Petrobras (PBR) — Institutional Positioning - Trade Idea ***

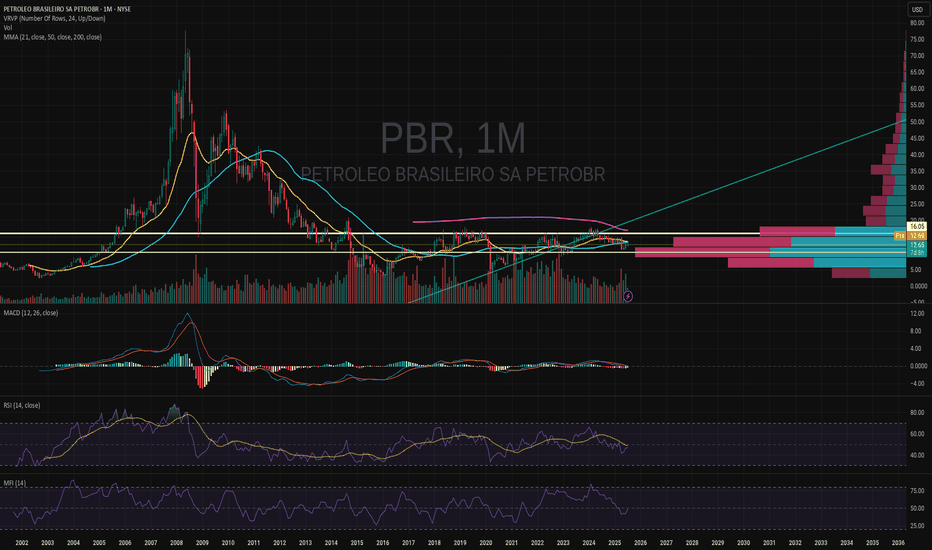

PBR is trading around 13.7–13.8, with persistent volume expansion since Jan 13, pointing to active institutional positioning rather than reactive retail flow, I am closely following institutional behavior on this structure.

From a price action perspective, PBR is holding above the 13.00 area while

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.962 EUR

5.70 B EUR

76.48 B EUR

3.70 B

About Petroleo Brasileiro SA

Sector

Industry

CEO

Magda Chambriard

Website

Headquarters

Rio de Janeiro

Founded

1953

IPO date

Jul 20, 1977

Identifiers

2

ISIN BRPETRACNOR9

Petróleo Brasileiro SA engages in oil and gas exploration, production, and distribution activities. It operates through the following segments: Exploration and Production; Refining, Transportation, and Marketing; and Gas and Low Carbon Energies. The Exploration and Production segment covers the activities of exploration, development, and production of crude oil, natural gas liquid, and natural gas, for the primary purpose of supplying its domestic refineries. The Refining, Transportation, and Marketing segment refers to refining, logistics, transport, and trading of crude oil and oil products activities as well as exports of ethanol. The Gas and Low Carbon Energies represents the activities of logistic and trading of natural gas and electricity, transportation and trading of liquefied natural gas, generation and electricity by means of thermoelectric power plants, as well as holding interests in transporters and distributors of natural gas. The company was founded on October 3, 1953 and is headquartered in Rio de Janeiro, Brazil.

Related stocks

PERSONAL JOURNAL #8 | PETROLEO BRASILIERO [PBR] | AUG 2025-2026Disclaimer

This is a personal journal of my exploits. This is not financial advice. Always do your own research.

Insight

Most companies are only now beginning to recovery post Covid-19, the localized correction in 2021 following Evergreen and Evergrande, as well as onset of new wars and high i

Burno moretti being chosen is good news for long termBruno Moretti being appointed as chairman has long term implications all being positive I'll admit I was a little bit skeptical at first but I do believe it is for the best of the company.

Ubs updated it from 14.40 to 15.50 and despite foreign arguments there is gonna be great times ahead.

Bull Flag on PETR4PETR4 will probably trade between R$29.50 and R$31.50 before breaking out. Confirmed breakouts (candle closes above prices like R$32) could drive the price to around R$35. The ex-dividend date of 21 August will probably be a catalyst to drive the prices higher. After this date we could see a short-t

PBR Trading Strategy

This concise plan outlines key entry points and profit targets for trading PBR. Follow the strategy to capture upward moves while managing risk effectively.

Entry Points:

• 14.5: Initial entry

• 13.7: Add on a pullback

• 12.7: Further averaging down if needed

Profit Targets:

• 16.0: Take partial

PBR.A goes up from here.PBR and PBR.A is set up to retake the previous highs as Oil continues its rise. Shocks to global supply are imminent. New discoveries give the company plenty of room to continue to increase production and global share well into the future. Political risk baked in. Max pain 12.50-11.50. Stop set at 1

See all ideas

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

5P0E

Petrobras Global Finance BV 6.85% 05-JUN-2115Yield to maturity

7.24%

Maturity date

Jun 5, 2115

US71647NBG3

Petrobras Global Finance BV 6.75% 03-JUN-2050Yield to maturity

7.10%

Maturity date

Jun 3, 2050

US71647NBJ7

Petrobras Global Finance BV 5.5% 10-JUN-2051Yield to maturity

6.94%

Maturity date

Jun 10, 2051

5P0K

Petrobras Global Finance BV 6.9% 19-MAR-2049Yield to maturity

6.93%

Maturity date

Mar 19, 2049

US71647NAK5

Petrobras Global Finance BV 7.25% 17-MAR-2044Yield to maturity

6.86%

Maturity date

Mar 17, 2044

US71647NAA72

Petrobras Global Finance BV 5.625% 20-MAY-2043Yield to maturity

6.82%

Maturity date

May 20, 2043

US71645WAS08

Petrobras Global Finance BV 6.75% 27-JAN-2041Yield to maturity

6.72%

Maturity date

Jan 27, 2041

US71645WAQ42

Petrobras Global Finance BV 6.875% 20-JAN-2040Yield to maturity

6.66%

Maturity date

Jan 20, 2040

US71647NBF50

Petrobras Global Finance BV 5.093% 15-JAN-2030Yield to maturity

6.42%

Maturity date

Jan 15, 2030

PTRB6166899

Petrobras Global Finance BV 6.25% 10-JAN-2036Yield to maturity

6.34%

Maturity date

Jan 10, 2036

XS0982711474

Petrobras Global Finance BV 6.625% 16-JAN-2034Yield to maturity

6.12%

Maturity date

Jan 16, 2034

See all PJXC bonds

Frequently Asked Questions

Depending on the exchange, the stock ticker may vary. For instance, on SWB exchange Petroleo Brasileiro SA stocks are traded under the ticker PJXC.

We've gathered analysts' opinions on Petroleo Brasileiro SA future price: according to them, PJXC price has a max estimate of 7.53 EUR and a min estimate of 5.66 EUR. Watch PJXC chart and read a more detailed Petroleo Brasileiro SA stock forecast: see what analysts think of Petroleo Brasileiro SA and suggest that you do with its stocks.

PJXC reached its all-time high on Mar 7, 2011 with the price of 15.000 EUR, and its all-time low was 1.281 EUR and was reached on Jan 20, 2016. View more price dynamics on PJXC chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

Yes, you can track Petroleo Brasileiro SA financials in yearly and quarterly reports right on TradingView.

Petroleo Brasileiro SA is going to release the next earnings report on Mar 5, 2026. Keep track of upcoming events with our Earnings Calendar.

PJXC earnings for the last quarter are 0.40 EUR per share, whereas the estimation was 0.30 EUR resulting in a 33.13% surprise. The estimated earnings for the next quarter are 0.22 EUR per share. See more details about Petroleo Brasileiro SA earnings.

Petroleo Brasileiro SA revenue for the last quarter amounts to 20.08 B EUR, despite the estimated figure of 20.54 B EUR. In the next quarter, revenue is expected to reach 18.37 B EUR.

PJXC net income for the last quarter is 5.23 B EUR, while the quarter before that showed 4.16 B EUR of net income which accounts for 25.73% change. Track more Petroleo Brasileiro SA financial stats to get the full picture.

Petroleo Brasileiro SA dividend yield was 10.66% in 2024, and payout ratio reached 148.05%. The year before the numbers were 14.02% and 57.10% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 10, 2026, the company has 49.19 K employees. See our rating of the largest employees — is Petroleo Brasileiro SA on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Petroleo Brasileiro SA EBITDA is 34.45 B EUR, and current EBITDA margin is 43.84%. See more stats in Petroleo Brasileiro SA financial statements.

Like other stocks, PJXC shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Petroleo Brasileiro SA stock right from TradingView charts — choose your broker and connect to your account.