Stock-to-Flow (S2F) → We are in phase green, historically marking the peak zone of a bull run. Last green phase lasted 200 days — we are currently ~130 days in. Rough estimate gives us ~70 days until the cycle top.

🎯 Targets & Probabilities:

Support: 280B (0.5 Fib)

Primary Target: 367B – 404B (0.786 – 0.888 Fib zone)

Unlikely Target: 1.618 Fib extension — not achieved last cycle.

Breaking above 0.618 Fib and using as support at least is the last structural confirmation I personally want to see before fully committing to alt season expectations.

📌 Thesis:

The cycle structure, S2F timing, and recurring market behavior point to a maturing but still active alt bull run. Momentum suggests upside continuation into early September, but the window is closing. I expect strong moves into the 0.786 – 0.888 Fib zone before the market tops out.

Once it breaks, there are no rulesWhat’s good Chambs 👑

In my eyes, the November high is one of the most important levels to keep an eye on.

If we manage to break above that high — and then the all-time high — with one or two strong green weekly candles, we'll likely reach the first major target zones of this bull run.

FOMO will kick in hard.

No one knows when the next 2021-style bubble will come. Maybe in a year, maybe in five—I don’t know. But when it comes, it will be massive. People underestimate how fast information spreads in today’s world. 998 out of 1000 people scroll three hours a day through TikTok and Instagram.

The classic guy who jerks off twice a day and blasts himself with 14 different dopamine hits in 10 minutes on a Monday morning—he’s gonna get fucked as hard as never before.

Sorry, but that’s just how it is.

There’s no other outcome.

How could there?

Most people enter the market when most people enter the market - And that’s right at the top.

Once it starts running, it’s so easy to pull everyone in.

Everyone is a free-kill.

It will rise, and everyone will feel like a genius during that time. Because guess what? Everyone will be right—price is going up, so how could you be wrong?

Egos will explode.

Even Max, 16 years old, who’s never even said the word “crypto” in his life, will turn his $1,000 into maybe $5K or $10K. He’ll feel like the smartest person alive, his 10 friends will believe him, and they’ll act just as incompetent like him.

Until one day—it’s all over. A sudden –40% portfolio drop. That’s if they don’t blow up their accounts earlier with futures gambles or chasing meme pumps.

It will explode up and disappear just as fast.

The worst part? Everyone will watch every single YouTube analysis video. At first, you won’t know what to do with the information, so you just absorb it. The guy might be right, but you forget that the he lives in a completely different position and perspective than you. For him, it’s daily analysis—he says what he thinks might happen but doesn’t change his plan based on that.

You, on the other hand, treat that one video as an all-or-nothing signal.

You need a plan—one that tells you exactly what to do no matter what happens. If you don’t have that plan, you’re done.

100%.

There’s no way around it.

And you won’t find this plan in a YouTube video—

Not in one, not in two, not even from your favorite crypto influencer.

Turn your own brain on.

Create a plan that fits you.

Be dependent on no one.

Control everything yourself—otherwise, you’re done.

I’m excited.

maybe not.

How can I protect my friends? How can i protect myselfe?

Can I even protect them?

Or is it something everyone has to go through once?

I don’t know.

Can i protect myselfe? - Yes.

I’m excited.

Amen🙏 - praying for all the people who will read this post when i repost it. Maybe it won’t even take that long😉😘

Valid Return to zone TCT modelValid Return to zone TCT model

This indicate the way to valid RTZ swing low

This is Kevin note to show the valid swing count

What to focus on is:

We find 3 drive pattern swing low and trade reversal

At swing low 2, we can see price cannot RTZ 50% and continues to the south and makes liquidity grab, then price return to 50% of the big zone. Here we can sell at drive 3 ( this is as we can see, the low volume swing of NDS, price moves fast to the downside to end the swing)

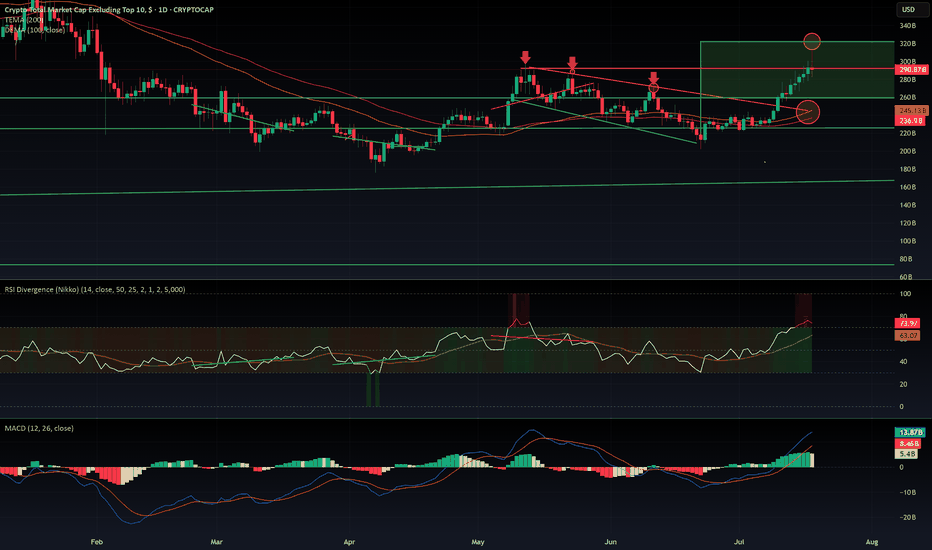

$OTHERS rejected from $320 B resistance. What is next?CRYPTOCAP:OTHERS Rejected at $320B: Is the Altseason on Pause?

CRYPTOCAP:OTHERS just got rejected at the $320B resistance after a decent pump — the kind that usually signals the start of an altseason. But if we dig into the indicators, warning signs are flashing:

- MACD is sitting in overbought territory.

- RSI is heavily extended, signaling potential exhaustion.

- EMA 100 & 200 are colliding with the top of a previous downtrend channel — a zone that historically acted as strong resistance.

The rejection was sharp. So what's next? Are we entering a range between $320B and $260B? It's quite possible. The aIf you wantltcoin market now sits at a decision point: either it keeps pushing higher or takes a breather — potentially pausing the rally until September.

Historically, August is a slow month in the West. People go on vacation, volumes drop, and markets tend to cool off. This seasonal pattern supports the idea of a consolidation phase before a stronger second leg of altseason kicks off in mid-September and carries into Q4.

I’m not posting too many ideas lately because the market landscape has changed. The new players aren’t just trading — they’re manipulating flows with massive capital to hunt retail liquidity.

They’re also using far more sophisticated tools than our classic MACD and RSI — including AI-powered indicators and multi-layered analytics that are beyond retail reach.

In this new environment, predictions are harder and risk is higher.

🧠 Do Your Own Research (DYOR), stay sharp, and don’t blindly trust social influencers.

6/ Altseason: Live - Is this really the Altseason?12day Result I know this is the exact question you're asking yourselves as you look at your portfolios. "What altseason? Everything is flat."

Maybe I was wrong two weeks ago when I said it had already started. But, as they say, the result speaks for itself.

12 days ago, as part of the Altseason Live challenge, I started with $10k . Today, the account is at $35k .

Let's break down what's really happening, and why your feeling of having missed out is an illusion.

You are absolutely right in your observations. If we look at most coins, we'll see that they are still at the very bottom. They haven't even begun their main move yet.

Below are random strong projects of the industry

Here is the visual proof. This isn't a "dumping" market. This is a market that is accumulating energy. And that's the best possible news for anyone who thinks they've missed out. The main, most powerful wave of growth that will lift all these coins hasn't even started.

My result wasn't achieved through general market hype, but through surgical, precise trades. I used my coin-picking strategy (which I wrote about in Post 2/ Altseason: Live - My Coin-Picking Strategy) -focusing on projects that play by their own rules. I continue to do deep research and enter every position with surgical precision.

Why August Will Be Incredible. The Calm Before the Storm.

What we are seeing now is the classic calm before the storm. Most market participants don't understand what's happening and are in a state of confusion. But if you look closely, you can see that many projects have already completed their accumulation phase. An immense amount of power is building up under the hood of the market.

I believe that August will be the month when this energy is unleashed. It will be the month that kicks off the explosive, broad movement that everyone is waiting for. And that is exactly why now is the most crucial time. It's not a time for FOMO, but for level-headed preparation.

So, knowing all this, what do we do next?

First, we don't panic. We understand that the main train is still at the station.

We keep hunting for strength. My strategy of finding strong projects remains unchanged.

We use every correction as a gift. Any 15-25% dip on a promising asset is an opportunity, not a catastrophe.

We prepare for August. The next month could be the defining one for this entire cycle.

My result proves that opportunities always exist, even in a "sleeping" market. And for complete transparency, all proof of my trades is broadcasted on streaming platforms. The real fun, the altseason we are all waiting for, is still ahead. Stay focused.

Best regards EXCAVO

Altseason 2025 – EthseasonWe’ve officially entered #ETH season. Some liquidity is flowing into alts, but CRYPTOCAP:ETH has now taken the lead from CRYPTOCAP:BTC as the big dog.

Old retail is here and slowly buying this dip... but the new retail is nowhere to be seen, yet! Still positioning for that full-blown altseason:

🥑 POLONIEX:GUACUSDT 🧱 MEXC:YBRUSDT ⛏️ MEXC:KLSUSDT

🌐 HTX:SYNTUSDT 🧪 MEXC:DEAIUSDT ✳️ MEXC:SAIUSDT

🔗 POLONIEX:LLUSDT 🎮 KUCOIN:MYRIAUSDT 🤖 COINEX:ENQAIUSDT

#crypto #altseason2025 #altseason #ethseason

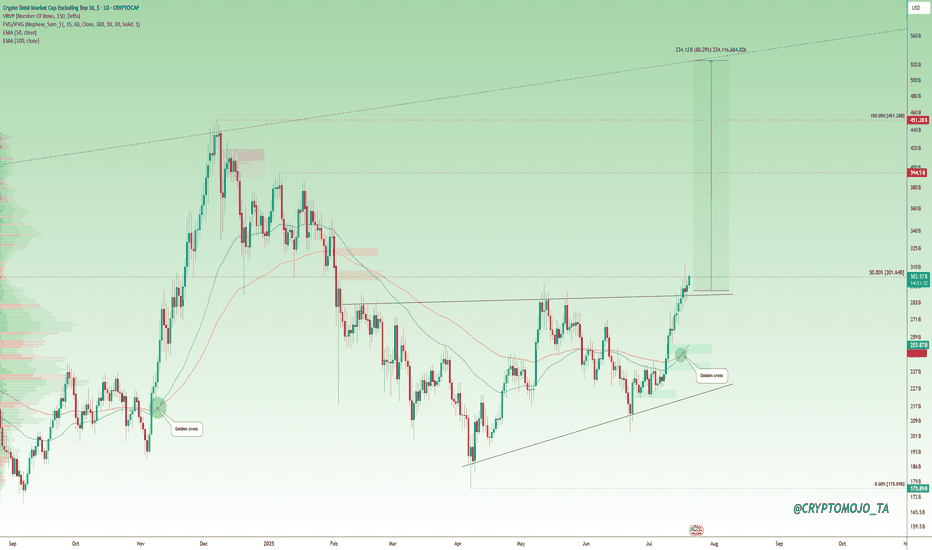

Altcoins Waking Up? Here’s What the Charts Are Telling Us!Altcoin Watch: Momentum Is Building!

A major shift is unfolding in the OTHERS chart, it just broke above its previous high and is on track to form a golden cross, a strong technical signal that often leads to a rally.

But here's the key: a confirmed breakout needs a solid close above the 50% retracement level (from the cycle top to the latest low). That’s when things can really turn bullish.

Right now, the broader altcoin market hasn’t truly taken off. We’re still early.

This is the time to scan the charts. Look for altcoins that are showing similar strength and structure.

🔍 One standout? CRYPTOCAP:LINK is already flashing signs of what's to come.

#Altseason2025

ALTcoin Market Outlook — Pivot Around Sept 15–22?This chart presents a detailed Ichimoku-based forecast for the altcoin market (Crypto Total Market Cap excluding top 10). Several technical and cyclical factors converge to suggest that mid-to-late September 2025 could mark a significant pivot high — potentially launching a strong move for alts.

🔹 Key Technical Observations:

Price rejected from the cloud and currently pulling back after an overextended move.

Tenkan (conversion) line expected to cross the Kijun (base) line next week, which typically indicates a trend decision point.

Price may retest the baseline as support before continuing higher — a healthy bullish retest scenario.

Lagging Span broke above Span A but faced rejection from the Base Line — reinforcing the idea of a necessary retest.

Kumo Twist occurs on Sept 15–22, historically a strong pivot signal (trend reversal or acceleration).

Fibonacci confluence zones project potential upside targets aligning with Fib 1.272–1.618 zones:

Conservative: 1.272 = $552B

Aggressive: 1.618 = $654B

These align with key historical reaction levels and Ichimoku projections.

Interpretation:

We may see a short-term pullback toward the Kijun, after which a strong bullish continuation becomes likely — especially if supported by macro liquidity or BTC.D rotation. The confluence of Ichimoku time theory, wave structure, and Fibonacci extensions suggests that the next major high in ALTs could occur around September 15–22, as the Kumo Twist aligns with wave count and momentum shift.

Trade Implication:

Use dips as buying opportunities as long as the Baseline holds. Expect volatility before the September pivot window, which may mark the next explosive move.

📅 Watch these levels:

Support: 263B (0.382 Fib), 281B (Kijun)

Resistance/Target: 360B (0.618), 440B (Fib 1.0), 552B–654B (1.272–1.618 targets)

This analysis is for educational purposes only. It does not constitute financial advice. Always do your own research (DYOR) and consult with a professional before making investment decisions. Markets involve risk, and past performance does not guarantee future results.

4/ Altseason: Live -The Final game is in September. My plan Altszn Live #4: My <50% Win Rate, the Psychology of Missed Profits, and the Endgame in September. Start with 10k

Let's be brutally honest. Running a public trading experiment comes with immense psychological pressure. This isn't a game. It's real money, real nerves, and a real reputation on the line. The last 9 days have been tough; I hit a losing streak, and I want to show it to you, not hide it. Because trading isn't a non-stop party of green numbers. It's a marathon where your own psychology is both your greatest enemy and your greatest ally.

Section 1: Working on Myself. My System vs. Crowd Psychology

To be profitable in the long run, you have to be honest about your strengths and weaknesses. My weakness? My trade win rate is less than 50%. Yes, more than half of my positions do not close in profit.

My strength? I've developed one rule that allows me to stay profitable despite this win rate. This isn't some pretty quote; it's a hard-won system: "Hold your profitable positions for as long as possible, and close your losing positions as quickly as possible."

Now, look at the market. Most people do the exact opposite. They "marry" their losing positions for years, while a 20-30% profit is an irresistible temptation they must lock in immediately.

This leads to the pain of missed opportunities (FOMO). I went through this myself with $RSR. I was waiting to buy at 0.081. The price touched 0.083 and then flew to 10 cents without me. That feeling of the market leaving without you while you wait for the perfect correction is familiar to everyone. It's that burnout that causes you to make mistakes. But I've learned my lesson: there will be no deep corrections this season.

Section 2: Altseason in Full Swing. Where is the Money Flowing, and Where is the "Final Station"?

Altseason is already here. This isn't a guess; it's a fact. Billions of dollars in USDT and other stablecoins are pouring into the market right now. Bitcoin is at its highs. Ethereum is moving up aggressively, just as I've said in my previous posts. But the biggest potential isn't in them right now.

Money moves in waves in the market. You need to understand this to avoid getting on at the "final station":

1. First, Tier-1: Capital flows into BTC and ETH. (This phase is almost over).

2. Then, Tier-2: The flow shifts to large-cap projects (LINK, UNI, SOL, etc.). (Happening now).

3. Next, Tier-3 & Tier-4: Money moves into smaller, riskier altcoins. (Our main target).

4. The Finale - Memecoins: Euphoria, insane percentages, media headlines. When your grandmother asks you about Dogecoin — that's the "final station." It's time to get off the ship.

And we have a date. September 2025. For me, this is the deadline, after which I'm moving into stablecoins and waiting for major shifts in the global economy.

Section 3: My Hunt for "Green Flags" and the XETR:HEI Trade

How do you find that Tier-3 project in this chaos that could deliver massive returns? I look for "green flags." The main one is a rebranding. New tokenomics, a new chart, a new concept. It's a startup with a history.

It was precisely this principle that led me to XETR:HEI (formerly AMEX:LIT ). A small capitalization, a strong narrative, and a complete reset of old holders. The probability of such a project taking off is extremely high.

I'm managing this trade, from entry to exit, in real-time within my private channel. These aren't just signals; it's a demonstration of the system in action.

Conclusion & Call to Action

This public experiment is my personal challenge. I have one shot and only two months to show a result. I'm sharing everything: the wins and the losses. All proof of my trades is available on streaming platforms.

In the first post about Altseason, I invited you to join this journey, and the response was incredible. It brought many strong and mindful people into our community. Let's continue.

If you want to follow my trades in real-time, and ride this final wave of the altseason with me, write "Altseason " in the comments or in pm

And I have a question for you. Share your thoughts, your pain points, your projects. What's on your radar? And one more thing: would you want me to open a separate public account with $1000 and trade it in parallel for transparency? Let's discuss. I'm open to any suggestions.

Best regards EXCAVO

#Others Update #1 – July 23, 2025#Others Update #1 – July 23, 2025

The Others chart (crypto market cap excluding top 10) had been following a well-defined ascending channel. However, in recent candles, the price has started slipping below the lower boundary of this channel — a potentially bearish sign for altcoins.

Despite still technically being within the broader impulsive structure, it’s critical for price to reclaim and hold above $316B to maintain bullish momentum.

If the market corrects back to the origin of the impulsive leg, we may see a drop toward $285B, which would likely cause a 10–20% decline in altcoins overall.

The structure is not entirely broken yet, but Others is hovering at a risky edge. If you're holding altcoins, now is the time to be extra cautious.