#XAI/USDT — Accumulation at Key Zone & Potential Reversal?#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0500, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0516

First target: 0.0526

Second target: 0.0536

Third target: 0.0550

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

XAIUSDT.P trade ideas

XAIUSDT UPDATE#XAI

UPDATE

XAI Technical Setup

Pattern : Bullish Falling Wedge Breakout

Current Price: $0.057

Target Price: $0.095

Target % Gain: 90.56%

Technical Analysis: XAI has broken out of a falling wedge on the daily chart with strong bullish momentum. The breakout is supported by increasing buying pressure and trendline resistance breach, projecting an upside toward $0.095.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

#XAI/USDT — Accumulation at Key Zone & Potential Reversal?#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0451, which represents a strong support point.

For inquiries, please leave a comment.

We are in a consolidation trend above the 100 moving average.

Entry price: 0.0462

First target: 0.0470

Second target: 0.0480

Third target: 0.0494

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

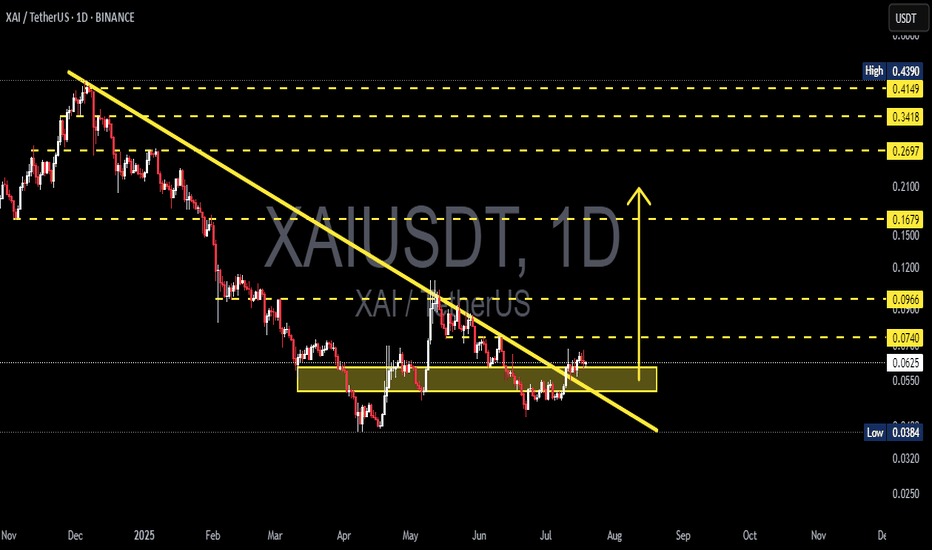

XAI/USDT — Descending Triangle: Ready for Takeoff or Breakdown?✨ Quick Summary:

The XAI/USDT chart is now at a critical decision point. For months, price has been consolidating inside the accumulation zone (0.0384 – 0.050), while being consistently pressured by a descending trendline from above. This structure forms a descending triangle, a pattern that often signals bearish continuation, but can also act as a powerful reversal base if a breakout occurs with strong volume.

Currently, price trades around 0.0504, right at the crossroads of major support and the seller’s pressure line. This means an explosive move — either a breakout or breakdown — is likely coming soon.

---

🔎 Chart Pattern & Price Structure

Support Zone (yellow box): 0.0384 – 0.050 → tested multiple times since April 2025, showing strong buyer defense.

Descending Trendline Resistance (yellow line): connecting lower highs since May, pressing price downward.

Pattern: Classic Descending Triangle → market is coiling tighter, awaiting a catalyst.

Market Psychology:

Buyers keep defending the same support.

Sellers consistently lower their asking prices.

This tug-of-war is reaching its breaking point.

---

🚀 Bullish Scenario (Breakout)

Key confirmation:

Daily close above the descending trendline.

Breakout and daily close above 0.0583 with significant volume.

Potential upside targets (layered resistances):

🎯 Target 1: 0.0583 (+15%)

🎯 Target 2: 0.0663 (+31%)

🎯 Target 3: 0.0715 (+42%)

🎯 Target 4: 0.0838 (+66%)

🎯 Target 5: 0.0973 (+93%)

🎯 Ambitious Target: 0.1094 (+117%)

Trading notes:

Strong breakouts often come with at least 2x average daily volume. The ideal setup is breakout → retest (turning resistance into support) → continuation. Conservative entries can wait for the retest confirmation above 0.0583.

---

⚠️ Bearish Scenario (Breakdown)

Key confirmation: daily close below 0.0384 with a full-bodied candle and high volume.

Downside risk:

Retest of the psychological support zone 0.033 – 0.030.

Breakdown here would likely extend the broader bearish trend, potentially setting new lows.

Trading notes:

A breakdown with volume often triggers panic selling. In this case, stop-losses for longs become crucial. Aggressive traders may consider shorts after a failed retest of broken support.

---

🔑 Extra Confirmation Factors

1. Volume: No volume = no trust in breakout/breakdown.

2. RSI / Momentum: Bullish divergence supports a breakout, bearish divergence confirms breakdown.

3. Market Sentiment: If BTC/ETH trend bullish, XAI’s breakout chances improve. A weak crypto market favors breakdown.

4. Fundamental Catalysts: Partnerships, project updates, or listings can flip the technical outlook.

---

📌 Conclusion

XAI/USDT is facing a make-or-break moment:

Bullish breakout could open a +40% to +100% rally.

Bearish breakdown could drag price back to the 0.030–0.033 zone.

For traders: this is the time to wait for confirmation. Entering too early in such a setup carries high risk. The best positions often come after the market chooses its direction.

---

#XAI #XAIUSDT #CryptoAnalysis #TechnicalAnalysis #DescendingTriangle #Altcoin #Breakout #SupportResistance #CryptoTrading

XAIUSDT Forming Bullish PennantXAIUSDT is showing strong bullish potential as it forms a classic bullish pennant pattern on the charts. This pattern usually emerges after a significant upward move, followed by a period of consolidation within converging trendlines. With a solid breakout expected, the technical setup suggests the possibility of a sharp continuation rally, aligning with an anticipated gain of 70% to 80%.

The good trading volume accompanying this formation strengthens the bullish outlook, as higher volume during consolidation often signals accumulation by smart money. A pennant breakout backed by strong volume typically leads to sustained momentum, allowing the pair to push toward higher resistance levels with confidence.

Investor interest in XAIUSDT has been increasing, reflecting growing demand and market participation in this project. The alignment of technical indicators and market sentiment makes this setup particularly appealing for traders and investors looking to capture high-percentage gains in the near term.

With bullish momentum building and a solid technical base, XAIUSDT appears ready to extend its rally once the breakout is confirmed. If the current trend continues, the projected 70% to 80% upside move could materialize, offering substantial opportunities for market participants.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

XAIUSDT 1D#XAI has broken above the long-term descending resistance on the daily chart and is currently facing rejection from the daily SMA100. In case of a successful retest, the potential targets are:

🎯 $0.0554

🎯 $0.0634

🎯 $0.0699

🎯 $0.0763

🎯 $0.0855

🎯 $0.0972

⚠️ Always remember to use a tight stop-loss and follow proper risk management.

XAI/USDT — Accumulation at Key Zone & Potential Reversal?Summary

The daily chart shows XAI in a consolidation/accumulation phase within a key support zone (yellow box) after a prolonged downtrend. The long-term descending trendline (yellow) has recently been broken, signaling early signs that the downtrend may be losing momentum. However, confirmation is still needed (daily close and volume validation).

Key Levels (from the chart)

Major resistances: 0.0740, then 0.0966, 0.1679, 0.2697, (historical high ~0.4149–0.4390).

Current price: ~0.0551

Strong support/accumulation zone: around 0.043 – 0.056 (yellow box)

Breakdown low: ~0.0384

Potential moves from ~0.0551:

To 0.0740 ≈ +34.3%

To 0.0966 ≈ +75.3%

To 0.1679 ≈ +204.7%

Downside to 0.0384 ≈ -30.3%

Pattern Analysis (detailed & relevant)

Medium-term downtrend: price has been trending lower since the late 2024 peak, following a descending trendline. Recently, there was a breakout above this trendline, an early sign of trend weakening.

Accumulation zone (yellow box): price has tested and bounced from this area multiple times (April — Aug), indicating strong demand.

Possible double bottom/base formation: lows in early April and July/August at similar levels hint at a potential base-building phase. Needs confirmation with a breakout.

Key watch: A daily close above 0.0740 with strong volume would confirm bullish momentum. A breakdown below 0.0384 would confirm bearish continuation.

Bullish Scenario

1. Breakout confirmation — daily close above 0.0740 with strong volume → first target 0.0966, followed by 0.1679 and 0.2697.

2. Support retest & continuation — price may retest the accumulation box before bouncing, confirming the zone as a base for further gains.

3. Bullish signs: strong-bodied candles, successful retests, and increasing volume on breakout days.

Bearish Scenario

1. False breakout — price breaks the trendline but fails to surpass 0.0740, falling back into the range.

2. Accumulation breakdown — daily close below the yellow box (especially under 0.0384) → opens downside continuation risk.

3. Lower highs persist — continued inability to make higher highs keeps sellers in control.

Risk Management Checklist (Not financial advice)

Wait for daily close confirmation, not just intraday spikes.

Watch volume for breakout validation.

Conservative stop-loss: below the support box or 0.0384.

Take partial profits at key resistances (0.0740–0.0966), let the rest run if momentum continues.

Adjust position size according to risk per trade (e.g., 1–2% of capital).

#XAI #XAIUSDT #Crypto #TechnicalAnalysis #Breakout #SupportResistance #Accumulation #CryptoTrading

#XAI/USDT breakout Buy breakout,#XAI

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the ascending channel, at 0.0511.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0513, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0591.

First target: 0.0547.

Second target: 0.0568.

Third target: 0.0591.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

XAI/USDT Breakout from Long-Term Downtrend — Is a Major Trend?🔍 Complete Technical Analysis & Market Insight

After months of downward pressure, XAI/USDT is finally showing significant signs of life. The pair has successfully broken out of a long-standing descending trendline that has capped price action since November 2024 — potentially marking the beginning of a new bullish phase.

📐 1. Pattern & Technical Structure:

🔸 Descending Trendline Breakout:

Price has broken above the descending trendline, ending a multi-month bearish phase.

The breakout is supported by bullish candles and an uptick in volume, suggesting momentum shift in favor of the bulls.

🔸 Strong Accumulation Zone (Demand Area):

The area between $0.0550 – $0.0740 has acted as a solid accumulation/support zone.

Multiple rejections and consolidations around this zone suggest aggressive buyer interest.

🔸 Higher Low Formation & Potential Reversal Structure:

A series of higher lows is forming, indicating a potential bullish trend reversal.

The price structure hints at the possible development of a larger bullish pattern, such as an inverse head and shoulders or base formation.

📈 Bullish Scenario:

If the breakout holds and the price sustains above the key support:

Short-term target:

$0.0966 – initial resistance and psychological level.

Mid-term targets:

$0.1679 – strong historical resistance.

$0.2697 – a major reaction zone from previous breakdowns.

Long-term target if momentum continues:

$0.3418 – $0.4390

⚠️ Confirmation with volume and follow-through candles is crucial to validate a sustained bullish move.

📉 Bearish Scenario:

If the price fails to maintain above the breakout zone:

It may retest the accumulation zone between $0.0740 – $0.0624.

A breakdown below $0.0550 would invalidate the bullish thesis and could lead back to the previous low at $0.0384.

Breaching below $0.0384 could trigger a renewed bearish continuation.

📊 Market Sentiment & Context:

XAI is at a technically significant point. With selling pressure weakening and early bullish structures emerging, XAI could be positioning for a strong upside move — especially if broader market conditions improve.

However, given the speculative nature of the current breakout, risk management remains essential. False breakouts are not uncommon, especially in altcoins.

🧭 Strategic Summary:

Potential Buy Zone (on retest): $0.0624 – $0.0740

Stop Loss (conservative): Below $0.0550

Take Profit targets:

Short-Term: $0.0966

Mid-Term: $0.1679 – $0.2697

Long-Term: $0.3418 – $0.4390

Big breakouts often begin with subtle but critical structural shifts. XAI is showing early signs of such a shift — it could be the calm before a bullish storm, or just a trap. Either way, it deserves your close attention.

#XAIUSDT #XAI #AltcoinBreakout #CryptoBreakout #TrendReversal #CryptoAnalysis

#TechnicalAnalysis #SupportResistance #BullishBreakout

Long XAIXAI is emerging as a leading token in the blockchain gaming sector, supported by strong infrastructure, community grants, and developer adoption.

Trade setup is as in chart for the following reasons.

Breakout 1D trendline: done

Breakout 4H local double bottom: done

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0476.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0472, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0483

First target: 0.0502

Second target: 0.0517

Third target: 0.0532

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

XAI/USDT Breakout XAI has completed a 60% retracement back to a key demand zone on the daily timeframe. Price action shows a clean breakout from the downtrend line, followed by a successful retest a classic confirmation of reversal structure.

with a potential upside move of +150% from current levels.

#XAI #XAIUSDT #CryptoTrade #AltcoinSeason #CryptoSetup #TechnicalAnalysis #CryptoReversal #BreakoutTrade #DCA #CryptoSignals #CryptoTrading #ChartAnalysis #AltcoinGems #150PercentTarget #CryptoDaily

XAI breakout Buy breakout, #XAI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 4.78, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 4.60.

Entry price: 4.88

First target: 5.047

Second target: 5.19

Third target: 5.35

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bounce from the lower boundary of the descending channel, which is support at 0.0448.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We have a trend of consolidation above the 100 moving average.

Entry price: 0.0466

First target: 0.0477

Second target: 0.0493

Third target: 0.0514

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.0570.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 moving average.

Entry price: 0.0686

First target: 0.0620

Second target: 0.0650

Third target: 0.0686

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0600, acting as strong support from which the price can rebound.

Entry price: 0.0610

First target: 0.0660

Second target: 0.0686

Third target: 0.0722

XAIUSDT / LONG / 12.06.25⬆️ Buy XAIUSDT, 12.06.25

💰 Entry: 0.06687

🎯 Target: 0.14819

⛔️ Stop: 0.05947

Reasons for entry:

— 1D

Price in consolidation for more than 1 day

Correction into the discount zone

— 1H

Divergence in long, exit from correction

Decrease in volumes during correction

Predominance of volumes for purchase

— 5m

Breakdown of the structure with correction into the discount zone

Strategy: medium-term, breakout

PS:

Breakdown for 5 minutes, more conservatively wait for 15 minutes for the structure breakdown.

#XAIUSDT Analysis — Reversal Confirmed, Eyes on 100%+ Potential

🚀 #XAIUSDT Analysis — Reversal Confirmed, Eyes on 100%+ Potential

🗓 Published: May 9, 2025

🕰 Timeframe: 1D | 📊 Exchange: Binance

🔍 Technical Overview

XAI just broke out of a bullish pennant formation following an aggressive bounce off key support.

Momentum is strong — with a breakout candle reclaiming previous structure resistance at $0.058.

📌 Setup Structure:

✅ Bullish Pennant → Breakout

✅ Daily candle closed above short-term range

✅ Volume and structure support bullish continuation

🟦 Support Zone:

$0.0499 – The base of recent structure and breakout origin

📉 Panic Level: Close below $0.0499 invalidates the current bullish thesis and opens risk toward $0.038

🟩 Entry Zone: $0.0704 (Current Price)

Price now sitting just above breakout zone and previous structure resistance.

🎯 Targets:

TP1: $0.0889 (+~26%)

TP2: $0.1219 (+~73%)

Full Extension (High Risk TP3): $0.140–0.160 zone

⚖️ R:R = ~6.15

High reward potential with defined stop loss and layered targets.

🧠 Strategy Insight

This is a textbook breakout + retest scenario.

Early entries already triggered

Add size on retest of $0.058 if market offers it

SL under $0.049 for aggressive; under $0.038 for wide swing setup

💡 Momentum is key — watch for follow-through within next 48H.

🗣 What’s Next?

Continuation above $0.075 confirms strength

Fail to hold $0.058 = trap breakout → cut quickly

📢 This could be a fast mover. Setup is asymmetric — small risk, high reward. Play it with discipline.

#XAI/USDT#XAI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.0812, acting as strong support from which the price can rebound.

Entry price: 0.0850

First target: 0.0890

Second target: 0.0931

Third target: 0.0978