This $PENGU Can Fly

Summary

COINBASE:PENGUUSD has traced a broad 2025 “cup” base, with April setting the low and price now back to the January supply shelf. Price forming a bullish wedge just below all-time highs. As we retest what I call the "blue sky" box, we attempt to resolve a contracting wedge to the upside, printing a fresh daily higher high (HH). While price accepts above local resistance, the path of least resistance is higher with an initial magnet toward the ATH "blue sky" box.

Market Structure and Setup

The higher-timeframe structure is the completed cup + reclaim of the former supply shelf ("blue sky" box). On the daily, the sequence is: retest of the shelf as support → wedge compression → upside break → HH. This multi-timeframe alignment (HTF reclaim + D1 momentum) provides defined risk against the shelf and clear upside reference points (ATH → extensions).

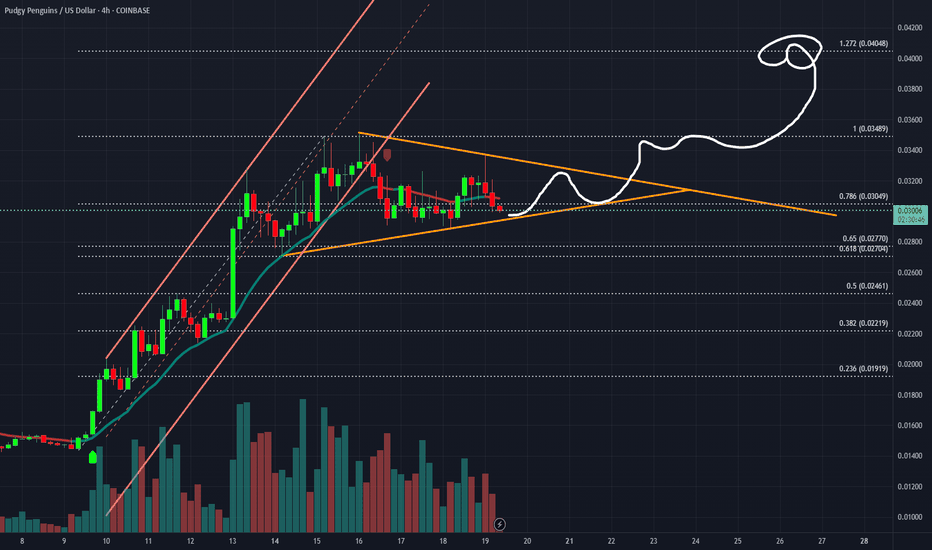

Fibonacci-Based Upside Roadmap

Anchor the swing from the April handle low to the August/September impulse high. The roadmap is:

First waypoint: prior ATH band / 1.00 extension (supply; expect reactions).

Continuations: 1.272 and 1.618 extensions of the April → August leg as conditional targets if ATH is accepted and weekly momentum persists.

These are waypoints, not promises—active only while price holds above the reclaimed shelf.

Microstructure: Acceptance > Expansion

The break produced a HH, but the higher-quality entry often comes from acceptance: a shallow pullback that holds the top of the blue box and forms a D1/4H higher low (HL). That HL becomes the pivot to trail against. If momentum continues without a pullback, treat local range highs as a go-with trigger and manage tightly.

Execution Plan

Setup A – Retest Buy (preferred): Accumulate on a controlled retest into the blue breakout box, then look for a 4H reclaim and higher low to confirm buyers. Invalidation is a daily close back below the shelf or loss of the HL. Distribute into the ATH band first; let a runner work toward 1.272/1.618 if acceptance above ATH materializes.

Setup B – Continuation Buy: If there’s no retest, enter on a clean break-and-hold above the recent HH as a momentum trigger. Invalidation sits under the breakout pivot (last 4H swing). Use smaller size and trail faster given the paid-up entry.

Setup C – Failed-Break Short (contingency/hedge): Engage only if price loses the shelf on a daily close and then rejects on a reclaim attempt from below. Invalidation is re-acceptance back above the shelf. Targets are the cup’s midpoint and the 50–61.8% retrace of the April → August impulse.

Invalidation Criteria

Near-term: a daily close back below the blue shelf = reclaim failed; stand down and wait for fresh structure.

Structural: a weekly close back inside the mid-cup range would negate the completed base and argue for more time/width.

Risk & Sizing

Risk ≤1% per idea; position size = account_risk ÷ (entry→stop). Cut risk further if liquidity is thin or wicks are frequent.

Use reduce-only stops and avoid clustering at obvious lows/highs.

Take 30–50% into ATH supply; trail the remainder beneath 4H HLs or a fast EMA pair (e.g., 8/21) to self-finance the trade.

Fundamental/Flow Linkages

As a high-beta crypto/NFT-adjacent asset, PENGU’s tape is sensitive to broad crypto liquidity, meme-beta flows, and listing/funding dynamics. A trending BTC/ETH backdrop and favorable risk sentiment are supportive; adverse headlines, liquidity air-pockets, or exchange changes can truncate moves abruptly.

Key Risks

Crypto beta: a risk-off impulse in majors typically unwinds alt momentum irrespective of local structure.

Liquidity/venue risk: thinner books can produce stop-hunts and gap moves; listing or market-maker changes can impact spreads.

Narrative fatigue: meme/NFT-linked tokens can overshoot then mean-revert sharply as attention rotates.

Technical failure: acceptance back below the shelf converts today’s support back into resistance and invites a deeper cup-middle retrace.

Conclusion

While PENGU consolidates around ATHs, I want to be long on retests that form higher lows or on clean continuation through range highs. First distribute into the ATH band; if acceptance builds above it, press runners toward the 1.272 → 1.618 roadmap. Lose the shelf on a daily close, and the trade is off until structure rebuilds.

Not financial advice. Levels and sizing should be adapted to your process and constraints.

PENGUUSD.P trade ideas

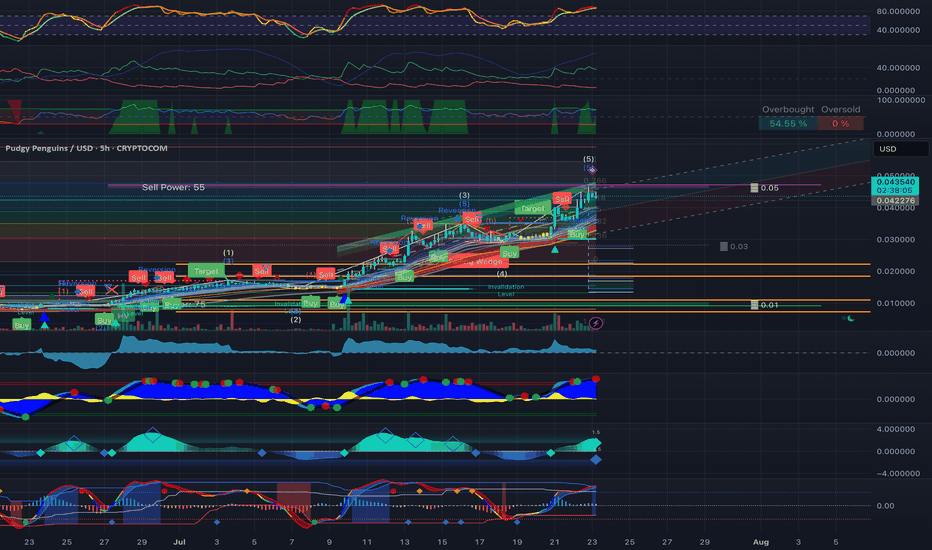

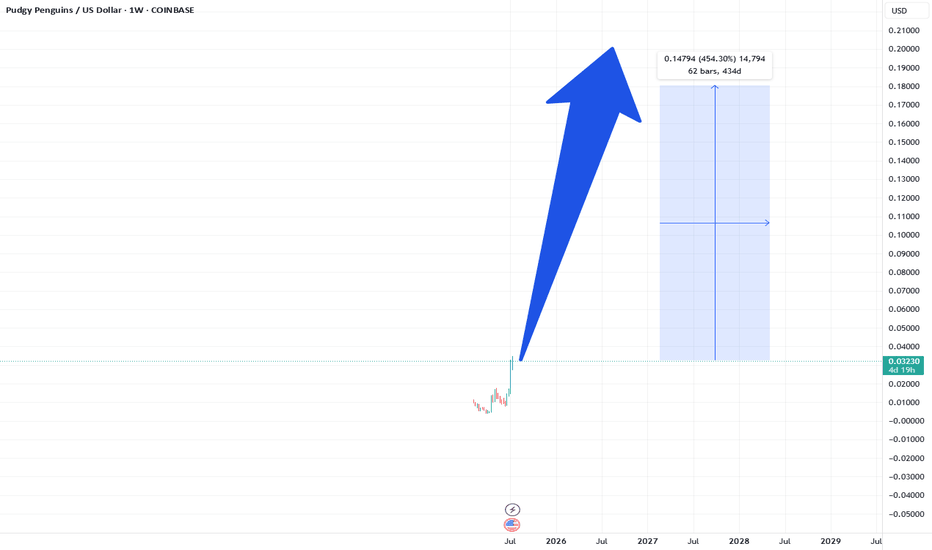

In September PENGU broke out of another falling wedge patttern Its price action in Q2 built a falling wedge and gave a breakout of 500% by July.

But now in September, PENGU broke out of another falling wedge pattern built in August price action. Let's assume ambitiously that another 500% to come, then it will hit $0.21.

But even on the conservative note, if bullish momentum continues this September, then atleaset 180% gains towards $0.10 is possible.

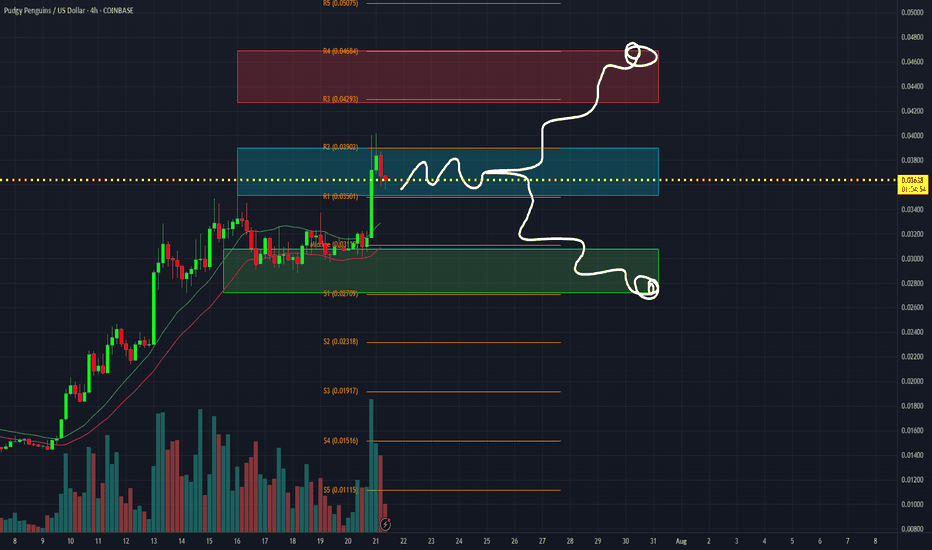

The Bearish Scenario for PENGUTaking a look at the possible bearish scenario for PENGU as we map out this trade idea. A loss of a four hour trend line followed by potential loss of a key local support could cause another leg down. I am bullish on this one however it's always important to have a plan. This really needs to start making some moves in my opinion or we just move to another potential trade setup elsewhere.

Quick Video Updating Previous PENGU Charts SharedI wanted to record a brief video of my thoughts for PENGU and where we may be headed. This is an overall compilation from the previous charts shared and how/why I feel this was a good entry for a run towards ATH on this chart. It looks to me that we have a strong support level that has formed along with a quick wick testing a previous weekly level. Right now we seem to be in a small range and in need of some momentum to begin a strong move as this coin has been recently known to do. With it being a Sunday I am not sure we get it today, but would love to see it! Alerts set for confirmations for both right and wrong scenarios on this trade idea as always. Enjoy your weekend!

Pengu inverse 12 hourOn the inverse chart I believe what we are seeing is a trend line break followed by a failed reclaim. This then lead to two swing high fails and is now starting its way into continuation (UP). On the hourly I believe it is currently on the cusp of its last “gasp” as it’s creating the peak of its rounded bounce. Still a few hours for this candle to confirm but at this moment I am anticipating acceleration towards ATH.

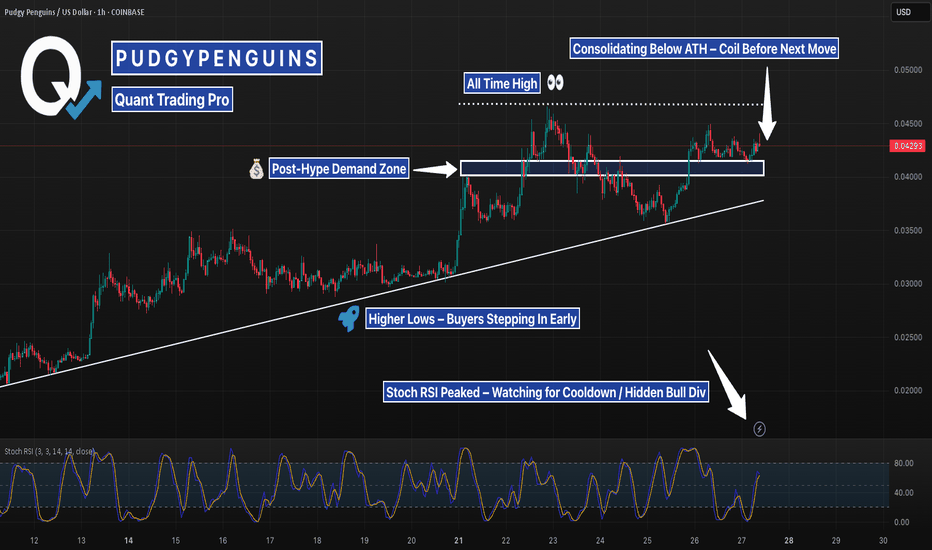

PENGU Coils Below ATH After Coinbase-Induced BreakoutPENGUUSD 1H chart following a massive breakout fueled by social media speculation and Coinbase hype. Price surged ~60% after Coinbase changed its profile picture to a Pudgy Penguin NFT on July 21 — marking a clear shift in sentiment. Since then, price action has respected a rising trendline, forming consistent higher lows while consolidating just under the all-time high wick.

The retest of the post-breakout demand zone shows clear interest from buyers, with price holding this level multiple times. Stochastic RSI is overheated, suggesting caution on immediate entries — but momentum remains bullish as long as the trendline holds. If this consolidation breaks to the upside, a full ATH retest or expansion move is possible.

Watching closely for a breakout or breakdown from this coiling structure.

Updated PENGU Technical Breakdown – Fibonacci FormatUsing the new impulse base of $0.0079 and the confirmed 4.65× multiplier, the recalculated high is:

- $0.0079 × 4.65 = $0.036735

All technical zones are now recalibrated off this updated anchor structure.

PENGU Technical Breakdown – 4.65x Anchor at $0.0079

🔹 Price Anchors

• Impulse Base (Confirmed): $0.0079

• Target High (Multiplier 4.65x): $0.036735

• Current Price: Refer to real-time chart

• Last Known Local Low: $0.0079 (confirmed base)

📐 Fibonacci Retracement ($0.036735 → $0.0079)

• 0.236: $0.030218

• 0.382: $0.026242

• 0.500: $0.022318

• 0.618: $0.018394

• 0.786: $0.013693

• 1.000: $0.0079

🎯 Fibonacci Extensions (if $0.036735 is reclaimed and exceeded)

• 1.618: $0.060973

• 2.618: $0.096211

• 3.618: $0.131449

📊 Indicators (1D)

• RSI: Monitor reclaim of 50–55 zone for upside unlock

• MACD: Bullish confirmation pending crossover and histogram slope

• Volume: Accumulation baseline rising; breakout requires >20-day average spike

🔑 Critical Price Zones

• Hard Support: $0.0079 (macro base)

• Reversal Trigger: $0.013693 (0.786 reclaim)

• Initial Momentum Zone: $0.018394 (0.618 zone)

• Full Breakout Confirmation: $0.022318 (0.5 reclaim with volume)

⏱ Time Projections (Post-Zone Breach)

• $0.018394 Zone: 6–9 days post $0.0136 reclaim

• $0.022318 Flip: 2–3 weeks under strength

• $0.036735 Retest: 5–6 weeks

• $0.060973 Extension: 7–9 weeks

❌ Invalidation Criteria

• Daily close < $0.0079 invalidates upside structure

• Momentum structure broken below this base

✅ Execution Model – Fibonacci Format

1. Entry Zone: Daily close > $0.013693 with volume acceleration

2. Stop Level: $0.0077 (beneath impulse floor)

3. TP Levels:

• TP1: $0.018394

• TP2: $0.022318

• TP3: $0.036735

• TP4: $0.060973

Recalibrated using $0.0079 impulse anchor and 4.65 multiplier. All Fibonacci zones structurally aligned.

Can Penguins Fly?Pudgy Penguins #Pengu is up nicely already 3.6X from it's april low.

And is sitting nicely outside the top 100 CMC list and is the 8th biggest Memecoin by marketcap.

It appears it is on the cusp of a cup and handle breakout and projects to a very high flying 5 cent log projection.

(#Crypto's are highly speculative and can go down -99%)

Long PENGUKraken listing upcoming as well as Abstract main net launching in a few days this thing is setup to pop. .0347 is the flat cloud and target, once that is breached it will be se to run on the cloud breakout. Also best team in crypto running penguins and major whale support as can be seen with super high volume on the NFTs.