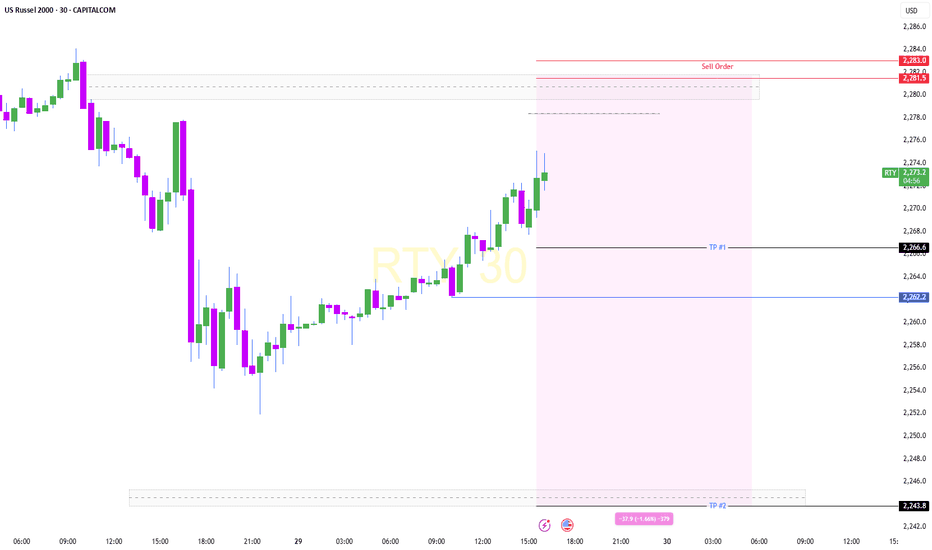

US2000 H4 | Bearish dropUS2000 is reacting off the sell entry at 2,281.28, which is an overlap resistance that aligns with the 38.2% Fibonacci retracement and could drop from this level to the downside.

Stop loss is at 2,310.43, which is an overlap resistance that lines up with the 38.2% Fibonacci retracement.

Take profit is at 2,241.59, which is a pullback support that is slightly above the 50% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

US2000 trade ideas

Pay close attention to the Russell 2000/S&P 500 ratio!1) The Russell 2000 is the US small-cap stock market index

The Russell 2000 is a stock market index comprising some 2,000 US small caps, making it the main barometer of small-cap performance in the USA. The S&P 500, on the other hand, is made up of 500 large US companies, representative of large caps, which are generally more diversified and internationally oriented. The Russell 2000 is characterized by higher volatility, as small caps are more sensitive to domestic economic conditions, interest rates and credit cycles, while the S&P 500 reflects the underlying trend of US tech stars.

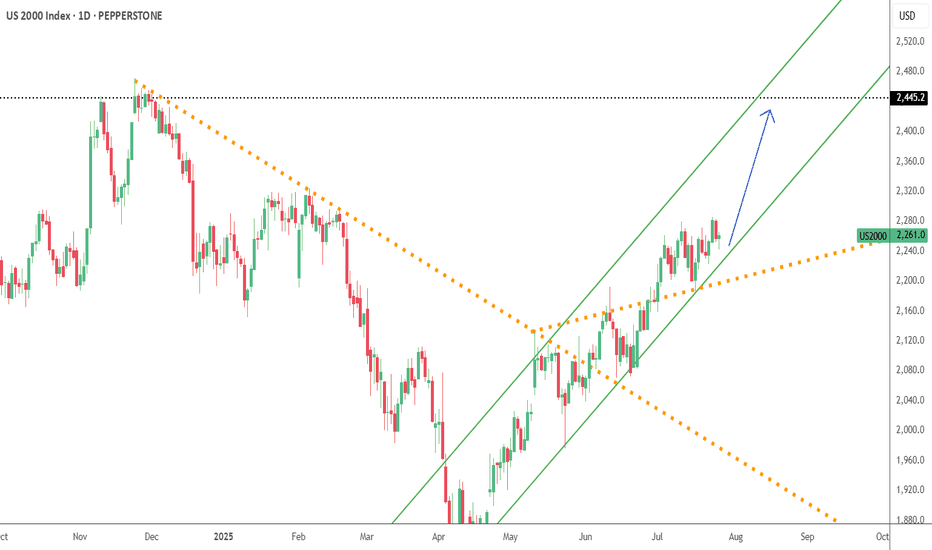

2) The Russell 2000/S&P 500 ratio is a major barometer of risk appetite in the stock market, and will enter a bullish rebound if and only if the FED makes a real pivot in the last quarter of 2025

A notable difference lies in profitability: a significant proportion of Russell 2000 companies are not yet profitable, whereas most S&P 500 companies are mature, benefiting from solid margins and more robust balance sheets.

For this reason, the Russell 2000 index is ultra-sensitive to the FED's monetary policy. Consequently, if the FED opts for a real pivot at the end of the year (several consecutive rate cuts), this will improve credit conditions and support small-cap stocks. On the other hand, if the FED opts for no pivot at all, or just a technical pivot, this will not be favorable for the Russell 2000.

This is why the Russell 2000/S&P 500 ratio can be considered an excellent risk barometer. For the moment, this ratio is following a downward trend, but major support is approaching, as is the start of divergence. The day this ratio turns upwards, it will be a strong signal in favor of risk appetite and the outperformance of small-cap stocks. That day hasn't yet come, but you should keep a close eye on this ratio between US small caps and the S&P500.

3) While the S&P 500 is as expensive as it was at the end of 2021 in terms of valuation, the Russell 2000 is cheap and still a long way from its all-time high

While the S&P 500 is back to its valuation level of the end of 2021, the Russell 2000's corporate valuations are still far behind and far from a zone of historical excess.

In terms of technical analysis, major support has been identified at 2135 points, and as long as the index holds above this support, it may be in a position to reach its all-time high.

The chart below shows daily Japanese candlesticks on the Russell 2000 index

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Russell2000 key trading levelsKey Support and Resistance Levels

Resistance Level 1: 2,308

Resistance Level 2: 2,330

Resistance Level 3: 2,341

Support Level 1: 2,265

Support Level 2: 2,245

Support Level 3: 2,223

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

RTY Russel 2000 expansion:bullish targetsTargets and thesis on chart

Expecting to see price action move towards the 2700-2900 region

Confluence with regular fib extension 2.618 non-log arithmetic chart

Trend based fib

EWT channel measured from wave 1 (2-4 transposed to 1)

Fractal

Expecting this move to align with the rest of the markets and peak around november 2024

US2000 H4 | Bearish breakoutUS2000 is falling towards the buy entry, which is a pullback suppor,t and a breakout off this level could lead the price to drop to the take profit.

Sell entry is at 2,281.10, which is a pullback support.

Stop loss is at 2,330.41, which is a swing high resistance.

Take profit is at 2,236.08, which is a pullback support that lines up with the 50% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

"US2000 THIEF TRADE: SWIPE & ESCAPE BEFORE BEARS!"🚨Russell 2000 Robbery: Pullback to Power Play⚡️💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Robbers & Money Makers, 🤑💰💸✈️

This is a full-blown heist plan on the US2000 (Russell 2000) index using the Thief Trading Style™, a perfect combo of real-time technicals + macro heat.

Get ready to swipe the bull run right after a tactical pullback — let’s rob the market clean and vanish at the high-voltage resistance level ⚡️🚨📊

📈 Entry Plan – The Vault Opens @ 2190.00

Watch for a clean pullback to the zone around 2190.00.

Place buy limit orders after confirmation from 15m or 30m candles – preferably near recent swing lows.

Smart move: Set alerts so you don’t miss the breakout trigger.

🛑 Stop Loss – Escape Hatch @ 2140.00

Use the nearest 4H candle wick or swing low as your SL level.

Thieves scale their lot size & SL based on position stacking and trade confidence.

🎯 Target – 2380.00 (Or Jump Before the Heat Gets Real)

Take profit near the heavy resistance zone. Don’t overstay — market traps ahead! Electric reversals & institutional bears wait there to flip the game ⚡🐻

👀 Scalpers’ Secret:

Only long scalps! 💣

No funds? Follow the swing robbers.

Trail your SL and let the bulls push your bags up.

🧠 What’s Fueling This Bullish Ride?

US2000 is surging with:

• Risk appetite from macro sentiment

• COT data aligning bullish

• Intermarket signals syncing up

• Rotational flows into small-cap strength

⚠️ Thief Trading Alerts – News Impact Zone Incoming!

• Don’t enter fresh trades during red news.

• Use trailing SLs to guard floating profits.

Market spikes are good — if you’re prepared.

💣💥This isn’t just a trade – it’s a mission.

Rob smart, trail hard, and cash out sharp.

📦💼Every move is calculated. Every entry is a chance.

🚀Stay sharp, robbers – next heist plan drops soon! 💼🔐📈

🏆Trade like a thief, win like a boss.

Russell 2000 Bullish Attack – Vault Break-In Loading🚨US2000 / Russell 2000 Heist Plan – Bullish Loot Incoming!🚨

🤑 Dear Robbers of the Market Vault,

The Russell 2000 is showing cracks in the bear walls—time for a bold bullish break-in! 🔓📈

The Thief has eyes everywhere, and right now, the loot sits between 2140.0 & 2320.0. Let's steal it!

📌 Asset: US2000 / Russell 2000

📍 Plan: Bullish (Heist Mode: ON)

🧲 Method: Layering entries like a smooth criminal 🎯💣

💵 Entry: Any price – the vault door’s open, rob at your timing!

🛡️ Stop Loss: 2140.0 (Guarded exit in case the heat gets too strong)

🎯 Target: 2320.0 (The gold bars are stacked here)

🧠 Robbery Blueprint (Strategy Notes):

Use multiple buy limit orders 🔄

Structure entries near swing lows in 15m/30m charts

Wait for dips, snatch the momentum—we rob during weakness!

Always place alerts to spot intraday cracks in the defense lines 📳📊

Don’t chase; we trap the trap!

💥Risk Alert & Protection Plan:

News events = 🔥 volatility bombs.

❌ No fresh trades during high-impact news

✅ Use trailing SL to lock in the loot

🔐 Protect your gains like the vault guards protect gold!

⚔️ Scalpers & Swing Thieves Note:

Scalp only on the long side

💸 Small capital = DCA entry + trail

💰 Big pockets = Straight breakout sniper shot

Stay light, stay fast, stay rich!

📢 Final Words from the Mastermind:

Boost this heist if you love the thrill of the steal 💥

Trade with precision, exit with profits, and never let the market catch you!

The next robbery plan drops soon... be ready, robbers 🐱👤🚨📈

Russell 2000 uptrend support at 2280.00Key Support and Resistance Levels

Resistance Level 1: 2320.70

Resistance Level 2: 2336.20

Resistance Level 3: 2352.80

Support Level 1: 2280.00

Support Level 2: 2264.10

Support Level 3: 2240.35

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 Key Trading LevelsKey Support and Resistance Levels

Resistance Level 1: 2320.70

Resistance Level 2: 2336.20

Resistance Level 3: 2352.80

Support Level 1: 2280.00

Support Level 2: 2264.10

Support Level 3: 2240.35

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Breakout or Fakeout as Small Caps Hit 6-Month High

U.S. small cap equities motored higher following the release of the July inflation report, with the Russell 2000 closing at its highest level since February. While I have serious reservations about the scale of rate cuts markets have priced in from the Federal Reserve over the next year given persistent strength in services inflation, the readthrough suggests economic activity is nowhere near as weak as the July jobs report would have you believe. That’s a bullish sign for small cap earnings, even though it may eventually lead to markets paring rate cut pricing in the period ahead. I suspect traders would take fewer rate cuts if it meant a stronger economy.

The latest surge saw the Russell close above 2278 resistance, providing a level for traders to work with depending on whether the breakout sticks. With RSI 14 trending higher and MACD having just crossed the signal line from below in positive territory, the momentum signals are entirely bullish, favouring a similar directional bias.

If the price can hold 2278, longs could be established above the level with a stop beneath for protection. Targets include 2320, 2375 and 2468, depending on desired risk-reward.

Alternatively, if the break fails, the setup could be flipped with shorts established beneath 2278 with a stop above for protection. 2242, the 50-day moving average, 2192, and the 200-day moving average are all options for targets. Given price and momentum signals, this setup looks a lower probability play relative to being long small caps.

Good luck!

DS

US2000 Bearish Alert: Institutional Shorts Spike 300%, TechnicalInstitutional Sentiment Shift

Net short interest exploded from –30K in early July to –90K by early August—a 300% jump in bearish conviction.

Daily Chart:

On August 1, US2000 closed below key support, carving a lower low—the first technical indication of a bearish reversal.

Weekly Chart:

A clear bearish engulfing candlestick reinforces the likelihood of further downside.

Macro & Market Backdrop:

• The Fed remains hawkish, quashing near-term rate cut expectations.

Reuters

• Small-caps continue to underperform—Russell trades rich but offers less structural strength compared to large-caps.

MarketWatch

• With stagflation risks rising, small/mid-cap companies could face underperformance and tighter financing conditions.

MarketWatch

Bottom Line:

With institutional short positioning intensifying, market structure turning bearish, and macroeconomic challenges mounting, the US2000 is poised for further pressure. Traders—watch for follow-through declines.

Russell2000 bullish sideways consolidationKey Support and Resistance Levels

Resistance Level 1: 2256

Resistance Level 2: 2273

Resistance Level 3: 2282

Support Level 1: 2197

Support Level 2: 2177

Support Level 3: 2141

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US2000 H4 | Bullish bounce offBased on the H4 chart analysis, we could see the price fall towards the buy entry which is a pullback support and could bounce to the take profit.

Buy entry is at 2,199.60, which is a pullback support that is slightly below the 38.2% Fibonacci retracement.

Stop loss is at 2,167.39, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Take profit is at 2,245.45, which is a pullback resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Russell2000 Key Trading LevelsKey Support and Resistance Levels

Resistance Level 1: 2256

Resistance Level 2: 2273

Resistance Level 3: 2282

Support Level 1: 2200

Support Level 2: 2177

Support Level 3: 2140

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Small Caps: Rebound or rollover at 200DMA?Near-term price action in U.S. small-cap stocks may be instructive for assessing longer-term directional risks, with the contract trading near the key 200-day simple moving average.

Despite breaking uptrend support and extending the bearish move late last week, buying dips remains the preferred strategy unless there’s clear evidence the U.S. economy is sliding into recession—an outcome unlikely to be resolved near-term with only second-tier economic data on the calendar this week. That also means market pricing for just under 100 basis points of Fed rate cuts by mid-2026 is unlikely to shift dramatically, helping to support risk appetite.

If the contract can reclaim the 200DMA and hold there, longs could be initiated with a stop beneath the level for protection against reversal. 2192 is an early hurdle for bulls with a break of that level opening the door for a run towards 2240 or even 2278.

Alternatively, if the contract remains capped beneath the 200DMA, the setup could be flipped with shorts established below the level and a stop above. Friday’s low and 2133 are obvious near-term targets, with support at 2075 the next downside level after that.

Momentum indicators remain mixed despite rolling over in late July, placing more weight on price action rather than any firm directional bias.

Good luck!

DS

Russell2000 Key Trading levelsKey Support and Resistance Levels

Resistance Level 1: 2194

Resistance Level 2: 2210

Resistance Level 3: 2227

Support Level 1: 2154

Support Level 2: 2135

Support Level 3: 2113

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 Key Trading LevelsKey Support and Resistance Levels

Resistance Level 1: 2194

Resistance Level 2: 2210

Resistance Level 3: 2227

Support Level 1: 2154

Support Level 2: 2135

Support Level 3: 2113

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US2000 H4 | Bearish dropBased on the H4 chart analysis, we could see the price drop lower from the sell entry to the downside.

Sell entry is at 2,224.89, which is a pullback resistance.

Stop loss is at 2,280.47, a swing high resistance.

Take profit is at 2,163.99, which is an overlap support that is slightly above the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

$RUT 15m – Liquidity Sweep + Discount Zone Reaction📉 TVC:RUT 15m – Liquidity Sweep + Discount Zone Reaction

WaverVanir DSS | July 31, 2025

The Russell 2000 just executed a sharp breakdown beneath equilibrium, tapping into our predefined discount zone and weak low near 2,219.62.

🧠 Smart Money Concepts Observed:

BOS (Break of Structure) confirmed → bearish control

Liquidity sweep through prior lows with wick rejection

Rejection forming inside key discount zone = potential demand reaction

Equilibrium now serves as upside magnet (reversion target: ~2,242–2,249)

🔮 VolanX Protocol Forecast:

Scenario A:

Price bounces off 2,219–2,221 zone, retests 2,242.71, and rejects at VWAP/Ichimoku cloud.

Scenario B:

Clean reclaim of 2,242 zone triggers reversion toward 2,255–2,261, but that requires volume conviction.

🚫 Invalidation: Acceptance below 2,219.62 = expansion lower toward 2,212.

⚠️ No volume data on this chart — trade with confirmation from correlated ETFs (IWM) or futures (RTY).

🛡️ VolanX DSS signal only. For educational purposes. Not financial advice.

#SMC #RUT #Russell2000 #SmartMoney #VolanX #WaverVanir #LiquidityHunt #OptionsFlow #MacroTech

Russell2000 sideways consolidation supported at 2232Key Support and Resistance Levels

Resistance Level 1: 2278

Resistance Level 2: 2300

Resistance Level 3: 2318

Support Level 1: 2232

Support Level 2: 2213

Support Level 3: 2193

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

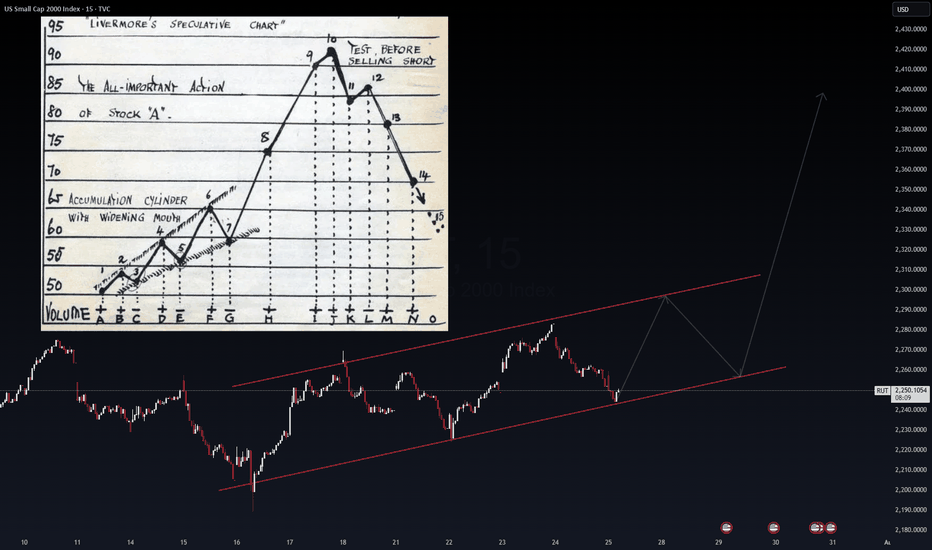

RUT Echoes IWM – The Livermore Playbook?The Russell 2000 (RUT) is painting a structure that mirrors the IWM ETF – a widening accumulation channel, setting up for a potential breakout. The VolanX protocol flags this as a classic Livermore Speculative Chart pattern, where phases of quiet accumulation lead to an explosive markup.

Channel Support: ~2,245 is holding as the battleground for bulls.

Short-Term Projection: Expect a possible ping-pong move between 2,260 – 2,300 before the real momentum ignites.

Breakout Level: Above 2,310, the price could rip toward 2,390–2,400 (Livermore’s “point 10” territory).

VolanX suggests that this structure is not random – IWM and RUT are moving in tandem, with mid-cap risk appetite quietly building. If liquidity inflows continue, this setup could fuel a sharp vertical rally into August.

"Are you seeing the same Livermore-style accumulation in IWM as VolanX does?"

#RUT #IWM #VolanX #Livermore #Accumulation #BreakoutWatch #TradingView