Smart Money Setup: Katy AI Turns Bearish on SLVSLV QuantSignals Katy 1M Prediction 2026-01-19

SLV Analysis

Current Price: $81.95

Final Prediction: $81.11 (-1.02%)

30min Target: $80.87 (-1.32%)

Trend: BEARISH

Confidence: 56.8%

Volatility: 15.5%

🧠 AI Insight:

Katy AI identifies mild but consistent downside pressure, with price expected to drift

Key stats

About iShares Silver Trust

Home page

Inception date

Apr 21, 2006

Structure

Grantor Trust

Replication method

Physical

Dividend treatment

Distributes

Distribution tax treatment

Return of capital

Income tax type

Collectibles

Max ST capital gains rate

39.60%

Max LT capital gains rate

28.00%

Primary advisor

iShares Delaware Trust Sponsor LLC

Distributor

BlackRock Investments LLC

Identifiers

3

ISIN US46428Q1094

SLV gives investors direct exposure to silver by physically holding the metal in vaults in London. As such, investors get exposure to spot silver (determined by the London Silver Fix), less fund expenses. As this fund is considered a collectible for tax purposes, taxes on long-term gains are quite steep. Still, SLV provides stability for buy-and-hold strategies.

Related funds

Classification

What's in the fund

Exposure type

Miscellaneous

Bonds, Cash & Other100.00%

Miscellaneous100.00%

Top 10 holdings

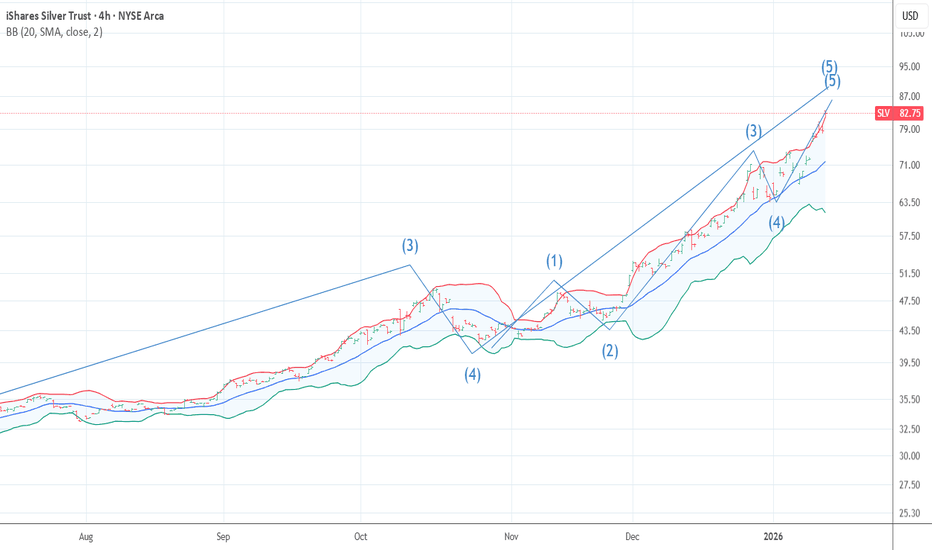

SLV - Parabolic Exhaustion Play - $100 Puts Feb 13📉 Pattern Recognition Setup

AMEX:SLV just completed a 68% run from $65 to $110 in under 3 months. This isn’t normal commodity ETF behavior - this is meme-stock price action.

Key Observation:

The current parabolic structure mirrors the prior $30→$48 spike that collapsed violently after hitting exha

Is The Price Of Silver Telling Us What The Dollar Is Going To DoTrading Fam,

I am sensing some events on the horizon, and the charts seem to confirm what I am feeling. I want to let you know what I am seeing. We’ll talk Silver, the dollar, S&P500, Bitcoin, and Ethereum in this video. Don’t shoot the messenger.

✌️Stew

Silver Bullion Play – SLV Trend & Demand ZonesiShares Silver Trust (SLV) is a physically backed ETF designed to reflect the day‑to‑day performance of spot silver bullion. I’m using this chart to map higher‑timeframe trend, key demand zones, and liquidity levels for swing‑long opportunities in silver, treating SLV as a clean proxy for the underl

QS V4 ELITE: SLV Mean-Reversion Short📉 SLV Weekly Trade

Direction: Bearish pullback

Buy: SLV $100 Put

Expiry: Jan 31, 2026

Entry: $6.40 – $6.60

🎯 Targets

Target 1: $8.00

Target 2: $10.40

🔴 Risk

Stop loss: $4.80

Hard exit: SLV above $106.70

⚠️ Trade Rules

Take 50% profit at +25%

Move stop to breakeven after Target 1

Use trai

SLV Quick UpdateIt's been many years now but we finally reached the wave 3 target. For all those that accumulated down below, congratulations. The wave 3 looks to be in so we should be prepared for a 38% pullback here. It can still go to $100 for the wave 3 but that move is usually more rare in fibonacci extensions

Parabolic / Blue Sky BreakoutThe SLV chart depicts a massive "blow-off top" or hyper-growth phase. The momentum is aggressively to the upside, but the distance from the nearest technical support (27.66) indicates the asset is significantly over-extended from its mean.

Bull Case: Momentum is dominant. With no overhead resistanc

SLV (Silver) — Monday Jan 26 Update | Liquidity & Trade ideaHappy Monday Jan 26 :)

SLV continues to trade in a liquidity-driven environment rather than a clean directional move. From a price-action standpoint, I’m closely watching how silver behaves around its current structure before committing to a new position.

Key zones I’m tracking:

Support / dema

iShares Silver Trust breakout setup favors upside this week:Current Price: 72.38 (Analysis was generated on Monday Morning)

Direction: LONG

Confidence level: 67%(Based on strong alignment between professional trader commentary and bullish X sentiment, but with relatively light volume and short-term resistance nearby)

Targets

Target 1: 75.00

Target 2: 78.5

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

An exchange-traded fund (ETF) is a collection of assets (stocks, bonds, commodities, etc.) that track an underlying index and can be bought on an exchange like individual stocks.

SLV trades at 105.57 USD today, its price has risen 3.95% in the past 24 hours. Track more dynamics on SLV price chart.

SLV net asset value is 102.23 today — it's risen 56.22% over the past month. NAV represents the total value of the fund's assets less liabilities and serves as a gauge of the fund's performance.

SLV assets under management is 56.07 B USD. AUM is an important metric as it reflects the fund's size and can serve as a gauge of how successful the fund is in attracting investors, which, in its turn, can influence decision-making.

SLV price has risen by 60.84% over the last month, and its yearly performance shows a 276.23% increase. See more dynamics on SLV price chart.

NAV returns, another gauge of an ETF dynamics, have risen by 56.22% over the last month, showed a 142.65% increase in three-month performance and has increased by 272.42% in a year.

NAV returns, another gauge of an ETF dynamics, have risen by 56.22% over the last month, showed a 142.65% increase in three-month performance and has increased by 272.42% in a year.

SLV fund flows account for 1.13 B USD (1 year). Many traders use this metric to get insight into investors' sentiment and evaluate whether it's time to buy or sell the fund.

Since ETFs work like an individual stock, they can be bought and sold on exchanges (e.g. NASDAQ, NYSE, EURONEXT). As it happens with stocks, you need to select a brokerage to access trading. Explore our list of available brokers to find the one to help execute your strategies. Don't forget to do your research before getting to trading. Explore ETFs metrics in our ETF screener to find a reliable opportunity.

SLV expense ratio is 0.50%. It's an important metric for helping traders understand the fund's operating costs relative to assets and how expensive it would be to hold the fund.

No, SLV isn't leveraged, meaning it doesn't use borrowings or financial derivatives to magnify the performance of the underlying assets or index it follows.

In some ways, ETFs are safe investments, but in a broader sense, they're not safer than any other asset, so it's crucial to analyze a fund before investing. But if your research gives a vague answer, you can always refer to technical analysis.

Today, SLV technical analysis shows the buy rating and its 1-week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SLV shows the strong buy signal. See more of SLV technicals for a more comprehensive analysis.

Today, SLV technical analysis shows the buy rating and its 1-week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1-month rating SLV shows the strong buy signal. See more of SLV technicals for a more comprehensive analysis.

No, SLV doesn't pay dividends to its holders.

SLV trades at a premium (3.30%).

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

Premium/discount to NAV expresses the difference between the ETF’s price and its NAV value. A positive percentage indicates a premium, meaning the ETF trades at a higher price than the calculated NAV. Conversely, a negative percentage indicates a discount, suggesting the ETF trades at a lower price than NAV.

SLV shares are issued by BlackRock, Inc.

SLV follows the LBMA Silver Price ($/ozt). ETFs usually track some benchmark seeking to replicate its performance and guide asset selection and objectives.

The fund started trading on Apr 21, 2006.

The fund's management style is passive, meaning it's aiming to replicate the performance of the underlying index by holding assets in the same proportions as the index. The goal is to match the index's returns.