Trade ideas

SugarUS LongSugar weekly candle just closed above the 20 ma and the 21 ema. Looking left when that occurred in the past we had at least one additional full body weekly candle close above those moving averages before trend reversal OR start of a further uptrend , especially in those cases that 21 ema crossed over the 20 ma to the upside.

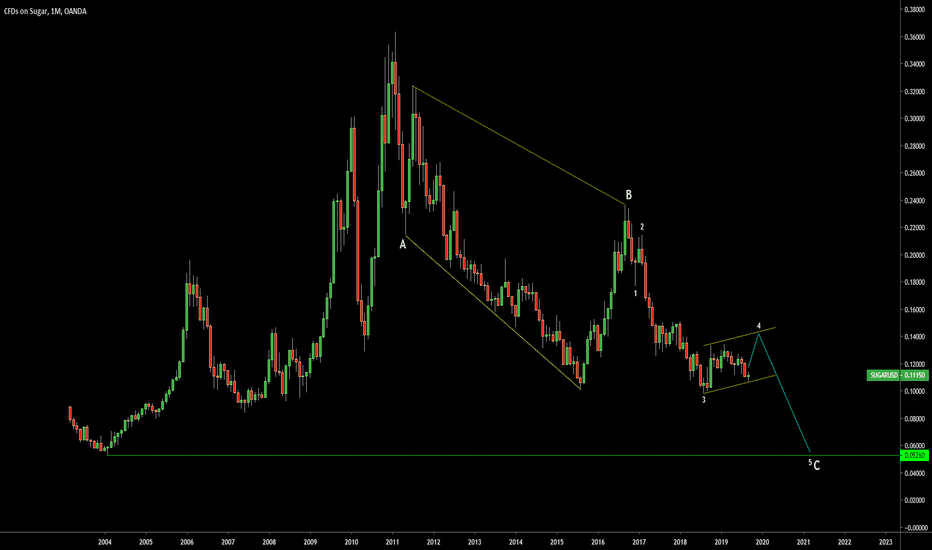

Linking this idea with my previous long position on Sugar.

Sugar US Long Waiting for the price to break to the upside after consolidating inside the descending wedge

Negative momentum on the MACD decreases as price moves to lower lows -bullish divergence.

First target for profits the 0.12128 high to 0.11322 low 0.5 fib level

Second target the 0.12599 to 0.11322 low 0.5 fib level which happens to coincide with the 0.618 of the fibonacci mention above

Sugar LongEnd of large degree correction, initial impulse seems to be an expanding triangle resting on support level. Imminent break of trend line resistance? Fibonacci extension of wave 1 to projected wave 2 and historical support and resistance suggest a target at the 0.19 mark to be expected after move higher into wave v then lower into higher degree wave 2.