Barrick Mining Corporation

No trades

Market insights

Barnes Group Inc

Upcoming Earnings today for Barnes Group Inc (est: 0.84) a miss could see Barnes re-test the top side of the rising channel. Anywhere inside the channel would be considered bearish for the short to medium term at least.

If expectations are met or beat, low 70s would be the first target to consider.

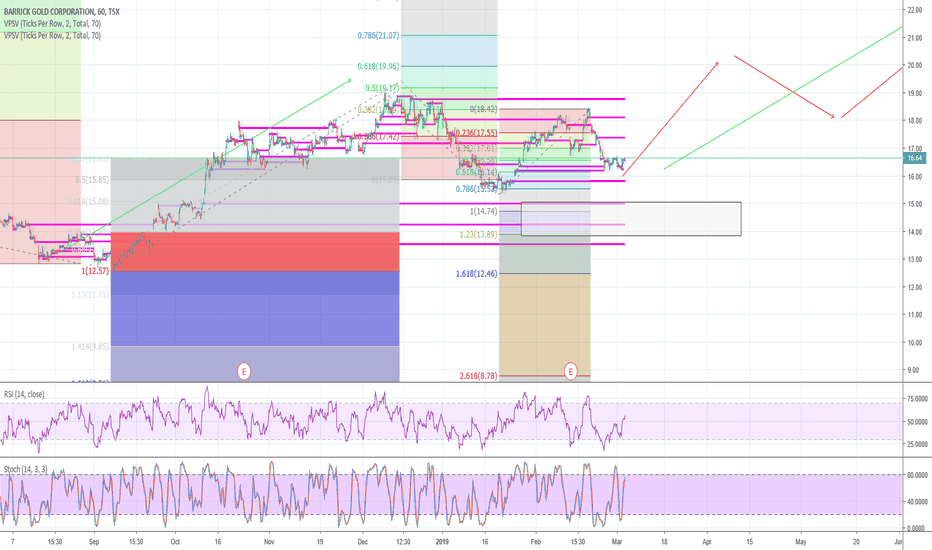

ABX : Buy Setup

There are 3 reasons why I chose ABX stock:

I am looking forward to a downward movement in USDCAD. (More explanation on Related Ideas.)

I also follow up the stocks related to the precious metal sector traded in the S&P 500 Index.

You can follow and let's communicate )

I think that precious metals are discounted according to the World indices.This is the most important reason. (More explanation on Related

Ideas.)

Technically, it is suitable for long position.

Parameters

Risk/Reward Ratio : 1/2.59

Stop-Loss : 21.79

Goal : 25.88

Is Gold Quietly Gearing up for a Run? Technicals Say Yes!One of the best ways to forecast Gold is looking at the senior stocks. Why? Senior stocks are the most highly short interest stocks in the precious metal sector and they never consistently rise until a Gold run is near.

I believe what we are seeing now is the "true" bull run for Gold in-the-making, and eventually Silver and Platinum will follow (Platinum will be the slowest of the 3). Gold bottomed at 1450, and in my opinion, is exactly where Gold should have been. The US-China trade war from much of 2019 is what pushed Gold exceptionally higher as a result of extreme uncertainty.

While the "deal" serves little purpose and will do nothing to revive economic numbers anywhere in the world, what it has done is essentially confirmed a bit of a "lets start over" type of mentality because Trump had the option of giving-in or escalating the trade war and allowing the market to plummet. Obviously, he chose the former.

In reality, Gold will quietly begin to run up - moreso in 2020. While most people will continue to short Gold as they think a USA/China trade deal will send it plummeting, the reality is, most logical investors know what we will see is a likely continuation of a blow-off top for the remaining of December, with a likely short in Q1 2020.

Contrary to popular belief, yields rising at this point no longer will push precious metals down. This was relevant during the height of the USA/China trade-war, however, yields will inevitably rise whenever the next recession occurs as investors lose faith in governmental treasuries.

Moreover, Powell stated rates will remain unchanged in 2020. As usual, the Federal Reserves job is to remain artificially optimistic and 'lie' to the public to mitigate any fear. In reality, Powell will likely cut 2 or 3 times in 2020 with, in my opinion, the first cut coming in March or April of 2020, a second late in the summer, and potentially a third later in 2020 depending on the probability of Trump winning or losing and how the market prices in uncertainty. Remember, central banks do not forecast recessions. They react to them.

The time to slowly add precious metals is now as by the time 2020 comes, you may have timed yourself out of the market.

Expect Barrick to continue to push higher off the 180 sinusoidal pivot set back in early November.

- zSplit

Barrick Gold: Gearing Up for Next Bull RunBarrick is one of those seniors that is notoriously heavy in short interest until a true bull run starts, and we may be around the corner from the second, and the second "real" bull run for Gold (for this year).

For now, it seems like the 1450 floor has held. For those who wish to "risk" waiting for a further drop in Gold, you may time yourself out of the market completely, only to _potentially_ save an additional 3-4% in stocks. In my opinion, the bottom for Goldspot is in the books.

RSI has created a solid and supportive base-line and the downtrend for many Gold stocks has either reversed already, or on the verge of reversal despite Goldspot being still far below 1500.

Barrick is extremely undervalued, and with their future acquisitions, recent dividend increase and excellent numbers, this stock should be trading in the $45-50.00 range at current Gold prices.

SL: $20.23

TP Q2 2020: $45-50

Strong Buy

- zSplit

Long $BBreakout of triangle consolidation to the upside gives us a good chance to test previous highs so long as the upper triangle edge holds as support. Buying while the market tests the support gives us a nice tight risk window. I'm going long at the next open, and it won't take long to discover if the breakout is real.

ABX daily bull flag setupKeeping an eye on ABX.TO tomorrow, we have a daily bullflag setup and currently consolidating on the 2hr chart in a Cup & Handle pattern. Bulls are looking to confirm the bull flag and want to do so one more than 1.4 million shares on the first hourly candle tomorrow - I want to see volume behind the breakout to confirm its real