Long trade

4Hr TF overview

Trade Journal Entry

Pair: SOLUSDT (Perpetual Mix Contract)

Type: Buyside trade

Date: Sunday 6th July 2025

Session: NY Session AM (00:00 am)

Timeframe: 4H

Trade Parameters

Entry: 147.797

Profit Level (TP): 289.421 (+95.82%)

Stop Level (SL): 145.025 (-1.88%)

Risk–Reward (RR): 51.09

Narrative

Market structure confirmed a macro bullish reversal, with price breaking above previous bearish ranges. Entry taken at discounted accumulation zone around 147.80, just above higher timeframe demand. Stop Loss is placed just beneath the structural low at 145.02 to protect against invalidation. Target projected into premium pricing at 289.42 — aligning with historical resistance & Fibonacci extension levels.

RR extremely favourable (51:1), reflecting asymmetric reward potential.

Trade captured continuation of NY session momentum, backed by strong volume inflows.

Mapping SOLUSDT since July 2025, and thought to share at this point for the community.

USDTSOL.P trade ideas

SOLANA LONGFed rate cut finally came in as expected with more on the way going forward.

All the 401k money is about to flood in to the market and most people are betting on Solana.

Ascending triangle breakout fully complete. Going long from here

Minimum price target from here is 480-500 zone .

SL below 185

SOL – Bulls Holding the Channel!SOL has been overall bullish, trading inside a clean ascending channel. Price broke above the $215 – $220 structure zone and pushed higher, but is now pulling back for a retest.

This zone is key 🔑 . It aligns with channel support, making it a strong confluence for buyers to step in. If bulls defend it, momentum could continue, and SOL may push toward higher levels inside the channel 🚀.

If the zone fails, a deeper correction could follow before another attempt from the bulls. Until then, the bias remains bullish as long as structure holds.

What do you think — will the bulls 🐂 step in and send SOL flying again, or will bears take over for a deeper pullback? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

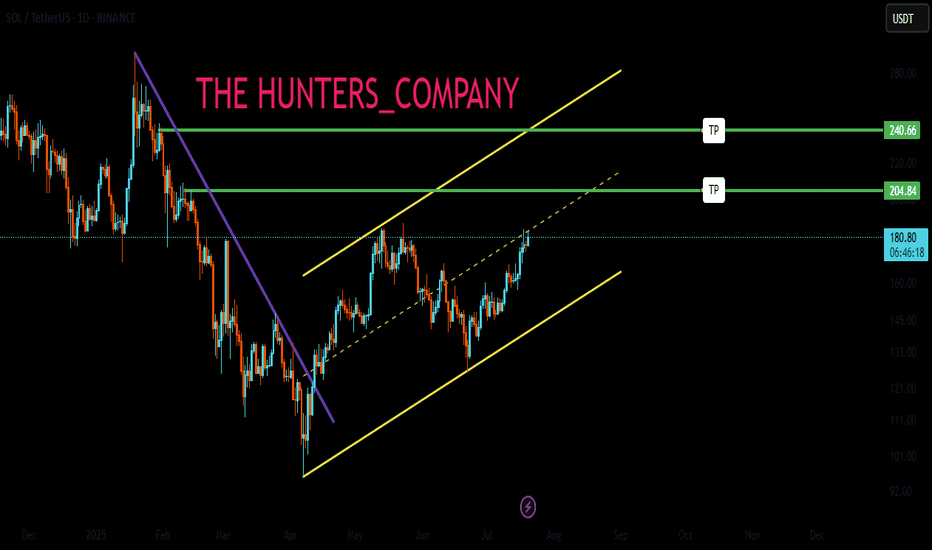

SOL/USDT – Daily OutlookSolana continues to trade within a bullish structure after breaking above key resistance. Momentum indicators suggest short-term exhaustion, opening room for a potential retracement.

The nearest demand zone lies between $216 – $202, which could serve as a re-entry area if price corrects lower. As long as this zone holds, the medium-term outlook remains bullish.

Fibonacci projections point towards $280 – $300 (1.236 – 1.618 extension) as the next upside targets, aligning with a potential strong resistance area.

In summary, while a short-term pullback is possible, the broader trend remains bullish with clear demand support below and Fibonacci targets above.

SOL — Bulls Need to Defend $230 for ContinuationSOL had a strong bullish week, almost tapping the $250 psychological level before rejecting down into the monthly level at $231.77, where price found support and bounced. This level also aligned with the 1.272 Fib extension ($231.96), making it a valid long opportunity.

🟢 Next Long Opportunity

The 0.382 Fib retracement ($230.39) of the move from the $199.32 low is the next key level to watch.

A retest here would:

Sweep liquidity from the current low

Offer a low-risk entry

Help fill some imbalances

📌 Overall, $230 is the level that must hold for bullish continuation.

Targets

TP1: $238 → R:R ~1:3

TP2: $252.91 (0.786 Fib retracement) → R:R ~1:8+ if momentum continues

Risk Management

Stop-Loss: Below $229 (clear invalidation)

Risk: Only 1% on this trade setup

Quick Take

If $230 holds, SOL could set up for another leg higher. This zone offers a clean, low-risk, high-reward long setup with clearly defined invalidation and attractive targets.

SOL There is No time to Give up! Change your life now!The initial target is to break 255 then 295-300 to break the all time high, then it will immediately fly to 420 - 450, here will start crazy volatility until 600 and above, then retail will enliven the Sol market, the price you need to be aware of is the price above 1000 - 1300 USD, because it is possible to get there, but volatility will be very fast, therefore the target price that we need to secure is around 600-800, for me I will aim for 630-730 from what I have analyzed.

Notes:

FED CUT RATES

SOLANA FIREDANCER

SEEKR

SOLANA ETF EARLY OCTOBER

PEACE WORLD UKRAINE_RUSSIA

FOMC CUT RATES TIL 1%

thank you and good luck

System Hopping - The Hidden Cost of Self-DoubtNOTE – This is a post on Mindset and emotion. It is NOT a Trade idea or strategy designed to make you money. If anything, I’m taking the time here to post as an effort to help you preserve your capital, energy and will so that you are able to execute your own trading system as best you can from a place of calm, patience and confidence.

Here’s a scenario:

You take a loss.

Then another.

Suddenly, the system you trusted yesterday feels broken today.

On this chart of Solana, imagine you were trading a breakout system. You may have had four false breaks that didn’t really follow through before the market finally broke higher. When do you give up on the idea or the system altogether?

How self-doubt shows up:

You start thinking: “Maybe another system would have worked better…”

You switch, tweak, reinvent mid-cycle.

You lose patience with the method you worked so hard to design.

You are in danger of system hopping.

Emotional side:

Self-doubt often disguises itself as “rational analysis,” but underneath it’s uncertainty, frustration, even a tightening in the chest. You hesitate to pull the trigger, second-guess your plan, or overcorrect with a brand-new approach.

It’s rarely your system that’s broken.

It’s the lack of trust in yourself to see it through.

Shift your mindset

Every system has drawdowns. If you abandon yours too soon, you never let it prove itself. So the task really is to find a way to collect the data without blowing out / over extending yourself.

Practical tips … the How:

Write down your system rules and keep them visible, so you trade what’s planned, not what you feel.

Track results over a proper sample size (50–100 trades) before judging performance.

Make sure you are position sizing sensibly. This is an art in and of itself. The key being - do not risk what you can not afford on any one trade / series of trades. Paper trade if you need to to start with just to collect the data on the system.

Journal emotions separately from trade outcomes — so you see when doubt is about you, not the system.

Set a “no system changes” rule during drawdowns. Only review at scheduled intervals.

Closing thought:

Your edge doesn’t come from finding the perfect system.

It comes from trusting a good one long enough to let it work.

Solana: Selling Pressure Hits 6-Month High as SOL Price Nears $2Currently, Solana trades at $235, sitting just 6% below the $250 milestone. Over the weekend, SOL attempted to reach this target but failed. However, it has managed to hold steady above the $232 support level.

If bullish momentum continues, Solana could rebound from $232 and test resistance at $242. A successful breach, particularly if long-term holders slow their selling. This could push SOL toward reclaiming $250 in the near term.

However, if selling pressure from long-term holders accelerates, Solana may struggle to defend $232 as support. This scenario could result in a correction toward $221, undermining bullish momentum and invalidating near-term upward projections.

Bullish Momentum Building for Solana (SOL) – Targeting $300!Solana (SOL) is showing strong bullish momentum on the 4-hour chart. The ascending curve pattern suggests a continuation of the uptrend, with price currently hovering around $234.87 and a projected move toward $300 .

🔍 Key Highlights:

Strong Uptrend: Higher highs and higher lows confirm bullish structure.

Technical Setup: Ascending pattern with clear breakout potential.

Target: Price projection points toward $300.

Risk Management: Stop loss level marked to protect against reversals.

This setup offers a great opportunity for swing traders and crypto enthusiasts looking to capitalize on Solana’s momentum. Stay tuned for updates and trade smart!

SOL – Demand zoneIncredible run on that last leg up, fueled by DAT buying.

We took some HTF internal liquidity, now I'm looking for price to bleed back into the demand zone marked on the chart.

Another scenario is that we might get another push up first, but it looks like that could trigger some more sellers to step in so I'll be patient for the demand block.

Ultimately, new highs are not out of the question I think.

$Sol Daily Bearish Divergence with Key Supports at $220Solana is flashing some important signals across multiple timeframes right now.

On the daily chart, a clear bearish divergence has formed while buying volume is steadily declining. This setup usually points toward a healthy correction phase. At the moment, SOL looks like it could slide toward the $225–$220 zone, where we might see the first reaction.

If SOL manages to hold above $200 support, this pullback could simply turn into a higher low, setting the stage for continuation upward. But here’s the caution: losing $200 means breaking the last structural support, which could flip the trend and open the doors for a new lower low — potentially triggering a much larger dump.

👉 In short: Watch the $225–$220 range for short-term correction targets. Keep a close eye on the $200 level, because that’s the line between a healthy pullback and a bearish breakdown.

Trade safe and don’t chase candles — let the levels confirm the story.

SOL The Whales are Selling at This Strong Resistance Level 230$SOL Current Market Update

The coin is now facing a very strong resistance around $230 .

This presents a great short opportunity .

After carefully monitoring buy and sell orders on-chain, I noticed a strong confirmation for the short setup:

Whales and Market Makers sell orders are clustered heavily around the $228 – $230 resistance zone.

✅ My Personal Strategy:

Short Entry: Resistance zone between $228 – $230

🎯 Target 1: $220

🎯 Target 2: $216

Please note:

This is not financial advice – I’m only sharing my personal trades.

Always do your own research before taking action.

👍 Don’t forget to like if you found this useful, and feel free to follow me for more analysis of this kind.

Best of luck 🌹

SOL 4H – FVG Reaction at 230 or Deeper Fill to 210?Solana’s trend remains bullish following the August 50/200 EMA cross, but price has pulled into a key FVG at 230. This first zone aligns with the 50 EMA, making it an important test for continuation.

FVG 230 Zone: Holding here could trigger a bounce toward 250+.

FVG 210 Zone: A deeper fill into this gap, confluenced with the 200 EMA, still keeps the broader structure intact.

Stoch RSI: Resetting at oversold, suggesting potential upside momentum if support confirms.

The next move depends on whether buyers defend the 230 FVG or allow price to dig into the 210 gap before continuation.

SOLANA UPDATEHello friends🙌

📉Given the decline we had, you can see that buyers came in and supported the price and were able to change the trend and create an ascending channel.

📈Now, considering that the price is hitting higher ceilings and floors, we can expect an ascending wave until the ceiling of the channel.

Don't forget risk and capital management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

Up or down?Hello friends

Well, considering the growth we had, the analysis of which we have already given you and it was full target, now we needed to go for another update.

Well, considering the price growth, there is an important resistance area on our way that they have determined for us.

If this resistance is validly broken, the price can move to the specified targets, but what if the price cannot break the resistance?

Well, don't worry, we have another scenario where if the price fails to break the resistance and falls, we have identified good support areas that if reached, the price can grow well to the set targets. Finally, it must be said that given the large number of buyers and the buying pressure we have in Solana, sooner or later, I think this resistance will be broken and we will see higher numbers.

*Trade safely with us*

$SOL Skyrockets to 240: Catch the Bull Run! BINANCE:SOLUSDT

CRYPTOCAP:SOL Skyrockets to 240: Catch the Bull Run!

Entry Level: Marked at 1 (240.00 USDT), suggesting a potential buy point near the current price.

Take Profit (TP) Levels:TP1: 0.786 (228.33 USDT)

TP2: 0.618 (219.17 USDT)

TP3: 0.5 (212.73 USDT)

TP4: 0.185 (185.46 USDT)

Stop Loss (SL): Set at -1.272 (254.84 USDT), indicating a level to exit if the price moves against the trade.

Dead Cat Bounce (DCB): Marked at -1.135 (247.36 USDT), possibly indicating a minor reversal point.

RSI (Relative Strength Index)Current RSI: Around 80.93, which is in the overbought territory (above 70), suggesting the asset may be overvalued and could be due for a pullback or consolidation.

Trend: The RSI has risen sharply in recent days, aligning with the price surge, indicating strong momentum but also potential overextension.

Key ObservationsThe chart indicates a bullish breakout with significant upward momentum, but the overbought RSI suggests caution. Traders might consider taking profits at the marked TP levels or waiting for a pullback to the entry or lower TP levels.

The SL is set above the recent high, providing a buffer against a potential reversal.

The analysis appears to use a Fibonacci-based strategy, with levels derived from a recent swing high and low.

SOL inside ascending triangle,breakout will define the next moveCurrently, SOL price is consolidating within a symmetrical triangle pattern inside an ascending channel.

A breakout in either direction will determine the next move, towards 230 if it breaks upward, or towards 194 if it breaks downward.

As shown on the chart, Solana has been moving within an ascending channel since late July.

At the moment, a Symmetrical Triangle is forming, and volatility is tightening inside the pattern.

This suggests that a breakout move is imminent, most likely within the coming days (up to a week).

If price breaks to the upside:

potential move towards the upper boundary of the channel around 230.

If price breaks to the downside:

potential decline towards the lower boundary of the channel around 194.

Let’s watch closely for the breakout confirmation.

Best regards 🌹

please note :

this is not financial advice — it reflects only my personal opinion.

PLEASE always do your own research before trading .. Good luck with your trades.

SOL/USDT Technical 4HSOL is currently in a bullish trend, supported by a black ascending trendline that connects recent higher lows.

The price has broken above a key resistance level at $253.17, signaling potential continuation of upward momentum.

The EMA 20 (Exponential Moving Average) is trending upward and closely hugging the price, confirming short-term bullish strength.

Bullish Case:

If SOL holds above $253.17, it could target higher levels such as $260 and beyond.

Continued support from the ascending trendline and EMA 20 suggests buyers are in control.

A retest of $253.17 followed by a bounce would confirm the breakout.

Bearish Risks:

If price fails to hold above $253.17 and drops below $239.14, a correction toward $235.33 is likely. A breakdown below the ascending trendline would weaken the bullish structure and shift momentum.

SOLANA - Bearish Doji reversal or break of $250 round number?Solana has been receiving a lot of positive press (largely from the institutions holding long positions). Whether this will become a self-fulfilling prophecy, will largely depend on the buy-in from retail traders.

Watch the volume indicators to ensure that there is convergence, not divergence, between it and price.

SOL/USDT | SOL Breaks 7-Month High – Still Bullish Above $218!By analyzing the Solana chart on the daily timeframe, we can see that the price is still pushing toward higher targets based on the main analysis. It has reached its highest level in the past 7 months and is currently trading around $225.

If the price holds above the key $218 level, we can expect further growth toward levels above $245. This analysis will be updated again. So far, the return from this setup has been more than 52% — I hope you’ve made the most of it!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban