Key stats

About Invesco QQQ Trust Series I

Home page

Inception date

Mar 10, 1999

Structure

Unit Investment Trust

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Qualified dividends

Income tax type

Capital Gains

Max ST capital gains rate

39.60%

Max LT capital gains rate

20.00%

Primary advisor

Invesco Capital Management LLC

Distributor

Invesco Distributors, Inc.

Identifiers

3

ISIN US46090E1038

QQQ is one of the most established and actively traded ETFs in the world, albeit one of the most unusual. The product is one of a few ETFs structured as a unit investment trust. Per the rules of its index, the fund only invests in nonfinancial stocks listed on NASDAQ, and effectively ignores other sectors too, causing it to skew massively away from a broad-based large-cap portfolio. QQQ has huge tech exposure, but it is not a 'tech fund' in the pure sense either. The fund's arcane weighting rules further distance it from anything close to plain vanilla large-cap or pure-play tech coverage. The ETF is much more concentrated in its top holdings and is more volatile than our vanilla large-cap benchmark. Still, the fund has huge name recognition for the underlying index, the NASDAQ-100. In all, QQQ delivers a quirky but wildly popular mash-up of tech, growth, and large-cap exposure. The fund and index are rebalanced quarterly and reconstituted annually.

Related funds

Classification

What's in the fund

Exposure type

Electronic Technology

Technology Services

Retail Trade

Stock breakdown by region

Top 10 holdings

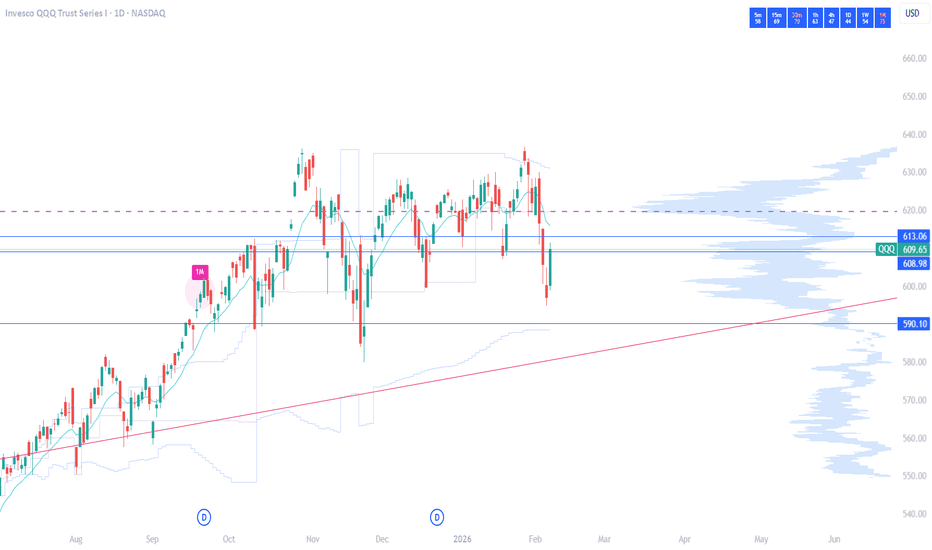

QQQ - 4 Feb 2026 Update - Sweeps completed - Observation Mode

Hey everyone, JP Quintero here

Over the past few weeks, I’ve been sharing some of my personal ideas, key levels, and structures on a few tickers and ETFs.

Quick background: I’ve been studying and trading the markets for about 5 years now. Over the past couple of years, I went through 2 solid ment

QQQ and Gold. A decisive Double Top.QQQ and GOLD. A decisive Double Top.

Statistics are fascinating. Look at Gold. It recently printed a textbook Double Top.

The result was violent. A drop of 9 sigmas .

In a normal distribution this is almost impossible. But in financial markets it happens.

This shows the power of a bro

Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFTWelcome to your essential weekly guide for navigating the dynamic stock market! In this in-depth analysis, we provide a comprehensive stock market forecast covering key movers like the S&P 500 CME_MINI:ES1! (SPY) and Nasdaq 100 CME_MINI:NQ1! NASDAQ:NDX (QQQ), alongside a detailed Bitcoin ( CR

QQQ - Ready For A BreatherI believe I have identified another Wyckoff distribution pattern on QQQ. In early October, we saw the first signs of selling. We got a selling climax at the start of November. We have consolidated within this range over the past 3 months, testing the channel's highs and lows. It is not a perfect Wyc

QQQ ShortBroader Market Structure (QQQ – 15m)

QQQ is in a short-term corrective phase within a larger bearish context. The prior selloff established a clear bearish structure, followed by a counter-trend rally. Price is now approaching a key area where upside looks corrective rather than impulsive. A CHoCH i

231K Jobless Claims, 108K Layoffs… But No Need to Panic Yet! WhySome people are starting to freak out about the latest labor market data 😅 But let’s break it down calmly, no panic needed.

1. **Initial Jobless Claims** came in higher than expected (231K vs forecast ~212K).

I circled January last year and January this year in red — you can see claims were u

QQQ Weekly Outlook – Week 6 of 2026 (Feb 09–13)QQQ Weekly Outlook – Week 6 of 2026 (Feb 09–13)

Weekly Recap

Last week, my base projection was that the market would lack a clear directional trend and trade in a range, reacting from key levels. Price behaved exactly as expected, rejecting from those levels and forming short term bounces throug

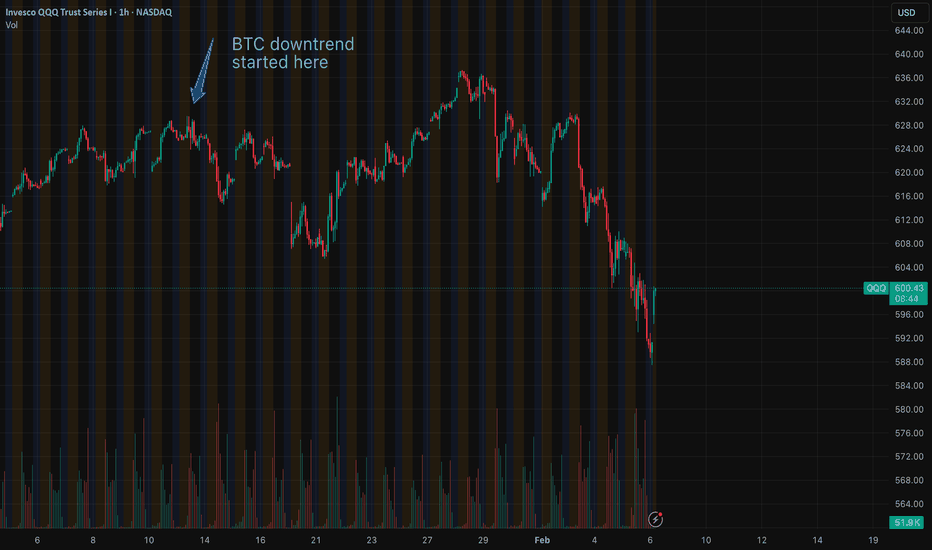

BTC vs QQQ — Synchronized Risk Move & RSm Signal | 6 Feb 2026BINANCE:BTCUSDT & NASDAQ:QQQ

Observation

BTC and QQQ have been moving lower within the same downside regime since 14 Jan 2026.

Yesterday’s synchronized decline confirms a short-term risk-off environment rather than a decoupling.

No macro or institutional assumptions are made.

RSm view (QQQ)

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

QQQ trades at 614.32 USD today, its price has risen 0.69% in the past 24 hours. Track more dynamics on QQQ price chart.

QQQ net asset value is 610.03 today — it's fallen 1.28% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

QQQ assets under management is 393.77 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

QQQ price has fallen by −1.21% over the last month, and its yearly performance shows a 15.88% increase. See more dynamics on QQQ price chart.

NAV returns, another gauge of an ETF dynamics, have risen by −1.28% over the last month, have fallen by −1.28% over the last month, showed a −2.02% decrease in three-month performance and has increased by 15.74% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by −1.28% over the last month, have fallen by −1.28% over the last month, showed a −2.02% decrease in three-month performance and has increased by 15.74% in a year.

QQQ fund flows account for 19.31 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

QQQ invests in stocks. See more details in our Analysis section.

QQQ expense ratio is 0.20%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, QQQ isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, QQQ technical analysis shows the sell rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating QQQ shows the buy signal. See more of QQQ technicals for a more comprehensive analysis.

Today, QQQ technical analysis shows the sell rating and its 1-week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating QQQ shows the buy signal. See more of QQQ technicals for a more comprehensive analysis.

Yes, QQQ pays dividends to its holders with the dividend yield of 0.46%.

QQQ trades at a premium (0.06%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

QQQ shares are issued by Invesco Ltd.

QQQ follows the NASDAQ 100 Index. ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Mar 10, 1999.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.