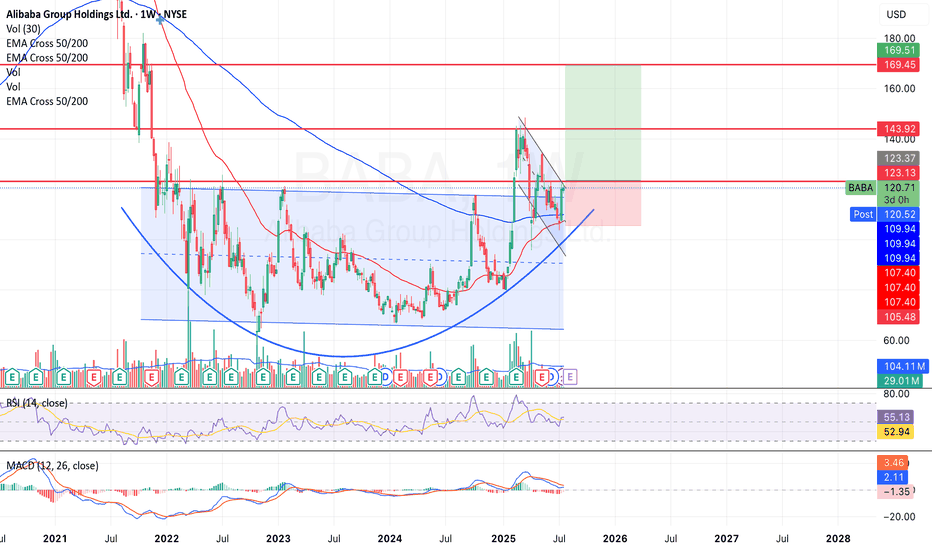

Ali BABA Potential Huge Up Targets ALi BABA have Potential Huge Up Targets with potential 3 years accumulation range from March 2022 to today 15 August 2025.

P&F Chart targets calculations

ATR 20 1 Box Size 3.5 calculated on 15-08-2025

Position Opened on 13-08-2025

News on 15-08-2025:

Saudi Investment Sold all 1.6 Million American Depository shares in BABA in Q2 2025 Ending its investment in the Company!!!!!!!

Lets see what this chart will unfold in the future

2RR trade ideas

Alibaba’s Next Stop: $200Alibaba (BABA) is showing clear signs of strength as it trades around $126, confirming entry into a new bullish channel.

The stock rejected further downside at $95, a level that aligns with major resistance-turned-support zones from 2016, 2023, and 2024. This successful defense signals that market sentiment has shifted, laying the groundwork for a sustained move higher.

If momentum holds, BABA could rally aggressively into the $190–$200 range by November–December 2025, where a significant resistance zone from 2018 awaits.

Alibaba | BABA | Long at $108.84Like Amazon, I suspect AI and robotics will enhance Alibaba's NYSE:BABA e-commerce, logistics, and cloud computing operations. There is some risk here, like other Chinese stocks, that they could be delisted from the US market if trade/war tensions rise. But I just don't think that is likely (no matter the threats) due to the importance of worldwide trade and investment. I could be way wrong, though...

NYSE:BABA has a current P/E of 14.2x and a forward P/E of 2x, which indicates strong earnings growth ahead. The company is very healthy, with a debt-to-equity of 0.2x, Altmans Z Score of 3.3, and a Quick Ratio of 1.5. If this were a US stock, investors would have piled in long ago at the current price.

From a technical analysis perspective, the historical simple moving average (SMA) band has started to reverse trend (now upward), indicating a high potential for continued (overall) price movement up. It is possible, however, that the price may reenter the SMA band in the near-term - the $80s aren't out of the question - as tariff threats arise. But that area is another personal entry zone if fundamentals hold.

Thus, while it could be a bumpy ride and the risk is there for delisting, NYSE:BABA is in a personal buy zone at $108.84 (with known risk of drop to the $80s in the near-term).

Targets into 2028:

$125.00 (+14.8%)

$160.00 (+47.0%)

$BABA’s next big run starts very soonHuge rounded bottom breakout, retest and bounce has occurred. We are now flagging before the next run begins

Tightness and expansion on the 2M bolinger bands.

Weekly Bolinger bands are becoming very tight again. Explosive move to the upside this year (if not this Q)

BABA Perfect long positionNYSE:BABA is at a strong level ahead of its next upcoming earnings, I am looking for it to continue within its already formed parallel channel on the weekly chart. The daily shows a strong rejection of its 50ema, consequently breaking a previous swing high. the break indicates possibility of bullish momentum through the level. The current consolidation phase into the long term trend and the consolidation occurring on the long term volume profile POC, all act as positive confluence to the general idea of a mid-long term buy position on BABA. CN50 is also showing great strength on the monthly chart, which is a great confluence with BABA's overall performance.

Constriction of Bollinger daily bands is an added confluence, indicating the potential for increased volatility and a large move to come out of this consolidation phase in the near term.

I have entered a large long position, with stops shown at levels shown on chart to allow the trade to breath in the midst of unexpected volatility around earnings etc. Stops and tp may be adjusted as conditions change.

Goodluck trading ;)

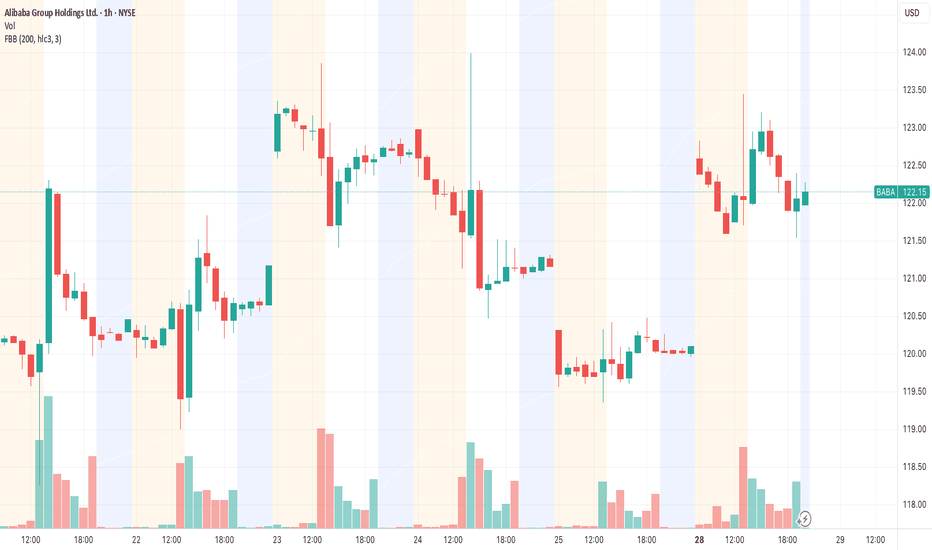

Bet on Alibaba’s Resilience: Long Position for Next WeekCurrent Price: $120.36

Direction: LONG

Targets:

- T1 = $123.50

- T2 = $126.00

Stop Levels:

- S1 = $118.50

- S2 = $116.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Alibaba.

**Key Insights:**

Alibaba remains a central figure in China's tech sector and investor sentiment as it prepares for its upcoming earnings report. Key drivers include its cloud computing segment, international expansion, and strategic initiatives within its e-commerce division. Regulatory clarity in China has encouraged a more favorable outlook, giving the stock a boost of confidence over the short-term.

The macroeconomic landscape in China remains a key determinant of Alibaba’s valuation, as consumer spending ebbs and flows post-pandemic. Furthermore, restructuring updates within its business units could signal improved operational efficiency, an exciting development anticipated ahead of the earnings report.

**Recent Performance:**

Alibaba’s stock closed at $120.36 during the latest trading session, showing stability amid broader market fluctuations in the Chinese tech space. The stock has held up well despite sector volatility, a sign that investor confidence is improving. Key price levels in recent weeks suggest consolidation, but with the potential for an upside breakout looming as earnings approach.

**Expert Analysis:**

Market analysts express optimism for Alibaba due to its diversified growth opportunities. Its ongoing emphasis on cloud computing and international markets is particularly viewed as instrumental in driving long-term profitability. In light of these growth channels, and a strategic focus on innovation, Alibaba remains a high-conviction trade. Analysts do highlight short-term earnings volatility, but with positive expectations overall.

The forthcoming earnings announcements are expected to provide clearer visibility on restructuring plans and revenue mix allocation, both of which could trigger renewed investor interest in the stock.

**News Impact:**

Recent regulatory updates in China signal a more stable policy environment, reducing existential risks for large-cap tech companies like Alibaba. Additionally, heightened consumer activity post-pandemic and possible improvements in China’s macroeconomic indicators form a supportive backdrop. Any insights into Alibaba’s operational roadmap, whether in the form of expansion strategies or business restructuring announcements, are likely to provide a positive trigger for the stock.

**Trading Recommendation:**

Based on Alibaba’s recent stability, strategic growth initiatives, and potential earnings-driven momentum, a LONG position is recommended. Investors should target the $123.50 level initially, with a more ambitious upside of $126.00. Stops are defined conservatively at $118.50 and $116.00, ensuring downside risk is managed appropriately while leaving room for the trade to play out profitably.

BABA Long UpdateAlibaba Setup & Bullish Thesis

BABA remains held up in a low-volume node, which has historically acted as a headwind to price momentum. However, accumulation volume patterns are forming, and the weekly chart structure is in harmony with a move higher. Really likeing the breakout on the micro and holding it with an inside week candle, Clean break through 124 area with volume sends it, the first target is $150, with potential for $180+ if price can traverse the low-volume area above. Notably, this level aligns with major Fibonacci confluences, strengthening the technical case. Lets let earnings send it.

Fundamental Tailwinds

1. Strong AI Push

Launched Amap 2025, the world’s largest AI-native map platform

Entered the AI wearables space with smart glasses to compete with Meta, signaling ambition in next-gen consumer AI

2. Analyst & Investor Support

Analysts at Benchmark and Bank of America continue to maintain Buy ratings

Featured by Motley Fool and Zacks as a top stock to accumulate on pullbacks

3. Macro Tailwinds

U.S. easing chip restrictions benefits Alibaba Cloud and AI expansion

China tech rebound and the broader AI growth narrative are key catalysts supporting further upside

BABA WEDGEalthough baba has a gap to fill above and below, it's showing strength, wedging, volumes coming back in, and million in call flow were placed yesterday. It's been chopping tightly for a bit now on the daily chart on low volume, but as the volume is starting to come back in, earnings coming up, and other bullish sentiment, I'm leaning towards a BABA breakout soon towards the 130s. Nfa

BABA 1M: Chinese favorite rising againTechnical setup:

Breakout from long-term triangle

Retest of trendline confirmed

Price holds above Fibo 0.236 (116.94)

First resistance: 151.85

Fibo targets:

→ 0.5: 187.82

→ 0.618: 219.50

Trade plan:

→ Hold after successful retest

→ Add on dips to 116–118

Targets: 151.85 / 187.82 / 219.50

Fundamentals:

Alibaba is restructuring around cloud and AI. Regulatory pressure from China is easing, and earnings are stabilizing. Buybacks and renewed institutional interest provide strong mid-term support.

Conclusion:

Alibaba may fall seven times, but rise eight — especially when Fibo and price action agree.

Baba - Waking GiantIt was trading at 300 levels during the 2020. Compare the EPS and sales with 2020 and 2025, there is a growth but the stock price has been trending down.

But from 2024, it has started the reversal and its trying to break the trend line.

Its 4th largest cloud provider world wide and its AI model Qwen gained traction with lots of downloads recently.

Target 1: 155$

Target 2: 210$

Stop loss: $90

BABA - Livermore's Speculative Chart Method Analysis

📊 Analysis Summary:

BABA (Alibaba) weekly chart shows completion of a 2+ year markdown phase and is currently forming what Jesse Livermore described as an "Accumulation Cylinder." The stock is now approaching a critical "Pivotal Point" that could signal transition into a major markup phase.

🔍 Analysis Phases:

**Markdown & Accumulation Stage:**

- Clear downtrend established from late 2020 highs

- Late 2022: Capitulation bottom formed with volume spike (white circle), initiating the "Accumulation Cylinder" phase

- During this period, stock quietly transferred from weak hands to strong hands, building a solid foundation

**Pivotal Point - Current Situation:**

- Price has broken above the major downtrend line

- Currently showing bull flag/pennant consolidation pattern (white declining trendline)

- Decisive breakout above this consolidation resistance represents Livermore's "The All-Important Action" - the key confirmation signal for new uptrend initiation

**Markup Phase & Targets:**

- Successful pivot point breakout should trigger the primary "Markup" phase

- Fibonacci-based targets (Levels 1-9) map the potential upside trajectory

- Ultimate target: **~$272 level (Level 8)** based on this analysis

- Following Livermore's strategy: Hold positions while trend persists, reassess on meaningful corrections

⚠️ **Risk Management:**

Monitor for failure to maintain stepped progression pattern that Livermore emphasized as critical for sustained major moves.

**Disclaimer:** This analysis is based on Jesse Livermore's theoretical framework for educational purposes and is not investment advice. All investment decisions are your own responsibility.

#Livermore #BABA #SpeculativeChart #TechnicalAnalysis #ClassicTA

Alibaba - A remarkable reversal!🛒Alibaba ( NYSE:BABA ) reversed exactly here:

🔎Analysis summary:

Recently Alibaba has perfectly been respecting market structure. With the current bullish break and retest playing out, there is a very high chance that Alibaba will rally at least another +20%. But all of this chart behaviour just looks like we will witness a major bottom formation soon.

📝Levels to watch:

$110, $135

🙏🏻#LONGTERMVISION

Philip - Swing Trader

BABA looks ready to drop.It’s been hitting the $125 wall since May and just can’t break it. This last bounce? Weak volume. No real buyers stepping in. RSI is already stretched and there’s no accumulation from big players.

If it loses $120 with conviction, we might see $110 or lower.

And let’s be real — China’s still struggling and the narrative isn’t exciting anyone anymore.

I’m eyeing a PUT. If it breaks $125 clean, I’ll flip my view. Until then… watch out.

BABA | Long | Strong AI & Seasonality Tailwinds (July 2025)BABA | Long | Strong AI & Seasonality Tailwinds (Aug 2025)

1️⃣ Quick Insight: Alibaba is showing strong AI-driven momentum, healthy fundamentals, and positive seasonality patterns. August–December tends to be bullish, and the stock is already holding up well despite recent dips.

2️⃣ Trade Parameters:

Bias: Long

Entry: Current price zone (~$123)

Stop Loss: $87

Take Profits:

TP1: $131

TP2: $143

TP3: $177

TP4: $206

TP5: $217

TP6: $257

Extended Target: $300 (if momentum holds through the parallel channel)

3️⃣ Key Notes:

Alibaba’s fundamentals remain solid with revenue up on a yearly basis since 2021, even though some quarters have shown pressure. EPS is expected to grow annually, and institutional interest is strong (43% holding increase by Maridea Wealth Management). The AI pivot with Qwen LLM models and Quark AI glasses launch could be major catalysts. Seasonality supports upside through mid-December before potential reversals.

4️⃣ What to Watch:

AI & cloud revenue performance (Qwen adoption)

Cainiao and other potential spinoff IPOs

Regulatory updates and U.S.-China tensions

Seasonal strength: historically bullish until late November–early December

📊 Outlook: Analysts forecast $150–$160 in the next 12 months (~20–30% upside). Bull case targets range $200–$250 over 3–5 years, with potential extension if AI & international commerce expansions deliver.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always do your own research.

Much needed break for $BABA on the horizonI took a much needed break but not as long as NYSE:BABA has taken since 2021; swinging between ~$70 and ~$120 over the past six years.

I strongly suspect that this might have something to do with Jack Ma's speech in late 2024 that made him go 'missing' from public view

- www.wired.com .

The stock has formed a multi-year rounded bottom (cup) followed by a handle formation, a classic bullish reversal pattern. Price is currently consolidating just below the ~$123 resistance with a potential target of $143 - $170 if this breaks resistance.

I will hedge my bets on a bullish run and find support around $107 - $109 if the breakout is rejected.

NYSE:BABA is currently trading above the 50 and 200-week EMA and I see a potential golden cross forming in the coming days.

U.S - China relations still proves challenging but with earnings on the horizon I am optimistic that it will be the catalyst for this breakout.

Long $BABA - NYSE:BABA is testing 200 SMA

- NYSE:BABA moves are explodes higher then cools then retest support then explodes higher than the last high. It's called trading with higher wavelength

-> Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $90 -> $72 ( -20% )

-> Move 2: July 2024, $72 -> $116 (+61%) then retraced $116 -> $80 ( -31% )

-> Move 3: Jan 2025, $80 -> $146 (+ 82.5%) then retraced $146 -> $108?? ( correction underway ) ~ -26% so far

-> Move 4: Likely from $100-105 to $180-200

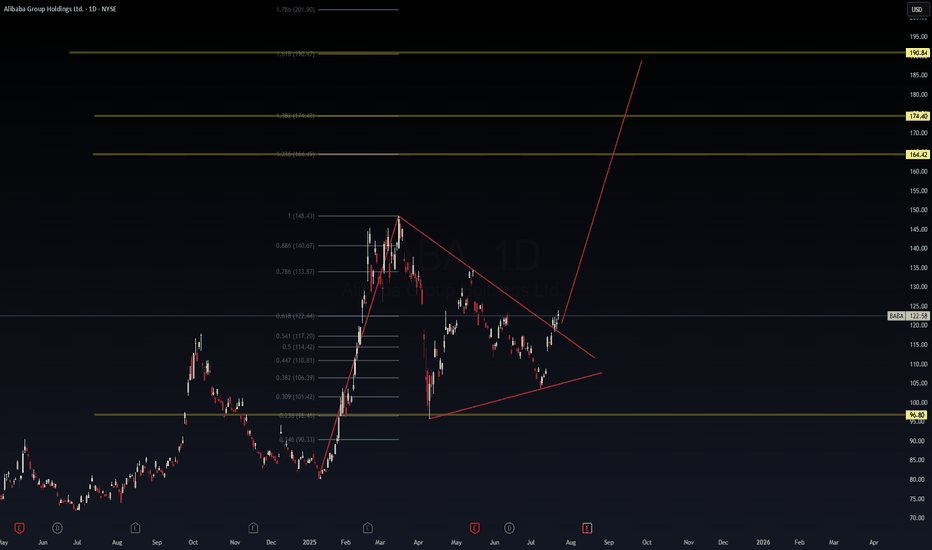

$BABA Breakout Imminent – Triangle Compression Ending, Fib .....📈 NYSE:BABA Breakout Imminent – Triangle Compression Ending, Fib Confluence Targets Set

After weeks of coiling inside a converging triangle, Alibaba ( NYSE:BABA ) just broke above the downtrend line with conviction. The structure and Fibonacci extensions point toward an explosive leg up—possibly targeting $164 → $174 → $190.

🔺 Setup Breakdown (Daily Chart)

Price: $122.58

Breakout confirmed above triangle resistance

Strong volume into the 0.618 Fib zone (from recent swing)

Measured move extension targets:

🟨 1.236 = $164.42

🟨 1.382 = $174.40

🟨 1.618 = $190.84

🧠 Macro Overlay (VolanX Protocol)

China stimulus whispers + tech rotation = alpha setup

Liquidity expansion in HK/US dual-listed names

Institutional buy zones aligning with breakout levels

🎯 WaverVanir Playbook

Entry: $121–123 (breakout retest range)

Stop: Below $117

Target 1: $164

Target 2: $174

Optional: Long Call Spread (e.g., $130/$160 for Sept)

This is a DSS-confirmed breakout model—not financial advice. Track it. Learn from it. Execute with clarity.

—

🔻 #VolanX #WaverVanir #BABA #BreakoutPlay #ChinaTech #FibonacciTrading #TradingView #SwingTrade #OptionsFlow #TrianglePattern #MacroCatalyst #QuantFinance #PredictiveTrading #InstitutionalSetups