POPCATUSDT.P trade ideas

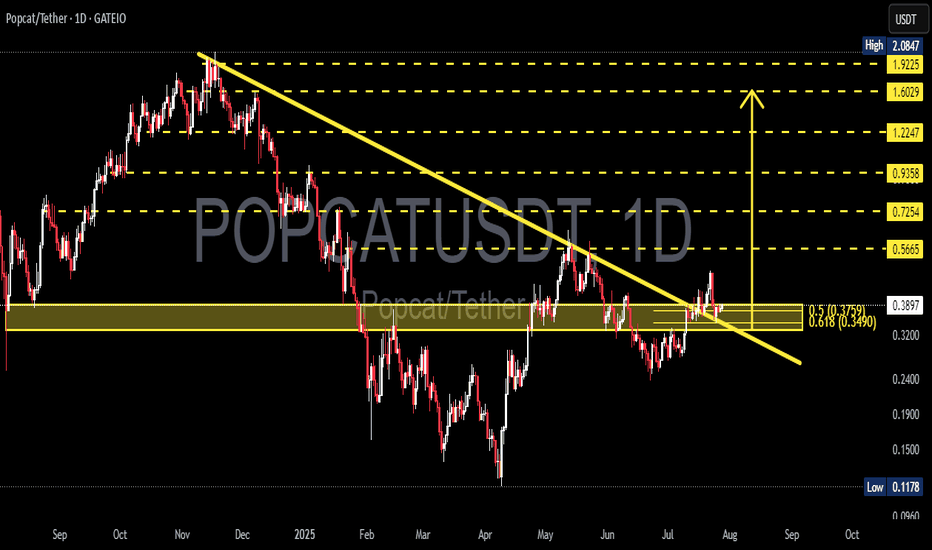

POPCAT/USDT — Descending Triangle: Ready for a Major Move?1. Current Market Condition

POPCAT/USDT is sitting at a very critical level. After a prolonged downtrend since late 2024, the price has formed a clear descending triangle, with consistent lower highs pressing from above while the 0.22–0.30 support zone continues to act as a strong demand area.

This setup signals compressed volatility — price is being squeezed toward the apex of the triangle, usually leading to a significant breakout in either direction.

---

2. Key Technical Levels

Major Support Zone (Yellow Box): 0.22 – 0.30

Immediate Resistance: 0.3427 → 0.4067

Mid-range Resistance: 0.5714 → 0.8874

High Resistance Levels: 1.5238 → 1.9510

Extreme Support (if breakdown): 0.0869

---

3. Pattern Explanation

Descending Triangle → classically a bearish continuation pattern, but in crypto, it can also flip into a reversal if broken to the upside with strong volume.

Price Compression → narrowing range suggests a “build-up of energy” for a big move.

Historical Demand Zone → the yellow box has been repeatedly tested since 2024, making it a decisive battleground for bulls and bears.

---

4. Bullish Scenario

Confirmation: 2D candle close above the descending trendline and 0.34–0.35 with strong volume.

Upside Targets:

First target: 0.4067

Mid target: 0.5714

Extended target (if momentum continues): 0.8874

Bullish Flow: Breakout followed by a successful retest of the broken trendline as new support would strongly validate the bullish case.

---

5. Bearish Scenario

Confirmation: 2D candle close below 0.22 with high volume.

Downside Targets:

Initial target: 0.17–0.13

Extended target: 0.09 (historical low)

Bearish Flow: A breakdown of the major support opens the door to an extended downtrend, as liquidity beneath 0.22 is thin.

---

6. Conclusion & Trader Notes

POPCAT is at a make-or-break point. Holding the demand zone and breaking to the upside could trigger a significant rally, while losing support would resume the downtrend.

Conservative traders → wait for confirmation: breakout above 0.34 or breakdown below 0.22.

Aggressive traders → may accumulate small positions near support with tight stop-losses.

Key factor: breakout volume, 2D candle closes, and retest behavior at support/resistance.

This is a textbook example of the market “holding its breath” before a decisive move.

---

POPCAT is locked inside a descending triangle, pressing against the 0.22–0.30 support zone. The market is at a crossroads — will bulls push for a breakout toward 0.40 – 0.57 – 0.88, or will bears take control with a breakdown below 0.22 and drive price to 0.13–0.09?

The triangle is near its apex. A breakout or breakdown in the coming weeks could define the next major trend for POPCAT. Traders should prepare their strategies now, as the market’s decision is approaching.

---

#POPCAT #POPCATUSDT #CryptoAnalysis #DescendingTriangle #Breakout #BullishCase #BearishCase #AltcoinAnalysis #CryptoTrading

POPCATUSDT 100% Gains? After a period of consolidation, POPCAT is beginning to show signs of a bullish reversal. Indicators such as MACD and RSI are turning positive, and trading volume is on the rise — a classic setup for a breakout. If the price successfully breaks above the key resistance at $0.38, the next target could be around $0.63, representing a potential 100% gain from current levels.

Recent candlestick patterns also suggest strong buying pressure on the 4-hour and daily timeframes. With confirmation above resistance, this altcoin could be entering a powerful rally phase.

POPCAT/USDT – Weekly Chart TAPOPCAT/USDT – Weekly Chart TA

Price abhi bhi falling channel ke andar trade ho raha hai, lekin support zone se bounce ka chance hai.

Key Support Zones:

0.2536 – 0.2500 USDT

0.1567 USDT (major last defense)

Breakout Confirmation:

Agar price 0.4290 ke upar close deta hai toh pehla target 0.5301 USDT hoga.

Iske baad potential rally ka agla phase open ho sakta hai.

Possible Scenarios:

Bullish – Channel break + retest → rally towards 0.53 → 0.70 → 1.30

Bearish – Support break → 0.1567 retest

📌 Weekly timeframe par patience zaroori hai.

⚠️ Spot safe, leverage par sirf breakout confirmation ke baad hi entry lo.

Quote: "The market is a device for transferring money from the impatient to the patient." – Warren Buffett

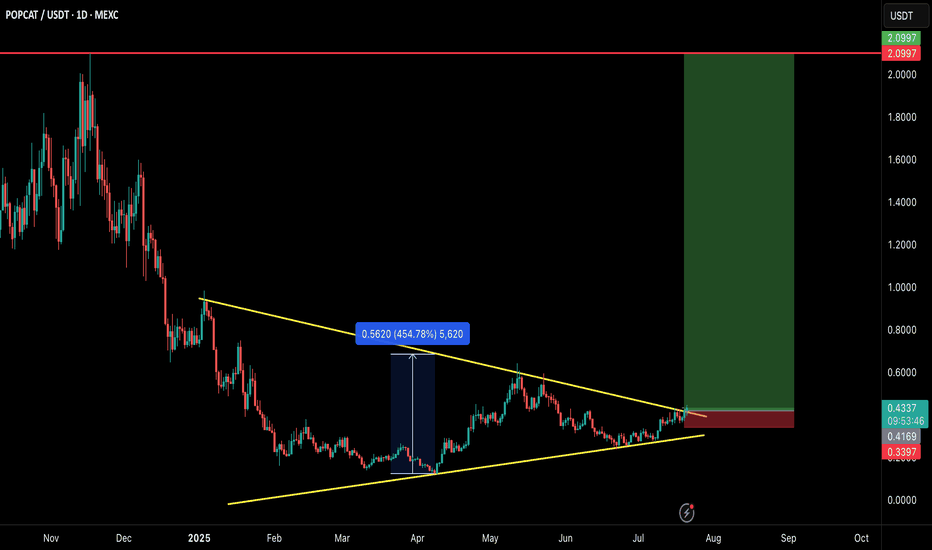

POPCAT/USDT – Testing Demand Zone: Reversal or Breakdown?POPCAT/USDT is currently retesting one of the most crucial demand zones in its mid-term price structure, located between $0.2700 – $0.3037. This area has historically acted as a strong support level and has triggered significant rebounds in the past. The market's reaction here will be key in determining whether POPCAT is ready for a bullish reversal or heading for a deeper correction.

---

🔍 Market Structure & Price Action

The price has entered a sideways consolidation phase after a steady decline from the $0.4067 region.

So far, the support zone at $0.2700 has been respected multiple times, indicating buying interest remains active.

However, no clear bullish reversal pattern has formed yet, making the next movement critical.

---

🟢 Bullish Scenario (Reversal / Bounce)

If the price manages to hold above this demand zone and forms a higher low along with a strong bullish candlestick confirmation, we could see a potential trend reversal.

🎯 Potential bullish targets:

TP1: $0.4067 – Minor resistance, top of the current range.

TP2: $0.5714 – Mid-range resistance, a previous breakdown zone.

TP3: $0.8874 – Major resistance, the last high before the steep drop.

TP4: $1.5238 – $1.9510 – Psychological resistance zone, possible medium-term swing targets if bullish momentum strengthens.

🔐 Key confirmations:

Bullish engulfing / hammer candlestick on the 2D chart.

Increase in volume + breakout above range resistance.

---

🔴 Bearish Scenario (Breakdown Continuation)

If the price fails to hold $0.2700 and we see a clear daily or 2D candle close below the demand zone, this would indicate loss of bullish strength and open room for further downside.

🎯 Bearish targets:

TP1: $0.2100 – Psychological support level.

TP2: $0.1179 – All-time low and historical bottom.

⚠️ Risk factors:

Strong bearish candle close + high volume breakdown would confirm sellers’ dominance.

---

🧩 Pattern & Formation Insights

A horizontal base / accumulation range is visible within the demand zone.

If the price rebounds, we could be forming a double bottom – a classic reversal signal.

However, if the zone breaks, the chart may develop into a descending channel or bearish continuation pattern.

---

🧠 Trading Strategy Outlook

Swing Traders: Consider long entries within the demand zone ($0.2700–$0.3037) with a tight stop-loss just below the zone. Aim for multiple resistance levels as take-profit targets.

Breakout Traders: Wait for confirmation above $0.4067 with increased volume.

Bearish Setup: Short entry upon breakdown below $0.2700 with targets towards the next support zones.

#POPCAT #AltcoinAnalysis #CryptoTechnicalAnalysis #DemandZone #BreakoutOrBreakdown #USDT #MEXC #SwingTrade #CryptoSetup #BullishReversal #BearishBreakdown #ChartAnalysis #TradingView

Week#3_July Wrapping_Trade #6 of week#3. PursuitOfConsistencyAs I waiting for a formation on a high probability short swing to form,

Am looking to play a degen long into a short zone and short the market lower between Asian and London session. I won't have the same Idea for NY.

If it trade NY, I will coin a thesis based on the close of London structure.

Otherwise I might wait through Friday or the weekend or whenever for my model to form.

POPCATUSDT – Breakout Confirmation or False Signal?On the daily chart of POPCATUSDT, the price has recently broken out of a descending trendline that has been acting as resistance since December 2024. This breakout signals a potential trend reversal from bearish to bullish.

Currently, the price is in a retest phase, revisiting the breakout zone, which also aligns with a strong support and Fibonacci retracement area:

Support zone: $0.34 – $0.38

Fibonacci 0.618: $0.3490 (major technical support)

Fibonacci 0.5: $0.3759 (typical retest level after breakout)

If the price holds above this zone and forms a bullish confirmation candle, it strengthens the case for continued upward momentum.

---

Pattern and Market Structure:

Descending Triangle Breakout: The price has broken out of a long-standing descending triangle pattern, which is typically a bullish reversal signal — especially if supported by volume (not shown in chart but crucial).

Neckline Retest: The current move is retesting the breakout zone, a common behavior after significant breakouts.

---

Bullish Scenario:

If the price holds above the $0.34–$0.38 zone and forms bullish price action:

Potential targets based on Fibonacci levels:

Target 1: $0.5665

Target 2: $0.7254

Target 3: $0.9358

Major targets: $1.2247 and possibly $1.6029 if bullish momentum sustains

---

Bearish Scenario:

If the price fails to hold above $0.34 and breaks down below the support:

Potential downside towards $0.26 – $0.20 zone

If selling pressure intensifies, it may revisit the key support low around $0.1178

---

Conclusion:

POPCATUSDT is at a critical decision point. The breakout from the descending trendline is an early bullish signal, but confirmation from the $0.34–$0.38 retest zone is essential. If it holds, a strong bullish rally may follow. However, a failure to hold could signal a false breakout and resume the bearish trend.

#POPCAT #POPCATUSDT #CryptoBreakout #AltcoinAnalysis #ChartPatterns #TechnicalAnalysis #FibonacciLevels #CryptoTrading #BullishSetup #BearishScenario

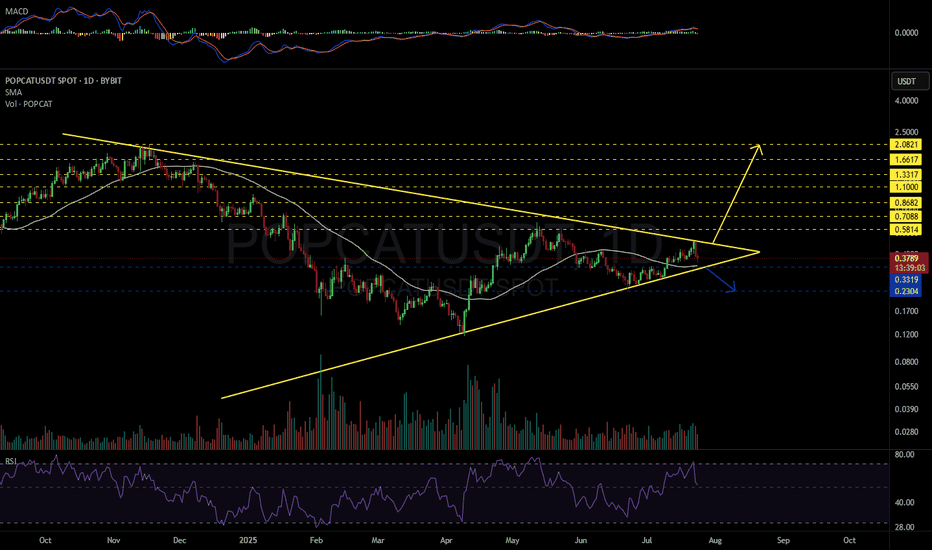

POPCATUSDT 1D#POPCAT is consolidating inside a symmetrical triangle on the daily chart — decision time is approaching. Will it break out upwards or downwards?

We plan to accumulate near the support level at $0.3319, which aligns closely with both the triangle support and the daily SMA50.

If a breakout occurs to the upside, the potential targets are:

🎯 $0.5814

🎯 $0.7088

🎯 $0.8682

🎯 $1.1000

🎯 $1.3317

🎯 $1.6617

🎯 $2.0821

However, if the price breaks below the triangle, it could retest the lower support at $0.2304.

⚠️ As always, use a tight stop-loss and manage your risk accordingly.

POPCAT/USDT – MEGA BREAKOUT INCOMING!POPCAT is breaking out of a large symmetrical triangle structure that has been developing for several months. This is a textbook bullish reversal setup with explosive potential — and the chart says it all! 👇

🧠 Technical Breakdown:

✅ Clean symmetrical triangle breakout on daily timeframe

🔥 Strong base formation followed by volume breakout

💹 Consolidated above trendline for weeks — breakout looks real

🛒 Entry Zone:

CMP ($0.43) or buy in dips toward $0.40–$0.42

🎯 Targets:

TP1: $0.65

TP2: $1.10

TP3: $1.60

TP4: $2.10

🛑 Stop-loss:

Close below $0.34

📊 Risk/Reward:

Solid RR > 4.0 with high potential if momentum kicks in. Volume and structure both support a strong upside.

📢 Final Thoughts:

This is not just a breakout — it's a multi-month accumulation breakout. If the market stays bullish, POPCAT could go parabolic again just like it did earlier.

🚨 Always use proper risk management and SL!

💬 Drop your thoughts in comments & don’t forget to hit that ❤️ if you find this helpful.

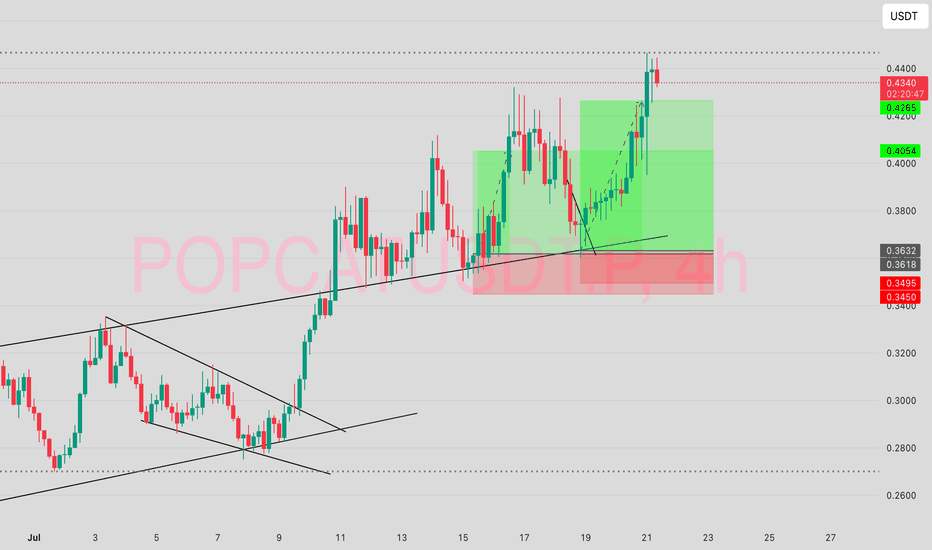

$POPCAT TARGETIt’s been several target hits over the weekend🤩🤩🤩

Someone shout BYBIT:POPCATUSDT.P

Aren't you excited? Well, I am!!!

This trade right here is a whooping 1:4.6RR nearly 1:5RR bringing in so much to the portfolio.

After the correction that happened on Friday, I saw a good opportunity to enter for LONG in many pairs. Yesterday being Sunday despite not being on chart, I was getting notifications of closed trades All in PROFIT, YES!!!

Today seems to give some corrections but I'm overly bullish. we just have to wait for the right entries and boom again.

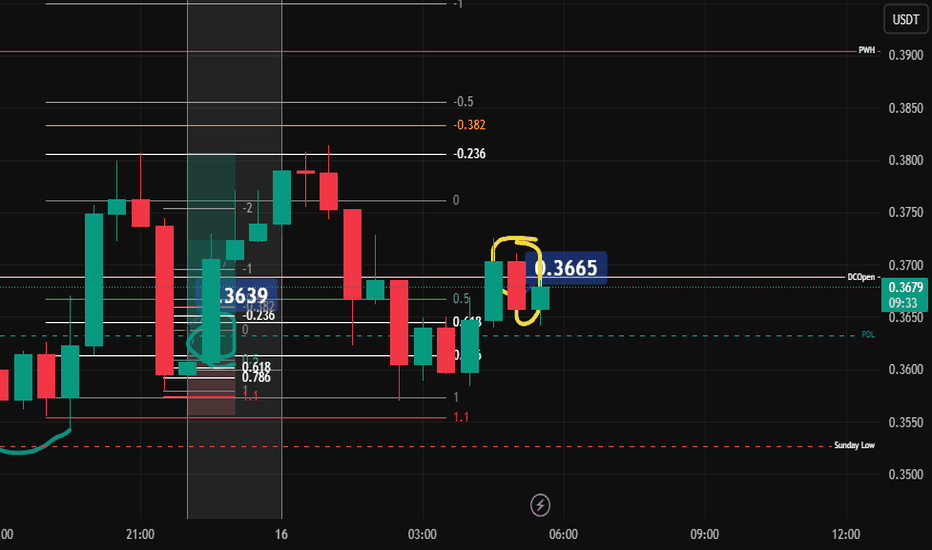

popcat long post trade📓 Trade Follow-Up — July 16 (Entry from Previous Session)

Timeframe:

Trading window is 10:00 p.m. to 12:00 a.m. (Vietnam time).

This session, I was on the charts for less than one hour.

⚙️ Trade Setup:

Trade idea was built during the New York open.

I didn’t execute the trade in real time because I hesitated.

Price moved without me, but I left a limit order at my pre-marked zone and went to sleep.

No chasing, no new setups added after market moved.

📈 Morning Outcome:

Woke up before 5:30 a.m.

The market had returned to the entry, nearly hit the stop loss, then turned.

I was in approximately +1% unrealized profit.

🧠 Morning Decision:

I had no pre-planned rule for what to do if I woke up and the trade was active.

Market was in Sydney session with about 90 minutes left in the trading day.

Tokyo session was approaching (~1 hour and 20 mins away).

I made a quick decision to close the trade:

Reason: setup originated during New York, no longer active session context.

I didn't want to micromanage outside my committed trading window.

During the short moment it took to decide, price pulled back slightly—final profit was just under 1%.

🧩 Notes:

I need to define pre-market and post-market rules:

What to do if a trade is active when I wake up?

Under what conditions do I manage or exit a trade outside my session?

Reaction was clean, no over-involvement or chasing.

Emotionally stable, but acknowledged mild excitement and urgency when waking up to a live position.

PopCat Long 15-July-2025

🧠 Trade Journal Reflection: July 15

Session: 10 p.m. – midnight (Vietnam time)

Context: Market felt “muddy” on the 1H chart. Needed time to analyze.

🔍 What I Saw:

Market was consolidating below the previous day’s low and today’s open.

Asian session stayed compressed.

London session didn’t break the range meaningfully.

New York session broke out above the day’s open—but then retraced deeply.

On the lower timeframes (45m, 30m, 15m), I identified valid swing highs/lows and noted a retracement that aligned with potential Fibs.

🎯 What I Did:

Measured my Fibonacci retracement levels.

Took time to interpret the situation—was leaning toward longing, but wasn’t fully decisive.

By the time the idea solidified, price had already moved.

I chose not to chase. Instead:

Left a limit order on the LTE (likely your identified entry zone).

Accepted that if price doesn’t come back, it’s okay—I will learn.

💡 What I Felt:

Anxious. A bit unsure. Took time to make the decision.

After placing the limit, I committed to not revenge trading or chasing another asset.

Proud that I chose patience over FOMO.

Acknowledged the lesson: Be quicker next time, but don’t force a trade.

🧭 What I Learned:

I’m becoming more self-aware. That’s rare and powerful.

Not all trades need to be executed to be valuable—this one taught me discipline.

I stayed in alignment with my time window and strategy, even though it felt uncomfortable.

If I’m more decisive and sharper tomorrow, great. If not, I’ll still be here learning.

💤 Final Words to Myself Before Sleep:

“I didn’t chase. I respected my boundaries. I traded with integrity, even if no order was filled. This is the version of me I want to show up with—calm, patient, and always learning. The market will still be here tomorrow.”

$POPCAT Bull flag breakout done$POPCAT Breaks Out of Bull Flag – Momentum Building

POPCAT has successfully broken out of its bull flag formation after respecting multiple touchpoints along the descending channel. The breakout confirms bullish continuation and flips prior resistance into support.

Key Levels:

Resistance: $0.38

Target Zone: $0.64 and potentially higher if momentum sustains

Structure favors higher highs as long as the retest zone holds. Volume trend supports the move.

$POPCAT - Chance of Seeing $1 in Q3

Haven’t posted much about Solana coins lately, but they’re starting to show signs of life again.

$POPCAT had a clear entry right at the weekly FVG below 33c. From here, it either retests the Monthly Open or begins a slow grind higher.

It performed exceptionally well last year, so there’s a good chance to offload some around the $1 mark if momentum picks up. BYBIT:POPCATUSDT

POPCAT - new breakout is coming📈 POPCAT 4H Chart Analysis – Bollinger Bands + MACD

Since 22 June, POPCAT has consistently formed higher highs and higher lows, suggesting growing bullish momentum and a potential breakout in sight.

On the 4H timeframe, POPCAT has followed a recurring pattern:

🔁 Bounce from the bottom of the Bollinger Bands → Rally to the top of the bands

This move has repeated on the following dates:

📅 Date 🔽 Support (Lower Band) 🔼 Resistance (Upper Band) 🔍 MACD Signal

22 June 0.238 0.304 Bullish cross

26 June 0.244 0.310 Momentum up

1 July 0.269 0.312 Bullish signal

7 July 0.277 0.308 MACD rising

Each time, the MACD indicator also showed a bullish crossover or increasing momentum, reinforcing the validity of the rally after the bounce.

🔒 Support has been rising, showing buyers are stepping in at higher levels.

📉 Resistance is tightening around 0.310–0.312, suggesting a potential squeeze.

After each rally, POPCAT has consolidated for a few days, pulled back to the lower band, and repeated the move upward. If this pattern continues, another upside rally could occur within 1–2 days.

TL;DR:

POPCAT is respecting a strong Bollinger Band + MACD setup. If it holds above ~0.277 and breaks past 0.312 with volume, we might see a strong continuation to the upside.

What do you think about this setup?

Drop your thoughts and charts in the comments below! 🔽📊🚀