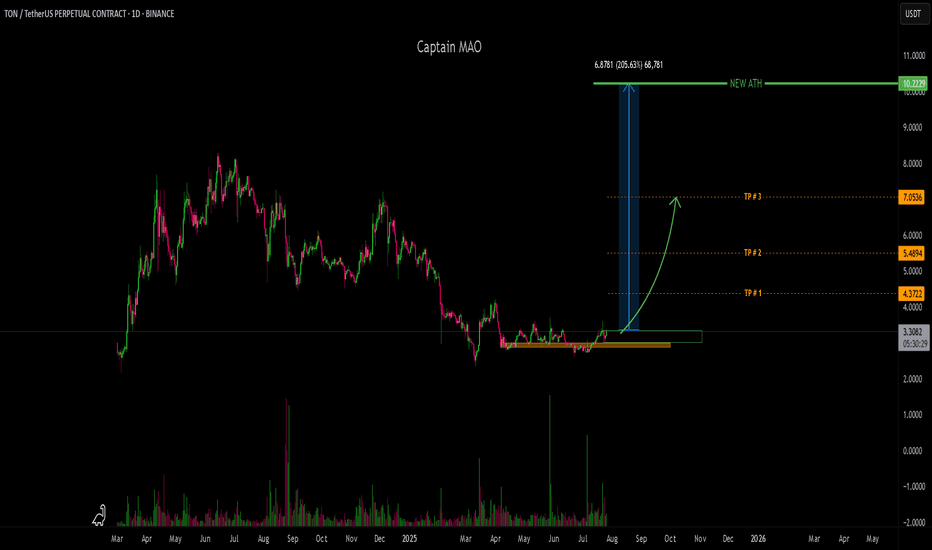

Toncoin TON price analysis💎 CRYPTOCAP:TON didn’t become a legend over the past 9 months — but at least our correction target of $2.30–2.50 played out with precision.

While most of the crypto market is currently going through a correction, #Toncoin keeps pushing upward. Still, we remain realistic:

🎯 First target: $5.40–5.80

🎯 Second target: $8.00–8.20

🚀 It’s not a “to the moon” scenario, but a potential 2x–3x from current levels is attractive.

The key support level OKX:TONUSDT remains at $3.00 — as long as it holds, the bullish trend remains valid.

TONUSDT.P trade ideas

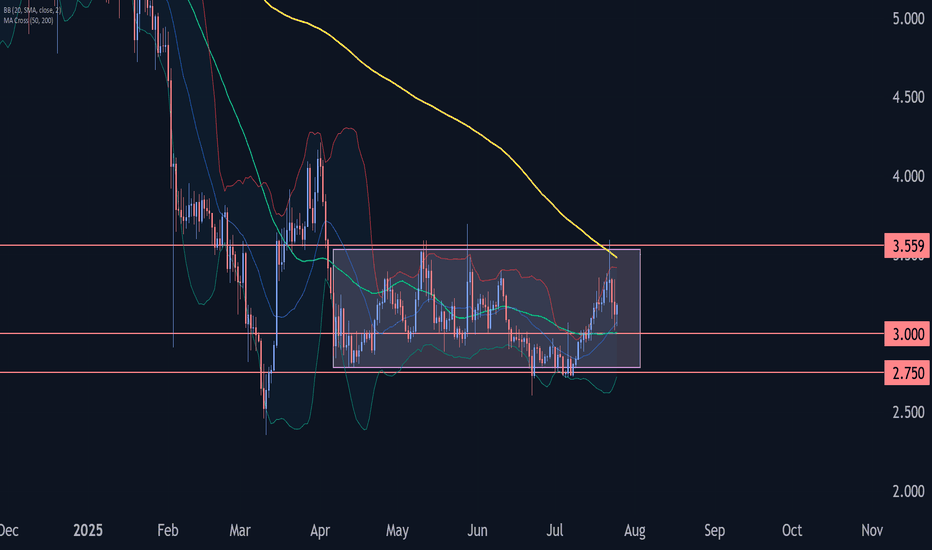

TON Bearish DivergenceBINANCE:TONUSDT

Trade Setup:

Target 1: 3.523 (0.786 Fibonnaci Golden Zone).

Target 2: 3.389 (0.618 Fibonnaci Golden Zone).

Target 3: 3.295 (0.786 Fibonnaci Golden Zone).

Target 4: 2.897 (0 Fibonnaci).

Stop Loss: 3.910 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 75.44, approaching overbuy territory, so caution is advised.

Lingrid | TONUSDT Potential Long From the KEY ZoneThe price perfectly fulfilled my last idea . OKX:TONUSDT is pulling back from a fake breakout above 3.590 but holding within the boundaries of an upward channel. The price is approaching strong confluence support near 3.250, where both the trendline and horizontal zone align. A rebound from this level could launch a new bullish leg toward the resistance zone. Buyers will look for confirmation at the bounce area to aim for 3.590 and beyond.

📌 Key Levels

Buy zone: 3.250 – 3.300

Sell trigger: Break below 3.250

Target: 3.590 – 3.700

Buy trigger: Bullish engulfing or breakout from local consolidation near 3.300

💡 Risks

Loss of support at 3.250 trendline

Bearish pressure from broader market sentiment

Another fakeout or choppy move around 3.300–3.400 zone

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

Toncoin Goes Bullish · 4X Leverage · Bottom Prices · OpportunityToncoin is breaking the sideways consolidation pattern. Today we have the highest price since late May, already two months ago, and rising volume. When you see how flat the action at the bottom is, you can tell how strong the bullish breakout that follows will me.

This is a friendly reminder because Toncoin will be huge in this altcoins market bullish cycle. I want you want you to be in, I want you to collect big projects, 1,000%+. That is why I am reminding you now. This trade setup can be approached both with leverage and spot, both options will do great.

After years of bearish action and months of consolidation, Toncoin is ready and the recovery is happening slowly but surely. Prices are rising slowly, no new lows. Prices are moving sideways but knowing the bottom is in the only logical conclusion is a break up. It is on the chart. It is inevitable, it is confirmed; profits and success.

Timing is really essential when trading. If you can get the right entry timing, a great price, trading becomes easy long-term. Once the bullish move shows up, you will be happy sitting in a strong position that only grows. That is because you bought the bottom. We are still looking at bottom prices, the last chance at the "opportunity buy zone."

We are doing 4X but we have positions with higher leverage from where prices were lower. You need to decide your own risk tolerance. If in doubt, zero leverage please. Only when you are 100% certain and you accept the full risk. The full risk is the liquidation of your position, all money gone. Are you ready to lose everything? If you are, better start trading spot. The chances of losing are very low. If prices drop, you get to pick a small paper loss and nothing more. Your number of altcoins stay the same. When the market starts to move, your money grows and the paper loss turns into a gain. You can't lose if you don't sell when prices are down. Buy when prices are low. Hold strong through the bullish wave. The time to buy is now. Buy and hold. You will be happy with the results.

Namaste.

TONUSDT Forming Falling WedgeTONUSDT is forming a classic falling wedge pattern, which is widely recognized in technical analysis as a bullish reversal signal. After a period of consistent downward price compression, the narrowing structure on the chart signals that selling pressure may be weakening. This setup often precedes a significant bullish breakout, especially when accompanied by growing interest and steady volume—as is currently being seen in TON’s market behavior.

The fundamentals behind TON (The Open Network) are also strengthening, with increasing adoption across the Web3 ecosystem and a growing number of partnerships tied to Telegram's user base. The synergy between Telegram and the TON blockchain has created an environment where real-world utility is beginning to align with on-chain momentum. This alignment often catalyzes strong upward price moves, making TONUSDT one of the more promising altcoin setups in the current market landscape.

The expected gain of 140% to 150% from current levels is not just speculative—it aligns well with the technical breakout projection based on the wedge’s height and the last key swing high. If TON can maintain support above the lower boundary of the wedge while volume continues to increase, the likelihood of a breakout followed by a strong upward rally becomes much higher. Historical breakout moves from similar wedge patterns often show explosive growth in relatively short timeframes.

TONUSDT is a high-potential chart right now and should be closely monitored by traders and investors looking for large-cap altcoin opportunities with bullish technical setups. This could be the start of a major trend shift for TON, especially as broader crypto sentiment begins to tilt bullish again.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

TON/USDT | Surges 18% – Eyes on $3.63, Then $4.20 and $4.68!By analyzing the Toncoin chart on the 3-day timeframe, we can see that after a pullback to the $3 area, strong demand kicked in, and within just one week, the price surged over 18%, reaching above $3.5. Toncoin is currently trading around $3.53, and I expect it to hit the $3.63 target soon. The next bullish targets after that are $4.20 and $4.68.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

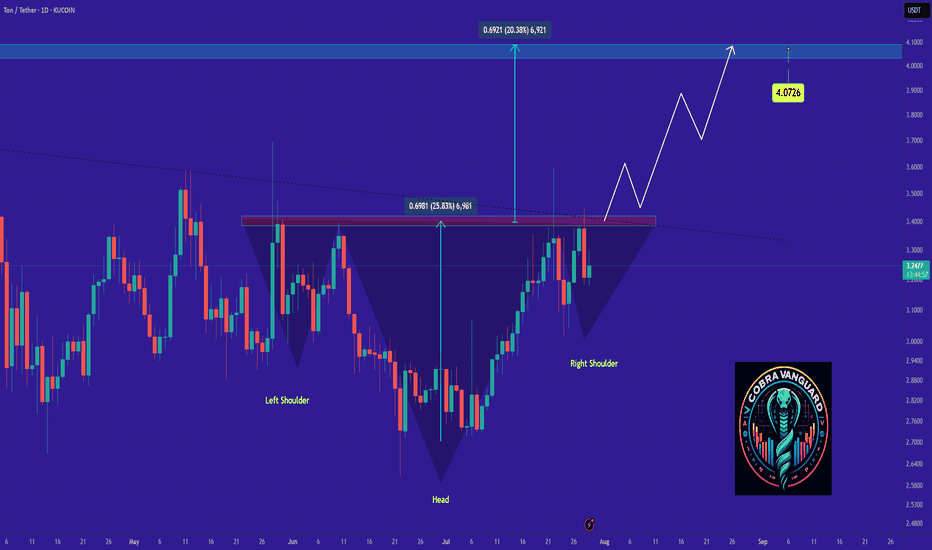

Toncoin (TON): Targeting $4.10TON coin looks still good; recently we filled one ofo ur targets and now price is near local liquidity area, which we intend to see to be broken and once we get that breakout, we are going to aim for the $4.10 area, so keep an eye on it for now

Swallow Academy

TONUSDT Analysis : Bullish Setup Breakout – Advanced MMC Analyze“Blue Ray Pattern Breakout Confirms Bullish Trend Continuation”

The 30-minute chart of TONUSDT highlights a clean and structured bullish setup based on the MMC (Mirror Market Concepts) methodology. The price action exhibits disciplined market behavior, respecting structural levels, breakout dynamics, and volume-based reactions.

🔷 1. Blue Ray Pattern – Trend Continuation Phase

This chart begins with the formation of the Blue Ray, a visual representation of trend consolidation and energy buildup. This pattern functions as a trend continuation flag or wedge. Prices compressed within a narrowing range, forming higher lows and lower highs, signaling accumulation under buyer control.

Once the pattern matured, we witnessed a decisive bullish breakout, where the price closed above resistance with conviction. This event marked a clear market intention shift and established a new impulsive leg.

🔍 2. Breakout Confirmation and Follow-Through

Post-breakout, TONUSDT experienced:

High-volume candles with elongated bodies, indicating increased buyer participation.

Immediate upside momentum that pushed the asset into a short-term overextended condition – often a healthy sign of strength when followed by a controlled pullback.

The breakout wasn’t just a false move – it was sustained, and the price held above the broken structure, proving that supply was absorbed and buyers were dominant.

🔑 3. Demand Zones (Minor and Major)

Two key MMC demand zones are highlighted:

🔹 Minor Demand Zone (~3.43–3.45):

This is the most immediate support and current price is hovering just above it. It's the first zone of interest for buyers and may serve as a re-entry or scaling point.

🔸 Major Demand Zone (~3.34–3.36):

In case of deeper retracement or volatility, this zone is expected to act as a strong bounce region based on past structure and MMC’s reversal logic. Price memory here suggests accumulation or reactive interest.

📐 4. Structure, Momentum, and Higher Timeframe Confluence

TONUSDT is in a confirmed uptrend, forming a clear sequence of higher highs and higher lows.

The structure supports a bullish flag breakout with minimal overhead resistance.

The projected path drawn on the chart illustrates a stair-stepping price pattern with continuation toward 3.60–3.70, if current levels hold.

📊 5. MMC Strategy Bias – Bullish

Using the MMC lens:

Blue Ray breakout confirms continuation

Volume absorption succeeded at the base of the flag

No signs of dominant supply entering post-breakout

Wave projection supports ongoing momentum

Structure favors buying dips, not shorting spikes

💡 Trader’s Takeaway:

TONUSDT is providing a textbook bullish opportunity under the MMC framework. As long as price stays above the Minor Demand Zone, continuation upward toward 3.60 and beyond remains in play. If price dips to the Major Zone, watch for strong buyer reactions for fresh entries.

Ideal for MMC traders and technical analysts looking to align with structured, logic-based entries and exits. This setup reflects market strength, technical clarity, and volume confirmation – a powerful trio for continuation plays.

TON is coming back to lifeAfter its past hype on tap-to-earn games and Durov's arrest, many buried the project.

However, it has recently begun to show signs of life and actively develop its ecosystem. Looking at the chart in more detail, I noticed many interesting patterns:

➡️ First, regardless of whether the price of TON is moving up or down, purchase volumes have been growing for a year now. This indicates extremely high confidence in the token and the ecosystem.

➡️ Second, Money Flow also shows inflows of fresh liquidity starting in March 2025. This means that new holders have been entering the token for almost half a year.

There is also a partial divergence with the price, as a flag pattern has formed on the chart since then. At the same time, liquidity has remained virtually unchanged during this period, forming a flat pattern.

➡️ Thirdly, TON is currently trading around the largest support zone at $2.911. With each correction, it reaches this level again, triggering a huge number of limit orders to buy.

➡️ Fourth, during the correction, a GAP was formed at the top at $4.855 - $3.883. And as we know, 99% of GAPs close sooner or later.

📌 Conclusion:

Right now, the token is super undervalued, according to the market and me too. Plus, it's really far from its ATH and is still trading close to its all-time low.

All this makes it a promising asset to buy even right now, in the middle of alt season 🔥

TON Swing Trade – Support Zone in FocusTON is holding a major support level, setting up for a potential bounce. With structure intact, this offers a favorable long entry for swing traders looking to capitalize on the next leg up.

📌 Trade Setup:

• Entry Zone: $3.20 – $3.35

• Take Profit Targets:

o 🥇 $3.60

o 🥈 $4.00

• Stop Loss: $3.088

TONUSDT Bullish Reversal from Demand with QFL Base | MMC Setup📊 Technical Breakdown – 4H Chart

✅ Overview

TON/USDT is exhibiting early signs of a bullish reversal after a structured decline into a key smart money demand zone. The setup reflects multiple layers of confirmation—QFL base, multi-supply absorption, liquidity inefficiencies, and a positive reversal pattern—suggesting a high-probability opportunity for upside.

🔹 1. Impulsive Move & Liquidity Sweep

Price rallied aggressively on July 22–23, pushing toward $3.60, breaking short-term highs and triggering liquidity grabs above recent consolidation zones.

This surge absorbed significant buy-side liquidity, leaving a supply zone behind, now marked as the Next Reversal Zone.

After liquidity was collected and orders filled, the market reversed sharply, consistent with institutional profit-taking or engineered liquidation traps.

🧠 Smart Money Insight: Institutions often push price into illiquid zones (above highs) to trap retail and fill large orders. This marks the first phase of the trap.

🔻 2. QFL Base and Multi-Supply Absorption

The price structure created a Quick Flip Level (QFL) — a smart money concept where price forms a base, drops, then rallies, leaving behind an institutional demand zone.

The current pullback has revisited this exact QFL base, now reinforced by 3x supply absorption, enhancing the zone's strength.

This confluence increases the probability of a strong reaction to the upside from this level.

📌 Note: The “If Cross 3x Supply” label shows that this zone has absorbed multiple attempts to break down. It's now acting as a demand pocket.

🔄 3. Reversal Area – The Engine Room of Smart Money

The Reversal Area is carefully marked at $3.20–$3.28 — the ideal discounted price zone where large buyers tend to step in.

This zone is structurally important:

Past breakout level

Aligned with QFL base

Beneath stop levels of breakout traders

A Positive Pattern has now formed within this area—likely a bullish engulfing, morning star, or pin bar, depending on candle confirmation.

📌 Psychology: This zone acts as a trap. Retail traders often panic sell here, while smart money accumulates quietly before launching price upward again.

🧭 4. Dual Scenario Structure – Projected Paths

You’ve beautifully mapped two valid future price scenarios based on reaction to the Central Reversal Zone (~$3.35):

🔵 Scenario 1 – Healthy Pullback Before Continuation

Price climbs toward the central zone, then pulls back slightly to retest support near $3.28–$3.30 (label 1).

This allows further accumulation before price breaks higher.

This is a safer re-entry scenario for patient traders looking for a retest.

🟢 Scenario 2 – Direct Impulsive Rally to Next Reversal Zone

Price continues with bullish momentum, slicing through $3.35 and aiming for the Next Reversal Zone at $3.52–$3.60 (label 2).

This zone contains remaining liquidity, left uncollected from the previous impulse.

Price is likely to reverse or pause at this level again due to heavy supply.

📌 Key Tip: If price reaches that zone without significant resistance or exhaustion, it may signal continuation potential with minor corrections.

💼 Strategic Trade Plan (High-Probability Setup)

Entry Zone: $3.20 – $3.28 (Reversal Area)

Stop-Loss: Below $3.15 (beneath structure + QFL base invalidation)

Target 1: $3.35 (Central Reversal Zone)

Target 2: $3.52–$3.60 (Liquidity Completion & Next Reversal Zone)

🧮 Risk-Reward Estimate:

Conservative: 1:1.8

Aggressive: 1:2.5 or better if price reaches high liquidity zone.

🔄 MMC Flow Summary – What the Market Makers Are Doing:

Create a trap at the top (collect liquidity and fake the trend)

Force price down into demand (scare retail + grab stops)

Absorb sell orders in bulk at QFL/demand zone

Form bullish reversal pattern (positive structure)

Push price upward again, aiming for uncollected liquidity above

📌 This is a classic MMC cycle — engineered by large players, and now you’re aligned with their strategy.

🧠 Why This Matters

This chart isn’t just about entry and exit; it’s about understanding the underlying psychology and structure. By aligning with the smart money footprint — QFL, supply absorption, and liquidity targeting — you're maximizing edge and minimizing guesswork.

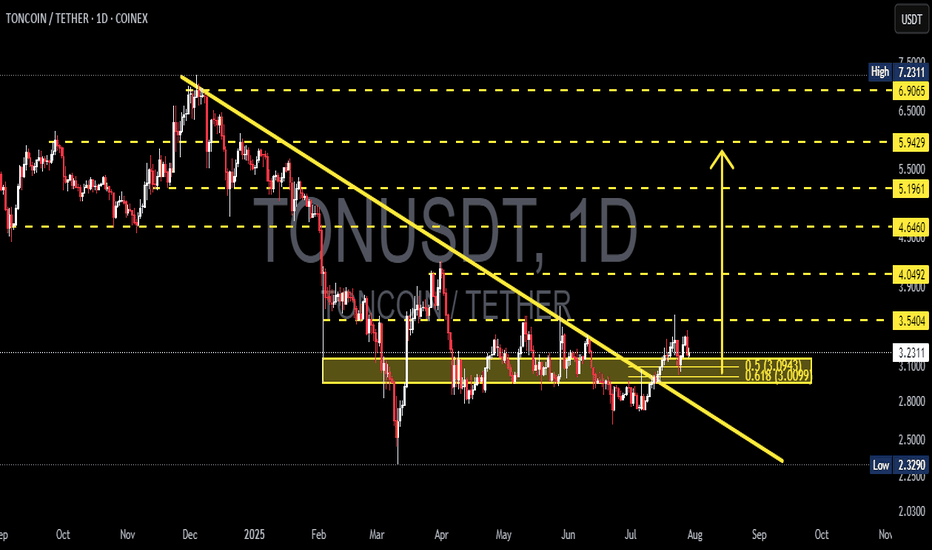

TONUSDT Breaks Out of Bearish Grip! Is a Bullish Rally?🔎 1. Key Pattern: Descending Trendline Breakout + Reaccumulation Zone

After months of downward pressure, TONUSDT has successfully broken above a dominant descending trendline that has been acting as resistance since December 2024.

✅ This breakout occurred with a strong bullish candle and aligns perfectly with a significant historical resistance zone (around $3.00–$3.12).

📌 The area also overlaps with the Fibonacci retracement levels (0.5–0.618) — a zone where trend reversals often occur.

This indicates that the move isn't just noise — it might be the start of a mid-term bullish trend.

---

🧱 2. Consolidation Box = Reaccumulation Zone

TONUSDT spent nearly 4 months ranging sideways between $2.80 and $3.20, forming a clear reaccumulation range.

🔁 This kind of price action often precedes a strong breakout, as smart money accumulates before the next leg up.

🟨 This box now acts as a critical demand/support zone for any potential pullbacks.

---

📏 3. Key Levels to Watch (Support & Resistance)

✅ Bullish Targets (Resistance Levels):

🔹 $3.5404 → Immediate resistance

🔹 $4.0492 → Major resistance to break

🔹 $4.6460

🔹 $5.1961

🔹 $5.9429

🔹 $6.9065

🔹 Local High: $7.2311

🔻 Support Levels:

🔸 $3.1248 – $3.0099 → Key Fibonacci support (0.5–0.618)

🔸 $2.8000 → Bottom of reaccumulation range

🔸 $2.3290 → Major support (also the cycle low)

---

📈 Bullish Scenario (Primary Bias)

If price holds above the key zone at $3.00–$3.12, we could see:

A move towards $3.54 USDT

Breakout above $3.54 opens the door to $4.05 → $4.64 → $5.19 and beyond

A clear structure of higher highs and higher lows confirms trend reversal

Momentum remains strong as long as price respects the breakout zone.

---

📉 Bearish Scenario (Alternative Case to Watch)

If price fails to hold above $3.00 and breaks back below $2.80:

This would suggest a false breakout

Momentum may shift bearish again

Price could revisit the $2.32 support, negating the bullish setup

A return to sideways or even downtrend structure is possible

---

🧩 Strategic Conclusion

TONUSDT has broken out of a key descending trendline and reclaimed a strong structural zone, indicating early signs of a bullish cycle.

📊 Key Levels to Monitor Closely:

Support (validation zone): $3.00–$3.12

Immediate resistance: $3.54

Mid-term targets: $4.05 → $5.19 and higher

> As long as TON stays above the golden zone (Fibonacci 0.5–0.618), bulls have the upper hand.

---

📘 Pro Tips for Traders:

Watch for volume confirmation during retests

Be patient for pullback entries or breakout confirmations

Manage risk — don’t FOMO blindly

#TONUSDT #TONCOIN #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #CryptoTrading #TON #Reaccumulation #BreakoutSetup #FibonacciSupport #BullishReversal #TONBullish

Toncoin (TON): Good Opportunity For Long Position | Good R:RToncoin is still looking good for upward movement, despite it moving rather sideways since the last time we checked the coin.

More in-depth info is in the video—enjoy!

Swallow Academy

TONUSDT TON is respecting a rising trendline while holding strong above the key SMA stack. The recent pullback found support right at the 55 SMA, showing potential for bullish continuation.

Technical Overview

• Price trending above the 55/110/220 SMA stack — all sloping upward

• Bounce from 110 & 220 SMA confirms bullish control

• MACD (20, 50, 21) turning up with histogram above 0

• Volume (TC) shows renewed buyer activity

Setup Summary

• Bias: Bullish continuation

• Entry: From 55 SMA support

• Target Zone: 3.77 – 4.20

• Invalidation: Break below 220 SMA or trendline

• Trade Style: Swing (1–2 week hold)

Tactical Takeaway

Clean structure, stacked moving averages, and momentum alignment. No hype — just tactical execution.

#TON Update #5 – July 27, 2025#TON Update #5 – July 27, 2025

TON has moved below its last impulsive wave, initiating a bearish phase on the 4-hour chart. The presence of long wicks may be a sign of significant trapped positions, likely indicating that whales have already closed out their trades in this zone.

Based on the 4-hour chart, Ton’s bearish shift and the following correction point to a new target at the $2.88 level. Keep in mind this analysis applies only to the 4-hour timeframe, not the daily.

You should consider the timeframe in which you're trading. As long as TON does not break above the $3.60 level and close a candle with a new high, it will remain bearish on the 4-hour chart. Therefore, I do not recommend any trades on TON at the moment.

TON/USDT - Bullish Channel in H4 (27.07.2025)The TON/USDT pair on the H4 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Channel Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming Days.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3.770

2nd Resistance – 3.989

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

TON/USDT - ATH !!!TON/USDT has been in a sideways consolidation phase for over 100 days, tightly ranging between the $2.90–$3.50 zone. This prolonged accumulation is forming a solid base structure, often seen before major trend reversals in high-cap altcoins.

Recent price action is beginning to show early signs of bullish momentum, with buyers gradually stepping in and volume starting to rise. This area is historically significant and marks a high-probability entry zone, especially if the market confirms the breakout.

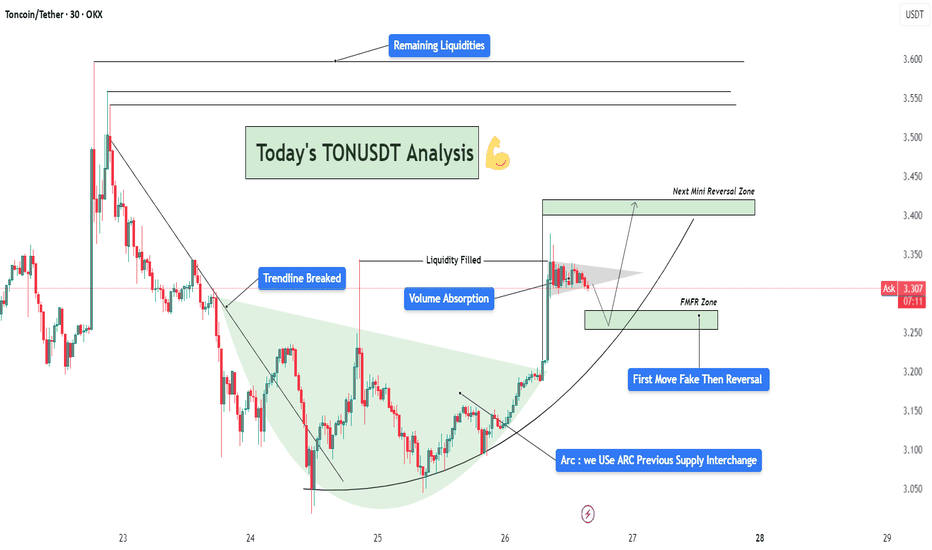

TONUSDT Analysis – Trendline Breakout | Liquidity| Arc + Target📈 Chart Summary:

The TONUSDT 30-minute chart presents a clean smart-money setup after a trendline breakout, volume absorption, and liquidity fill, supported by a beautifully formed ARC accumulation pattern. This structure hints at institutional involvement and a strategic roadmap for the next probable moves.

🔎 Technical Components Breakdown

1️⃣ Trendline Breakout – Shift in Structure

Price had been following a descending trendline with multiple touches, establishing bearish market structure.

Eventually, that trendline was violently broken to the upside, signaling a change in character (CHOCH) – one of the first signs of a potential bullish reversal.

The breakout candle was strong, with a wide body and notable bullish volume. This often indicates institutional interest or engineered breakout via a stop-hunt.

2️⃣ Volume Absorption – Smart Money Accumulation

After the breakout, the price didn't immediately rally. Instead, it consolidated with wicks on both sides – a sign of volume absorption.

This is where smart money absorbs opposing orders, typically absorbing sellers before a larger directional move.

This consolidation confirmed the idea of liquidity engineering – they trap liquidity (shorts) and use it as fuel.

3️⃣ Liquidity Filled – Stop Hunt Behavior

A sharp wick into previous highs grabbed resting liquidity, filling orders and sweeping stop losses.

This action invalidated weak resistance, setting up the platform for a larger move.

🧠 Conceptual Structure – ARC Play & Reversal Dynamics

✅ ARC Formation – Rounded Accumulation Base

The light green arc highlights the rounded bottom, a common technical pattern representing accumulation over time.

This kind of base often indicates that smart money is building positions silently, especially after a significant downtrend.

In this context, the ARC acts as a dynamic support, and the structure mimics the reversal of market sentiment from bearish to bullish.

🌀 FMFR Zone – “First Move Fake, Then Reversal”

Labeled FMFR zone between 3.22–3.26 signifies a potential trap setup.

The expectation is a manipulated downward move (fakeout) that will be quickly reversed, catching breakout sellers off-guard.

Smart traders can use this as a high-probability re-entry zone by waiting for wick rejection, engulfing candles, or bullish divergences.

📍 Short-Term Targets & Zones

🟩 Next Mini Reversal Zone – 3.38 to 3.42

This is a probable area for minor pullback or distribution, especially for scalpers or short-term trades.

Price may stall here due to earlier supply and psychological round levels.

🟦 Remaining Liquidity Zones – 3.55 to 3.63

Higher timeframe liquidity remains uncollected above.

If bullish momentum continues with support from volume and structure, expect price to sweep these levels next.

These zones are ideal for medium-term swing targets.

🧾 Trade Setup Idea (Not Financial Advice)

Item Details

Entry On rejection/confirmation within FMFR zone (3.22–3.26)

Stop-Loss Below arc support or structural low (3.18 area)

TP1 3.38 (Mini reversal zone)

TP2 3.55 (Liquidity target 1)

TP3 3.63+ (Extended target)

📘 Market Psychology in Action

Fear/Greed Play: Initial selloff invited fear, smart money accumulates quietly via the arc. Fakeout traps greed and late shorts.

Trap-Reversal Model: FMFR zones exploit retail stops, offering entries for institutional players.

Liquidity Mapping: The chart clearly maps how price is attracted to uncollected liquidity zones – a classic order flow approach.

Toncoin Wave Analysis – 25 July 2025- Toncoin reversed from resistance level 3.5585

- Likely to fall to support level 3.0000

Toncoin cryptocurrency recently reversed down from the key resistance level 3.5585 (which is the upper boundary of the sideways price range inside which the price has been trading from April).

The key resistance level 3.5585 was strengthened by the upper daily Bollinger Band.

Given the strongly bearish crypto sentiment seen today, Toncoin cryptocurrency can be expected to fall to the next round support level 3.0000 (former resistance from the start of July).

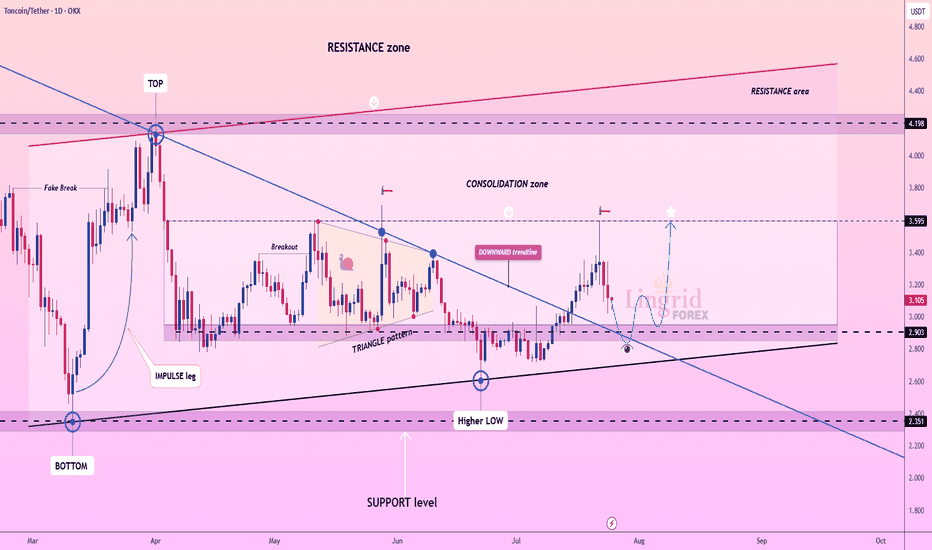

Lingrid | TONUSDT Potential Rebound from Support ZoneThe price perfectly fulfilled my last idea . OKX:TONUSDT is testing support after pulling back from the consolidation zone and forming a higher low above key structure. The chart shows a breakout from the downward trendline followed by a corrective retracement back toward confluence support. As long as price stays above 2.903, a bounce and renewed move toward 3.595 remains the base case. Structure favors bullish continuation after the retest of the breakout level.

📉 Key Levels

Buy trigger: Break and hold above 3.200

Buy zone: 2.903 – 3.050

Target: 3.595

Invalidation: Break below 2.903

💡 Risks

Failure to hold confluence of upward trendline and horizontal support

Weak follow-through above 3.2 could indicate distribution

Resistance at 3.595 may trigger renewed selling before breakout

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!