Crypto Total Market Cap Excluding BTC and ETH, $

No trades

Key data points

Previous close

—

Open

—

Day's range

—

About Crypto Total Market Cap Excluding BTC and ETH, $

Bitcoin and Ethereum are such major players and so popular among investors that when you enter the market, they draw all the attention to themselves leaving other coins in their shade. It's not that they do not deserve this attention, but without their colossal figures, investors could take a healthier look at the crypto market to define its overall state and direction. Following this logic, we've calculated total crypto market capitalization excluding BTC and ETH market caps and displayed how the final number changed over time on the chart. Hope it proves useful in your analysis of crypto markets.

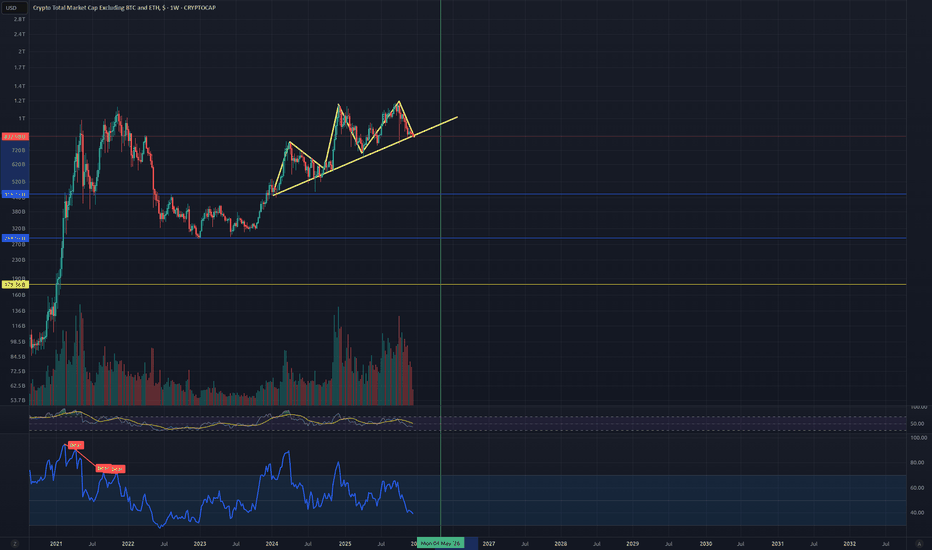

TOTAL3 (1W) — Elliott Wave White Scenario

TOTAL3 often produces overlap, messy structure, and wick traps. This idea is valid only if price respects the levels listed below and especially the 580B weekly rule.

Bigger Picture (Wave Structure)

We are dealing with Wave 5 of 5 on a higher degree.

Wave 3 (higher degree) topped on Decembe

are you ignoring the power of divergence in trading?Let’s talk about divergences - the closest thing we have to seeing the future in technical analysis.

Price is lying to you all the time. Indicators lie too. But when price and indicator start lying in different directions - that’s divergence. And that moment, when the lies don’t match anymore, is w

TOTAL: bounce or further drop? Key levels to watch today!Tired of watching your whole crypto watchlist bleed in sync and wondering if the party is over for everyone at once? Lately headlines about tighter liquidity and fresh regulatory pokes have turned sentiment risk-off again, and according to market data the TOTAL crypto cap just flushed to new local l

Altcoins at Risk of a Bigger Drop Alongside BitcoinPoint 1:

In the past, breaking the 100-week moving average led to a 48% drop.

This has happened again and could result in a decline to around $420 billion market cap.

Point 2:

A rising wedge pattern that leads to a bearish move has formed, just like before.

Additionally, Bitcoin is following its 4

Crypto May Be In Trouble!Trading Fam,

I feel dirty for posting these recent titles. They are not intended to be clickbait. I swear. I am only relaying to you what I am seeing in the charts. I never really gain popularity by becoming bearish on crypto anyways. Degens still heart the moonboys. I am not one.

Now, to put it s

TOTAL3: Altcoins Prepare for $8.6T Market Cap by 2029Based on fractals and fibs, considering common possibilities and eliminating those which were deemed unlikely, TOTAL3 appears primed to extend its run throughout 2028. The waves may not produce pure verticals as it did in the past and instead, we could see years of overlapping, ping-pong action. Wit

Total 3 - Future TargetsHere is a more in depth analysis of my last post:

First, we have two Fibonnaci trends drawn. The one from the macro lo around $28 B to the top around $1.3T. This is where we can see the marketcap triple topped in our last post by every weekly candle closing below $1.3T. What you can also see is c

Total 3 - Triple TopOne thing that I just noticed when looking back at old charts is Total 3 triple topped!

Looking back at our 2021 top, both 2024 and 2025 were rejected at the exact same level! We can confirm this as every single weekly candle failed to close above the pivotal $1.3T level. I am also seeing total 3 s

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's value movements over previous years to identify recurring trends.