Mari Energies Breaks Out of TriangleMARI is displaying a strong bullish setup as price has successfully broken out of a long consolidation within a symmetrical triangle pattern, confirming strength above the key 0.5 Fibonacci retracement level at 664.95. With the breakout accompanied by higher lows and steady upward momentum, the stock is now targeting the next Fibonacci levels at 720.40 and 789.00, with a broader upside potential extending towards 899.90 and even 1,027.71. The breakout structure suggests buyers are regaining full control, while the invalidation zone remains below 609.50, keeping the risk-reward profile highly attractive for positional traders.

MARI trade ideas

MARIPSX MARI :: Day Level

📈 MARI Trading Recommendation

Current Market Price (CMP): PKR 685

💎 Bullish Bias: BUY & HOLD

✅ My clear view: MARI is a strong buy for long-& Mid term investors. Fundamentals are solid, and the recent dividend announcement strengthens the positive outlook.

💹 Long-Term Investors:

Enter at the current price for early entry and hold for very strong returns.

Support Levels for Accumulation (if price dips):

🔹 654 (immediate support; key level after breaking smaller range Jan–Sep 2025)

🔹 643

🔹 620

🔹 610

This allows accumulating MARI at discounted prices while maintaining a bullish long-Mid term view.

📊 Technical Outlook:

Range Bound: Since January 2024, MARI has been trading in a broader range of 590–744.

Resistance: 723–744

Support: 590–612

Smaller Positive Range: 605–654, which has been positively broken.

654 now acts as key support.

⚡ Intraday / Short-Term Traders:

Monitor daily price action carefully. Not recoomended for intraday Trading but can manag as per below:

Rule: Do not hold if the price closes below 654 with a bearish candle on the daily chart.

A break below may lead to pullbacks toward 643–610.

Target TP1: 723 TP2: 744

Pattern: Formation of a bullish flag indicating potential upward movement.

✅ Summary:

Long-Mid term: Buy & hold 💎

Short-term: Watch 654 closely ⚡

Market sentiment favors upward movement, making MARI attractive for both accumulation and swing trading.

MARI PROBABLY IN WAVE '' C '' OR " 5 " - LONGThis is in continuation to our ongoing tracking of MARI.

Our preferred wave count suggests that we are in a wave C of an ABC correction which will target, level of 710 - 720 and then 740 - 750. Alternately price can take resistance from the

green trend line, in which case price might reverse from 680-690 level towards 580 - 590 level.

There's also a possibility that the 5th wave has started which will take prices above 900+ but we hardly doubt it. Price movement and volume will confirm either this is a C or 5 wave.

Posting this with delay as I was unable to post this during trading hours, price might dip back toward 630 - 640 level giving another buying opportunity.

Trade setup:

Entry price: 661 (we are already active in this trade)

Stop loss: We are not marking any stop loss because MARI has very strong fundamentals and we are bullish for the long term in it.

Targets:

T1: 710 - 720

T2: 740 - 750

T3: 900 +

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

#MARI ENERGIES LTD (PSX) – LONG-TERM BREAKOUT ANALYSIS & TARGETSTechnical Overview

Mari Energies has officially broken out of its second consolidation box after 18 weeks (≈5 months) of range-bound movement, forming a bullish harmonic AB=CD pattern on the weekly timeframe.

✅ Breakout Confirmation: The stock has once again repeated its historical behavior—breaking out of consolidation, followed by a strong impulsive leg, similar to the previous 4-month base.

🟩 Short-Term Target: PKR 900, aligning with the previous all-time high.

🟩 Mid-to-Long-Term Targets (2026–2027): PKR 1225 to 1234, in line with the AB=CD extension.

🔻 Stop Loss: PKR 533, below the consolidation base for risk management.

🔍 Fundamental Snapshot (as of 2025)

Metric Value

EPS (Trailing 12M) ~PKR 272.25

P/E Ratio ~2.5× (extremely undervalued relative to sector)

Market Cap Over PKR 800 billion

Dividend Yield ~13% (exceptionally strong)

Revenue Growth (YoY) Consistent double-digit growth

Net Profit Margin Over 40%, indicating strong operational efficiency

Debt-to-Equity Low – strong balance sheet

Strategic Assets Operates Pakistan’s largest onshore gas field – Ghotki Block

Stability Low beta, defensive utility stock, strong dividend payer

Mari remains fundamentally one of the most stable and cash-rich companies on PSX, with strategic importance in the energy sector. Its earnings consistency and dividend payouts offer strong downside protection.

🔮 Outlook for 2026–2027

If macroeconomic and energy market stability continues, Mari is well-positioned for compound gains in both price and dividends.

Price Forecasts:

🎯 2026 Target: ~PKR 900+ (short-term pattern completion)

🎯 2027 Target: ~PKR 1230+, subject to sustained volume and earnings support

With its low P/E, high yield, and technical breakout, Mari could re-rate significantly if broader market sentiment improves.

📌 TL;DR – Mari Energies Weekly Trade Plan (2025)

Parameter Value

Pattern Harmonic AB=CD

Buy Zone Current price (~PKR 681–700)

Stop Loss PKR 533

TP1 PKR 900

TP2 PKR 1234

Time Frame Long-Term (Weekly/Monthly)

📎 Has broken consolidation after 18 weeks — mirroring prior breakout setup. As long as it holds above 533, structure remains bullish.

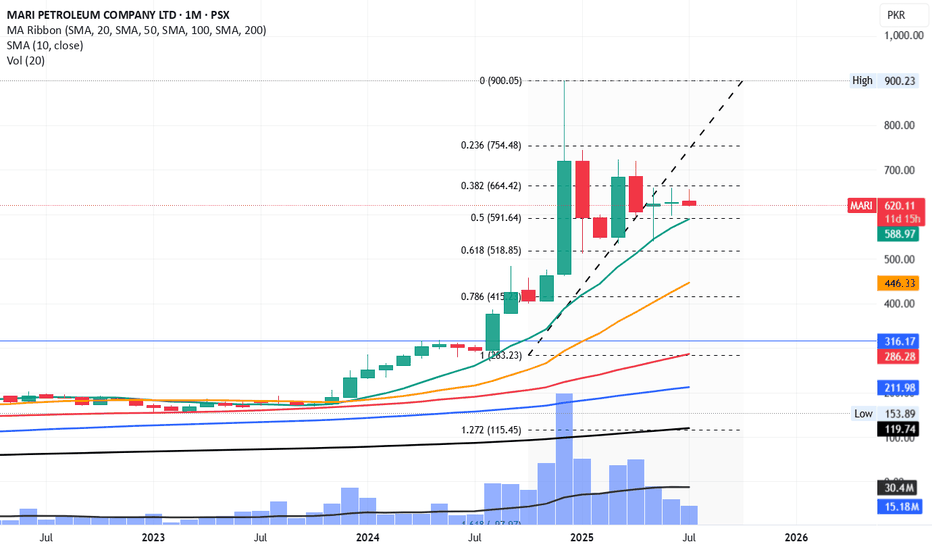

MARI ShortSince July 2023, Mari has never breached and closed below SMA10 on monthly timeframe.

If it breaches it and closes below 588, the downfall will be sharp.

Its first stop would be 519 and then 446 and 415 can also be on cards.

Sorry for Mari lovers but it can become a harsh reality.

However, 415 to 446 can be an ideal time for accumulation for long term investment purpose.

its not a buy / sell call, just my personal opinion.

Near Breakout!MARI Analysis

CMP 671.65 (09-09-2025 01:17PM)

Near Breakout!

Weekly Closing above 665 - 667 would

be a positive sign.

It has the potential to touch 800 & then 900+

On the flip side, Immediate Support lies around 665 - 672

& then around 630 - 640.

If it breaks 625 this time, more selling pressure will be observed.

MARI – TECHNICAL BUY CALL (11 AUGUST 2025– 2nd Strike) | MARI – TECHNICAL BUY CALL (New Targets Unlocked – 2nd Strike) | 11 AUGUST 2025

The stock previously made a high of Rs. 900 in a powerful spike fashion and then went into a complex pullback. This pullback has now taken the shape of a wedge (light purple), and inside this wedge, the stock has formed a springboard trading range (light blue). We expect the stock to continue moving upwards.

MARI Trade Idea1- Price is in uptrend and HH/HL are intact.

2- Price is stalling within golden pocket zone.

3- Price squeezing in between wedge pattern.

4- RSI on weekly @ 52 and monthly @ 66 which

is showing that bullish momentum is intact.

5- We need to wait for bullish candlestick pattern

within GP or breakout of the wedge pattern.

.

MARI Petroleum Company Ltd (PSX) Buy Idea✅ Buy Idea Summary

Symbol: MARI

Timeframe: Daily

Current Price: 652.96

📊 Analysis & Plan

Context:

Price has bounced from a higher-timeframe demand zone (highlighted in blue) and is currently forming a bullish structure.

Key Observations:

Swing Failure Pattern near top (distribution clue).

Liquidity Pool marked at 720 — likely target for short-term buy-side liquidity.

Strong bullish reaction after price tapped near the low of the previous range.

🛒 Entry:

At/around: 652.96 (Post price).

🎯 Target Levels:

TP1 (Partial/Intraday): 720 (Liquidity Zone)

TP2 (Major Target): 829.88

TP Final: 900.23

🛑 Stop Loss:

Below 539.13 (last swing low and structural invalidation)

📥 Reinforcement Buy Zone:

Blue Demand Area (around 460–500):

“If I got here, I will look to buy more.”

→ A key reaccumulation area if price revisits.

MARI PROBABLY IN WAVE '' C '' OF CORRECTION - SHORTThis is in continuation to our ongoing tracking of MARI.

MARI is most probably in wave C of an ABC correction and since prices moved down giving confidence to our bearish wave count, we are taking a small position by short selling.

Due to market volatility we will trade this setup with cautious using trailing stop loss until we reach our target. We only recommend small positions at the beginning and once prices starts to unfold in our favor we will add more to our positions on bounce backs

Alternately prices can move up toward 650-660 level which is highly unlikely now but not out of question

If our wave count is correct then we can make around 8.50% or 15.50% on this trade.

Trade setup:

Entry price: 604

Stop loss: 632

Targets:

T1: 535-550

T2: 515-500

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.