EURUSD: Price May Continue To Fall Inside WedgeHello everyone, here is my breakdown of the current Euro setup.

Market Analysis

From a broader perspective, the price of EURUSD has shifted into a bearish phase after a prior Upward Channel failed and broke down. This reversal led to the formation of the current Downward Wedge, a pattern that has been guiding the price lower through a series of lower highs and lower lows.

Currently, the price is at a critical decision point. After bouncing from the lower part of the wedge, it has rallied correctly and is now directly testing the descending resistance line of the formation. This is a key area where sellers have repeatedly shown strength in the past.

My Scenario & Strategy

My scenario is based on the expectation that this Downward Wedge is a continuation pattern and the dominant downtrend will resume. I'm looking for the price to be rejected from the wedge's resistance line. A confirmed failure to break higher would be the key signal that the next impulsive move down is about to begin.

Therefore, the strategy is to watch for this rejection. A confirmed reversal would validate the short scenario. The primary target for this move is the 1.1615 Support, which aligns with the major Support zone.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

USDEUR trade ideas

EU - Bullish Bias🔹 Pair: EURUSD

🔹 HTF Overview: Major higher-high order block respected cleanly. Strong bullish intent and volume confirmed; market structure favors upside continuation.

🔹 MTF Confirmation: Original OB failed, but price tapped deeper into the hidden anchor block. Expecting this zone to act as the true smart money foundation.

🔹 LTF Setup: Waiting for a CHoCH and lower-high break. After that, I’ll target a pullback below 50% equilibrium into discounted areas for long entries.

🔹 Targets: Continuation toward higher-timeframe liquidity above recent highs.

🔹 Mindset Note: Patience is the edge. Smart money confirms before committing.

EURUSD SUPPLY LEVEL REJECTED|SHORT|

✅EURUSD after a clean retest of the supply zone, rejection wicks and initial displacement lower set a bearish draw. ICT bias favors continuation as price seeks sell-side liquidity below recent lows, rebalancing nearby inefficiency. Time Frame 3H.

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

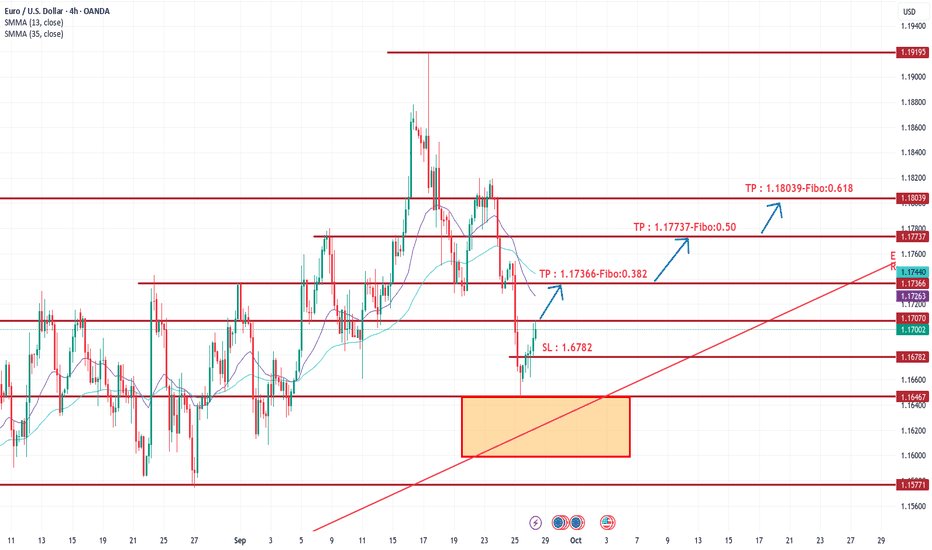

EURUSD H4- Strong Bullish Trend Daily and Weekly

EURUSD : Strong Uptrend based on Moving Average.

Recommendation : Buy Trading if the price is 1.10924 above

Analysis -

1. Strong Bullish Trend - Daily and Weekly

2. Support and Registance

3. Fibo Retracement

4. Moving Averages

SL1 : 1.16782

SL2 : 1.16467 (Recommendation)

TP1 (Fibo: 0.382) : 1.17366

TP2 (Fibo: 0.500) : 1.17366

TP3 (Fibo: 0.618) : 1.18039

EURUSD: Move Down Expected! Short! '

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.17283 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 1.17084.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Shooting Star COT backed reversal play in EURUSDEUR/USD printed a shooting star and engulfing right at the key supply zone around 1.1768 following last week’s FOMC – a strong signal that a potential top might be in place.

The move is not just technical, it’s backed by positioning data:

EUR longs reduced (-3.4k contracts)

USD longs added (+2.5k contracts)

Smart Money is quietly shifting toward the Dollar.

With Eurozone data on deck, the stage is set for a potential catalyst to accelerate the downside. Technically, the next significant demand zone sits at 1.1460. A level that has repeatedly attracted buyers in the past.

Setup: Short bias remains valid below 1.18200

I take an entry on the current supply but would be ready to re-enter if we move into the supply above.

1.TP: 1.16500

2.TP: 1.16000

3.TP: 1.14600

SL: Above 1.1768

EUR/USD Bullish Roadmap — Resistance, Risk, and Reward Levels😂 EUR/USD: The Great "Thief" Wealth Heist Map (Swing/Day Trade) 🤑💸

🎯 Asset: EUR/USD - The Euro vs. U.S. Dollar Forex Fiesta!

📈 Strategy: Swing/Day Trade with a Thief-Style Bullish Plan

🚨 The Master Plan: Bullish Bandit Breakout!

✅ Bullish Confirmation: We’re riding the bullish wave with a pullback to the Kijun-Sen (Ichimoku Cloud’s trusty moving average) for confirmation. This is our signal to jump into the heist!

🔍 Key Levels to Watch: The Kijun-Sen pullback signals strength, so keep your eyes peeled for price action aligning with this level to confirm the trend.

🕵️♂️ Entry: The "Thief" Layered Limit Order Ambush

💡 Thief Strategy: We’re setting up a sneaky layered limit order approach to maximize our entries. Stack those buy limit orders like a pro!

📍 Buy Limit Layers:

1.16800

1.17000

1.17200

1.17400

⚙️ Pro Tip: Feel free to add more layers based on your risk appetite — the more, the merrier (but stay sharp, thieves!).

🎯 Entry Flexibility: You can enter at any price level within this range, but layering ensures you’re grabbing the best deals in this volatile market.

🛑 Stop Loss: The Thief’s Escape Plan

🔐 Stop Loss: Set at 1.16600 to keep your capital safe from the market’s sneaky traps.

⚠️ Note: Dear Thief OG’s (Ladies & Gentlemen), this is my suggested stop loss, but it’s your heist! Adjust based on your risk tolerance and take the money at your own risk.

🎯 Target: Dodging the Police Barricade Trap!

🚨 Take Profit Target: Aim for 1.18700, where a strong resistance zone (aka the "Police Barricade") awaits, combined with an overbought signal and a potential trap for the unprepared.

💥 Why This Level?: Historical resistance + overbought conditions = a perfect spot to cash out before the market pulls a fast one!

⚠️ Note: Dear Thief OG’s, this is my suggested take-profit, but you’re the boss of your loot. Secure profits at your own discretion and escape with the bag! 💰

🔗 Related Pairs to Watch (Correlation Kings)

To make this heist a success, keep an eye on these correlated forex pairs (all in USD):

FX:USDJPY : The yen often moves inversely to EUR/USD. If USD/JPY is dropping, it could signal USD weakness, boosting our bullish EUR/USD plan.

FX:GBPUSD : The pound and euro often dance together. A bullish GBP/USD could reinforce our EUR/USD setup.

OANDA:USDCHF : Another inverse mover. A falling USD/CHF could confirm USD weakness, supporting our bullish bias.

Key Correlation Insight: Watch for USD strength/weakness across these pairs to validate our EURUSD breakout. If the USD is weakening broadly, our bullish heist is more likely to succeed!

🧠 Key Points for the Heist

📊 Technical Confirmation: The Kijun-Sen pullback is our green light for the bullish trend.

🕵️♂️ Layered Entries: Use multiple buy limit orders to catch the best entries and spread risk.

🚨 Risk Management: Stick to your stop loss and take-profit levels, but adjust based on your trading style.

👀 Market Traps: Watch out for the resistance at 1.18700 — don’t get caught by the overbought trap!

🔗 Correlation Check: Monitor USD/JPY, GBP/USD, and USD/CHF for broader market context.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This Thief-Style trading strategy is just for fun and entertainment purposes. Trading involves risks, and you should only trade with funds you can afford to lose. Always conduct your own analysis and consult a financial advisor before making trading decisions.

#️⃣ #EURUSD #ForexTrading #SwingTrading #DayTrading #ThiefStrategy #TechnicalAnalysis #KijunSen #ForexHeist

EURUSD — Retest of Broken Trendline Offers Short Setup📉 EURUSD — Retest of Broken Trendline Offers Short Setup

EURUSD has broken below its ascending trendline and pulled back for a retest near the 1.1730–1.1750 supply area. This zone also aligns with prior support turned resistance, making it a key decision point.

Price is currently trading around 1.1723, and rejection from here could signal further downside toward the 1.1620–1.1600 demand zone.

🔎 Technical Breakdown (4H timeframe):

Trendline break confirms bearish shift ✅

Retest into supply near 1.1750 ✅

Prior support flipped into resistance ✅

Downside liquidity target: 1.1600–1.1620 ✅

🎯 Trade Setup:

Sell Zone: 1.1720–1.1740

Stop Loss: 1.1770 (above supply)

Take Profit: 1.1620 (next demand)

Risk-to-Reward: ≈ 1:3

⚠️ This is my personal trading view, not financial advice.

💭 Do you think EURUSD holds under 1.1750 for a clean drop, or will buyers reclaim the trendline? Share your outlook below 👇

#EURUSD #Forex #TradingView #PriceAction

#029: EUR/USD Long Investment Opportunity

The pair recently broke the 1.1700 support zone, showing strong rejection and signs of a possible bullish reversal. Volume confirms accumulation near the lows, while retail traders remain largely positioned on the short side. Hello, I'm Forex Trader Andrea Russo, an independent trader and prop trader with $200,000 in capital under management. Thank you in advance for your time.

From an institutional perspective, this creates favorable conditions for a potential continuation of the upside.

Momentum indicators are turning positive, and the next few sessions could be crucial for a breakout attempt.

Key Focus:

Support zone around 1.1690-1.1700

Resistance area near 1.1810

Retail sentiment is still strongly short-term → possible upward pressure from institutional investors

⏳ The trend remains bullish in the short term, with expectations of a progressive upward move in the next 24-32 hours.

EURUSD - BEARISH RE-TEST IN PLAYEURUSD on the 1H timeframe is showing a clear bearish structure after breaking down from the recent support zone. The level around 1.1730–1.1732, which previously acted as support, has now flipped into resistance following the strong bearish move. This change in market structure signals that sellers are currently in control.

After a sharp drop, price is now retracing upward to retest the broken support zone, which aligns perfectly with the concept of support turning into resistance (S/R flip). This zone is expected to act as a rejection area, providing a potential short entry for traders waiting for confirmation.

The ideal entry would be around the 1.1730 resistance area, with bearish confirmation candles strengthening the setup. From there, price is expected to resume its downward move in line with the dominant bearish trend.

Trading Plan:

• Entry: Around 1.1730 (resistance retest)

• Bias: Bearish continuation after rejection

• Target: 1.1680 zone (recent swing low / support level)

• Risk Management: Place stop-loss above the resistance zone (1.1740–1.1745), as a breakout above this level would invalidate the bearish setup.

Notes:

The market structure remains bearish as long as price stays below 1.1730 resistance. If price breaks and sustains above this level, the bearish bias weakens, and a potential shift in momentum could occur.

Role of commodities in global trade and economyPart 1: Understanding Commodities

Definition:

Commodities are basic goods used in commerce that are interchangeable with others of the same type. For instance, a barrel of crude oil, a bushel of wheat, or an ounce of gold is considered identical regardless of where it comes from.

Categories of Commodities:

Energy Commodities – Crude oil, natural gas, coal, uranium.

Metals – Precious metals (gold, silver, platinum) and industrial metals (copper, aluminum, nickel).

Agricultural Commodities – Wheat, rice, corn, soybeans, coffee, cocoa, sugar, cotton.

Livestock and Meat – Cattle, hogs, poultry.

Each category plays a different role in global trade and economic stability.

Part 2: Commodities as the Foundation of Global Trade

Historically, trade revolved around commodities. The Silk Road connected Asia and Europe through the trade of silk, spices, and gold. The Age of Exploration in the 15th century was driven by Europe’s hunger for spices, sugar, and precious metals. Even today, 80% of global trade in goods involves commodities or commodity-based products.

Why commodities dominate global trade:

Universal demand across all economies.

Lack of substitutes for essential raw materials.

Their role in industrial production and consumption.

They are priced and traded globally, ensuring uniform valuation.

Part 3: Commodities and Economic Growth

Economic growth and commodities are deeply interlinked. Industrial revolutions, for example, were fueled by coal, steel, and oil. Modern economies rely on rare earth metals for electronics, lithium for batteries, and crude oil for energy.

Energy as an Engine of Growth:

Countries like the U.S., Russia, and Saudi Arabia have built wealth on oil and gas exports.

Emerging economies like India and China depend heavily on imports to fuel industries.

Agriculture and Food Security:

Export-oriented economies such as Brazil (soybeans, coffee) and Thailand (rice, sugar) rely on global commodity demand.

Food prices affect inflation, poverty levels, and political stability.

Metals as Industrial Inputs:

Copper is crucial for construction and electronics.

Lithium and cobalt are now strategic due to electric vehicles (EVs).

Part 4: Commodities as Drivers of Global Trade Balances

Trade balances of countries are shaped by commodities:

Export-Driven Economies: Nations like Saudi Arabia, Qatar, and Russia rely on hydrocarbon exports for their GDP and fiscal budgets.

Import-Dependent Economies: Countries such as India and Japan face trade deficits due to heavy energy and gold imports.

Commodity Cycles: Booms in commodity prices lead to export windfalls, while downturns create fiscal challenges.

Example: The 2003–2008 commodity supercycle, driven by China’s industrial expansion, lifted commodity-exporting nations in Africa and Latin America into high growth.

Part 5: Commodities in Financial Markets

Commodities are no longer just goods; they are also financial instruments traded globally. Futures, options, and swaps allow investors to speculate or hedge against price volatility.

Hedging: Airlines hedge against crude oil price rises. Farmers lock in crop prices in advance.

Speculation: Hedge funds and traders profit from short-term movements.

Price Discovery: Commodity exchanges like NYMEX, LME, and MCX provide transparent price benchmarks.

Thus, commodities act as both physical goods and financial assets in the global economy.

Part 6: Commodities and Inflation

Commodities directly influence inflation and monetary policy:

Rising oil prices increase transportation costs, raising inflation globally.

Food commodity prices (wheat, rice, soybeans) directly affect household expenditure.

Central banks monitor commodity indices to set interest rates.

Example: In 2022, a surge in oil and wheat prices (due to the Russia–Ukraine war) triggered global inflationary pressures.

Part 7: Geopolitics and Commodities

Commodities are tools of power and diplomacy. Nations with resource dominance often use it as leverage.

Oil and OPEC: Saudi Arabia and other OPEC nations control global supply and influence prices.

Russia and Natural Gas: Russia has used gas supplies to Europe as a political weapon.

China and Rare Earths: China controls over 60% of rare earth production, essential for electronics and EVs.

Thus, commodities are not just economic assets but strategic weapons.

Part 8: Commodities and Currency Markets

Commodity exports and imports affect currencies:

Petro-currencies (Russian Ruble, Canadian Dollar, Saudi Riyal) fluctuate with oil prices.

Import-heavy countries (India, Turkey) face currency depreciation when commodity prices rise.

Gold historically acted as the global reserve currency.

Today, the U.S. dollar remains the dominant pricing currency for most commodities, reinforcing its global economic influence.

Part 9: Commodities and Developing Economies

For developing nations, commodities are double-edged swords:

Opportunities:

Export revenues build infrastructure and reduce poverty.

Example: Botswana grew rich through diamond exports.

Risks (Resource Curse):

Overdependence on one commodity leads to vulnerability.

Nigeria suffers from oil dependence and weak diversification.

Sustainable development requires balanced use of commodity wealth.

Part 10: Environmental and Green Economy Dimensions

The global shift toward sustainability is transforming commodity markets:

Transition to Green Energy: Declining demand for coal, rising demand for lithium, cobalt, and rare earths.

Carbon Markets: Carbon credits have emerged as a new tradable commodity.

Sustainable Agriculture: Demand for organic and eco-friendly agricultural exports is rising.

Thus, the energy transition is reshaping trade patterns and creating new winners and losers.

Part 11: Technological Impact on Commodity Trade

Blockchain and Smart Contracts: Improving transparency in supply chains.

AI and Big Data: Predicting price movements and managing risks.

Digital Commodity Exchanges: Increasing retail investor participation.

Technology is making commodities more accessible and efficient to trade.

Part 12: Case Studies

Oil and Middle East Economies:

Saudi Arabia’s Vision 2030 seeks to reduce reliance on oil exports by diversifying into tourism and technology.

Coffee in Latin America:

Coffee exports sustain millions of farmers in Brazil, Colombia, and Vietnam.

Gold in India:

India imports over 800 tons annually, making gold a key factor in its trade deficit and currency movements.

Part 13: Risks and Volatility in Commodities

Price volatility due to demand-supply shocks.

Climate change disrupting agricultural yields.

Political instability in resource-rich regions.

Speculative bubbles in commodity futures.

These risks affect economies, investors, and global trade.

Part 14: Commodities and Global Inequality

Resource distribution is highly unequal:

Africa holds vast mineral wealth but suffers from poor governance.

Western economies control advanced commodity trading platforms.

Developing nations remain vulnerable to price shocks.

This imbalance creates economic disparities globally.

Part 15: Future Outlook of Commodities in Global Trade

Energy Transition: Renewables and EV metals will dominate.

Food Security: Climate change will raise importance of agricultural trade.

Technology-Driven Markets: AI-driven commodity trading will expand.

Sustainability: ESG (Environmental, Social, Governance) metrics will shape trade policies.

Conclusion

Commodities remain at the heart of the global economy. They power industries, feed populations, and drive trade balances. They influence inflation, currencies, geopolitics, and financial markets. While services and technology are growing, commodities still act as the foundation of global trade.

The future will see commodities reshaped by sustainability, technology, and geopolitics. Nations that manage their commodity wealth wisely, diversify their economies, and adapt to green transitions will thrive in the global marketplace.

In essence, commodities are not just goods—they are the lifeblood of the global economy.

EUR/USD H1 Technical Analysis – Sep 29, 20251. Main Trend

The H1 chart shows the pair is in a downtrend, confirmed by lower highs and lower lows.

The red arrows mark key resistance levels where price has previously reversed downward.

2. Key Support & Resistance Levels

Immediate resistance: ~1.1760 (swing high, point A)

Next resistance: ~1.1820 – 1.1880 (previous highs)

Immediate support: ~1.1715 – 1.1720 (recent swing low)

These levels are crucial for planning entries and exits according to swing high/low principles.

3. Short-term ABC Retracement Scenario

The chart illustrates a potential ABC corrective wave:

(A) – initial upward retracement after the low

(B) – corrective pullback following A

(C) – expected continuation upward toward the next resistance

This is a counter-trend retracement pattern within a larger downtrend. Price may rise short-term but could face selling pressure near resistance.

4. Trading Strategies

Strategy 1 – Trend-following (short):

Wait for price to pull back to zone B ~1.1720–1.1725

Open a short position aiming for the continuation of the downtrend

Stop-loss: above resistance A ~1.1760

Take-profit: near the recent swing low ~1.1715

Strategy 2 – Short-term reversal (long):

If price breaks resistance A (~1.1760) with strong bullish momentum

Open a long position targeting the next resistance zone ~1.1760–1.1780

Stop-loss: below B low ~1.1720

5. Supporting Tools

Trendlines: Connect highs/lows to spot potential breakout points

EMA (9/21 H1): Crossovers can confirm short-term retracement waves

RSI H1: Identify overbought/oversold conditions to confirm momentum

- Summary

Main trend: Downtrend

Key levels: Resistance ~1.1760, 1.1820; Support ~1.1720

Strategy: Wait for ABC completion → sell with trend or buy on breakout

Indicators: EMA + RSI + Trendlines to confirm entries and exits