FCX - We had a great month, can we continue with the uptrend?FCX

Looking for a potential buy!

🔍 Technical Context:

FCX had a tremendous up-beat with 24% increase in the stock just in march!

MACD Bullish Crossover: A clear bullish cross on the MACD confirmed upward momentum.

RSI Strength: The RSI remains in bullish territory, signaling further upside potential.

Favorable Risk-Reward Setup: The stock maintains support above breakout levels, offering an attractive trade opportunity.

📰 Fundamentals

Analyst Upgrades: J.P. Morgan and Scotiabank both issued upgrades and increased their price targets, reflecting confidence in FCX’s future performance.

Tariff Advantage: Potential U.S. tariffs on imported copper could benefit domestic producers like Freeport-McMoRan, increasing their advantage.

Strategic Policy Support: FCX is advocating for copper to be classified as a critical mineral, which could unlock tax credits and boost annual profits by up to $500 million.

📌 Trade Plan

📈 Entry: 41.90

✅ Target: 58.30

❌ SL: 23.90

💡 Looking for a potential 35% increase!

Freeport-McMoRan, Inc.

No trades

What traders are saying

Freeport-McmoranFreeport-McMoRan Inc. (NYSE: FCX) is a leading international mining company and one of the world's largest publicly traded producers of copper. Headquartered in Phoenix, Arizona, the company also produces significant quantities of gold and molybdenum.

Core Operations & Assets

Freeport-McMoRan operates a diverse portfolio of long-lived assets across three continents:

Indonesia: Operates the Grasberg minerals district in Papua, which contains the world's largest gold mine and second-largest copper mine. Operations are currently being restored following a major mudslide in September 2025.

North America: Operates seven open-pit copper mines, including Morenci in Arizona (the largest in the U.S.), Bagdad, Safford, Sierrita, and Miami in Arizona, plus Chino and Tyrone in New Mexico.

South America: Key assets include Cerro Verde in Peru and El Abra in Chile.

Molybdenum: Owns the Henderson and Climax mines in Colorado, making it the world’s largest molybdenum producer.

Recent Financial & Operational Performance (As of January 2026)

On January 22, 2026, Freeport-McMoRan reported its full-year 2025 and Q4 results:

2025 Financials: Reported annual revenue of $25.9 billion with a basic EPS of $1.53.

Q4 Highlights: Surpassed analyst estimates with $5.63 billion in revenue and adjusted earnings of $0.47 per share, bolstered by high copper prices (averaging $5.33/lb) despite a drop in production.

Grasberg Recovery: A phased restart of the Grasberg Block Cave mine is on track for Q2 2026, with 85% of district production expected to be restored by the second half of 2026.

2026 Outlook: The company expects to sell approximately 3.4 billion pounds of copper and 800,000 ounces of gold for the year.

From Google AI ^

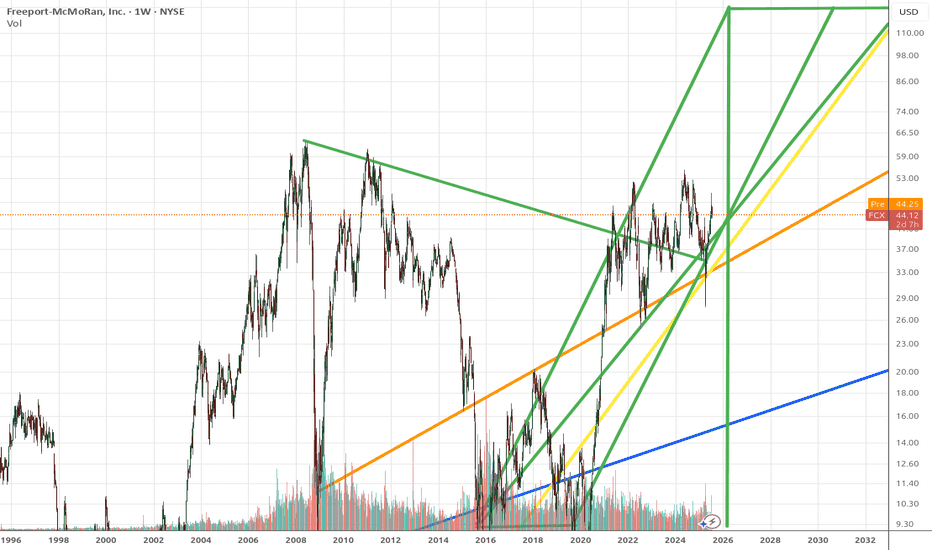

- Broke out of its tightening wedge

- Has run up since then

- May consolidate for sometime

- Buy 20-25% and add on dips

- Bullish on long term

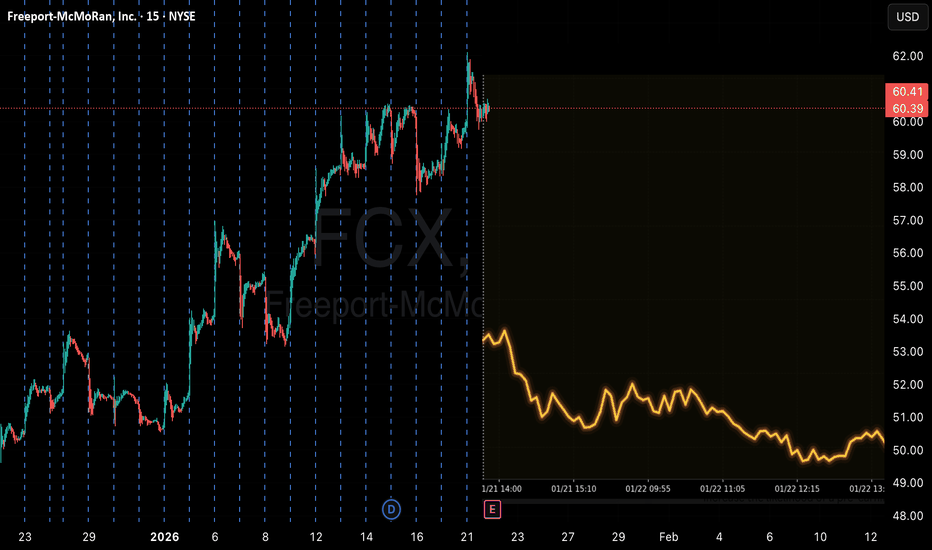

Earnings Conflict Alert: AI Turns Bearish Into FCXFCX Earnings Signal | 2026-01-21

🎯 Trade Bias

Primary Direction: BUY PUTS

Confidence: 55%

Conviction: MEDIUM

🧠 Trade Rationale (Why This Trade)

Katy AI predicts a short-term downside move (-0.77%)

Stock is overbought (RSI 75.7, Stochastics 85.8)

Setup favors a pre-earnings pullback / sell-the-news

Fundamentals are bullish → conflict increases volatility risk

💰 Options Trade Setup

Option Type: PUT

Strike: $60.00

Expiry: Jan 23, 2026

Entry: ~$1.40

Target 1: $2.10 (+50%)

Target 2: $2.80 (+100%)

Stop Loss: $0.98 (−30%)

📏 Position Sizing

Recommended Size: ≤ 2% of portfolio

Keep size small due to earnings uncertainty

⚠️ Key Risks to Monitor:

Strong bullish fundamentals may overpower AI signal

Katy AI confidence is only 50%

Exit or hedge before earnings release to avoid gamma risk

Freeport May Be Coming to LifeFreeport-McMoRan has been in a tight range for months, but some traders may think the copper miner is coming to life.

The first pattern on today’s chart is the falling trendline along the highs of late September and late October. Prices pushed above that line last week and are also challenging $43.31, the October 9 close that’s also presented resistance.

Second, the 50- and 200-day simple moving averages are almost on top of each other. That highlights the long period of sideways movement. With metal prices climbing and the U.S. dollar falling, could long-term neutrality morph into bullishness?

Third, the 8-day exponential moving average (EMA) crossed above the 21-day EMA. MACD is also rising. Those patterns may be consistent with short-term bullishness.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

FCX down to $35, then $25Looks like a clear downtrend back down to $35.

Watch what happens at $35.

- how much demand

- only only short-term or longer-term demand

Here rice will get a change to pop higher, and potentially challenge this current downtrend. But likely, price will still continue to fall lower.

No guarantee it will reach as low as $27, need to watch as price unfolds. But wouldn't be surprised to see this happen, then have some bullishness enter the market (whether for the short- or long-term period).

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 45usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.31.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FCX: The Dumpy Trinity Strikes – Flush the Drama and Buy the DipThey say bad luck comes in threes, but for Freeport-McMoRan NYSE:FCX , it's more like a triple-decker dump truck of drama! 😩

First off, the "Liberation Day Mega Dump" – The Don launched a barrage of tariffs hitting the stock like a patriotic plunger.

Then, the "Copper Crash Poo Poo" – prices tanking faster than a bad burrito aftermath.

Lastly, the "Grasberg Mine Mud Butt" incident – a literal mudslide turning operations into a slippery mess!

Now that we've got this unholy "Dumpy Trinity" complete, is the universe finally done pooping on FCX? Are we gearing up for some glorious upside? 🚀 It won't happen overnight (no need to chug coffee and stare at charts till dawn), but heck yeah, I think we're primed for a comeback! I scooped up shares right on the day of that Grasberg dump-fest.

Could we dip a tad lower first? Eh, maybe – life's full of plot twists. If it hits $28-$30, I'd be piling in like it's Black Friday at the toilet paper aisle.

I also expect Copper to hecking PAMP again at some point. So this should respond accordingly.

But remember, folks: YOU WON'T GET RICH IF YOU CAN'T HOLD! 💎🙌 Stay strong, don't panic-sell at the first rumble. Who's with me on this wild ride? Let's turn this crap into cash! 🤑 #FCX #StockDumps #BuyTheDip

FCX)| Long | Metal Demand Surge | (June 16, 2025)Freeport‑McMoRan (FCX) | Long | Inverse Head & Shoulders + Metal Demand Surge | (June 16, 2025)

1️⃣ Short Insight Summary:

FCX appears to be forming an inverse Head & Shoulders pattern, signaling a potential bullish reversal. Strong fundamentals and rising metal demand align with this technical setup.

2️⃣ Trade Parameters:

• Bias: Long

• Entry: $34 (targeting neckline retest)

• Stop Loss: $30 (below pattern’s right shoulder support)

• Take Profit 1 (TP1): $38–$42 (entry-level resistance)

• Take Profit 2 (TP2): $46–$48 (next resistance band)

• Final Target: $50 (room to let remainder run beyond pattern breakout)

3️⃣ Key Notes:

✅ Company posted ~$0.42 EPS last quarter, with ~$25 B in revenue and ~$2 B net income.

✅ Forward estimates suggest EPS growth through 2027—historically accurate with recent beats.

✅ Beta ~1.075, slightly above market, indicating modest volatility.

✅ FCX is a global player—leading copper, gold, and moly producer across North America, South America, Africa.

✅ Technical structure, supported by trajectory in metal demand, strengthens bullish case.

4️⃣ Optional Follow‑up Note:

Will monitor for confirmation of neckline breakout. If price closes above $38 with volume, consider shifting stop to breakeven and scaling into the position.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Freeport McMoran - Run with copper...1. Trend Analysis

Overall Trend: The stock has been in a downtrend since mid-2023 but is showing signs of a potential reversal.

Recent Price Action: The stock recently bounced from a support level around $35.59 - $37.43, indicating a possible trend reversal.

Moving Averages: The stock is trading near short-term moving averages, suggesting a consolidation phase. It needs to break above the key resistance levels (around $39.17 - $41.63) to confirm an uptrend.

2. Key Support & Resistance Levels

Support: $35.59 (recent low) and $37.43

Resistance: $38.09, $39.17, and $41.63

3. Indicator Analysis

MACD (Moving Average Convergence Divergence): The MACD is showing a bullish crossover, indicating potential upward momentum.

RSI (Relative Strength Index): RSI is near 52.13, suggesting the stock is approaching a neutral-to-bullish zone but is not yet overbought.

Volume: A significant increase in volume indicates strong buying interest, which supports the bullish case.

4. Divergence Signals

Bullish Divergence: The price made a lower low, while RSI and MACD made higher lows, indicating potential upward momentum.

5. Trade Setup

Long Entry: Above $38.09, with confirmation above $39.17.

Stop-Loss: Below $37.43 (as marked on the chart).

Take-Profit Targets:

First target: $40.79

Second target: $41.63

Further target: $44.30

Conclusion

Bullish Reversal Possible: The stock is showing a potential trend reversal with bullish divergence and increasing volume.

Breakout Confirmation Needed: A close above $39.17 would strengthen the bullish case.

Risk Management: A stop-loss below $37.43 is recommended in case the price fails to hold support.

Opening (IRA): FCX July 18th 25/March 21st 39 Long Call Diagonal... for an 11.02 debit.

Comments: Taking a directional shot post-earnings on weakness, buying the back month 90 delta call and selling the front month 30 delta that pays for all of the extrinsic in the long, resulting in a break even that is slightly below where the underlying is currently trading.

Metrics:

Buying Power Effect: 11.02

Break Even: 36.02/share

Max Profit: 2.98

ROC at Max: 27.04%

With these, I generally look to take profit at 110% of what I put them on for and/or look to roll out the short call to reduce my cost basis/downside break even should that not be hit.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $1.94.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Can We Get +EV from EV? With stocks like FCX, sometimes the answer isn’t just about gold—it’s about finding the copper that holds everything together.

While everyone scrambles for the gold nuggets in the mainstream Electric Vehicle (EV) market, you might be missing opportunities further upstream in the feeder streams. These are the overlooked areas that quietly power the whole operation. As I work on my 2025 guide to researching and finding hidden gems in this very market, I stumbled upon a curious situation that’s sometimes overlooked when researching a stock: a well-timed opportunity to combine deeper research with the possibility of an early position.

What is that opportunity, you ask? Well, it’s all about timing and understanding the mechanics of dividends, coupled with an upcoming earnings catalyst.

The Hidden Value in Copper

Let’s face it—copper wire isn’t exactly the sexiest investment out there. But sometimes, the dressed-down stock has a greater long-term value precisely because it spans multiple industries. Copper isn’t just critical for EV motors and renewable energy—it’s a foundation material for infrastructure, electronics, and more.

Enter Freeport-McMoRan Inc. (FCX). This copper powerhouse caught my attention for two key reasons:

1. A dividend payout date approaching on Jan 15, offering a 1.6% yield.

2. An earnings report set for Jan 23, creating the potential for amplified movement shortly after the dividend window.

Now, before you jump in, remember: this isn’t about chasing dividends or speculative hype. Instead, it’s an opportunity to observe, research, and learn. Here’s why FCX is a fascinating case study and what to watch for.

Why FCX Is a Great Study

1. **Dividend Catalyst (Jan 15)

- Watching the stock’s behavior leading up to and after the ex-dividend date could give insights into how investors value the dividend.

- Track whether the stock trades with increased volume or volatility as traders position themselves to collect the dividend.

2. **Earnings Catalyst (Jan 23)

- With earnings just a week after the ex-dividend date, you have a rare overlap of events that could amplify price movement.

- Depending on sentiment, the stock could rebound from the ex-dividend price drop—or face additional pressure if earnings or guidance disappoint.

3. **Copper Exposure

- FCX is already on our radar for its ties to EVs, renewable energy, and infrastructure projects.

- Broader copper demand, influenced by economic sentiment or supply chain news, could add another layer of movement to this stock.

What to Watch

1. Pre-Dividend Price Action (Now through Jan 14)

- Look for increased buying as traders position for the dividend.

- Monitor volume trends and whether FCX breaks key technical levels.

- Keep an eye on market sentiment and copper-related news.

2. Ex-Dividend Price Adjustment (Jan 15)

- Observe if the stock drops by exactly the dividend amount ($0.15) or if external factors cause a different adjustment.

- Watch for recovery post-drop—does buying interest resume, or does the stock stall?

3. Earnings Anticipation (Jan 16–23)

- Monitor implied volatility (IV) for options, as IV typically rises before earnings.

- Consider how copper prices or macroeconomic trends (like China reopening or U.S. infrastructure spending) might affect sentiment heading into earnings.

4. Post-Earnings Reaction (Jan 23 and Beyond)

- Listen to the earnings call for insights on copper demand, production costs, and forward contracts.

- Note whether the stock aligns with broader copper and EV trends or diverges based on the results.

Possible Outcomes

1. Bullish Scenario

- Dividend buying drives interest, and earnings provide a strong catalyst for growth.

- The stock rebounds quickly after the ex-dividend date and continues upward momentum post-earnings.

2. Bearish Scenario

- Dividend adjustment leads to further downside pressure, and earnings fail to meet expectations.

- The stock underperforms compared to copper peers.

3. Neutral Scenario

- Dividend adjustment happens as expected, and earnings provide no surprises.

- FCX trades sideways, maintaining a range-bound pattern.

How to Track and Document

1. **Price & Volume:**

- Record closing prices from now through Jan 23.

- Note volume spikes and their timing relative to events.

2. **Options Activity:**

- Monitor the options chain for changes in implied volatility as earnings approach.

- Look for unusual activity around certain strikes or expirations.

3. **Copper Prices:**

- Track global copper prices, as they could influence sentiment for FCX.

4. **News Flow:**

- Stay updated on copper demand, EV adoption, and infrastructure-related headlines.

A Practical Exercise in +EV Thinking

FCX presents a unique opportunity to explore the layered dynamics of dividends, earnings, and macroeconomic trends. Even if you don’t take a position, tracking these events can sharpen your understanding of how catalysts play out in real time.

And, of course, this study aligns perfectly with the philosophy behind my upcoming eBook and print guide:

**“Adding to Your Nest with EV in 2025 – A guide for researching the hidden gems in the EV market sector of trading.”**

So, can we get +EV from EV? The answer lies upstream, in the copper that holds everything together.

-Bob Cavin 3

$FCX - Potential trendline bounceNYSE:FCX is getting close to checking back the uptrend line. In the past, the trendline has provided reliable support.

If the trendline fails to provide support, it could drop to the $37 to $36 area, which would be an ideal entry point.

Knowing that, what would you do? Enter at the trendline checkback or wait for the trendline to break?

As always, I share my opinions and trades. I'm not suggesting that anyone follow my trades. You do you.

FCX Freeport-McMoRan Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FCX Freeport-McMoRan prior to the earnings report this week,

I would consider purchasing the 50usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $1.49.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Gold Mining Coming Up??NYSE:FCX

With the option Flow coming in this gave us a bullish bias on the stock. After the trader placed his trade the markets drove the stock down which is max pain. The quicker the market maker drives the stock against the trader, the higher the chance of the trade going in their direction. While going through NYSE:FCX 's option chain we have 2 major put walls, the $40 and $40.5 strike giving more of a reason to move the stock higher. For the technicals the stock created a technical bottom and a liquidation bottom indicating the stock is ready to move higher!

Freeport in Freefall?Freeport-McMoRan has struggled since the spring and some traders may see risk of further declines.

The first pattern on today’s chart is the series of higher highs and higher lows since early August. The copper miner fell through the bottom of that channel on Tuesday, creating a potential bear-flag breakdown.

Second is the zone around $43.30. It was a high in December and important breakout level in March. FCX recently tried to hold this support area but yesterday tore through it.

Third, the breakdown is occurring around the 200-day simple moving average. That may suggest that a longer-term uptrend is ending.

Speaking of the long run, the price action between April and July could be viewed as a top. Not only did FCX fail to break above its 2022 peak. It also formed a potential head-and-shoulders reversal pattern.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.