Oil at a Crossroads as US–Iran Talks LoomOil at a Crossroads as US–Iran Talks Loom

Oil has not been moving for days. The current geopolitical tension is creating an even more confusing path for one of the most traded commodities.

The problem this time is Iran.

The White House confirmed that the US and Iran will meet for talks in Oman on

About West Texas Intermediate Crude Oil cash

Crude Oil is a naturally occurring liquid fossil fuel resulting from plants and animals buried underground and exposed to extreme heat and pressure. Crude oil is one of the most demanded commodities and prices have significantly increased in recent times. Two major benchmarks for pricing crude oil are the United States' WTI (West Texas Intermediate) and United Kingdom's Brent. The differences between WTI and Brent include not only price but oil type as well, with WTI producing crude oil with a different density and sulfur content. The demand for crude oil is dependent on global economic conditions as well as market speculation. Crude oil prices are commonly measured in USD. Although there have been discussions of replacing the USD with another trade currency for crude oil, no definitive actions have been taken.

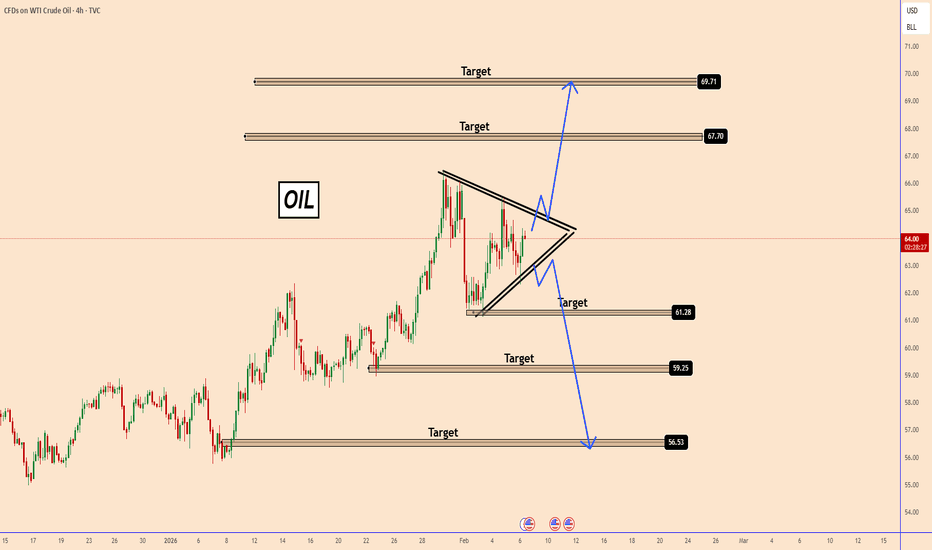

CRUDE OIL (WTI): Massive Breakout ConfirmedCrude Oil is currently experiencing significant bullish pressure.

The market violated a prominent falling trend line on a 4-hour chart, and it has also moved beyond a substantial horizontal demand zone.

These violated horizontal and vertical structures now form an expanding demand zone.

I anticipat

Hellena | Oil (4H): SHORT to 100% Fibo (59.144).As for oil, a major ABC correction in wave B of a higher order continues.

Wave “C” should be approximately equal to wave “A”, so I expect a correction in wave ‘B’ to the level of 63.789, followed by a decline in wave “C” to the level of 100% Fibonacci extension 59.144.

There is a possibility of wave

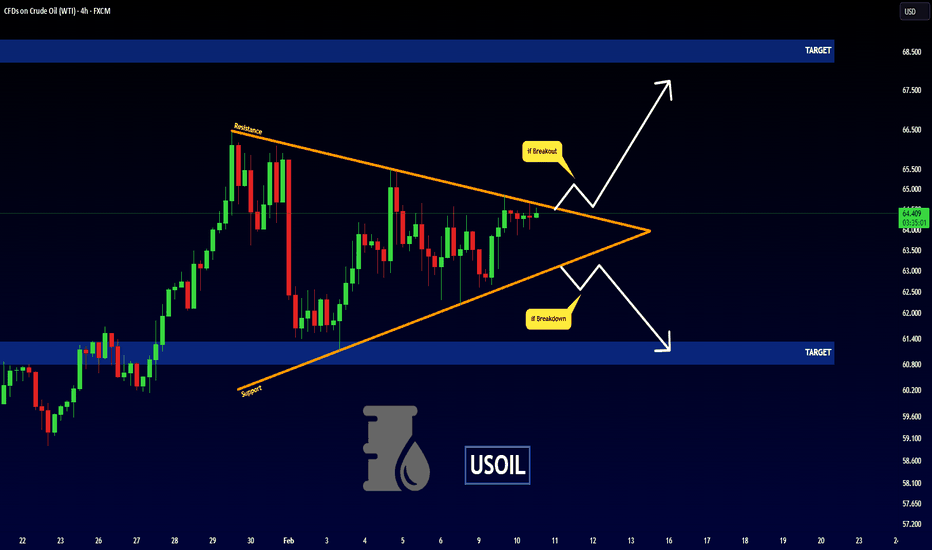

2 Scenarios - USOILHello traders,

the USOIL price has formed a symmetrical triangle pattern,

so we now have two possible scenarios :

🟢 BULLISH SCENARIO:

If the market breaks and closes above the resistance line,

we can expect a strong bullish move .

🎯 TARGET: 68.230

🔴 BEARISH SCENARIO :

If the price breaks

USOIL Price Action: FVG Rebalance After Liquidity GrabUSOIL shows a classic smart money sequence starting with an impulsive bullish move, followed by distribution near premium prices. Price tapped into a bearish Fair Value Gap (FVG) near the highs, which acted as a strong institutional supply zone, triggering a sharp sell-off.

After the rejection, the

WTI Oil Price Climbs to a Monthly HighWTI Oil Price Climbs to a Monthly High

As the XTI/USD chart shows, the price per barrel moved above the 4 February peak yesterday, marking its highest level since the start of the month. The bullish sentiment has been driven by geopolitical uncertainty. According to media reports:

→ The Trump–Net

WTI OIL bullish for remainder of February.About 2.5 months ago (December 30 3025, see chart below), we made a strong bullish case on WTI Oil (USOIL), calling for a 2-month rally that would be targeting $69.00:

The Target hasn't been hit yet but the rally did start following an exact bounce on the 10-month Support. The $69.00 sits exact

WTI Crude Oil - Bullish EW Count - 11/02/2026This is not financial advice, always do your own research.

As global tension rises, one must consider a position in crude oil - and what a tempting position it is to monitor currently. It may be a little early, but soon it may be too late; crude oil moves quickly when it's ready.

A few technical

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.