sushi/usdtsushi has been trading on a descending triangle for some times now and there is a higher probability that it is eventually coming into an end, that is in the near future, which might be so soon, we might see a big improvement in price if everything goes as planned. These support levels shows that th

SUSHIUSDT Breakout or Bull Trap?Yello, Paradisers – could this finally be the moment SUSHIUSDT flips the script, or are we about to walk into another trap? With Bitcoin potentially preparing for a short-term pullback, traders need to be extra cautious right now. That said, SUSHIUSDT is showing promising signals that are worth your

SUSHI/USDT – Symmetrical Triangle Compression Near Key Flip Zone🔎 Market Overview

SUSHI is currently trading around $0.799, consolidating within a symmetrical triangle pattern that has been forming since mid-July. This setup reflects a period of decreasing volatility and volume, where the market is accumulating energy for the next major move.

The $0.72–0.83 zo

SushiSushi usdt daily analysis

Time frame 4hours

Risk rewards ratio >2.3

First target 0.985$

Sushi, as you can see in the chart, is trapped inside a yellow triangle.

If the price breaks out above the upper side of the triangle, our initial target will become achievable.

If we experience small fluctuat

Resistance is broken!!!Hello friends

it is clear that we have a downtrend and in this downtrend we have an important resistance that we have identified for you and given the strength of the sellers, the price has not yet managed to break this resistance.

We also found important support points with Fibonacci (which has

Sushi Holds Key Fibonacci Support as Bulls Target $0.93Sushi (SUSHI) has bounced from the $0.73 daily support, where the point of control (POC) and 0.618 Fibonacci retracement converge. This bullish reaction increases the probability of a continuation toward $0.93.

Sushi’s recent price action highlights a strong defense of a key technical zone. The $0.

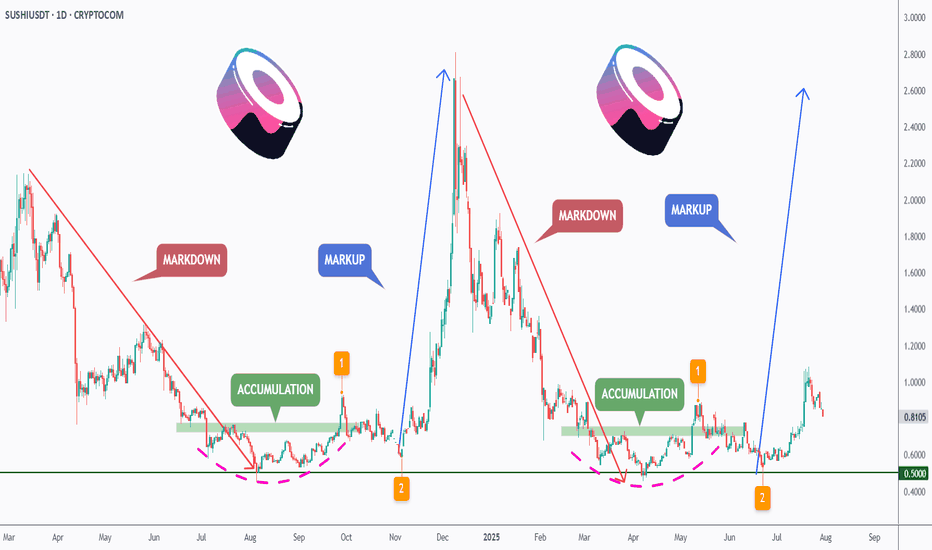

[Deep Dive] SUSHI – Edition 3: Accumulate. Anticipate. Accelerat🧠 Cycle Anatomy: What the Chart Is Telling Us

📉 Phase 1: Markdown

The bears dominated, slicing price downward into key historical support around the $0.50 mark — the same level that anchored the previous accumulation zone.

📦 Phase 2: Accumulation

Both accumulation phases (mid-2023 and Q2 2025

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.