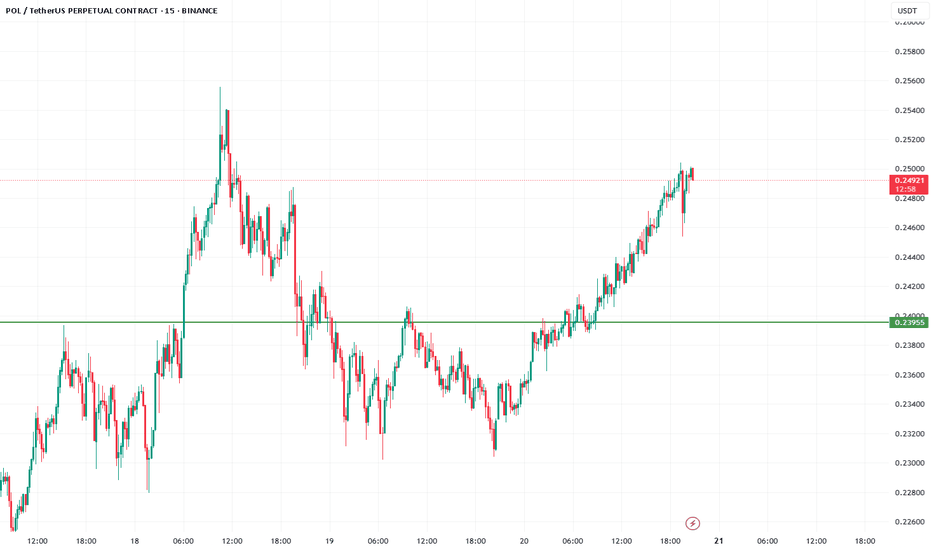

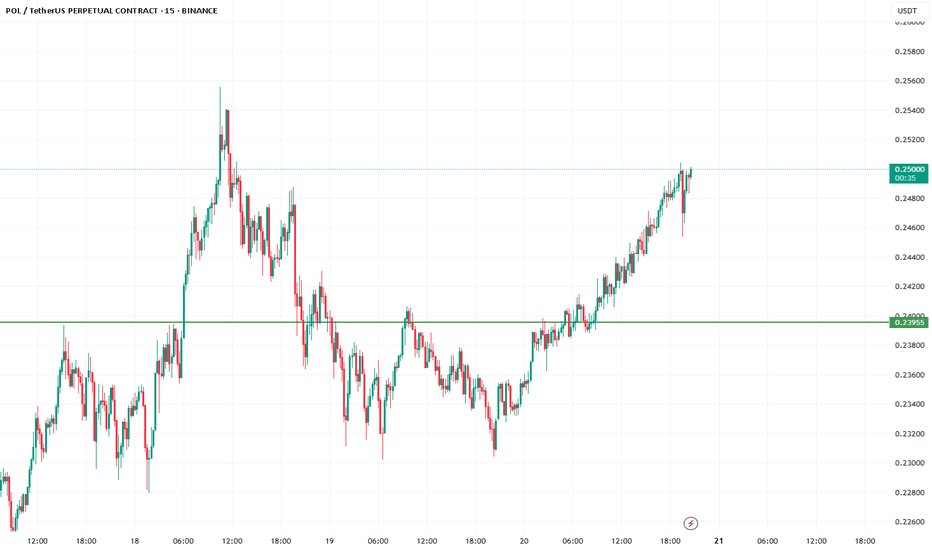

POL – Demand in Action!Price has been rejecting the resistance zone around 0.2620 – 0.2677 and is now approaching a key demand/support area near 0.2320 – 0.2270.

✅ If buyers step in here, we could see another bullish impulse toward the resistance levels.

✅ The demand zone remains a crucial area to watch for trend-following setups.

⚠️ However, a clear break below the 0.2270 support would invalidate this bullish scenario and shift the bias.

For now, I’m watching how price reacts at the green demand zone for the next potential swing.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

POLUST trade ideas

POL/USDT Perpetual Swap on OKX1. Chart Context

Pair: POL/USDT Perpetual Swap on OKX

Timeframe: 1H

Current Price: ~0.2415 USDT

Bias: Long (buy) setup

2. Key Levels

Weekly Open / Daily Open (~0.2490–0.2500): Important level of interest for bulls; if reclaimed, it strengthens the long thesis.

Monday High (~0.2525): First liquidity target above.

Monday Low (~0.2410): Currently acting as short-term support.

Stop Loss (~0.2291): Below prior liquidity zone to invalidate the long.

Take Profit (~0.2594–0.2610): Target aligned with previous resistance area.

3. Trade Setup

Entry Zone: Around 0.2410–0.2420 (near Monday Low).

Stop Loss: At 0.2291, below the structure and liquidity sweep area.

Take Profit: At 0.2594–0.2610, above Monday High and near prior resistance.

Risk/Reward Ratio: Roughly 1:2.5 (highly favorable).

4. Rationale

Price swept liquidity near Monday Low, trapping shorts and offering a favorable long entry.

Strong support confluence at Monday Low with risk defined just below.

Upside targets are clearly mapped to Monday High → Weekly Open/Daily Open → Resistance levels (~0.2610).

Momentum suggests potential mean reversion after the sharp decline.

✅ In summary:

This is a high R:R long setup with entry near 0.2410, invalidation at 0.2291, and targets up to 0.2610. The trade thesis is based on liquidity sweep and reclaiming key opens.

TradeCityPro | POL Testing Range Top Amid Bullish Momentum👋 Welcome to TradeCity Pro!

In this analysis I want to review the POL coin for you. One of the so-called Ethereum Killer projects that in the previous bull run was highly hyped to replace Ethereum and now with a market cap of 2.6 billion dollars is ranked 42 on CoinMarketCap.

📅 Daily Timeframe

In the daily timeframe, this coin, like most altcoins, is in a very long-term range box. Now, after significant buying volume, it has reached the Maker Seller zone at the top of the box.

✔️ Since the price has registered a higher low than the 0.1717 bottom, the probability of breaking the zone has greatly increased. On the other hand, buying volume has gradually increased as the price has moved from the bottom of the box to the top, which shows the strength of the bullish trend.

⚡️ Now several daily candles in a row are stuck near this zone, consolidating just below it. If the zone is broken, we can have a long-term long position or even buy this coin in spot.

📊 If the bullish move starts, the resistance levels we can use as targets are 0.3299, 0.4271, and 0.5310. If the bullish trend continues and there are no signs of weakness, each of these levels can act as a new trigger for a long position.

🔍 If the price gets rejected from the resistance zone, with the breakdown of the 0.2315 trigger, the probability of a bearish move toward the 0.1717 bottom also exists, and with the breakdown of 0.2315 we can open a risky short position.

💥 With the breakdown of 0.1717, we also get the main confirmation of the trend change, and if this level is broken, this coin could have a very large drop.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Polygon has successfully formed a strong bottom structurePolygon has successfully formed a strong bottom structure, showing signs of accumulation at lower levels. We are now witnessing the early stages of a potential breakout. If momentum sustains, this could confirm the bottom and open the path for a bullish move ahead.

The Top vs The Bottom · Polygon vs Bitcoin, Ether & XRPEthereum will keep on growing of course and Bitcoin as well. Notice the difference between Bitcoin, Ether, XRP and Polygon. What an incredibly huge difference. The three mentioned are trading at very high prices compared to past history while POL is trading very close to its bottom.

I mean, this can definitely be good.

POLUSDT is trading at bottom prices but the downtrend is no longer active. There are no new lows in more than four months. The entire wave between December 2024 and April 2025 lasted four months. So seeing the same amount of time that produced such a strong bearish move produce nothing more than consolidation, is good news.

Polygon has been trading at bottom prices but slowly going up. We have a rising bottom, an ascending triangle. The upper resistance that is keeping the pattern active is still valid and being challenged this week. As soon as this resistance breaks, expect maximum growth. Some pairs will move up right away while others will continue to consolidate for months.

Polygon's consolidation is reaching its end.

Thanks a lot for your continued support.

Namaste.

POL/USDT Preparing for a Major Breakout?📊 Chart Overview:

POL/USDT is currently showing signs of a potential trend reversal after months of sustained bearish momentum. The price is now testing a long-term descending trendline that has acted as a strong resistance since the November 2024 peak — and this moment could be a critical turning point for the market.

---

📌 Pattern Structure & Technical Setup:

🔸 Primary Pattern: Descending Trendline, capping every rally since late 2024.

🔸 Potential Reversal Structure: Falling Wedge Pattern – often a bullish reversal signal, supported by weakening bearish pressure and a series of higher lows forming since June 2025.

🔸 Current Position: Price is testing the trendline resistance around the $0.24–$0.27 zone.

---

📍 Key Price Levels:

✅ Resistance:

$0.2740 → Key breakout level; confirmation of trendline break.

$0.3290 → Important horizontal level, previously acted as major support.

$0.4301 – $0.7147 → Extended bullish targets based on Fibonacci retracement and historical price memory zones.

🛑 Support:

$0.2200 → Minor support if price rejects the trendline.

$0.1520 → Major long-term support (current all-time low).

---

📈 Bullish Scenario (Breakout Case):

If price successfully breaks and closes above $0.2740, we could expect:

Confirmation of a long-term downtrend breakout.

A shift in market sentiment from bearish to bullish.

Short-term target: $0.3290 → then $0.4301.

Higher upside potential if volume supports the breakout and altcoin momentum strengthens.

> 🚀 Volume will be the key validator – a breakout without volume = weak signal.

---

📉 Bearish Scenario (Rejection Case):

If the price fails to break the trendline:

Likely rejection and pullback toward the $0.2200 support zone.

If selling pressure increases, a retest of the $0.1520 demand zone is possible.

This would extend the consolidation phase or confirm continued bearish control over the medium term.

---

🔍 Conclusion & Trading Strategy:

POL/USDT is at a technical decision point. A confirmed breakout could mark the end of the accumulation/distribution phase and trigger a new bullish leg.

📌 Strategy Overview:

Breakout Traders: Enter after confirmed daily close above $0.2740, target levels above.

Reversal Traders: Enter conservatively after a retest of the breakout zone with a tight SL.

Bearish Traders: Consider shorts on strong rejection at the trendline, targeting $0.22 → $0.15.

---

🧠 Extra Notes:

Watch Bitcoin dominance and overall market sentiment.

Volume confirmation is crucial for validating breakout strength.

Be cautious of fakeouts, especially around dynamic resistance like trendlines.

#POLUSDT #CryptoBreakout #FallingWedge #AltcoinAnalysis #TechnicalAnalysis #CryptoSetup #PriceActionTrading #BullishBreakout #BearishScenario #CryptoReversal #TrendlineBreakout

PENDLE Breakout Watch – Red Resistance Being Tested! 🚨 CRYPTOCAP:PENDLE Breakout Watch – Red Resistance Being Tested! 🔴⏳

CRYPTOCAP:PENDLE is testing the red resistance zone.

📊 If breakout confirms, next move could target:

🎯 First Target → Green line levels

A breakout here could trigger buyer momentum and push price toward the next key resistance.

Polygon · Bottom, Recovery & 5,000% Growth PotentialPolygon has been bullish since April, clearly rising from its base for months. Now this Cryptocurrency trading pair is preparing for a new phase and market cycle. It is preparing for its 2025 bull market wave.

Polygon after a major drop produced a clear bottom and higher lows. This process has been active now four 120 days/4 months. This is a long consolidation period and there are no new lows, clearly. A rising triangle as a reversal signal is also present on the chart.

The accumulation period has been lasting, we can see how patience is key for success. Who would be able to hold for four long months? Who is still holding wise for 120 days?

Well, those who wait get paid. Those who waited will get paid but there is no need to wait because you can still buy and profit from the incoming bullish wave. The difference is that prices are higher now so growth potential is limited compared to several months in the past, that's how it works. The market builds up strength slowly and as this strength is being built prices grow.

When there is enough strength, enough interest and enough growth, the masses enter the market and this produces a major bull run. I've been warning you, we are getting very close. The action is already happening now, don't be surprised when you see a 300%+ bullish jump. That is exactly what is coming and it will all happen within a few months.

Expect 500% to start but aim for 1,000%, 2,000% and in some cases even more. Many good, strong and reputable pairs will grow 3,000%, 4,000% or 5,000%. Polygon will be one of the big ones.

Thanks a lot for your continued support.

Namaste.

gkgj,hgfj- SUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

SUI - Breakout of the yearSUI is currently trading near the resistance line. Price was reject around this resistance line in the previous pump.

- Given the current bullish market, price is expected to breakout from this resistance easily

Entry Price: 4.04

StopLoss: 3.2

TP1: 4.5059

TP2: 5.3810

TP3: 6.5106

TP4: 7.8772

TP5: 10+

Don't forget to set stoploss.

Stay tuned for more updates

POL At Critical Fib Level, Targeting 0.28 With 16% GainHello✌

Let’s analyze Polygon’s upcoming price potential 📈.

BINANCE:POLUSDT is currently testing a crucial daily support level that aligns with a significant Fibonacci retracement zone 📉. This area could provide a strong foundation for a bounce. If the support holds, a move toward 0.28 is likely, offering approximately 16% upside potential 📈.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

Pol (POL): 3 Good Trading Setups We Caught | July 2025POL coin is in a pretty volatile spot where we might get a really good trade from here once we see the confirmations we talked about in the video. 3 good trading opportunities, where the mid-term trade looks the best out of them all!

P.S. idk why but called Pol coin polyatomic multuple times so do not pay attentions to that :)

More in-depth info is in the video—enjoy!

Swallow Academy

Buy Trade Strategy for POL: Backing the Future of Web3 GovernancDescription:

This trading idea highlights POL, the new token powering the next evolution of the Polygon ecosystem, which is shifting toward a more robust and scalable multichain architecture. Designed to eventually replace MATIC, POL introduces advanced staking and governance capabilities that aim to unify and secure various Layer 2 solutions under one interoperable umbrella. Its core function is to support validators across multiple Polygon chains, making it an essential asset for the future of decentralized Web3 infrastructure.

The migration to POL is more than a technical upgrade—it's a strategic move to strengthen long-term network sustainability and user empowerment. As adoption of Polygon’s technology continues to grow across DeFi, gaming, and enterprise solutions, POL is positioned to become a fundamental component of the next generation of blockchain governance.

Disclaimer:

This trading idea is for educational purposes only and is not to be considered financial advice. Investing in cryptocurrencies, including POL, carries a high level of risk and may result in the complete loss of capital. Always conduct your own due diligence, evaluate your personal financial situation, and consult a licensed financial advisor before making investment decisions. Past performance is not indicative of future results.

Polygon (POL): Loading For Breakout | Good Momentum After 200EMAPolygon has formed a decent bullish trend here where price is looking for a potential breakout, which would give us a very good opportunity for a long position so that's what we are looking for.

A break of 200 EMA is where buyers should establish dominance and then lead the price to upper zones!

Swallow Academy