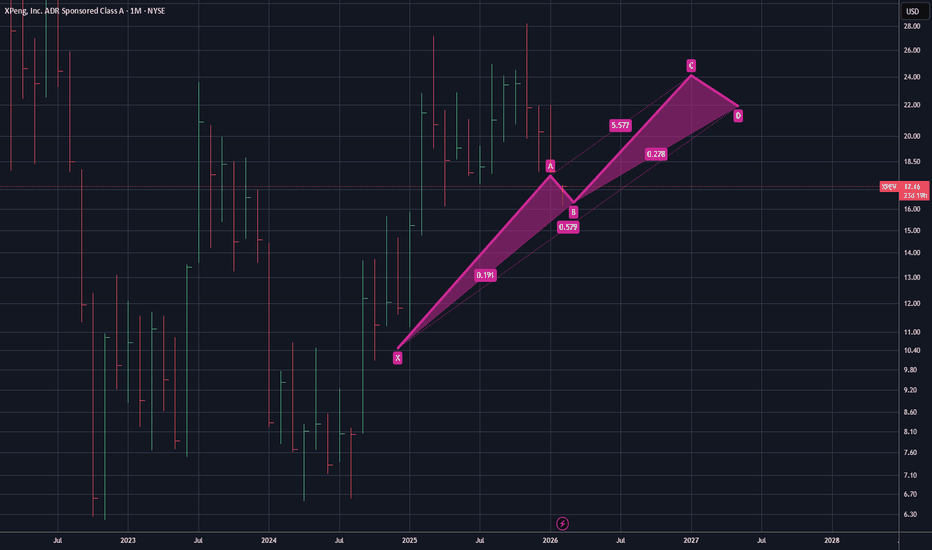

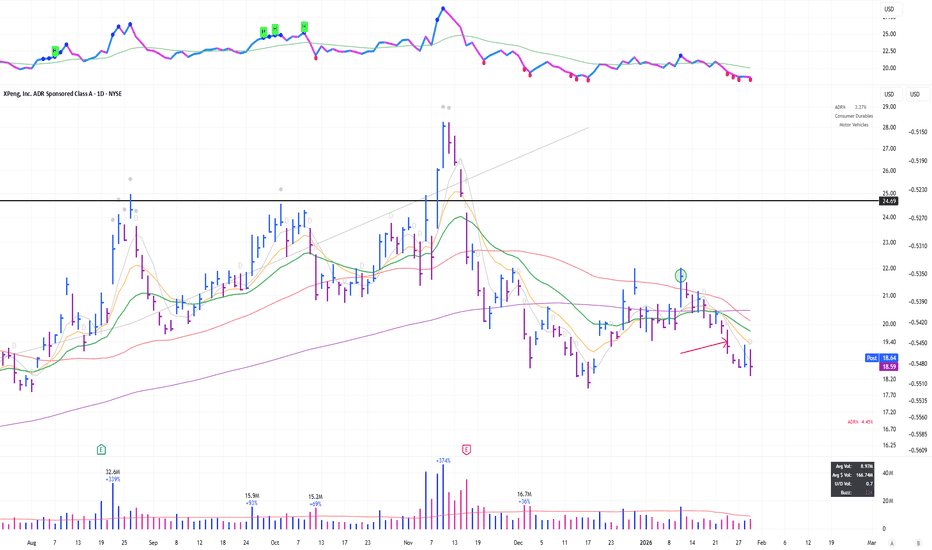

$XPEV - Next Leg Up? $24 Target by 2027XPEV's correlation seems to be bottoming out the bearish leg. I believe that with enough bullish support, the next wave up seems to be trending to $24 by the year 2027. If that is true, that sets up a decent step-in for a long. As always, none of this is investment or financial advice. Please do you

XPeng Inc.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.42 USD

−804.56 M USD

5.68 B USD

775.50 M

About XPeng, Inc. Class A

Sector

Industry

CEO

Xiao Peng He

Website

Headquarters

Guangzhou

Founded

2015

IPO date

Aug 27, 2020

Identifiers

3

ISIN US98422D1054

XPeng, Inc. engages in the design, development, manufacture, and marketing of smart electric vehicles. Its products are environmentally friendly vehicles, namely an SUV (the G3) and a four-door sports sedan (the P7). It also provides a range of services to the clients, including supercharging service, maintenance service, ride-hailing service and vehicle leasing service. The company was founded by Xiao Peng He, Heng Xia, and Tao He in 2015 and is headquartered in Guangzhou, China.

Related stocks

$XPEV: CSP on Descending Channel Support - Chinese EV📊 CHART PATTERN SETUP

My quantitative screener flagged XPeng (XPEV) testing multi-month

descending channel support.

🔍 TECHNICAL STRUCTURE:

- Pattern: Descending Channel (correction since Nov highs)

- Current Price: $17.00

- Support Zone: $16.00-16.50 (channel bottom)

- Recent Action: Rejection wic

XPEV - Time to rev to the top =======

Volume

=======

- neutral

==========

Price Action

==========

- Broken out of 3 year trendline, rebounded and rebounded at trendline

- Double bottom and Cup + handle spotted

- 6 month rounding formed

=================

Technical Indicators

=================

- Ichimoku

>>> price closed abo

XPEV TECHNİCAL ANALYSİSXPEV has formed a flag pattern.

It previously drew a flag with a bottom at $19 and a target of $46, and it has now broken out and appears to have given its final confirmation today.

As long as there are no daily closes below $27, I see the $46 target as highly probable.

Don’t forget to support my p

long on robotics XPEV1. Formation and Trend

The chart shows a rising trendline (green) starting from the lows around April 2025.

→ This represents a medium-term uptrend, confirmed by several bounces off support.

The price is currently above the trendline but below strong resistance at around $23.70 (red line).

2. Pri

XPEV trade breakdownReasoning:

Strong Industry/Sector

Virtual contraction pattern, big breakout on volume

Long-Term Investors (3-12 Month Holds)

Entry: Full position on breakout

Profit Taking: Sell 1/4 to 1/5 at Goal 1

Exit Signal: Close below 20-day EMA (your trend guide) or 50EMA

Why: Strong moves are

The Car of the FutureExplosive delivery growth and market share gains in Chinese market

Gross margins expanding

A.I Leadership with global expansion

ALL of which these characteristics behavior confirming the institution appetite thesis with a key breakout/volume day

At a RS Rating of 95

I have reasons to believe NYSE:

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ROBO

L&G ROBO Global Robotics and Automation UCITS ETF USD Class AWeight

1.19%

Market value

11.13 M

USD

HNCS

HSBC ETFs NASDAQ Global Climate Tech UCITS ETF USD Cap Accum- USDWeight

0.86%

Market value

1.15 M

USD

Explore more ETFs