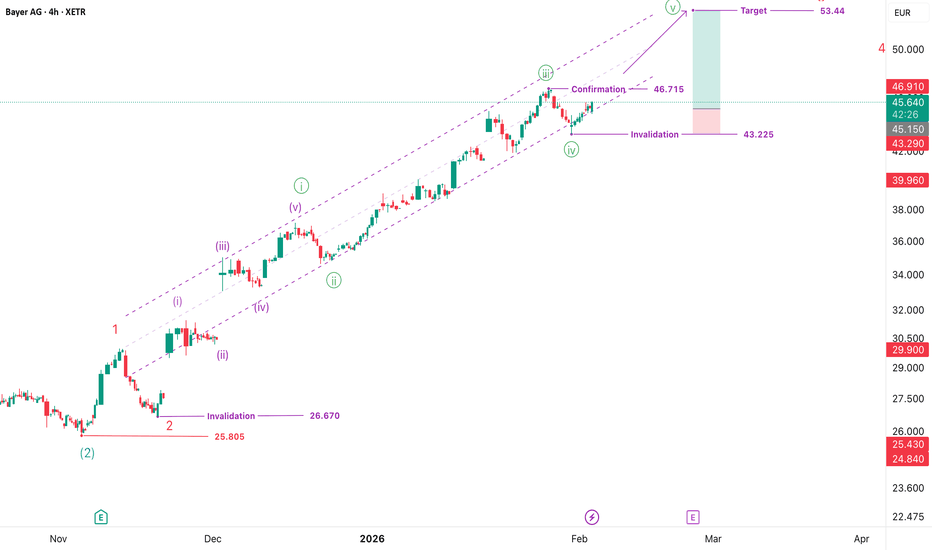

BAYER: Wave (X) CompleteBayer shares have continued their bullish momentum since our last update. As shown on the daily chart, we now primarily believe that the low of wave (X) in blue is already in place, and that the next phase will see wave (Y) advancing above all marked resistance lines.

As a result, we have deactivat

Bayer AG

No trades

Key facts today

Bayer's blood thinner asundexian cut recurrent stroke risk by 26% in a trial with 12,000 patients. Analysts expect peak sales of 4 billion euros, boosting Bayer's shares by 0.3%.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.190 CHF

−2.40 B CHF

43.82 B CHF

About Bayer AG

Sector

Industry

CEO

William N. Anderson

Website

Headquarters

Leverkusen

Founded

1952

IPO date

Nov 28, 1997

Identifiers

2

ISIN DE000BAY0017

Bayer AG engages in the business of life science fields of healthcare and nutrition. It operates through the following segments: Crop Science, Pharmaceuticals, and Consumer Health. The Crop Science segment includes developing, producing, and marketing products in seeds and plant traits, crop protection, digital solutions, and customer services to promote sustainable agriculture. The Pharmaceuticals segment is involved in prescription products especially for cardiology and women’s health; specialty therapeutics in the areas of oncology, hematology, ophthalmology, and cell and gene therapy; diagnostic imaging equipment; and necessary contrast agents. The Consumer Health segment focuses on non-prescription products in the dermatology, nutritional supplements, digestive health, allergy, cough and cold, and pain and cardiovascular risk prevention categories. The company was founded by Friedrich Bayer and Johann Friedrich Westkott on August 1, 1863 and is headquartered in Leverkusen, Germany.

Related stocks

Bayer-4h timeframe-bullish continuation

Looks like Bayer is moving higher with wave 5 green, target 53.

Bayer has been my favourite stock to analyze and trade. Recently I feel like assigning the personality traits of the asset I analyse. And this is Bayer personality.

✅ Interestingly, Bayer is a big German pharma corporation. And its p

Bayer bullish continuation 1H timeframe, target 51✅ Bingoooo

Another correct prediction. Bayer is currently trading at 45.5, 26% gain since I made this post. The next target is at 51, and I expect a correction on the lower timeframe at that level.

Upside for Bayer is still massive, with correction in lower timeframe along the way, of course.

Inval

Late cycle. Medicine ++In November 2023, it was reported that German chemical concern Bayer AG was considering options for splitting the business due to weak financial performance.

Management considered several options:

spinning off the health products or agricultural fertilizer businesses into a separate company;

Bottom up with clear upside momentumXETR:BAYN Bayer is looking at a possible rebound after the stock rose strongly and attempting to break above the bearish gap seen.

Ichimoku is showing a strong bullish signal and we believe near-term should see further upside.

Long-term MACD is back to the positive. Stochastic confirms the bull

Bayer stock : Contrarian storyBayer stock might be considered a contrarian investment:

Legal overhang from Monsanto acquisition: The ongoing litigation related to the Roundup herbicide has created significant uncertainty and negatively impacted Bayer's stock price. A contrarian investor might see this as an overreaction and bel

Bayer AG Analysis: Growth Potential and Positive Buying SentimenThe history of Bayer AG shares goes through many key moments and events:

Foundation and early years: Bayer was founded in 1863 by Friedrich Bayer and Johann Wagner in Germany. The company initially dealt with the production of chemicals and textile dyes.

Development of aspirin: In 1897, Bayer synt

Bayer (BAYN): End of a long 9-year correctionBayer (BAYN): XETR:BAYN

Upon request from one of our members, we're taking a closer look at Bayer AG. We believe that we are still in an overarching Wave II. This wave finds its last true support at the 88.2% retracement level at €24.51. Falling significantly below this level would likely lead

Bayer (BAYN): Is the Bottom Finally Here?Since our initial analysis in November, Bayer's stock has experienced a 40% pullback. Despite missing our limit order by 2%, we have decided to enter the market now and plan to make additional purchases if the price drops further.

The stock has held around the 88.2% Fibonacci retracement level. We

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

BAYZ4140706

Monsanto Company 4.7% 15-JUL-2064Yield to maturity

7.19%

Maturity date

Jul 15, 2064

BAYZ3875861

Monsanto Company 3.6% 15-JUL-2042Yield to maturity

6.94%

Maturity date

Jul 15, 2042

BAYZ4067527

Monsanto Company 4.65% 15-NOV-2043Yield to maturity

6.74%

Maturity date

Nov 15, 2043

BAYZ4230946

Monsanto Company 3.95% 15-APR-2045Yield to maturity

6.72%

Maturity date

Apr 15, 2045

BAYZ4140707

Monsanto Company 4.4% 15-JUL-2044Yield to maturity

6.52%

Maturity date

Jul 15, 2044

US7274NBH5

Bayer US Finance II LLC 4.7% 15-JUL-2064Yield to maturity

6.37%

Maturity date

Jul 15, 2064

B16A

Bayer US Finance II LLC 4.7% 15-JUL-2064Yield to maturity

6.30%

Maturity date

Jul 15, 2064

US7274EAM5

Bayer US Finance LLC 6.875% 21-NOV-2053Yield to maturity

6.19%

Maturity date

Nov 21, 2053

US7274NBG7

Bayer US Finance II LLC 3.95% 15-APR-2045Yield to maturity

6.18%

Maturity date

Apr 15, 2045

BAYZ5705356

Bayer US Finance LLC 6.875% 21-NOV-2053Yield to maturity

6.14%

Maturity date

Nov 21, 2053

BAYZ4662675

Bayer US Finance II LLC 4.4% 15-JUL-2044Yield to maturity

6.14%

Maturity date

Jul 15, 2044

See all BAYN bonds

EWLD

Amundi Index Solutions SICAV - Amundi MSCI World Swap UCITS ETFWeight

5.46%

Market value

387.36 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of BAYN is 39.765 CHF — it has decreased by −0.49% in the past 24 hours. Watch Bayer AG stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange Bayer AG stocks are traded under the ticker BAYN.

We've gathered analysts' opinions on Bayer AG future price: according to them, BAYN price has a max estimate of 50.33 CHF and a min estimate of 21.05 CHF. Watch BAYN chart and read a more detailed Bayer AG stock forecast: see what analysts think of Bayer AG and suggest that you do with its stocks.

BAYN reached its all-time high on Mar 18, 2015 with the price of 149.585 CHF, and its all-time low was 36.350 CHF and was reached on Jan 13, 2026. View more price dynamics on BAYN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BAYN stock is 0.49% volatile and has beta coefficient of 1.07. Track Bayer AG stock price on the chart and check out the list of the most volatile stocks — is Bayer AG there?

Today Bayer AG has the market capitalization of 40.37 B, it has increased by 2.38% over the last week.

Yes, you can track Bayer AG financials in yearly and quarterly reports right on TradingView.

Bayer AG is going to release the next earnings report on Feb 25, 2026. Keep track of upcoming events with our Earnings Calendar.

BAYN earnings for the last quarter are 0.53 CHF per share, whereas the estimation was 0.34 CHF resulting in a 55.65% surprise. The estimated earnings for the next quarter are 0.34 CHF per share. See more details about Bayer AG earnings.

Bayer AG revenue for the last quarter amounts to 9.03 B CHF, despite the estimated figure of 9.05 B CHF. In the next quarter, revenue is expected to reach 10.37 B CHF.

BAYN net income for the last quarter is −900.06 M CHF, while the quarter before that showed −185.99 M CHF of net income which accounts for −383.93% change. Track more Bayer AG financial stats to get the full picture.

Yes, BAYN dividends are paid annually. The last dividend per share was 0.10 CHF. As of today, Dividend Yield (TTM)% is 0.25%. Tracking Bayer AG dividends might help you take more informed decisions.

As of Feb 6, 2026, the company has 92.81 K employees. See our rating of the largest employees — is Bayer AG on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Bayer AG EBITDA is 8.37 B CHF, and current EBITDA margin is 18.30%. See more stats in Bayer AG financial statements.

Like other stocks, BAYN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bayer AG stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Bayer AG technincal analysis shows the strong sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Bayer AG stock shows the strong sell signal. See more of Bayer AG technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.