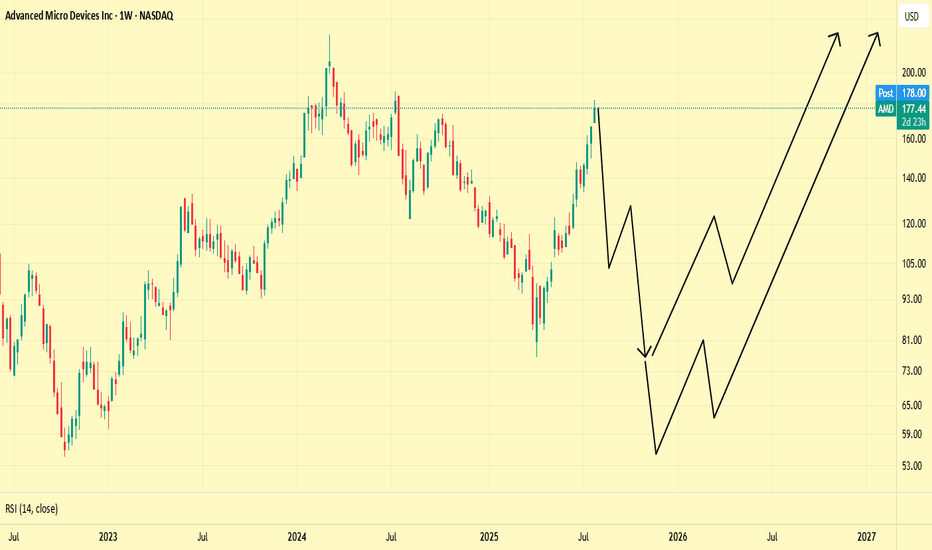

AMD Rebounds from Support: Path to $200+ Unlocked?

AMD Rebounds from Support: Path to $200+ Unlocked?

AMD has successfully rebounded from its ascending trendline and the strong support zone of

145−150.

This indicates a potential bullish continuation, with a stop loss recommended below $145 to manage risk.

The immediate upside target for AMD is identified between $185 and $188.

Should the stock breach this initial resistance, a secondary target range of $200 to $205 comes into play.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

AMD trade ideas

AMD $160C – Tactical Bounce Trade You Don’t Want to Miss

# ⚡ AMD Weekly Mean-Reversion Setup (Sept 7, 2025)

### 🔍 Market Snapshot

* **Price:** \~\$151.14

* **Technicals:** Daily RSI 28.4 → Deeply oversold 📉 | Weekly RSI 54.1, falling

* **Options Flow:** Strongly bullish (C/P = 2.13) ⚡

* **Volatility:** Low (VIX \~15), gamma low → cheap premium

* **Timeframe:** 5-day weekly expiry

---

### 🎯 Trade Idea: Tactical Bounce Play

* **Instrument:** AMD

* **Direction:** CALL (Mean-reversion)

* **Strike:** \$160

* **Expiry:** 2025-09-12

* **Entry:** \$0.77 (mid/ask)

* **Profit Target:** \$1.54 (+100%)

* **Stop Loss:** \$0.31 (-40%)

* **Size:** 1 contract (small % account, scale per risk rules)

* **Confidence:** 65%

---

### ⚠️ Key Risks

* Prior week -10% drop & heavy distribution → counter-trend risk

* Full payoff requires \~\$9 move in 5 days → moderate probability

* Concentrated \$150 puts can act as support or accelerate downside

* Weekly theta decay → exit by Thursday, avoid Friday gamma ⚡

* News/macro shock risk → use small sizing

---

### 🔑 Trade Rationale

1. Daily RSI extreme → plausible 3–5 day bounce

2. High call flow @ \$160 → short gamma/short-term buying interest

3. Low VIX → cheap premium relative to potential move

---

### ⚙️ Execution Notes

* Enter at open, limit \$0.77

* Stop at \$0.31, take partial profit at +50% (\$1.16), full at +100% (\$1.54)

* Cut if price drops below \$148–\$149 on heavy volume

---

📊 **Summary:** Tactical, defined-risk mean-reversion play. Not a trend reversal — small allocation, event-driven weekly call.

\#AMD #OptionsTrading #WeeklySetups #TradingView #MeanReversion

AMD Trendline Break – Short-Term Weakness, Long-Term AI Power PlAMD has broken below its long-standing ascending trendline, which has been respected multiple times since April. This is the first real sign of weakness after months of steady upside. The $162–165 zone, once strong support, is now acting as resistance. Unless bulls can reclaim this area quickly, AMD risks sliding lower toward $150 or even deeper levels.

Technical View:

• Trendline: Broken on daily chart → bearish short-term shift.

• Resistance: $162–165 (former support), $186–187 (weak high).

• Support Levels: $150 psychological, then $135–140 range.

• Indicators: RSI softening, MACD negative, short-term MAs leaning bearish.

Fundamental Backdrop:

Despite this technical weakness, AMD’s long-term story remains strong. HSBC recently upgraded AMD with a $200 price target, citing its MI350 AI chips that rival Nvidia’s Blackwell GPUs. The MI400, due in 2026, could expand GPU sales to $20B by 2028. Melius Research also raised its target to $175, highlighting AMD’s AI trajectory. Fundamentally, AMD is building momentum as a serious competitor in the AI chip race.

Trade Setup (Swing Idea):

• Entry Zone: $162–165 rejection area.

• Stop Loss: Above $188 (weak high).

• Take Profit 1: $150 (psychological level).

• Take Profit 2: $135–140 demand zone.

• Long-Term Accumulation: Any dip below $150 could be a strategic buy for investors with a $175–200 upside target in the AI cycle.

My View:

Short-term, the break of trendline favors bears — I’m watching for a retest of $162–165 to confirm resistance. Medium-term, I see pullback opportunities. Long-term, AMD’s AI roadmap gives conviction that dips should be accumulated rather than feared.

(Not Financial Advice) NASDAQ:AMD

AMD Weekly Call Play – $170 Strike Ready to Explode?

## 🔥🚀 AMD Weekly Options Setup (Sep 3, 2025) 🚀🔥

💎 **High-Risk, High-Reward Call Play!** 💎

### 📊 Market Consensus

* 📈 **Bias:** Moderately Bullish (short-term upside skew).

* 🏦 **Flow:** Institutional heavy call buying (C/P = **2.19**) at \$170 strike.

* 📊 **RSI:** Weekly strong (70.8), Daily weak (43.2) → divergence ⚠️.

* ⏰ **Risk:** Only 2 DTE → Gamma & Theta decay **very high**.

---

### 🎯 Trade Setup

* 🏦 **Instrument:** AMD Weekly Call (Exp 09/05)

* 🚀 **Strike:** \$170

* 💵 **Entry:** \$0.59

* 🛑 **Stop Loss:** \$0.30 (≈50%)

* 🎯 **Target:** \$1.18 (+100%)

* 📅 **Exit Rule:** Close **by Thursday EOD** (don’t hold into Friday gamma).

* 📏 **Size:** 1 contract (keep it small)

* 📈 **Confidence:** 65%

---

### ⚠️ Key Risks

* ⏳ Time decay → Premium can evaporate fast.

* 📉 Weak daily momentum → Possible pullback.

* 🕒 Slippage & spreads → Use **limit orders**.

---

## 📌 Tags (TradingView + SEO Boost)

\#AMD #OptionsTrading #WeeklyOptions #CallOptions #SwingTrade #Breakout #TechStocks #RiskReward #StockMarket #TradingSetup #GammaRisk #ThetaDecay #MomentumTrading

AMD (2025+) Catalysts & Risks: 300 USD PT Bulls🟥 AMD (2025+) Catalysts & Risks: Analyst Views

________________________________________

🔑 Key Catalysts Driving AMD’s Stock Growth (2025+)

🌌 Quantum-Centric Supercomputing with IBM

AMD’s collaboration with IBM to merge CPUs/GPUs with quantum computing promises a whole new class of hybrid architectures. If successful, this could unlock brand-new compute markets in research, defense, and enterprise.

Impact Score: 9.5/10

🏗️ Hyperscaler Traction & Data-Center GPU Gains

AMD’s MI355 and upcoming MI400 accelerators are gaining traction with big cloud players. Even a modest 10% market share in AI GPUs would be transformative for AMD’s revenue mix.

Impact Score: 9/10

📈 Analyst Upgrades & Bullish Price Targets

Wall Street has turned bullish—multiple PT hikes point to 20–40% upside. Analyst enthusiasm often accelerates institutional inflows, reinforcing AMD’s momentum.

Impact Score: 7.5/10

🌍 Global AI Accelerator Growth & Middle East Expansion

AMD is securing multi-billion sovereign AI infrastructure deals in the Gulf (Saudi, UAE). These large-scale contracts validate AMD’s credibility as a true Nvidia alternative.

Impact Score: 8.5/10

💰 Strong Financial Performance & Executive Optimism

Q1 results crushed expectations with revenue and profit growth across data center and AI. Sustained beats strengthen AMD’s credibility and support multiple expansion.

Impact Score: 8/10

🔗 Broad Ecosystem & Strategic Acquisitions

Acquisitions like Xilinx and Silo AI give AMD a richer portfolio spanning FPGAs, AI software, and custom servers (Helios). This positions AMD as more than just a chipmaker—an AI infrastructure player.

Impact Score: 7/10

________________________________________

⚠️ Key Negative Drivers & Risks

🇨🇳 China Export Restrictions

AMD is losing access to a massive end market due to US export rules. This already shaved off ~$1B in projected sales and could worsen with future policy shifts.

Risk Severity: 9/10

📉 Under-whelming AI GPU Sell-In

Past misses on data-center GPU sales remind investors that adoption is not guaranteed. If hyperscalers hesitate, AMD’s AI growth story could stall.

Risk Severity: 7.5/10

💸 Valuation & Excess Rally Risks

Shares are up massively YTD—if results don’t keep pace, profit-taking could spark sharp pullbacks.

Risk Severity: 7/10

⚡ Short-Term Volatility & Earnings Reaction

Even with growth, near-term misses or cautious guidance could swing the stock hard.

Risk Severity: 6.5/10

🥊 Competitive Pressure

Nvidia’s CUDA ecosystem remains deeply entrenched, while custom silicon from hyperscalers (Google TPUs, AWS Trainium) eats into the TAM. AMD is fighting uphill.

Risk Severity: 8/10

________________________________________

📝 Summary Outlook (Sept 2025)

AMD is no longer the underdog—it’s becoming a legitimate AI infrastructure contender. The IBM quantum partnership and hyperscaler adoption of MI400 GPUs could be game-changers. Sovereign AI deals in the Middle East and ecosystem-expanding acquisitions amplify the story.

But execution risk is high—China export bans, entrenched Nvidia dominance, and valuation stretch leave little room for error. Success hinges on AMD proving it can scale its AI GPUs and secure recurring demand.

Rank Catalyst 🚀 Score (0–10)

1⃣ 🌌 Quantum-Centric Supercomputing with IBM 9.5

2⃣ 🏗️ Hyperscaler GPU Adoption (MI355/MI400) 9

3⃣ 🌍 Middle East AI Mega Deals 8.5

4⃣ 💰 Strong Financial Growth 8

5⃣ 📈 Analyst Upgrades & PT Revisions 7.5

6⃣ 🔗 Ecosystem & Acquisitions (Xilinx, Silo AI, Helios) 7

AMD: Drawing Closer...Step by step, AMD has been drawing closer to our magenta Target Zone between $143.63 and $130.77, which remains a favorable range for long entries. Prices should establish the low of turquoise wave 4 within this zone before reversing higher to resume the ongoing upward impulse—initially breaking above resistance at $185.27 and targeting the peak of magenta wave (1). However, we see a 33% chance that magenta wave alt. (1) has already completed, with a quicker low for wave alt. (2) likely to form below support at $126.13. Due to this alternative scenario, potential long trades within the magenta zone could be protected with a stop either 1% below the lower boundary of the zone or at the $126.13 level.

Advanced Micro Devices (AMD) Stock Analysis. My buyAdvanced Micro Devices (AMD) Stock Analysis

AMD, listed on NASDAQ, has generally been on an upward trend. However, the last 2 weeks, the stock experienced a brief flash downturn, dropping to around the $157 level and witnessed a good recovery last week, reaching $186 zone.

Since then, it has pulled back and is currently trading at approximately $176 share.

Outlook:

I remain bullish on AMD with entries from $176 - $172 and anticipate a potential move toward the $200 level, with a longer-term target around its all-time high near $226.

For my entry strategy, I am adding positions at different levels, with an initial entry around $176 and another if it drops further

Position (s) are for a mid- to long-term hold.

Let’s see how it unfolds! If you have any insights or thoughts, please share them in the comments. I’d love to connect with you. Don’t forget to follow, share, and subscribe. Thank you.

AMD Flush with possible buyers stepping in near $147 for a move Check out the chart....not financial advice and manage your own risk. I am looking for a flush near open Monday down to $147ish and then a move back up to about $155 if we can make it there. I have 3 Price targets - 1st is the psych level of $150/ 2nd is $154/$155 and then about $157 if we can get there. I will personally trade options likely about 7 -14 days out and take profits on the way up and move stop losses up.

AMD analysisAMD has completed a clear harmonic pattern, and the reaction from point D confirms that sellers are in control.

From my perspective, the technical setup points toward a continuation lower, with the 135–139 USD zone as the most probable destination. This area lines up with prior demand and fits the symmetry of the pattern.

📝 Conclusion: I expect AMD to trade down into the 135–139 USD region. This is my professional view based on the current structure, though as always, markets are uncertain and nothing is guaranteed.

👉 Stay tuned for more structured market insights — follow along for consistent expert-level analysis.

AMD 3Hour Time frameAMD 3-Hour Snapshot

Current Price: $155.82

Change: +2.91% from the previous close

Market Cap: $252.87 billion

P/E Ratio: Not specified

Beta: 1.89

🔎 Key Levels

Resistance:

R1: $160.00 (recent high)

R2: $165.00 (next resistance zone)

Support:

S1: $150.00 (immediate support)

S2: $145.00 (next support level)

📈 Technical Indicators

RSI (14): Not specified

MACD: Not specified

Moving Averages:

5-period SMA: Not specified

50-period SMA: Not specified

200-period SMA: Not specified

📌 Market Sentiment

Recent Catalyst: Positive momentum following recent gains and analyst upgrades.

Sector Performance: Semiconductor sector showing strength, with AMD leading gains among peers.

Options Activity: Significant trading in call options at $160 strike price, indicating bullish sentiment.

📅 Outlook

Bullish Scenario: A breakout above $160.00 could lead to a push toward $165.00 and higher.

Bearish Scenario: A drop below $150.00 may test support around $145.00.

Overall Bias: Moderately bullish, with positive momentum but facing near-term resistance.

Must go down to go upI think AMD needs to cool off before it continues further, possibly tapping $160 first before a serious correction. Targets are listed at the strong support ending at $120. RSI printing bearish divergence on multiple time frames

Look at the red line, look at the direction of price. It's still a downtrend.

AMD 1D Time frameMarket Snapshot

Current Price: ~$155.82

Daily Change: +2.9%

Recent Trend: Up more than 30% year-to-date, but momentum has slowed in the last few weeks.

🔎 Technical Indicators

RSI (14-day): ~54 → Neutral, neither overbought nor oversold.

MACD: Slightly negative → Mild selling pressure.

Moving Averages:

5-day MA: ~$154.6 → Supportive (bullish short-term).

50-day MA: ~$157.9 → Acting as resistance.

200-day MA: ~$168.3 → Major long-term resistance.

Summary: Short-term momentum is holding, but medium to long-term averages are pushing down on price.

📈 Support & Resistance

Immediate Support: ~$150 – $155 zone

Resistance Levels: ~$158 (50-day), then ~$168 (200-day)

📅 Outlook

Bullish Case: If AMD sustains above ~$158, upside targets near $170–175 open up.

Bearish Case: A break below ~$150 could drag it toward $140–145.

Bias: Neutral to mildly bearish in the near-term, with long-term upside still intact if it reclaims the 200-day MA.

AMD — Watch for Pivot Reversal or Trend ContinuationMarket view

Actual volatility is high, confirmed by the Volatility Bars indicator.

The rate of change in the SMA is decreasing, suggesting momentum is weakening.

The previous candle was a Doji, indicating short-term indecision.

Price closed below the prior day’s low, adding bearish pressure.

A potential Pivot Point reversal is forming.

This reversal setup is confirmed by increasing Convolution Probability, supporting a higher chance of a directional move.

Trade plan

Long (trend continuation): buy on a break above the August 19, 2025 open.

Short (reversal): sell on a break below the pivot reversal at 158.25.

Stop-loss and position sizing: use volatility-based stops (e.g., ATR multiple) and risk no more than a small fixed percentage of capital per trade.

AMD...What's next?The Good (Bullish Side)

Uptrend Recovery: After bottoming near $76 in April 2025, AMD has made a strong rebound, more than doubling into the $180s. That’s a powerful recovery with momentum behind it.

Support Levels: $140.98 (Bull Target 1, now support) held beautifully during the climb. As long as price stays above that zone, bulls remain in control.

EMA Structure: The green ribbon is showing bullish alignment, with short-term EMAs stacked above longer-term ones. Trend is intact despite the pullback.

Targets: Bull target 2 is $183.56. If AMD breaks above $186.65 (recent resistance), it has room to run higher.

The Bad (Bearish Side)

Resistance at $186.65: Price already got rejected at that level. Until AMD closes convincingly above it, this ceiling is heavy.

Lower High Risk: If AMD fails to reclaim $186 and rolls over, it risks forming a lower high — which could signal a deeper retrace.

Macro Weakness: Semi stocks (including AMD) are cyclical. If broader tech/economy cools, AMD can easily retrace to the $140–150 zone.

“Too Good to Be True” Filter

The recent rally from ~$76 to ~$186 is a 142% move in ~4 months. Moves that vertical rarely sustain without corrections. Expect at least some chop or a larger retracement before continuation.

Cost vs. Benefit Analysis

Chasing now (~$168–170): High risk since you’re buying under resistance. Best case you capture a breakout, worst case you eat a $20–30 pullback.

Waiting for confirmation ($186+ breakout): Lower risk entry, but you’ll miss the first 10% of the move.

Buying a retrace to $150–155: Better reward/risk, but you risk missing the run if it never pulls back that far.

✅ Bottom Line: Looking good overall, but this is not a safe buy point. AMD is stuck between resistance and support. Smart money waits for either a breakout above $186 with volume or a dip closer to $150 for better risk/reward.

AMD LongLooking at AMD on the 15-minute chart, the broader market structure remains bearish overall, with price forming a series of lower highs and lower lows since the swing high near 186.65, which also marked a Break of Structure (BOS). That BOS confirmed seller dominance at the time. However, a recent Change of Character (CHoCH) around 157.8 signaled the end of the sharp downtrend and the beginning of a recovery phase, as buyers defended key demand and shifted momentum back upward. This suggests that while the macro structure is still heavy, the short-term trend is attempting a reversal.

The key supply zones are clustered between 176–178 and further above at 182–184, where price previously dropped sharply, showing strong selling pressure. These are strong supply levels, as sellers reacted aggressively there. The nearest demand zone sits around 164–166, where buyers stepped in firmly and defended the structure after the CHoCH, marking it as a solid base. Below that, demand extends into the 158–160 range, but that zone would only come into play if the higher demand fails.

Within the marked region, price is currently reacting to the 167 supply area, showing minor hesitation but not heavy rejection yet. Momentum still leans in favor of buyers after the recent higher low was formed. If buyers hold above 166, the likely scenario is a push higher toward the 176 zone, where sellers are expected to re-enter. However, if 166 fails and price breaks back below 164, this short-term bullish setup would be invalidated, and sellers would regain control.

Trade bias: Bullish in the short term

Expected direction: Continuation higher into 176 supply after holding above 166 demand

Invalidation level: A breakdown below 164 would weaken the bullish outlook

Momentum condition: Buyers currently hold the edge with higher lows forming, though supply remains heavy overhead

Price behavior: Controlled upward structure, with buyers gradually reclaiming levels

Buy AMD with Confidence. Hello I am the Cafe Trader.

My goal is to help you find great pricing for your long term, and help you finesse your position the markets.

Today we are going to take a closer look at AMD.

As of right now AMD has just peeled off it's highs, gapping down. Is this where buyers are stepping in? Should you buy now? What are some short term plays that can maximize your profits?

CONTEXT

On the Chart I have labeled different levels of Demand. Knowing where the players are (buyers and sellers) can help us be surgical in price and timing.

In my opinion it is best to trade in terms of scenarios. How players react is just as important as Where they react.

For example: Say you are waiting in a long line for coffee. After some time, the line moves very slowly. We can start to ask questions, like "Why is this taking so long? How long will this take?"

"How" is an important question because we would have to examine how fast, or slow, the line is moving. We are in the dark with how big the current players are in the market.

Knowing "How" will help us position ourselves well with the other players. This lines us up for the best pricing, and helps us be able to get out of a position quick if we are wrong.

SHORT TERM

AMD had mixed earnings. This puts pressure on the buyers but they are still in control.

With a new seller inbound It's probable to hit the "Top of Demand" before breaking new highs.

Short Scenario (Red Line)

I think this will touch quick, reject, and then a few days of sideways before the real move down. You can take a Short right in this zone at 172, but if you buy puts, look to get good pricing. If we move up 4% the contracts might be too expensive to swing 3-5 days. I think after the touch, wait two days or so, and then look to get into some options.

Short (shares)

Entry 172

Stop 178.75

TP 150

Short (options)

Entry is after a test of the strong supply, wait a couple days.

Strike price: 160 Strike (or higher)

Premium: 4 to 1 R

$1.50 4-5 days TP $600

$2.50 6-10 days TP $1000

Long Scenario.

If we do not touch the strong supply before going down, This could drop aggressively. Unlike the previous scenario, I am expecting a hot reaction off the strong Demand area.

Long (shares)

Entry 135.50

Stop 124

TP 172

Long (options)

As soon as it touches, same day and next days contracts, 1 - 2 standard deviations outside the money. I think It can get to 140 minimum the same day.

Strike 136-137

Premium: 2.50-3.50 (if you get it cheaper, great!) Really this will depend on if it touches on a Monday, or a Friday lol.

TP 150% - 400%

LONG TERM

These prices should align with your own sentiment and Due Diligence of AMD.

Fair: $149.50 (Top of Demand)

Deal: $133.50 - 135.50 (Strong Demand)

Steal: anything under 108

(2nd Strong Demand)

Don't forget to Boost and follow!

More insight to come, and make sure you check out all my channels.

Much Love and Happy Trading!

@thecafetrader

AMD Pullback Opportunity After 70%+ Rally – Watching $111–$120 📈 AMD Update – Strategic Re-Entry Plan

From our original buys at $108, AMD has delivered an impressive 70%+ rally. This strong momentum reflects continued bullish sentiment and growth potential in the semiconductor sector.

We’re now looking to add on a pullback into a confluence support zone between $111 and $120. This level aligns with the:

61.8% Fibonacci retracement

99-day TRAMA

Horizontal support at $120

📍 Entry Zone: $111–$120

🎯 Take Profit Targets: $160 / $220 / $300

❌ Stop Loss: Weekly close below $100

#AMD #NASDAQ #SwingTrade #Fibonacci #TechnicalAnalysis #StockMarket #TradingIdeas

a return to solid buyers presents a cheap =BUY opportunity 1->3 : creates a higher high with number 2

being a solid low , meaning the buyers that

came from here surpassed the sellers from

high number 1

4: a return to the solid buyers

* what do I think will happen :

* a return to solid sellers is always a good idea for

a buy setup

* some negative factors as far as this theory goes would be the bearish divergences on rsi, mfi and accum/dist.

* on a higher high we are potentially returning to a double bottom which is a bullish indication, also we have an overall uptrend which is good

- the chaos theory indicator shows a 63% ofance of follow through to the halfway mark between these sets of zones, at which point we would be much more confident about going long, this also gives us a breakeven and a target point.