CMGThe CMG stock sell from 56$ Stop loss closing above 69$ is rising within an upward channel. It broke through the upper boundary and triggered a trap, then fell back inside the upward channel. It then bounced off the channel's midline, which has supported the stock several times. Afterward, it returned to test the upper peak of the upward channel and indeed dropped sharply from it. We anticipate a decline to the lower boundary of the channel, and from there, we will monitor the prices. If the stock manages to hold the decline and we see some price action, it could signal an entry point. Otherwise, it might break the channel.

Trade ideas

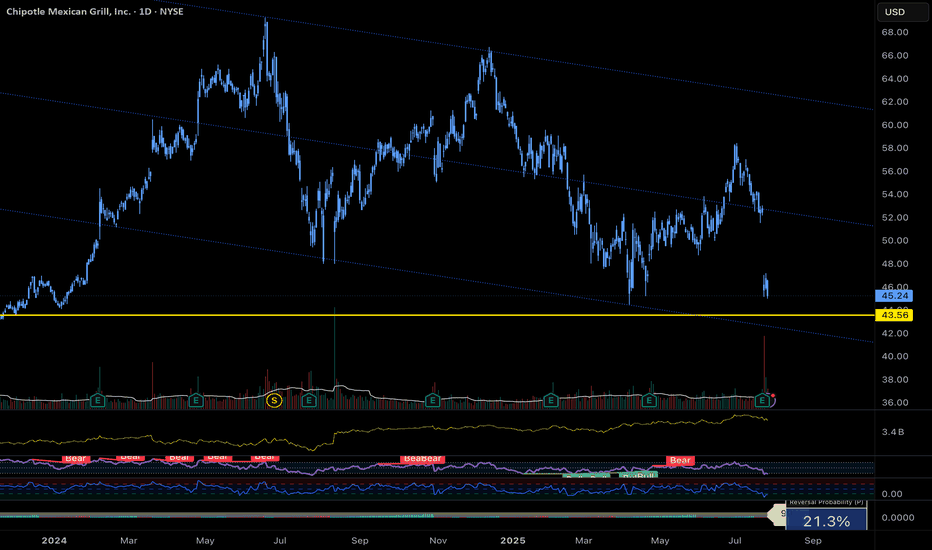

$CMG - Weekly RSI OversoldChipotle stock NYSE:CMG is now down over 55% since its all time high in 2024.

Weekly RSI is now in oversold territory and stock has retraced back between the golden 0.5 (50%) and 0.618 (61.8%) Fibonacci retracement levels.

Keeping our eyes on this one.

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor. I am an amateur investor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or stock picks, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies. I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on here, expressed or implied herein, are committed at your own risk, financial or otherwise.

Feel free to give us a follow and shoot us a like for more analysis updates.

$CMG is having correction by multiple compression.- NYSE:CMG is not undervalued, price has fallen lower from all time highs but the drop is justified.

- This company was trading at 65x forward earnings perhaps because of flawless execution by it's ex-CEO.

- But this company is experiencing declines in same store sales and revenue growth is moderating.

- Currently, as of Sept 14, 2025, It's trading at 27x forward earnings which is not too high but not too low either.

- I have marked three zones, first red zone is for people looking for a counter trend/bounce ideally for swing traders. Yellow/Cyan for investors who might want to DCA and lastly green zone which is good for long term investors.

Year | 2025 | 2026 | 2027 | 2028

EPS | 1.21 | 1.42 | 1.67 | 2.07

EPS% | 8.38% | 17.02% | 17.63% | 23.82%

EPS is growing mid teens. A fair forward p/e would be 15 but I am willing to pay around 20 x forward p/e for the brand value with a hope they will turn around the business

Year | 2025 | 2026 | 2027 | 2028

EPS | 1.21 | 1.42 | 1.67 | 2.07

Fair value | $24 | $28.4 | $33 | $41.4

As we know, we are only a quarter away from 2026, therefore, If I had to consider NYSE:CMG it would be around somewhere between $28-$33 otherwise I will stay away from this company.

Chipotle Mexican Grill | CMG | Long at $30.56Chipotle NYSE:CMG stock has dropped dramatically since 2024, but the company has been *highly* overvalued for many, many years (69x p/e in June last year). As of Friday, November 7, 2025, the stock price entered my "crash" simple moving average zone (green lines). I do not suspect this is truly bottom, though. The company's growth is likely to slow into 2026 as people continue to spend less, and the stock finally starts to enter a reasonable p/e value (currently 27x). I anticipate further entry possibilities near $25 in the short-term if the economy continues to show more and more weakness. Entry into the "major crash" simple moving average zone, or gray lines, near $20-$24 isn't out of the question either. Thus, a personal entry at $30.56 is simply a starter position.

Growth

Earnings per share anticipated to rise from $1.60 in 2025 to $1.82 by 2028.

Revenue expected to rise during that time from $11.9 billion to $16.6 billion.

www.tradingview.com

Health

Extremely healthy, financially

Altman's Z Score / Bankruptcy risk: 7.5 (very low risk)

Quick Ratio: 1.5 (low debt)

Action

While there is risk of continued near-term pain for NYSE:CMG , the longer outlook is reassuring if true. Thus, at $30.56, Chiptole is in a personal buy zone (starter position) with risk of a continued drop to $25 or, "major crash" territory in the low $20s. These will be other personal entry points.

Targets into 2028

$35.00 (+14.5%)

$39.00 (+27.6%)

Chipotle, UnconvincedUnconvinced. That is how I feel about CMG. From the public’s perspective, Chipotle is a dying company. Prices up while quantity and quality are down is the main objection from the public. All reviews point to your local chipotle as the nastiest places you can go with overpriced food and rude workers. I do not buy it. I may be naive, but can anybody name a business that hasn’t shrunk quantity or quality to meet margins over the past few years. We are in a bull market; how do you think stocks go up? Margins and profits go up. In 2016 I could eat at McDonalds for $7 now it’s closer to $15. Meanwhile chipotle used to cost $8 now it is $10 and there is outrage. I believe that consumers are spoiled or ignorant (as am I, I must confess.) This is a publicly traded company, if your expenses have doubled since 2019, what do you think happened to theirs? Are the leaders going to just lose their job to shareholder outrage just because they won’t increase prices by 20% over 5 years? I think not. And as for the rude and nasty chipotles, yes, I agree, but I do think that is more of a generational and geographical problem than we give it credit for (I am 25 so I understand.) A Boca Raton chipotle will be a better experience than a Mississippi location (I’m from Mississippi, relax.) I do not go into many fast-food style restaurants and feel engulfed with pride in my fellow gen z ers (is that the right generation? Idc.) Moral of the story every time I go into chipotle: it’s packed, not that clean, I still get a bowl for $10, and it’s mildly healthy.

Now as for what Ceo Scott boatwright has said during his interviews after Q3 earnings and guidance. He blames the slowdown in guidance to his team's conservative outlook and the economy for the next 2 quarters. Meanwhile, Rev up 7.5% yoy, which is moderate. Including that last time we entered this price range in Q1 and Q2 of 2022 area, net income has almost doubled. This seems like the same tariff scare we saw 7 months ago, sell the news, and then find out it might not be that bad. I believe Americans will still spend their last dollars on things they don’t need. Am I saying that Americans aren’t struggling no, But I do not think chipotle is first cut to a financial freedom. All you can do is think for yourself and the people around you. When my family and I want a meal and don’t want to drop $100 at Texas roadhouse, Chipotle is the budget friendly option that doesn’t make you feel sick like conventional fast food.

I know this company has its problems, but when a household name like Chipotle drops 50%+ you must wonder why. For about .5-1% of my portfolio, I am willing to bet that the “why” is over exaggerated. As seen on the charts. This is the first time that the PE and RSI have met at this level since the GFC. It does seem like a falling knife, and I would be stunned if we didn’t go lower, but $25-$31 seems like a good starting point for me. If you are looking for a quick flip this is not the move for you, but I believe in 10 years I’ll be happy and finally able for afford extra guac! Good luck out there and remember THIS IS NOT FINANCIAL ADVICE.

Q3 notes (what I found interesting)

CEO Scott Boatwright

Says the overall economy is hitting business the hardest right now

Notes that spending has slowed, especially among their main customers — 25–34-year-olds making under $100K

Expects things to turn around by Q2 2026

Loyalty program remains a strong point for the company

10-Q Highlights (Q3 2025)

Revenue up 7.5% year-over-year in the third quarter

Opened 84 new stores — around 300 more total than this time last year

Operating cash flow: $1.7B for the first nine months of 2025 vs. $1.6B last year — mostly due to tax timing and the H.R.1 – One Big Beautiful Bill Act

Investing cash flow: Used $7.3M vs. $701.5M last year — big change from a drop in investment purchases, partly offset by higher spending on new restaurants

Financing cash flow: Used $1.7B vs. $735M last year — mainly from more stock buybacks

Interest rate note: Company has about $1.8B in cash and investments — most of it interest-bearing, so rate changes affect their income and results

Chimichurri Salsa will bring $CMG to $50NYSE:CMG Is at a great discount after rising 657% since 2020 to It's peak in June 2024. Since June, the Stock has fallen about 40% after mediocre results. Now, its around the $40-42 range, which in my opinion, is at a perfect discount. While earnings have been constant with the estimate, their revenue since 2020 has doubled, and they're at a 4B surplus with total assets vs total liabilities this year.

One of the reasons why I am buying this stock is because im a chipotle food addict, I love their food, especially their burritos and bowls, so its no wonder I am buying this stock. You can laugh at me, call me stupid for this, but I am trusting Chipotle. Trust the process.

Don’t Sleep on $CMG - Is This the Start of Fresh Rally?Could be!I've been a fan of Chipotle and I think I am beginning to like the set up of its chart now.

After that long downtrend (gap down) from the $52s, NYSE:CMG finally looks like it’s trying to carve out a bottom base. You’ve got a clean breakout from the descending trend line and a solid close above short-term resistance near $41. Volume picked up — that’s confirmation you want to see when something’s flipping sentiment.

The stochastics are curling up from oversold, signaling a momentum shift. The 50-day MA looks ready to flatten and possibly turn up. If this move holds above $40s (a psychological and technical level), this could trigger a bullish reversal wave toward that $46–47 range next, where the 200-day MA sits as the next wall. It would be nice if that gap would be filled at no time, similar to what happened to our recent trade to ( NYSE:LAC ).

Bigger picture: $39–$40 zone is the make-or-break level for bulls. Lose that, and it’s back to the base-building zone around $37. But if momentum follows through, this might be the early stage of a trend reversal rather than just a bounce.

If in case this price action holds up above that line $41.76, I will start a small position even if I got an average cost at $42s. Then if this uptrend pattern follow thru - I'll add more. I'll put my stop at $36. It's kinda loose but this stock is not as volatile as the AI's so I will give this time to play out.

I'm a bit worried about the US Shutdown as people will definitely try to cut down their expenses, so there will be a factor to the final quarter store revenue of NYSE:CMG , but let's see...

So again, manage your trade carefully and God bless you all.

Happy weekend.

CMG Bullish Reversal Setup – Targeting $44.30The stock is currently forming a strong accumulation base around the $38.90 – $39.30 zone after an extended downtrend. Recent price action suggests a potential bullish reversal is underway, supported by increasing volume and structural signs of accumulation.

Parameter

Level

✅ Entry Zone

$38.90 – $39.30

🎯 Target 1 (TP1)

$44.30

🎯 Target 2 (TP2)

$45.30

❌ Stop Loss (SL)

Below $36.00

⚠️ Key Breakout Level

$40.40 – $41.00 (breaking above confirms bullish momentum)

Trade Scenario

• Phase 1: Price is expected to bounce from the current support zone ($38.90 – $39.30) and challenge the first resistance around $40.40 – $41.00.

• Phase 2: If momentum continues, the stock could rally into the major supply zone between $44.30 and $45.30, which is the primary take-profit zone.

• Phase 3 (Optional): A breakout above $45.30 could open the door to higher levels, but that is beyond the current trading plan.

⸻

⚠️ Risk Management Notes

• Stop-loss below $36.00 ensures risk control. Any hourly or daily close below this level invalidates the bullish scenario.

• A strong breakout above $41.00 is a key confirmation signal for the move toward the $44.30 – $45.30 target area.

• Expect minor resistance near $40.40, but clearing it will likely accelerate the rally.

⸻

📌 Summary

As long as price stays above $36.00, the bullish scenario remains valid. The expected upward move targets $44.30 – $45.30, making this trade setup suitable for short- to medium-term swing trading on the 1-hour timeframe.

CHIPOTLE BACK TO 50 !Why Chipotle (CMG) Could Climb to $50 by 2026: Tasty Bull Case Chipotle’s trading at ~$43 today (Sep 23, 2025), down slightly YTD, but with strong fundamentals and operational wins, $50 (16% upside) by EOY 2026 is achievable long-term. Here’s the recipe:Revenue & Same-Store Growth: Q2 '25 comps +11.1% and $3.8B revenue (15% YoY) signal robust demand. Analysts project 13% YoY growth to $12.5B in '26, driven by 300+ new stores and digital orders (30%+ of sales). This supports $1.75 EPS, pushing P/E to 28x for a $50 target.

Operational Efficiency: Chipotlanes (drive-thru) now in 60% of new locations, boosting margins to 28%+. Automation in prep (e.g., Autocado) cuts costs 5%, per management, fueling EPS growth to $2.10 by '26, aligning with $50 at 24x forward P/E.

Analyst Optimism: 27 firms avg $50.24 PT (high $62), with BMO Capital’s $56 Buy rating citing loyalty program strength (35M+ members). CoinPriceForecast sees $53 mid-'26, clearing $50 on 10% comps.

Consumer Resilience: Despite inflation, CMG’s premium positioning (health-focused, customizable menu) retains Gen Z/Millennial traffic, hedging macro risks. LongForecast eyes $54 by Q3 '26.

Chipotle (CMG): Brand Power Meets Technical PatienceWhat they do: Fast-casual burritos/bowls with a heavy digital and throughput focus.

Why it’s strong: Industry-leading unit economics, brand love, and a deep U.S. runway—now going global.

Developments:

Asia entry JV (SPC Group): first restaurants in South Korea & Singapore in 2026.

Some metrics:

Forward P/E: ~27.5x.

ROIC (TTM): ~19–22%

Debt/Equity: ~1.35 (lease-heavy model).

Piloting kitchen automation like “Autocado” (guac prep) and “Chippy” (chips).

Risks: Food inflation; labor availability; brand hit risk from food-safety headlines.

Moat in a line: Brand + operational throughput at scale.

Technical view

A bit sloppy, but the criteria are in place. It’s “sloppy” because the levels don’t line up compactly — if they were a few percent tighter, it would form a stronger support zone.

Still, the high-probability area is there, between $32 - $43

- Trendline drawn from monthly closing prices

- Channel projection

- Previous highs turning into support

- 50% drop from the ATH

Cheers,

Vaido

CMG: A Strategic Long Thesis and Tiered Accumulation PlanThe recent price action in Chipotle Mexican Grill (CMG) suggests the stock has entered a critical consolidation phase following a significant move. This period of price weakness, rather than signaling a reversal of the long-term trend, presents a calculated opportunity for a multi-tiered accumulation of a long position. The thesis is built on the premise that the stock is finding a strong base of support from which a new leg of the uptrend will launch, targeting a previous high.

This strategy employs a sophisticated dollar-cost-averaging approach to mitigate risk and optimize the average entry price. The trade is structured to enter at the first sign of a bottom, and then add to the position on subsequent dips, assuming the price tests lower support levels before a final rally.

Trade Idea:

Entry Point 1: Initial Position (First Green Arrow)

The first green arrow marks the initial entry into the long position. This entry is not a blind "catch the falling knife" attempt, but a strategic move at a key technical level.

Entry Points 2 & 3: Scaling In (Next Two Green Arrows)

The next two green arrows represent the subsequent opportunities to add to the position, a core element of a well-defined pyramiding strategy.

Exit Point: Taking Profit (Red Arrow)

The red line and red arrow mark the final, predetermined exit point for the entire long position. This level is defined by a major overhead resistance zone.

$CMG – Do-or-Die at $40 SupportCurrent Setup:

Price is trending inside a clear descending channel, with lower highs and lower lows since the $69 peak.

It’s now sitting right at a critical support band around $40–41, aligned with the lower channel boundary.

RSI is near 40, showing weakness but not oversold.

PMO (top grid) is negative and declining = bearish momentum.

Bullish Case:

If $40 holds, CMG could bounce within the channel, with resistance levels at $45–48 and then $52–55.

A decisive breakout above the descending channel (~$56–58) would be needed to flip the bigger picture bullish.

Bearish Case:

A breakdown below $40 would be a big technical negative, likely exposing $36 → $32 → $27 levels.

Given weak momentum and repeated failures at resistance, downside risk remains significant.

Risk/Reward View:

Reward: Bounce from $40 support could give a 15–20% upside if channel resistance is tested.

Risk: Breakdown below $40 risks a steep drop toward $32 or lower = poor reward/risk for early longs.

Takeaway :

CMG is at a do-or-die level around $40. Holding this zone offers a bounce opportunity, but momentum remains bearish. Breakdown would confirm further downside.

CMG....Patience will payoff🔎 Technical Picture

• Trend: Still in a downtrend. Price is trading below the 10, 20, 50, and 200 SMAs (42.77, 43.12, 45.29, 50.11). That’s textbook bearish until proven otherwise.

• Support: Current local low at $41.18. If that breaks, Bear Target 1 at $38.86 and Bear Target 2 at $34.24 are realistic.

• Resistance: Needs to reclaim $42.77–43.12 zone (cluster of 10 & 20 SMAs). Then $47.22 (Bull Target 1). True reversal signal would require reclaiming the 50-day SMA (45.29) and ideally the 200-day SMA (50.11).

• Momentum: Price Heat Meter is in the lower end, but no strong bullish divergence yet. Bearish continuation is still favored.

________________________________________

⚖️ Cost vs. Benefit

• Buying now: You’re catching a falling knife. Limited upside until price clears resistance. You risk a drop to the 30s if momentum accelerates.

• Waiting: Higher probability entry would be above $43–45 with confirmation. Yes, you’ll miss a few points, but you’ll avoid dead money or a steep drawdown.

• Short/Bearish play: More favorable risk/reward until bulls prove control.

________________________________________

🚩 Too Good to Be True Filter

• Some traders may argue “it’s oversold, time for a bounce.” But oversold does not equal reversal. Without a break of trend structure and volume confirmation, bounces are more likely dead cat rallies than sustainable reversals.

________________________________________

✅ Verdict

• Not a good buy yet.

• No confirmed reversal. You’d be gambling on a bottom.

• Best strategy:

o Aggressive trader: Short/bear bias until $41.18 breaks or $43+ reclaims.

o Swing investor: Wait for a daily close above $45 before considering long positions.

CMG - Bullish Engulfing off 200 SMA & Support Zone?(Weekly chart) NYSE: CMG price action went through a series of flush downs into multiple support levels, where market makers likely cleared out stop-losses. At that zone, price formed a bullish engulfing pattern, signaling a potential attempt to rebound and regain momentum.

Price action highlights:

1) Flush down into the previous high level (resistance turned support).

2) Confluence with the 200 SMA on the weekly chart – a strong long-term support line.

3) Extension through the lower Bollinger Band, signaling short-term oversold.

4) Stochastic oversold, hinting at potential reversal.

5) Last week formed a strong bullish engulfing candle at supports.

This setup offers a favorable risk-reward profile — limited downside with strong upside potential.

$CMG Long Swing Trade Pros

-Major pullback from highs: -40% from ATH.

-Technical confluence at support: Top of 2020–2024 range, weekly 200MA, and weekly volume POC.

-Gap magnet above: July 22 gap to $50.76 (+21% from here) with intermediate target $45–47 (+8–9%).

-Strong fundamentals: YOY revenue and gross profit growth consistently +20–30%.

-Brand moat: Loyal customer base, pricing power, consistent product quality.

-Innovation: Ongoing AI & robotics investment in meal prep. Supports margin expansion over time.

-Post-split price appeal: Lower nominal price post 50:1 split may draw in retail on recovery.

Risks

-Valuation still stretched: P/E of 38 even after a large correction. Leaves room for further multiple compression.

-Macro headwinds: If consumer spending slows, fast-casual dining could see softer traffic.

-Gap risk to the downside: A decisive break below $40 could trigger selling toward $35–37.

-High expectations baked in: Growth slowdown could cause outsized downside.

Entry Zone: Current levels ($43–44)

Targets:

-TP1 (Conservative): $46–47 → +8–9%

-TP2 (Aggressive): $50–51 → +18–21% (gap-fill / daily POC target)

Stop Loss:

-$41–40 → Below key support confluence (old range top, weekly 200MA).

-Close below $40 = setup invalidated.

Timeframe:

-Swing trade → Expectation of move playing out over several weeks to a few months.

Notes:

-Trim partial position at TP1 to lock gains, let rest ride toward TP2.

-If price fails to reclaim $44 within the next few sessions, reassess — could indicate sellers still in control.

-P/E still high. Not a value play.

CMG entering a stage 4 downtrendCMG may have entered a stage 4 downtrend.The price has reflected sharply off the 200 daily moving average and busted rapidly on enormous volume to the low of the previous volume base formed from the week of March 10th to the week of June 9th. The 200 daily moving average has turned over and is sloping downward, alongside the 50 daily moving average. CMG has demonstrated poor relative strength (SPX). The consumer services sector remains in generally good condition, and there are large market caps that are showing strength and performing well in it. There are also many large market caps in the sector that have transitioned out of their respective stage 2 advances, and have started stage 3 distributions and stage 4 declines. Although MCD, the largest market cap in the restaurant industry, continues to perform very well- most of the stocks in the industry have begun to roll over into stage 3 distribution ranges and stage 4 declines. A short entry in CMG was made at ~$55, and more will be added to this position between $47.50 to $50 if the price corrects back to this level.

$CMG Approaching Major Support – Buy the Dip or Breakdown?Chipotle ( NYSE:CMG ) just reported earnings and missed on both revenue and same-store sales. Transactions fell 4.9%, and the company lowered its full-year outlook — triggering a sharp decline on elevated volume.

Technically, we’re approaching a major confluence of support near the $43 area (both diagonal trendline support and historical horizontal level).

🔻 Indicators currently suggest continued selling pressure, so traders looking to buy the dip should remain cautious.

Trade Setup Idea:

- Watch for bullish reversal patterns (engulfing, double bottom, trend shift) on 15min–1hr charts

- Avoid premature entries; trend reversals often take time

- NYSE:CMG Confirmation > prediction

📌 Keep alerts set. This one’s worth watching closely.

#CMG #Chipotle #TradingView #TechnicalAnalysis #SupportAndResistance #DipBuy #StocksToWatch

CMG watch $55.76: Golden fib maybe good support for Next Leg UPCMG trying to recover from loss of CEO and tariff worries.

Uptrend showing signs of strength, retesting a key support.

$55.76 a possible long entry with $54.84 fib for stop loss.

.

Previous analysis that caught THE BOTTOM:

====================================================

.