Crude Oil’s Breakout: What It Means for Risk AssetsThis isn’t a trade setup or a recommendation to go long oil. It’s a case study: what a confirmed crude oil breakout can mean next for risk assets like stocks, crypto, and other commodities.

Oil may be setting up as one of the most important trades of 2026, with implications far beyond the energy se

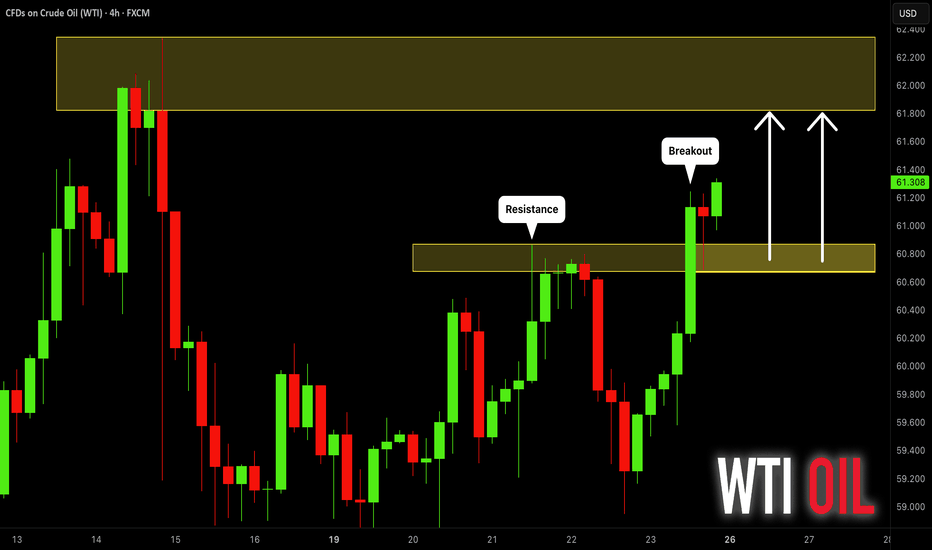

CRUDE OIL (WTI): Bullish Continuation

WTI Crude Oil is going to continue rising, following

a confirmed bullish break of structure on a 4h time frame.

Next resistance - 61.8

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts

Generational OPPORTUNITY to buy $USOIL hereSell gold, buy oil. GENERATIONAL opportunity to own energy here. Generational!

Opportunities like this come along once in a great long while and it seems almost illogical to act on it because the recent trend is so strong (down, in this case) and persistent that it never seems likely that the trend

Hellena | Oil (4H): LONG to resistance area 62.545.Colleagues, after a strong upward movement, I decided to observe the price and understand what is happening.

Now I believe that this movement resembles the beginning of an “ABC” correction, which means that the higher-order wave “A” ended at 54.956.

This means that we can expect the upward movement

Hellena | Oil (4H): SHORT to support area 62.295.Colleagues, earlier I described the upward movement as a full-fledged ABC correction, and the price justified expectations and completed the planned upward movement, but at the moment I think it is worth considering that wave A has been extended.

This fits well with both the old and new scenarios.

Oil (WTI): Strong Rejection From Major Supply Zone 62.5Oil (WTI): Strong Rejection From Major Supply Zone 62.5

Oil has once again reacted strongly from a well-defined supply zone around the 62.00–62.50 area, a level that previously acted as resistance in September and October 2025.

The latest rejection confirms that sellers remain active at this zone

Crude Oil (WTI): Short-Term Bullish Correction Before BearishHI!

Looking at the 4H chart for US Crude Oil (WTI), the price action suggests a short-term corrective rally before a continuation of the bearish trend. Below are the key levels and potential scenarios:

Key Levels:

Resistance Area (Green Zone): Currently, oil is approaching a key resistance l

Bullish breakout?WTI Oil (XTI/USD) is reacting off the pivot and could rise to the 1st resistance, which is an overlap resistance.

Pivot: 60.27

1st Support: 58.58

1st Resistance: 65.88

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Mark

oil breakout soon. falling wedge setupOil is the laggard when all commodities are rising. The decline of the USD

is playing out in real time. I expect oil to breakout high and spike this year

due to geopolitical outcomes. history repeats because human nature never

changes. In real terms, oil is soooooo cheap... if Oil was priced p

USOIL Local Short! Sell!

Hello,Traders!

CRUDE OIL taps higher-timeframe supply after aggressive buy-side expansion. SMC suggests distribution and smart-money selling, with downside draw toward resting sell-side liquidity below. Time Frame 10H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.