Goog....The question is how high?

Strong Trend: Price has been pushing higher since April 2025, with higher highs and higher lows intact. The green zone shows momentum is with the bulls.

Breakout Attempt: You’re sitting near recent highs around 212.90, which shows buyers are in control. If it clears that resistance cleanly, Bull Target 1 (201.75) is already hit, and Target 2 (230.12) is in play.

Volume Uptick: Volume looks supportive of the breakout move (12.61M shown). More buyers stepping in usually confirms the move.

⚠️ Concerns (Why It Might Fail)

Overextended Run: The stock has already run ~40+% since April. Moves like this often see consolidation or pullbacks before the next leg.

Bear Targets Still in Play: If the breakout fails, your downside risk is real: 142.66 → 145.05 (Bear Target 1), and possibly 128.79 (Bear Target 2). That’s a nasty ~30–35% potential drop.

Resistance at 212.90: If it can’t close strong above here, you may get a short-term double top.

🎯 Cost vs. Benefit

Upside to Bull Target 2 (230.12): ~8% gain.

Downside to Bear Target 1 (145.05): ~32% risk.

Risk/Reward: About 1:4 against you right now unless you use a tight stop. That’s not attractive for a fresh entry.

🤔 Too Good to Be True Filter

“This chart looks like it’s going straight to 230” — probably not that easy. Expect chop and possible pullbacks around the 210–215 zone. If it does blast through with high volume, then you’ve got confirmation.

GOOA trade ideas

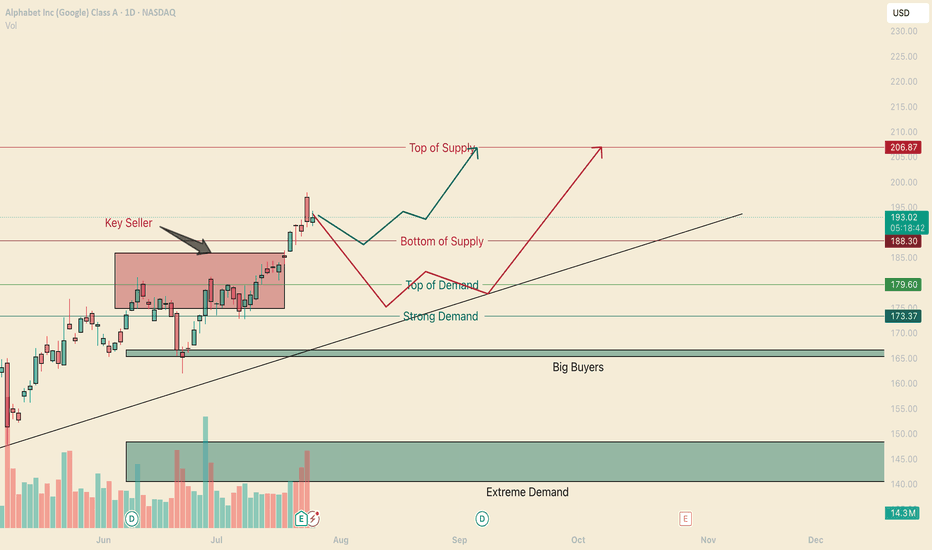

Google Buyers Entered Seller Territory.Hello, I am the Cafe Trader.

To finish off our series of the MAG 7 we have GOOGL up next.

If you have been keeping up, I will offer insight into Long term and short term interest. Google has taken out a key sellers on July 21st, and also closed inside the supply zone. This is very bullish, bulls have not got much pushback from the bears, suggesting this could test the highs again, and prime itself for a breakout.

Long term price guide helps you align a buy area with your conviction. I will update the price as of friday's close (today)

Long Term

Aggressive: $179 - If we close today above the bottom of supply line, then I would suggest this aggressive price adjust to 187.50

Fair Sentiment $166 - 173 - Between the big buyers and the strong demand. Also having the trend to support adds a 3rd strength.

Extreme Deal $140-148 - If you can catch a deal here, best to snatch it up. Alot of Big money wil be doing the same.

Short Term

weakness in the supply area is suggesting a run to the top. Trying ot get in here can be tricky. Since today is friday, the close is extremely important to see how our next week will be framed. So here I have 2 Bullish scenarios to help you find opportunity for GOOGL.

Green Scenario

Yes its possible it will run strait up into the top of supply, as a trader, you don't want to be that buyer just yet. I wouldn't personally feel great about trading the green line scenario without seeing a real buyer step into the market. So if we can Find a real buyer, we will play off of them and rirde to the top.

No entry or price targets on this one yet.

Red Scenario

This scenario has a real buyer, and personally I think is a safer trade to take (as of right now). With this squeeze that's happening, there is a good chance at some point there will be buyers getting exhausted and shorts getting a grip on this. This is why I would not buy "top of demand" but would look to get close as I could to the strong demand. and then a ride back to the "Top of Supply"

Entry: 175

Stop: 170

Partial Profit: (when the sellers step in, thats our first TP)

Target: 206

That's a wrap on our MAG 7 series, Happy Trading and we will see you next time.

Next week we are going to chart out Crypto, if you have any specific suggestions you want to see me chart, comment below.

@thecafetrader

GOOGL Wave Analysis – 25 August 2025- GOOGL broke key resistance level 205.00

- Likely to rise to resistance level 215.00

GOOGL recently broke the key resistance level 205.00 (which stopped the sharp daily uptrend in February and also stopped wave i last month).

The breakout of the resistance level 205.00 accelerated the active short-term impulse wave 3 from the end of June.

Given the strong daily uptrend, GOOGL can be expected to rise to the next resistance level 215.00 (target price for the completion of the active impulse wave 3).

Momentum Watch: GOOG Entry ZoneNASDAQ:GOOG – Trend Continuation Setup

The price has been trending within a clean ascending channel since April 2025.

After a pullback toward the midline and Bollinger basis, price is showing potential support.

Setup:

• Entry: $175 (conceptual)

• Stop: $165.5 (below channel)

• Target: $208 (upper boundary)

• Risk/Reward: 3.51

Stochastic is retracing but remains above key support zone.

As long as the channel holds, expecting continuation toward $200–208 by late September.

⚠️ Market remains under pressure following July 9th events, which could increase short-term volatility across tech.

google ATH or what?google ATH or what?

optimism coming back or no? Chyna CHyna CHyna? or no CHyna? let us know~~

🐉We value full transparency. All wins and fails fully publicized, zero edit, zero delete, zero fakes.🐉

🐉Check out our socials for some nice insights.🐉

information created and published doesn't constitute investment advice!

NOT financial advice

Google: Facing Key Resistance as Uptrend StallsGoogle has faced continued upward pressure, moving closer to the key resistance at $209.28. Turquoise wave 2 should reach its peak below this level – and indeed, recent bearish signals could suggest the top may already be in. Once wave 2 is confirmed complete, we anticipate a sharp sell-off below support at $138.35 in wave 3. However, if bullish momentum persists and price breaks above the $209.28 resistance, we will expect a new corrective high for magenta wave alt.(B) , which would temporarily delay the anticipated decline (probability: 30%).

support confirmed, continuation expected, upside target = BUY * first thing before even I begin analysis. ignore the divergences here

* when you have divergence for both sides, its just trying to trick you out , so

to speak, the bearish divergence is glaringly obvious here, but its misleading

1. strong sellers enter at #1 , pushing us down to #2

2. we push up above the #1 strong sellers, with a gap at the previous resistance

showing strong buyer conviction

3. this is the site of the test, we test this support and it seels to have volume

pushing what would have been the biggest bear bar, or 2nd at least, and making it

a large wick small bearish volume left due to buyers entering

* what do I think will happen

* I think we tested here the micro structure, and we will make the next leg up

* every time price has closed above a zone, it has had a 55% chance, over the past 2,500

candles to reach the next zone, so stop entry above this current candle and go for

continuation , which is always a safe move generally speaking

Google: A compelling buy at the current priceHello,

As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." This mindset is particularly relevant right now with Alphabet Inc.

Despite being a company whose products we use daily—and will likely rely on even more in the future—Alphabet's stock recently declined following comments from Apple’s Eddie Cue regarding a drop in Safari search traffic. This has sparked concerns about Google's dominance in search and its ad revenue streams. Analysts are also highlighting growing competition from AI-driven platforms such as OpenAI, Grok, and Perplexity, raising questions about the future growth of Google Search.

While the headlines may seem discouraging, we remain confident in Google’s enduring leadership in the search space, underpinned by its unmatched scale, infrastructure, and user base. We also believe the market continues to underestimate how far ahead Google truly is in artificial intelligence.

In our view, this dip represents a strategic buying opportunity for long-term investors. Below is our in-depth analysis of Alphabet and why we believe it remains a strong investment.

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. Google Services includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. Google Services generates revenues primarily from advertising; fees received for consumer subscription-based products such as YouTube TV, YouTube Music and Premium, and NFL Sunday Ticket, as well as Google One; the sale of apps and in-app purchases and devices.

KEY NOTES FROM THE Q1 2025 EARNINGS CALL

Revenue up to $ 90.23 Billion (Q1 2024: $ 80.54 Billion)

Operating income for quarter one 2025 at $ 30.61 Billion (Q1 2024: $ 25.47 Billion)

Net income for quarter one 2025 at $ 34.54 Billion (Q1 2024: $ 23.66 Billion)

Diluted Earnings per share closed at $ 2.81 as at 31st March 2025 (2024: $ 1.89). Alphabet’s Board of Directors declared a quarterly cash dividend of $0.21 representing a 5% increase from the previous quarterly dividend of $0.20.

Cash and cash equivalents remained flat as of the end of March 31 2025 at $ 23.26 Billion (2024: $ 23.47 Billion)

Google advertising continues to do the heavy lifting for the alphabet business contributing $ 66.89 Billion of the total $90.23 Billion. Google Services includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. Of this amount, the breakdown is as below

•Google search & other: $ 50.70 Billion

•Youtube ads: $ 8.93 Billion

•Google Network: $ 7.26 Billion

Other services offered by the platforms contributed revenues as below

Google subscriptions, platforms & devices: $ 10.38 Billion

Google cloud: $ 12.26 Billion

Other bets: $ 450 million. Other Bets is a combination of multiple operating segments that are not individually material.

Hedging gains: $ 260 million

The company announced a share buyback program of up to $70 billion of its class A and class C shares. The buy backs will be executed through open market purchases or through privately negotiated transactions.

Business Opportunities/Strengths

Alphabet’s advertising business is firmly embedded in digital advertising budgets, allowing it to capitalize on the ongoing growth in digital ad spending.

The significant cash flows from advertising enable Alphabet to reinvest in growth areas like Google Cloud, AI-enhanced search, and innovative ventures such as Waymo. (Waymo is Alphabet's autonomous driving technology subsidiary, focused on developing self-driving cars and related technologies.)

With a strong foothold in the public cloud market, Alphabet has a substantial opportunity as a major provider for enterprises transitioning to digital platforms.

Risks to consider

Although Alphabet is working to diversify, text-based advertising remains its primary revenue source, presenting a concentration risk.

Ongoing investments in emerging, sometimes unproven technologies through its Other Bets segment continue to strain cash flows.

Increasing regulatory scrutiny of Alphabet's search dominance worldwide could lead to significant market disruptions through structural reforms.

Recommendation

We view Alphabet as a solid business with diverse solutions ranging from advertising, cloud business and driverless cars as well. While we acknowledge that the antitrust cases have continued to make headlines, we encourage investors to remain invested and focused on the business’s strengths. The business has unique products that will have the ability to remain leaders for a very long period of time. Android is the operating system for the majority of the world’s smartphones with more than two-thirds of all smartphones in the world running it. Virtually all smartphones, other than those manufactured by Apple, run on Android. We see this remaining as a google strength for a very long time. The Google Play Store’s unmatched ecosystem creates significant barriers for competing operating systems, limiting their access to critical applications. The recent correction on US technology companies provides us with a solid buying price for some of these great companies. Alphabet alone corrected by about 31% and has since bounced back.

We see the current price as a great entry price for long term investors based on both technical and fundamental analysis with a target price of $ 203.

$GOOG: Wired Paths🏛️ Research Notes

Examining interconnection:

Progression started with highs expanding until some point where contraction of both time and price difference of those highs.

Being aware of its geodesics, I choose to map the surface area of that transformation. Hence, I ended up with this structure.

Sierpinski Fibs show structural "opportunity cost" of price giving up either trajectory.

Alphabet Inc. (GOOGL) – Multi-Year Fibonacci Expansion Outlook📈 Alphabet Inc. (GOOGL) – Multi-Year Fibonacci Expansion Outlook

Timeframe: 1M | Horizon: 2025–2027

🔍 Technical Overview

Alphabet (GOOGL) has maintained a strong monthly uptrend after reclaiming the 50% Fibonacci retracement at $202.39. Price action is showing higher lows since late 2022, signaling accumulation and long-term institutional positioning.

Key Fibonacci levels plotted from the 2022 low to the 2025 projected swing high suggest:

61.8%: $216.98 – Key breakout confirmation level.

78.6%: $237.77 – Strong resistance zone, potential partial profit area.

100%: $264.24 – Medium-term bullish target.

127.2%: $297.89 – First major expansion target into 2026.

161.8%: $340.69 – High-probability target for late 2026/early 2027 if macro tailwinds remain.

200%: $387.95 – Stretch target under euphoric conditions.

📊 Macro & Fundamental Context

Earnings Resilience – Alphabet continues to deliver double-digit revenue growth, fueled by Search, YouTube, and Google Cloud. Margins remain robust despite AI-driven capex expansion.

AI Adoption Cycle – Integration of Gemini AI across Search and Workspace could unlock significant incremental revenue and defend market share from competitors like MSFT/OpenAI.

Digital Ad Market Recovery – Global ad spend is rebounding as consumer confidence stabilizes; this benefits Alphabet’s core segments disproportionately.

Rate Policy Shift – With the Fed pivoting towards a neutral-to-dovish stance in late 2025 projections, mega-cap growth valuations may expand further.

📅 Outlook & Targets (24-Month Horizon)

Base Case: $264.24 by mid-2026 (+31% from current levels).

Bull Case: $297.89–$340.69 by late 2026 to early 2027 (+48%–69%).

Bear Case: Failure to hold $187 support could revisit $167–$140 range.

⚠ Risk Factors

Regulatory pressures in the U.S. and EU targeting antitrust and advertising models.

AI monetization lag versus expectations.

Macro shocks (geopolitical, recessionary) compressing tech multiples.

📝 Trading Plan (Not Financial Advice)

I’m watching the $216–$218 zone closely — a clean monthly close above here strengthens the path toward $237 and beyond. Pullbacks toward $187–$190 could be attractive for positioning, provided macro data supports risk-on sentiment.

📌 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Always do your own research and consult a licensed financial advisor before making investment decisions.

GOOG 2026 LEAPs: $205 Calls for the Next Big Tech Wave!## 🚀 GOOG LEAP Setup (2025-08-08) 🚀

**Bias:** 📈 **Moderate Bullish** (short-term momentum + low volatility)

**Strategy:** Buy Call LEAP – Target upside with managed risk.

**🎯 Trade Plan**

* **Instrument:** \ NASDAQ:GOOG

* **Type:** CALL (LONG)

* **Strike:** \$205 (0.6-0.7 delta sweet spot)

* **Entry:** \$27.40

* **Profit Target:** \$54.80 (+100%)

* **Stop Loss:** \$18.22 (-30%)

* **Expiry:** 2026-09-18

* **Size:** 1 contract

* **Confidence:** 72%

**📊 Key Notes:**

* RSI (Weekly): 70.1 → strong momentum

* VIX: 15.4 → favorable for LEAP entries

* High valuation (90% of 52-week range) = pullback risk ⚠️

* OI = 0 → possible liquidity challenges

GOOGL Holding the Uptrend – Is $200 Within Reach? Aug 7📊 Technical Analysis (1H & 15M Chart)

GOOGL continues to respect the ascending trendline formed from the August 1st low, bouncing cleanly from higher lows and holding above 194–195 support. On the 1H chart, MACD remains slightly bullish with histogram building positive momentum, and Stoch RSI is trying to curl back up from mid-zone — suggesting there’s still fuel for another push.

Price recently tapped the 197.80 resistance area and rejected slightly, but no breakdown yet. The 15-minute chart shows consolidation just under this resistance — a breakout above 198 could trigger continuation.

Key 1H Levels:

* Support: 194.67 → 193.52 (prior base)

* Trendline Support: Holding strong since August 1

* Resistance: 197.85 → breakout level

* Target: 200 psychological + 202.5 swing fib extension

15M Intraday View:

* Price is wedging into resistance — either a breakout over 198 or a rejection back to 195 expected soon.

* If VWAP holds and price reclaims 197.50 quickly, bulls have a strong case to ride momentum toward $200.

* If 195 breaks, momentum may unwind to 193.5–194 demand zone.

🧠 GEX & Options Sentiment

Based on the GEX snapshot:

* Major Call Wall sits at $200, which is also the Highest Net GEX zone. Dealers will likely hedge short if we push into that zone, causing momentum to slow down or reverse.

* Clustered resistance: 197.85–200 is loaded with GEX7–GEX10 and call wall volume.

* Current Price (~196.09) is sitting right under the 2nd Call Wall at 197.65 (72.65%) and 3rd Call Wall at 195.65 (29.69%).

On the downside:

* GEX9 at 190 is a critical support with positive net gamma, so dips to that level may get bought.

* Below that, HVL at 188 and Put Walls at 185 / 182.5 could act as deeper demand zones.

Options Metrics:

* IVR: 21.9 → relatively cheap premiums

* IVx Avg: 33.8 (IV contracting slightly, -1.11%)

* Call Bias: 10.9% → bullish but not euphoric

📌 Trade Thoughts

Bullish Setup (if breakout over 198):

* Entry: 198.10+

* Target 1: 200

* Target 2: 202.5

* Stop: <195.50

Bearish Rejection (if fails under 197.85 again):

* Entry: <195.00

* Target 1: 193.5

* Target 2: 190.5 (GEX9)

* Stop: >198

Conclusion:

GOOGL is coiling just below major gamma resistance. A clean breakout over 198 could trigger a short squeeze toward $200+. However, failure to break and a rejection from this zone could unwind gains quickly toward 194 or lower. Watch VWAP and trendline closely for intraday guidance.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and trade responsibly.

GOOGL Poised for a Breakout! Aug. 5GOOGL Poised for a Breakout! Key Gamma Levels Driving the Next Move 🚀

Technical Analysis & GEX Insights

GOOGL has been grinding higher after finding support around the 185–186 zone and holding the bullish recovery trend. Price is now consolidating just under 195, setting the stage for a potential breakout toward 200+ if momentum persists.

From the GEX (Gamma Exposure) perspective, the highest positive Net GEX & major CALL resistance wall sits around 200, which also aligns with a big liquidity magnet for option dealers. If price can clear and hold above 195–197, dealer hedging could accelerate upside moves toward that 200–202.5 target.

On the downside, the HVL (High Volume Level) support sits around 185, with additional PUT support at 182.5. Losing this level could quickly invite selling pressure back toward 175.

15-Minute Chart View (Short-Term Setup)

Short-term trend remains constructive, but buyers need to hold 192.5–193 intraday to keep the upward bias intact. A break below 192 could trigger a quick retest of 190–189, while sustained strength above 195 opens the path to 197–200 in the coming sessions.

My Thoughts & Suggestions Based on GEX

* Bullish Scenario: Above 197, consider 195/200 call spreads or straight calls with short-dated expiries for momentum.

* Bearish Scenario: Failure at 195–197 could provide a short scalp opportunity back toward 192–190; consider small put positions or debit spreads targeting 190–188.

* Neutral/Wait Mode: If price chops between 192–195 without clear volume expansion, better to wait for a decisive break.

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk, and you should always do your own research and manage risk appropriately before entering any position.

Big Money is Buying GOOGL Calls — Are You In?

## 🚨 GOOGL WEEKLY TRADE IDEA (Aug 4–8)

**Institutional CALL Buying Surges — \$197.50 CALL Setup Triggered**

---

### 📊 Model Consensus Breakdown:

* **🔁 Call/Put Ratio**: **3.33** — strong bullish options bias

* **📉 RSI**: Weak Daily & Weekly = ⚠️ caution zone

* **💰 Volume**: Institutional call flow ✅ but light overall volume ❌

* **🧠 AI Model Split**:

* ✅ **Grok, Gemini**: Bullish lean

* ⚠️ **Claude, DeepSeek**: No trade – weak conviction

* ⚖️ **Meta**: Wait-and-see bias

🧭 **Net Sentiment: MODERATE BULLISH** (With structural caution)

---

### 🎯 Trade Setup:

| 🔧 Strike | 💵 Entry | 🎯 Target | 🛑 Stop | 📅 Expiry | 🔒 Confidence |

| ------------- | -------- | --------- | ------- | --------- | ------------- |

| \$197.50 CALL | \$0.69 | \$1.05+ | \$0.34 | Aug 8 | 65% ✅ |

🕰 **Entry Timing:** Market open

🔍 **Volume Note:** Trade ONLY if opening volume aligns with premarket flow

📉 **Momentum Flag:** Falling RSI = quick exits if invalidated

---

### 🔥 WHY IT MATTERS:

* **Whales Are Loading Calls** despite momentum weakness

* **VIX Low = Options Cheap** = better R\:R on call spreads or singles

* **Target Return**: \~52% upside on premium w/ tight risk guardrails

---

### 🚨 RISKS:

* RSI trend down → invalidates quickly

* Weak market breadth = easy rejection on fakeouts

* Earnings hangover & macro drag = overhang risk

---

### 🏷️ Hashtags / Tags:

`#GOOGL #Alphabet #OptionsTrade #CallOption #AITrading #BullishFlow #TradingView #WeeklySetup #StockSignal #RiskReward`

GOOG | Long | Breakout After Ranging Base | (Aug 2025)GOOG | Long | Breakout After Ranging Base | (Aug 2025)

1️⃣ Short Insight Summary:

GOOG has been ranging for nearly a year between ~$125–$185, forming a strong accumulation base. If it successfully retests the $181–182 zone, I’m looking for a breakout entry with a long-term upside.

2️⃣ Trade Parameters:

Bias: Long

Entry Zone: $181–182 (after a successful retest and confirmation)

Stop Loss: $174 (tight invalidation below support)

TP1: $204 (first momentum target)

TP2: $245 (mid-term resistance)

Partial Exits: Around $226 and $264 (based on prior structure and historical resistance)

Long-Term Target: $370–420 if the multi-year structure plays out

3️⃣ Key Notes:

✅ GOOG has shown strong financial health (Altman Z-score 12.4, low debt)

✅ It trades at a modest valuation (P/E ~18–19× vs peers at ~44×)

✅ A breakout could be fueled by AI and Cloud growth, especially if regulatory headwinds ease after the August 8, 2025, antitrust resolution

❌ If price breaks above without retesting $181, I’ll skip the trade—no chase

❌ AI disruption and regulatory overhang still loom as longer-term risks

4️⃣ 💡 If this idea reaches 10+ likes 👍, I’ll post a detailed follow-up with updated chart levels and trade management zones!

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Every interaction helps keep the content free, pushes it to more traders, and motivates me to post deeper analysis here on TradingView.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

GOOGLE BUY SET UPGOOGLE is on an overall WEEKLY uptrend, coming off of a WEEKLY retest. Within that retest, we have a 4HR BOS. Waiting for 4HR retest in on of my zones for continuation to previous high. A WEEKLY candle would have to BREAK and CLOSE below the previous WEEKLY HL for possible reversal. Happy trading

~~~~I want everyone to succeed

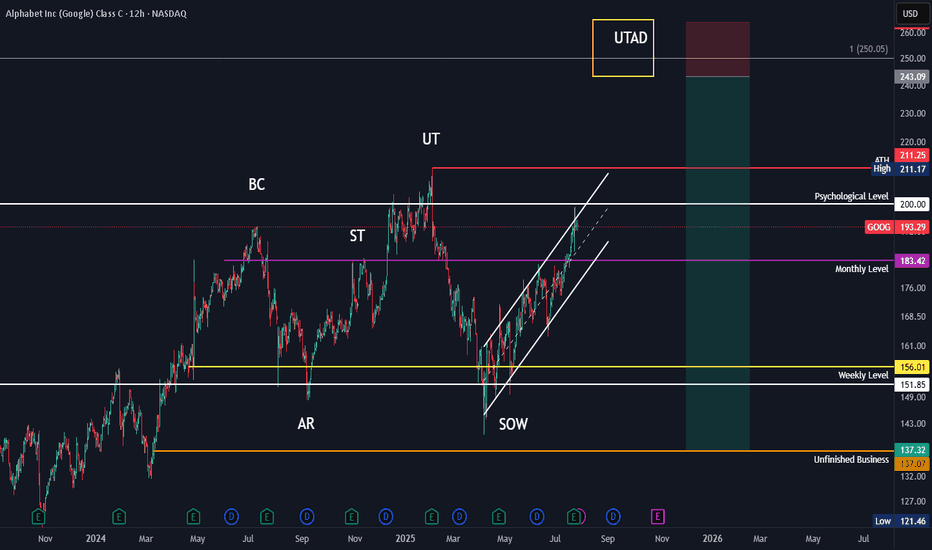

Google in a distributive phase?Could be printing a distribution here. Early signs, so very early on this idea. Would need to see PA evolve like showed in the graph. Alternatively if it makes a HH, it could be printing a UTAD. Either way, I'll be looking for signs whether Wyckoff Distribution does indeed play out.

$GOOG Eyes Breakout Above $198Currently at $197.12, NASDAQ:GOOG is trading above both its 50-period SMA (~$196.00) and 200-period SMA (~$192.50) on the 30-minute chart. The trend remains bullish with support holding firm at $192.50, and bulls are watching closely as the price flirts with resistance near $198.75. This steady grind higher signals strength and trend continuation. Using UltraAlgo Optimizer to catch the next gorgeous set-up — charting tomorrow’s giants with UltraAlgo

GOOGL Forecast – Dual AI Model Confirmation📊 GOOGL Forecast – Dual AI Model Confirmation

🔹 Posted by WaverVanir | VolanX Protocol

NASDAQ:GOOGL is showing strong bullish structure backed by both Smart Money Concepts (SMC) and AI model consensus.

🧠 VolanX AI Protocol Forecast (30-Day)

🎯 Target: $223.08 (+13.3%)

📈 Accuracy: 98.2%

📉 Drawdown: 0.00% (Backtested)

🧮 Sharpe Ratio: 7.70

🔵 Rating: Strong Buy

📉 WaverVanir DSS Model (Sentiment Score: 83)

🔸 30-Day Target: $198.47

🔸 Micro pullback expected before resuming uptrend

🔸 Ideal for refining short-term entries

🔍 SMC Structure:

BOS + CHoCH Confirmed

Premium zone at $197.94 cleared

1.236 Fib target: $201.83

1.618 Fib confluence: $207.92

Trajectory path = $223.08 if liquidity extends

📌 Strategy:

Entry: ~$196.95

TP1: $200.89

TP2: $223.08

SL: $188.80

R:R ~ 3.2:1

📢 Signal powered by WaverVanir DSS + VolanX Protocol

This is institutional-grade AI meets market structure.

#GOOGL #VolanX #WaverVanir #AITrading #SmartMoneyConcepts #SMC #Fibonacci #SwingTrade #Forecast #TradingView #StockSignals #InstitutionalAlpha #DecisionSupport #MachineLearning #DSS

Waiting for a buy trigger.Google stock is at a good spot where it could make a strong upward move. At this price level, we see multiple confluences both in terms of trend and from the perspective of indicators and oscillators. So, if it manages to break through this level, the price could move nicely.