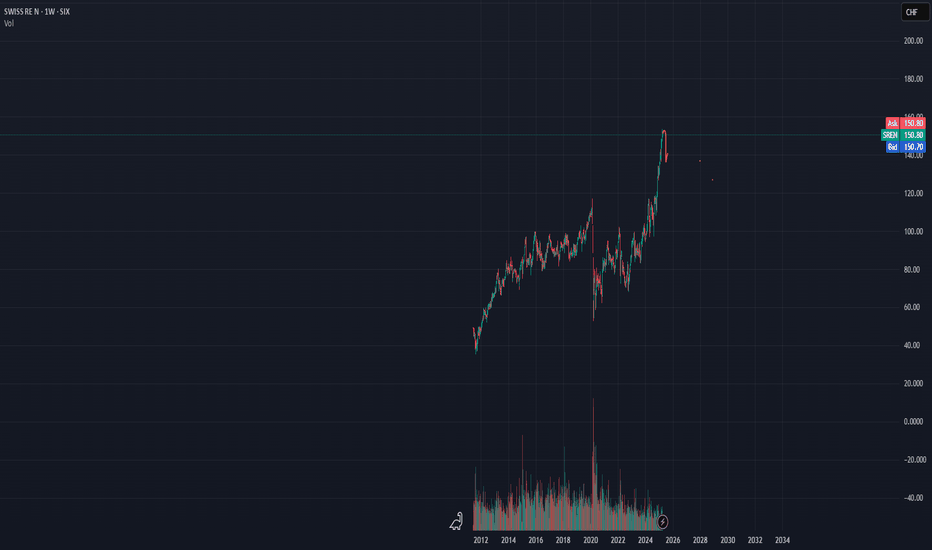

Swiss RE Crash ahead?+low volume

+MACD overbought

+RSI overbought

+increase in dividends

+Divested insurance company stake

+Thailand & Myanmar earthquake uncertainty

+Trump tariff unceartainty

+Most shares are in the hands of baby boomers, who are on the brink of retirement

+I really don't see how the next generation wi

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.95 CHF

2.80 B CHF

44.17 B CHF

250.51 M

About Swiss Re AG

Sector

Industry

CEO

Andreas Berger

Website

Headquarters

Zurich

Founded

1863

ISIN

CH0126881561

FIGI

BBG00HCYV7Y7

Swiss Re AG engages in the provision of reinsurance, insurance and other insurance-based forms of risk transfer. It operates through the following segments: Property and Casualty Reinsurance, Life and Health Reinsurance, Corporate Solutions, Life Capital, and Group Items. The Property and Casualty segment comprises of the business lines property, casualty including motor, and specialty. The Life and Health segment includes property and casualty; and life and health sub-segments. The Corporate Solutions segment offers innovative insurance capacity to mid-sized and large multinational corporations across the globe. The Life Capital segment encompasses the closed and open life and health insurance books, as well as the ReAssure business and the primary life and health insurance business comprising elipsLife and iptiQ. The Group Items segment represents the administrative expenses of the corporate center functions that are not recharged to the operating segments. The company was founded on December 19, 1863 and is headquartered in Zurich, Switzerland.

Related stocks

Swiss Re (SREN.vx) bullish scenario:The technical figure Channel Down can be found in the daily chart in the US company Swiss Re (SREN.vx). Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is one of the world's largest reinsurers, as measured by net premiums written.

Swiss Re AG bullish scenario:We have technical figure Triangle in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Re AG is a reinsurance company based in Zurich, Switzerland. It is the world's largest reinsurer, as measured by net premiums written. The Triangle has broken through the resistance line

SREN.vx bullish scenario:SREN.vx bullish scenario:

We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Found

SREN.vx bullish scenario:We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Founded in 1863, Swiss Re opera

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

DEMQ5253921

Argentum Netherlands BV for Swiss Re AG 6.05% 17-FEB-2056Yield to maturity

6.49%

Maturity date

Feb 17, 2056

US36158FAA8

GE Global Insurance Holding Corp. 7.0% 15-FEB-2026Yield to maturity

5.67%

Maturity date

Feb 15, 2026

SSRE3938889

Swiss Re Treasury (US) Corp. 4.25% 06-DEC-2042Yield to maturity

5.42%

Maturity date

Dec 6, 2042

SSRE3680636

GE Global Insurance Holding Corp. 7.75% 15-JUN-2030Yield to maturity

4.43%

Maturity date

Jun 15, 2030

RUK15

Schweizerische Ruckversicherungs-Gesellschaft AG 0.75% 21-JAN-2027Yield to maturity

0.31%

Maturity date

Jan 21, 2027

XS218195911

Swiss Re Finance (UK) Plc 2.714% 04-JUN-2052Yield to maturity

—

Maturity date

Jun 4, 2052

XS1973748707

Swiss Re Finance (Luxembourg) SA 5.0% 02-APR-2049Yield to maturity

—

Maturity date

Apr 2, 2049

DEMQ4370876

Argentum Netherlands BV for Swiss Re AG 5.625% 15-AUG-2052Yield to maturity

—

Maturity date

Aug 15, 2052

XS196311696

Swiss Re Finance (Luxembourg) SA 2.534% 30-APR-2050Yield to maturity

—

Maturity date

Apr 30, 2050

SSRE5782823

Swiss Re Subordinated Finance Plc 5.698% 05-APR-2035Yield to maturity

—

Maturity date

Apr 5, 2035

MHOR5390434

Matterhorn Re Ltd. FRN 25-JAN-2027Yield to maturity

—

Maturity date

Jan 25, 2027

See all SREN bonds

Frequently Asked Questions

The current price of SREN is 130.50 CHF — it has increased by 0.81% in the past 24 hours. Watch Swiss Re AG stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on SIX exchange Swiss Re AG stocks are traded under the ticker SREN.

SREN stock has fallen by −8.10% compared to the previous week, the month change is a −11.82% fall, over the last year Swiss Re AG has showed a −1.88% decrease.

We've gathered analysts' opinions on Swiss Re AG future price: according to them, SREN price has a max estimate of 172.25 CHF and a min estimate of 118.08 CHF. Watch SREN chart and read a more detailed Swiss Re AG stock forecast: see what analysts think of Swiss Re AG and suggest that you do with its stocks.

SREN reached its all-time high on Aug 7, 2025 with the price of 156.80 CHF, and its all-time low was 35.10 CHF and was reached on Aug 11, 2011. View more price dynamics on SREN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SREN stock is 1.67% volatile and has beta coefficient of 0.49. Track Swiss Re AG stock price on the chart and check out the list of the most volatile stocks — is Swiss Re AG there?

Today Swiss Re AG has the market capitalization of 35.64 B, it has increased by 2.57% over the last week.

Yes, you can track Swiss Re AG financials in yearly and quarterly reports right on TradingView.

Swiss Re AG is going to release the next earnings report on Feb 27, 2026. Keep track of upcoming events with our Earnings Calendar.

SREN net income for the last half-year is 2.21 B CHF, while the previous report showed 1.01 B CHF of net income which accounts for 119.82% change. Track more Swiss Re AG financial stats to get the full picture.

Yes, SREN dividends are paid annually. The last dividend per share was 6.01 CHF. As of today, Dividend Yield (TTM)% is 4.64%. Tracking Swiss Re AG dividends might help you take more informed decisions.

Swiss Re AG dividend yield was 4.58% in 2024, and payout ratio reached 62.68%. The year before the numbers were 6.57% and 65.90% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Dec 9, 2025, the company has 15.02 K employees. See our rating of the largest employees — is Swiss Re AG on this list?

Like other stocks, SREN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Swiss Re AG stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Swiss Re AG technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Swiss Re AG stock shows the neutral signal. See more of Swiss Re AG technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.