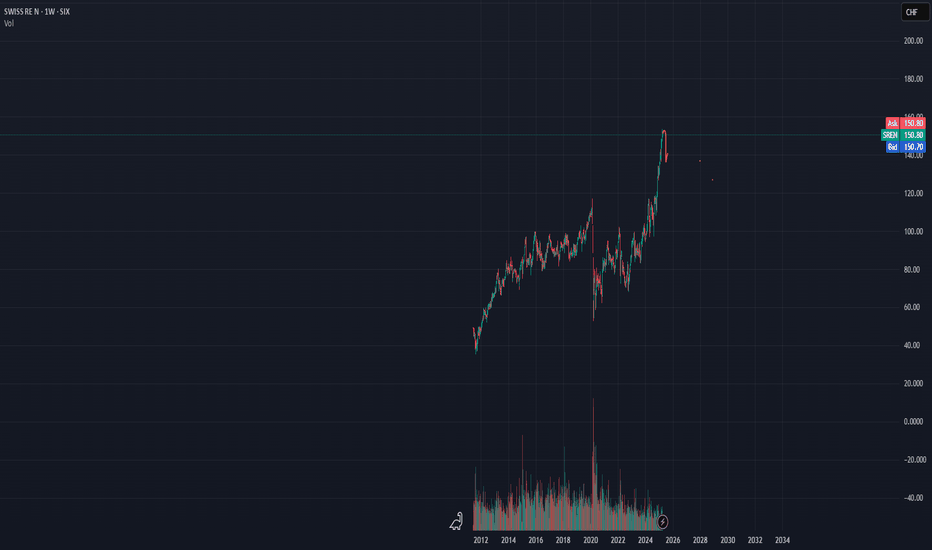

Swiss RE Crash ahead?+low volume

+MACD overbought

+RSI overbought

+increase in dividends

+Divested insurance company stake

+Thailand & Myanmar earthquake uncertainty

+Trump tariff unceartainty

+Most shares are in the hands of baby boomers, who are on the brink of retirement

+I really don't see how the next generation wi

Swiss Re Ltd

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.18 USD

3.18 B USD

50.12 B USD

About Swiss Re AG

Sector

Industry

CEO

Andreas Berger

Website

Headquarters

Zurich

Founded

1863

Identifiers

3

ISIN US8708861088

Swiss Re AG engages in the provision of reinsurance, insurance and other insurance-based forms of risk transfer. It operates through the following segments: Property and Casualty Reinsurance, Life and Health Reinsurance, Corporate Solutions, Life Capital, and Group Items. The Property and Casualty segment comprises of the business lines property, casualty including motor, and specialty. The Life and Health segment includes property and casualty; and life and health sub-segments. The Corporate Solutions segment offers innovative insurance capacity to mid-sized and large multinational corporations across the globe. The Life Capital segment encompasses the closed and open life and health insurance books, as well as the ReAssure business and the primary life and health insurance business comprising elipsLife and iptiQ. The Group Items segment represents the administrative expenses of the corporate center functions that are not recharged to the operating segments. The company was founded on December 19, 1863 and is headquartered in Zurich, Switzerland.

Related stocks

Swiss Re (SREN.vx) bullish scenario:The technical figure Channel Down can be found in the daily chart in the US company Swiss Re (SREN.vx). Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is one of the world's largest reinsurers, as measured by net premiums written.

Swiss Re AG bullish scenario:We have technical figure Triangle in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Re AG is a reinsurance company based in Zurich, Switzerland. It is the world's largest reinsurer, as measured by net premiums written. The Triangle has broken through the resistance line

SREN.vx bullish scenario:SREN.vx bullish scenario:

We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Found

SREN.vx bullish scenario:We have technical figure Channel Down in Swiss company Swiss Reinsurance Company Ltd (SREN.vx) at daily chart. Swiss Reinsurance Company Ltd, commonly known as Swiss Re, is a reinsurance company based in Zurich, Switzerland. It is the world's second-largest reinsurer. Founded in 1863, Swiss Re opera

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

DEMQ5253921

Argentum Netherlands BV for Swiss Re AG 6.05% 17-FEB-2056Yield to maturity

6.49%

Maturity date

Feb 17, 2056

SSRE3938889

Swiss Re Treasury (US) Corp. 4.25% 06-DEC-2042Yield to maturity

5.42%

Maturity date

Dec 6, 2042

SSRE3680636

GE Global Insurance Holding Corp. 7.75% 15-JUN-2030Yield to maturity

4.84%

Maturity date

Jun 15, 2030

SSRE3680633

GE Global Insurance Holding Corp. 7.0% 15-FEB-2026Yield to maturity

2.80%

Maturity date

Feb 15, 2026

RUK15

Schweizerische Ruckversicherungs-Gesellschaft AG 0.75% 21-JAN-2027Yield to maturity

0.49%

Maturity date

Jan 21, 2027

XS3038052067

Swiss Re Subordinated Finance Plc 6.191% 01-APR-2046Yield to maturity

—

Maturity date

Apr 1, 2046

SSRE5782823

Swiss Re Subordinated Finance Plc 5.698% 05-APR-2035Yield to maturity

—

Maturity date

Apr 5, 2035

XS196311696

Swiss Re Finance (Luxembourg) SA 2.534% 30-APR-2050Yield to maturity

—

Maturity date

Apr 30, 2050

US87089NAA81

Swiss Re Finance (Luxembourg) SA 5.0% 02-APR-2049Yield to maturity

—

Maturity date

Apr 2, 2049

XS1973748707

Swiss Re Finance (Luxembourg) SA 5.0% 02-APR-2049Yield to maturity

—

Maturity date

Apr 2, 2049

XS302520780

Swiss Re Subordinated Finance Plc 3.89% 26-MAR-2033Yield to maturity

—

Maturity date

Mar 26, 2033

See all SSREY bonds