Fastenal Company

No trades

What traders are saying

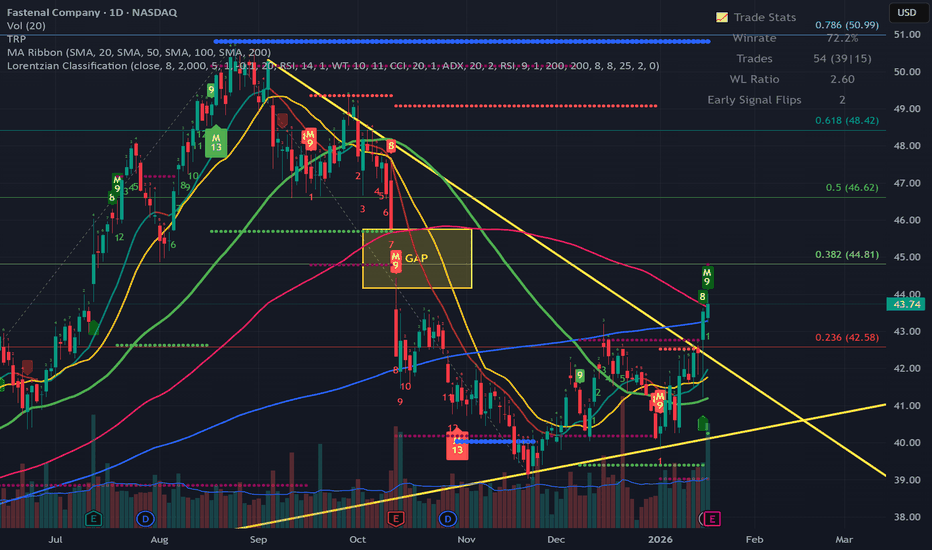

FAST — Breakout StructureHello Everyone, Followers,

FAST is the second one for today.

Let''s drill down:

📈 FAST is forming a clean breakout structure after a prolonged downtrend and base formation.

Price has broken above descending resistance and is now attempting to reclaim key moving averages.

🔹 Technical Overview

After months of consolidation and lower highs, FAST has broken its descending trendline and is building a higher low structure.

This suggests a transition from bearish to bullish market structure.

This is a classic base → breakout → continuation setup.

🔹 Key Levels

Support

42.5 – 43.0 → Breakout zone

40.0 – 40.5 → Rising trendline

38.0 – 39.0 → Demand zone

Resistance / Targets

45.0 – 46.5 → Fib resistance

48.5 – 50.0 → Prior range high

🔹 Outlook

FAST is attempting to reverse its downtrend.

Holding above the breakout zone keeps the bullish structure valid.

My first target is 45.50 - 46.00 and it will probably close the GAP that it created on October 25

🔹 My Plan

Watching for breakout retest near 42.5 – 43.0

Bullish bias above rising trendline

Invalidation if price loses 40.0

If you enjoy and like clean, simple analysis — follow me for more.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday to all and hopefully green trade day for next Week.

#SPX500 #NASDAQ #FAST

FAST long tradeHypothesis:

FAST has been trading in an upward channel trend since 2023. My confluence with the long term channel trend, with positive financial data is my edge.

Risks: Since FAST broke the upward trend, the entry zone may be very volatile in range and time in this zone. My stop loss is conservative because of this.

Trade technicals:

Entry: Entry zone will trigger me to set stock buys in two or three entries in this zone, lowering my average price.

Stoploss: at lower line shown in graph.

Separate from stock buys, I may enter an options trade depending on contract prices and entry point.

FAST / FASTENAL / Long scenario / Fractal & SeasonalityMy view from a seasonality standpoint:

Bullish time ahead until around mid of december. Maybe one little dip lower before the action starts.

my view basted on a fractal analysis:

uncertain about on emore breaking the low but then upside at least to the former high.

*this is not a trade vall nor is it financial advice. think and trade for yourself and on your own discretion and risk

FAST watch $48.61/86: Resistance to close longs and wait for DIPFFAST give us nice profits from a perfect entry (see below).

Currently testing a key resistance zone at $48.61-48.86

Look for a Dip-to-Fib or Break-n-Retest to re-enter long.

.

Previous Analysis that caught PREFECT LONGS

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

========================================================

.

VWAP Order Types: How Small Funds Use them.VWAP orders are used by Independent Small Funds Managers. IF a Small Fund or Small Asset company has 3 billion or less assets under management, the SEC classifies them as NOT a professional side entity.

This is because most independent Small Funds Managers have no Financial Degree, no professional certification aka CMT, CFA etc.

These managers often know less about the inner workings of the stock market than the average retail trader. It is wise to check to see the dollar value of a small fund and make sure it has more than 3 billion in assets as these managers have minimal experience, education, and usually no certification.

The small funds managers became enamored with the VWAP order as an order that could be placed several days to weeks ahead and then trigger when volume surges.

Unfortunately, that can often cause major sudden whipsaw action. especially intraday and pose much higher risk of sudden huge run downs when buyers evaporate.

The 2010 FLASH CRASH that stunned the financial world was an error on the part of a Fundamental trader who accidentally hit the VWAP order type rather than the TWAP order type for selling futures he had decided to sell. The VWAP order quickly caused a major stock futures sell off especially for the SP500 futures. Then the VWAP caused a systemic spreading of selling into the stock market and options market.

During highly stressed market conditions VWAPs triggering can drive prices down as panic among the less informed retail groups spreads rapidly. The goal is to enter a sell short with pro traders, rather than chasing a VWAP order that is spiraling out of control. When the VWAPs cease, then the market whipsaws or rebounds suddenly upward again.

This is just a snippet of what you need to learn about VWAPS but it is a good start for all of you. Trade Wisely

Long FAST @ 80.32 - because the odds are in my favorI don't care what your trading strategy is. In the end, if you're going to be successful at trading, it's about putting the odds in your favor. In my case, I like to put the odds WAYYYYYY in my favor.

NASDAQ:FAST is one of my top stocks. Out of over 1,000 trades going back to the month before Black Monday in 1987, it has only produced 3 "losing" trades, and they'd all have been opened in the last 7 days. That's well above

a 99% win rate.

The AVERAGE gain on those trades has been 2.21% (excluding the near zero impact of the 3 current losers) and each took on average, just over 2 weeks to complete. On a per day held basis, that's about 4.5x the average daily return of the S&P 500 and includes periods of trading covering Black Monday, the dot.com crash, the Asian currency crisis, the Financial Crisis/Great Recession of 2007-09, and various other extreme market drawdowns.

You can see that during the most recent 3 month drawdown in the stock, I'd have come out ahead, so I'm not particularly concerned that the last couple of weeks have been rough ones for $FAST. I would consider the potential closing of the "gap" from a few weeks ago as normal and healthy from a technical perspective and offering price support at the level prior to that gap, as well as from the blue uptrend line.

I never have an absolute guarantee that a trade will make money for me, but this stock is about as close as it gets to that. In fact, it was all I could do not to buy a 4x sized lot to cover the 3 trades I could have made that I didn't because I was maxed out on the number of positions in my portfolio or chose stocks with even better risk/return statistics than this one. If it goes down another day, I may just do that. I'll obviously note it here if I do.

Per my usual strategy, I'll add at the close on any day it is still a "buy" and I will use FPC (first profitable close) to exit any lot on the day it closes at any profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

Earnings Friday #FASTEarnings Friday

Position myself with a smaller size today before the close. A good scenario would be a strong report with a positive outlook on the earnings call.

If the criteria meet my standards, I will enter with a larger position size and trail the stop by 8%. On the second day,

I’ll consider adding to the position. I want the technical structure to be clear and everything to align seamlessly, making the decision straightforward and logical.

Future possible downturn!Hi Everyone,

I thought I would put this out there to see what people think. Charting the entire history of Fastenal Company (FAST) shows that the market and this company is not only at an all time high but to continue on the same path would mean going straight up! This cannot continue for long before there is a major movement down. If we mirror the past but as a downturn I see a "Head and Shoulders" pattern showing up in future charts (as drawn on the chart). I saw this showing up on a lot of charts of different companies. However, I was not sure how this downturn would happen. Now that the election is over, I can see how this downturn would show its self in the economic plans of the newly elected president. If he is able to carryout his economic agenda of tariffs and mass deportation it will be the catalyst for this historic event. People are going to think that the economy is being destroyed. Look for this event to materialize more and more as the president's economic plan is implemented and shows up in the charts!

FAST potential Buy setupReasons for bullish bias:

- Falling wedge pattern

- Price respecting long term trendline

- Price is at the weekly support zone

- Bullish divergence

Here are the recommended trading levels:

Entry Level(Buy Stop): 66.85

Stop Loss Level: 59.08

Take Profit Level 1: 74.62

Take Profit Level 2: Open

Taking aggressive entry at CMP, but safe entry will be above 66. Also, heads up Earnings date is 12 July (Friday)

FAST 1H Swing Long Aggressive Trend TradeAggressive Trend Trade

- short impulse

- expanding ICE

+ volume 2Sp

+ weak test

+ first bullish bar closed entry

Calculated affordable stop limit

1 to 2 R/R take profit

Daily context

"+ long impulse

+ SOS test level

+ right volume distribution"

Monthly context

"+ long impulse

+ SOS level

+ 1/2 correction?

+ right volume distribution"

Sell Stop 67.15 LMT 67.84, GTC

Sell Limit 69.19, GTC

FAST Fastenal Company Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FAST Fastenal Company prior to the earnings report this week,

I would consider purchasing the 62.12usd strike price Calls with

an expiration date of 2024-7-19,

for a premium of approximately $2.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.