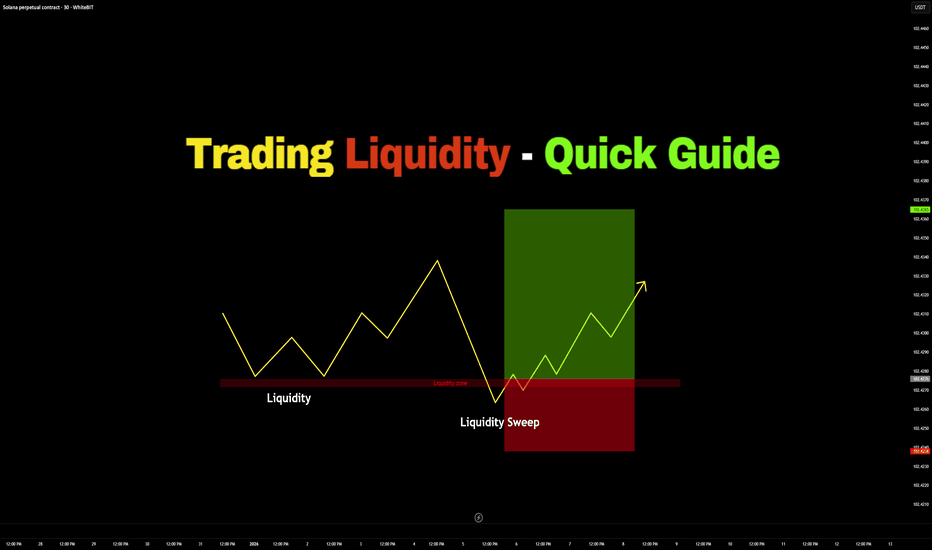

Trading Liquidity – Quick Guide in 5 StepsWelcome back everyone to another guide, today we will speed run "Trading Liquidity" in a quick 5 step guide. Be sure to like, follow and join the community!

1) Identify Liquidity:

- Equal highs or cluster of highs (Buy-side Liquidity)

- Equal lows or cluster of lows (Sell-side Liquidity)

- Obviou

TOP Altcoins for 2026 ~ ALTSHappy New Year 🥂

Here's a quick glance at my TOP 5 alts of choice for 2026, and why.

💭Injective (INJ)

Fast, interoperable DeFi infrastructure. Active development and a clear use-case in scaling decentralized trading.

💭Illuvium (ILV)

Prioritizes high-quality gameplay and steady development, back

SOL/USDT | Continuing the trend? (READ THE CAPTION)By analysing the 4H chart of SOLUSDT, we can see that After weeks of struggling with the Demand Zone, not being able to break through it, Solana has finally gone out of there. It went on to just over $140 and it is currently being traded at 137.70 level, just above the IFVG High, it may touch the hi

Solana’s Not Done Yet — Hitting 136 Soon?🚀 Solana Update | TF 15M

Hey everyone! 👋

In my previous post, my targets were:

🎯 127.50 & 130

Before SOL reached the first target, it dipped slightly below my old cancellation zone. But that didn’t break the long picture it actually strengthened it 💪.

🔥🎯New targets:

➡️ 132

➡️ 135

➡️ 136 😎

❌New

Mastering MFI: The Money Flow Index as a Momentum, Volume...🔵 Mastering MFI: The Money Flow Index as a Momentum, Volume & Trend Framework

Difficulty: 🐳🐳🐳🐳🐋 (Advanced)

The Money Flow Index (MFI) is often overlooked, yet it combines price and volume into a single oscillator. This makes it one of the few indicators capable of revealing not just momentum

Solana (SOL) — 15m Local Bullish StructureHello, friends!

How did you celebrate the New Year? 🎉

I wish everyone a productive and profitable 2026!

I haven’t posted ideas on TradingView for a few weeks, but I’ve decided that starting from the very first day of 2026, I’ll be sharing ideas daily.

So here is my first one:

Despite my previous

SOL road map (4h) !The price on the 4h timeframe is within an ascending triangle, which can be promising. If the price breaks this pattern with bullish candles, it could easily rise by the distance of AB=CD.

Best regards CobraVanguard.💚

Give me some energy !!

✨We spend hours finding potential opportunities and writin

Solana (SOL): Waiting For Clean Breakout | Momentum BuildingSOL is still stuck inside the sideways range, and price is now pressing into the upper resistance once again. This zone has been tested multiple times, so pressure is clearly building here.

Two scenarios we care about. First one is a MSB around the EMAs — if buyers manage to flip structure there, t

SOLANA Weekly CLS - Model 1 ShortHi friends, new range created. As always we are looking for the manipulation in to the key level around the range. Don't forget confirmation switch from manipulation phase to the distribution phase to make the setup valid. Stay patient and enter only after change in order flow. If price reaches 50%

SOLANA - retest resistance of the trading range BINANCE:SOLUSDT has been rising since the session opened amid a weak market. The altcoin is showing bullish momentum in a predominantly bearish market, with a focus on the 145.0 zone.

Bitcoin is rebounding from resistance amid a global downtrend. There is currently no bullish potential (across

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.