XRPUSD.P trade ideas

Why the 95% failIt's no secret that over 90% of retail traders lose money. I am not talking about throwing some money into crypto and hoping for the moon type wins or losses. I mean actually trading and making a living from it.

You see, when you start, you are hungry for information - what's the best course, who has the best strategy, what if I trade 25 instruments on a 1-minute timeframe. Surely more profits...

After doing this for over 25 years, you get to see people come and go, sometimes they come back with a new idea and more funds to give the market.

But overall, some of the core problems are - all the gear and no idea.

Not only do people invest in screens, the latest hardware and of course the legendary Bloomberg subscription for 24/7 news.

What about indicators?

Has your screen ever looked a little bit like this?

The issue with more indicators is the majority of them lag to price action, re-paint or are simply not needed. Then combine that with the lack of experience, and you are left questioning do I buy or sell if my RSI is up but the moving average just crossed down?

You are not alone, most traders have been there if not all!

It is hard enough when even the brokers and exchanges fight against you - have you ever seen a scam wick directly to your stop and bounce?

What about the A-book vs the B-book?

In an A-book model, the broker passes their clients' trades directly to the market. Essentially, the broker acts as a middleman, executing trades on behalf of clients in the open market. This means that the broker's profits come primarily from commissions and spreads rather than trading against the client.

B-book, the broker takes the opposite side of the client's trades, essentially acting as the counterparty. Instead of sending trades to the open market, the broker keeps them internally.

The next one that always tickles me is the 100% win rate strategy that someone automated and for a few hundred dollars, it's all yours!!

Look, if there was a silver bullet, a 100% winning strategy you could buy off the shelf - we wouldn't have any other profession on the planet! The world's population would be professional traders. You know the saying " if it sounds too good to be true, it probably is".

You see Elliott waves where they have no right to be. Simply no logic or using them on a tick chart and hoping for miracles.

How about getting some financial advice from a spotty teen who rented a sports car for a video shoot this afternoon? Yeah, sounds like a good plan to help you retire young!

==============================

So, how to avoid all of these things?

Well, to start with, your tradingview chart, on a regular laptop or desktop with one screen, removing all the indicators and increasing the timeframe.

Then you reduce the number of pairs you look at and get to know them. Treat them like a new language. Learn the character traits, how they behave around major news events, what happens to them if the dollar goes up or oil drops 5%.

Don't treat trading like a game.

Instead, treat it like a business, use hours that suit your lifestyle. Deploy proper risk management. Don't see it as a one trade one win type concept. Treat it with respect and profit from it weekly.

You will find, when you learn to manage risk correctly, you care very little about markets going up or down. You tend to sleep with ease and a growing bank balance.

The market has plenty of soldiers fighting on its side, and it does its best to recruit you to fight against yourself!

In summary, less screens, less data inputs (indicators), less instruments, higher timeframes, ignore the influencers, Proper risk management and learn to understand there is no silver bullet.

Trading is statistics and that's all it is.

You can be very profitable with a low strike rate and a large risk-to-reward ratio. Or as simple as a 2% gain per 1% loss and a 50/50 win rate still makes you money!

Disclaimer

This idea does not constitute as financial advice. It is for educational purposes only, our principal trader has over 25 years' experience in stocks, ETF's, and Forex. Hence each trade setup might have different hold times, entry or exit conditions, and will vary from the post/idea shared here. You can use the information from this post to make your own trading plan for the instrument discussed. Trading carries a risk; a high percentage of retail traders lose money. Please keep this in mind when entering any trade. Stay safe.

XRP/USD – Failed Bounce, Bears in Control🔴 SHORT below $3.21 – targets $3.15 and $3.10

XRP failed to hold above $3.28 and dropped under its 200 SMA. RSI at 43 shows sellers still holding momentum. A close below $3.21 could send price toward the $3.15 zone quickly.

📊 Keywords: #XRPUSD #TrendBreak #CryptoShort #MomentumFade #BearishBias

XRP Look For Buy As It Is Showing Trend Continuation PatternXrpUsd, peesonally for me it is showing trend continuation pattern per current market structure. Ideally it should not go down break below 2.9033. Look for your buy set ip before entering.

Target ideally above 3.6606 or the best case 4.1364.

Dont risk over 1% for this trade.

XRP Consolidation pattern breakout imminentLooks to me like XRP is breaking out of a rectangle or consolidation pattern as we speak.

Pattern formed since NOvember 2024 and since then XRP has been trading in this range.

Our current weekly candle is clearly in the process of attempting a breakout above the upper band or resistance trendline of the consolidation pattern.

We still have a day for candle close of this week.

Look to see if a potential engulfing candle print occurs or not.

Also note, this is by no means confirmation of the pattern break. We would need a concise bullish candle pattern for the next week to print for COnfirmation.

If we do confirm breakout. XRP will be back in price discovery mode like BTC. And i personally wouldn't sleep on it.

Its one of the better performers in crypto and seems like to me with every passing day a major player like BTC. (Opinion based on TA)

I would also monitor the MACD indicator. Observe for increasing histogram bars and deep green color as well as bullish cross.

On Macro timeframes, being above the 0 line on MACD is always bullish until we cross below.

Ripple (XRP/USDT) – $4 Breakout in SightTrend:

XRP remains in a strong uptrend on both Daily and 4H timeframes.

Price is holding above 50 EMA and 200 EMA, confirming bullish structure.

Pattern:

Ascending triangle forming with resistance at \$3.50.

Higher lows indicate aggressive buying pressure.

Breakout target from the pattern projects toward \$4.00 – \$4.20.

Key Levels:

Support: \$3.15 – \$3.20 (major demand zone)

Resistance: \$3.50, then \$4.00

Breakout Trigger: \$3.50 (4H close with strong volume)

Indicators:

RSI in bullish territory (above 60) but not overbought.

MACD showing steady bullish momentum.

Volume spikes align with upswings, suggesting institutional buying.

Trade Plan:

Entry (Breakout): \$3.50 – \$3.55 on 15m/1H close above resistance with volume.

Stop-loss: \$3.25 (below last higher low)

TP1: \$4.00

TP2: \$4.20 – \$4.30 (extended breakout target)

Bias: Bullish while price remains above \$3.25 support.

📈 XRP is coiling just below multi-month resistance. A confirmed breakout above \$3.50 could open the door to a fast rally toward \$4.00 and beyond.

RippleI put Ripple in a fib channel. If we look at the potential within this channel, we can see that there's room to run. Ripple is a crypto, so I like to look to the .786 in crypto, but the .618 in stocks. Crypto just seems to do a little bit more. Let's assume the price spikes on Monday up to the .618. That's around $28 or so. I've been saying "$30 (sell $28)" for ages and ages. And now the moment is here.

I do think Ripple will blow through my $30 target, but when you look at my XRP/BTC charts - which is what you should be looking at), then you can see that after the $30 pump, a huge retrace comes right after with a $5-7 landing, before making an even higher swing high in the price and in satoshis.

You need to look at the XRPUSD and the XPRBTC, with both of them being of equal importance. If you're watching just one, then you're only seeing half the picture.

XRP - The Unpopular Analysis!XRP printed a macro triangle from 2021-2024. Triangles are an Elliot wave pattern resulting in a terminal thrust up in a motif wave before price returns to the bottom of the triangle at $0.28! Now this seems extremely unlikely given whats going on fundamentally but I don't make the rules so don't shoot the messenger!

The motif wave appears to have completed wave 4 bull flag at the $1.6 swing low and wave 5 is underway (which can overextend). Elliot wave count would suggest we are near a major top after one more push up to new highs. More realistic price targets for a deep retracement would be $1.6 again which the ascending weekly 200EMA would catch up to for confluence.

Interested to hear from the other Elliot wave specialists on this count!

Analysis is invalidated below $1.6

New long signals are building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very good profits lately in these markets!

Safe trading

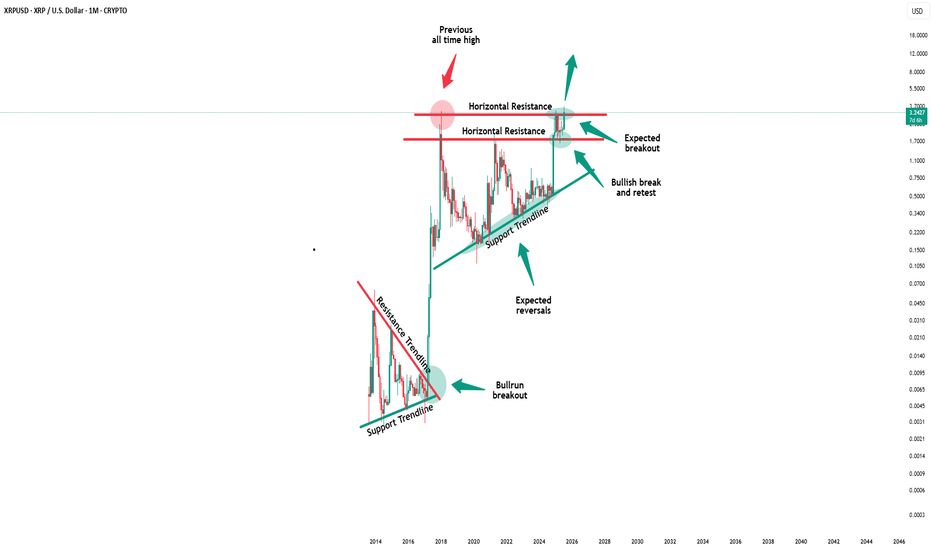

Can XRP hit 10$ in 2025 ?Can XRP hit 10$ ???

if you see this XRP CRYPTOCAP:XRP chart, all 12 years of history, you can see simple & clean,

12 years ago XRP price was 0.00286$ only, and recentl XRP created ATH 3.66$

in 2017 XRP Price 0.003$ and from there XRP Showing big Rally

The past 8 years 1,22,000% price increase

i'm highly confident we can see 10$ mark as well,

The next target is already mentioned in the chart, along with price details.

Share with others and follow now @GlobalRashid for more content like this.

XRP — Weekly Outlook (9–16 Aug 2025)Short-term bias tilts bullish-neutral, with a breakout above $3.42 potentially triggering a rally toward $3.70. On-chain metrics are improving, derivatives remain balanced, and the post-SEC-case momentum is still alive — but all eyes are on the upcoming US CPI release for the next decisive move.

Current Price: $3.32 | Market Cap: ~$197B | 24h Volume: ~$7.5B

📰 Market Context

Regulatory breakthrough — the SEC vs. Ripple case has officially ended with a $125M fine and a ban on direct institutional sales. This removes a major legal overhang while keeping some restrictions in place.

On-chain activity shows XRPL transactions and active accounts (7-day moving average) trending higher compared to June, indicating renewed network usage post-July rally.

Derivatives market remains balanced: Open Interest is steady at ~$3.4B with only ±1% daily change. Funding rates are slightly positive at +0.01%, showing mild bullish sentiment but no overextension. Liquidations in the last 24h are ~$15–16M — within normal range.

📊 Technical Levels

Main support is at $3.15 (20-day MA). If that breaks, next supports are $3.05–$2.95, then $2.70.

Immediate resistance is $3.40–$3.42; a breakout here could open the path to $3.60–$3.66.

RSI (14D) is between 55–62, suggesting moderate bullish momentum. MA-20 sits at $3.15, MA-50 at $2.61.

📅 Key Macro Event

The US CPI report for July will be released on 12 Aug 2025 at 12:30 UTC. Expect volatility as inflation surprises can shift USD strength and global risk appetite.

📈 Weekly Scenarios

Base (55%) Consolidation — consolidation between $3.15 and $3.42 if price holds above $3.15 with neutral OI and funding.

Bullish (30%) Breakout — breakout above $3.42 on strong volume and a $200–300M rise in OI could push price toward $3.60–$3.70, possibly retesting $3.66.

Bearish (15%) Pullback BITSTAMP:XRPUSD — break and close below $3.15 with rising long liquidations could trigger a move to $2.95–$3.05, and in extreme conditions down to $2.70.

✅ Action Points

Watch for a breakout above $3.42 with confirmation from OI and trading volume.

Track XRPL active accounts and payments — if they rise with price, the move is more likely sustainable.

Consider adjusting leverage or widening stops around CPI release time to handle potential volatility.

💬 My view: Short-term bias is bullish-neutral, with upside potential if $3.42 breaks on strong volume. Macro data and on-chain metrics will determine if the rally can extend.

XRPUSD is going for Wave 3Trend: Uptrend continuation.

The price already completed wave 2 at 50% retracement and now continues her journey to wave 3 in 5 subwaves. The minimum target of Wave 3 is near the resistance level of the previous high, as shown in the chart.

This is only my perspective of EW counting for XRPUSD. Not recommended to trade based on my perspective, as it may be wrong. Advice: Do your own TA prior to trade.

XRP Price Forecast: The SEC Case is Over — What’s Next for XRP?XRP Price Forecast: The SEC Case is Over — What’s Next for Ripple’s Token?

📅 Date: August 8, 2025

📈 Current Price: ~$3.33–$3.37 (+11% in 24h)

1. The Legal Battle is Finally Over

After more than three years of uncertainty, Ripple and the U.S. SEC have jointly filed to dismiss all remaining appeals, officially ending their long-standing legal dispute. The 2023 ruling stands: XRP sales on secondary markets are not securities — a regulatory green light that removes the biggest cloud hanging over Ripple’s future.

Why this matters:

Opens the door for institutional adoption without fear of legal backlash.

Boosts confidence among payment providers, banks, and fintech platforms to integrate XRP.

Positions Ripple as a credible player in global cross-border settlement.

2. Market Reaction in the Past 48 Hours

Price Surge: XRP jumped 11–13% in less than 24 hours, adding nearly $20B in market cap.

Volume Spike: Trading volume up ~200%, signaling entry of “smart money” and institutional flows.

Short-Term Targets: Market momentum hints at a move towards $3.50–$4.00.

3. Technical Analysis

Support Zones: $3.10–$3.20 (primary), $2.90 (secondary).

Resistance Levels: $3.50, then $4.00.

Indicators: RSI at ~68 (approaching overbought), Golden Cross formed — a strong bullish signal.

4. Fundamental Drivers Ahead

Expansion of RippleNet’s banking partnerships.

Growing role in cross-border payments — a $150T annual market.

Participation in CBDC infrastructure projects.

5. Price Forecast Scenarios

Timeframe Likely Scenario Bullish Scenario Key Triggers

Next Month $3.50–$3.80 $4.00+ Momentum, positive news

End of 2025 $4.50–$5.50 $6.00+ ETF approval, new banking deals

By 2030. $10–$15 $20+ Global adoption, CBDC integration

6. Entry & Exit Points

🎯 Short-Term Trade:

Entry: ~$3.30

Exit: $3.80–$4.00

📊 Medium-Term Position:

Entry: ~$4.20

Exit: ~$6.00

🌍 Long-Term Hold:

Entry: ~$8.50

Exit: $20+

7. Risks to Watch

Global crypto market corrections.

Slower-than-expected institutional adoption.

New regulatory hurdles outside the U.S.

💬 Final Take:

The removal of legal uncertainty turns XRP into one of the most asymmetric risk/reward opportunities in the current crypto landscape. Volatility will remain, but the medium-to-long-term upside potential is significant — especially if Ripple captures a larger share of the global payments market.

📌 This is not financial advice. DYOR and manage your risk accordingly.

XRP/USD Long Setup – Bullish Bounce from Key Demand Zone!XRP is showing early signs of a bullish reversal after a strong rejection from the $2.74–$2.90 demand zone. Price has started to push upward, forming a higher low structure on the 4H timeframe, suggesting a possible continuation toward higher levels.

🔍 Technical Breakdown:

Demand Zone (Support): $2.74 – $2.90 (Strong buy zone highlighted in orange)

Current Price: $2.987 (Trading above the demand zone with higher lows forming)

First Target (TP1): $3.231 (key structure resistance)

Second Target (TP2): $3.549 (supply zone where previous selloff began)

✅ Bullish Confluences:

Price bounced cleanly from demand zone

Bullish market structure with higher low

Visible volume support at current levels (LuxAlgo VRVP)

Room to move into imbalance above

📌 Trade Setup:

If momentum continues and XRP holds above $2.90:

Entry Zone: $2.95 – $3.00 (current level)

SL: Below $2.74 (beneath demand zone)

TP1: $3.231

TP2: $3.549

🧠 Notes:

Break and close above $3.231 would open the path to higher levels

Watch for consolidation before breakout

Supply zone at $3.549 is significant — partial TP is wise

🟢 Bias: Bullish

Xrp - This is the bullrun breakout!🔑Xrp ( CRYPTO:XRPUSD ) breaks the triangle now:

🔎Analysis summary:

After the recent bullish break and retest, Xrp managed to already rally another +100%. This is a clear indication that bulls are still totally in control of cryptos and especially Xrp. It all just comes down to the all time breakout, which will then lead to a final parabolic rally.

📝Levels to watch:

$3.0

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

All in XRPRegulatory Shift: Barriers for Ripple and XRP are easing, clearing the path for dominance in crypto/blockchain markets.

End of Retail Bubble: The retail-driven crypto era is fading, with institutional players paving the way for entry.

XRP ETF Progress: Eight XRP spot ETF applications from major funds await SEC approval, expected within months.

Ripple Lawsuit Nearing End : Resolution is imminent, setting a precedent for other crypto projects.

Blockchain as Infrastructure: The new U.S. Treasury Secretary and SEC Director recognize blockchain as critical national infrastructure, comparable to railroads and the internet in its transformative potential. This perspective aligns with the rhetoric of global financial authorities like the IMF, BIS, and WEF, as well as leading consulting firms, which have championed blockchain’s role in revolutionizing finance and cross-border transactions over the past few years.

Market Trends : Stablecoins, CBDCs, tokenization, and cross-border payments will drive growth, settling on public blockchains.

XRP’s Advantage : Stress-tested by global banks and governments for over a decade, XRP is uniquely equipped for large-scale enterprise adoption. Backed by Ripple, a leading fintech with connected leadership and top talent, XRP leverages unmatched expertise and a global network of bank and payment partners, driving innovation and solidifying its enterprise-grade infrastructure.

Market Performance: Post-election, XRP surged 500%, outperforming all coins, with stop-loss hunting below $3 likely over.

Conclusion and price prediction XRP remains largely unnoticed by mainstream media, its transformative potential yet to resonate with the broader public. Compared to Bitcoin, XRP is still in its infancy as a store of value and speculative asset for retail investors. Yet, as market dynamics shift and critical developments unfold, a potent blend of utility-driven demand and speculative momentum could propel XRP to $10 by the end of 2025. If Ripple’s vision of an Internet of Value takes root—enabling seamless, instant, and low-cost global transactions, capturing a substantial portion of SWIFT’s payment flows, and harnessing the power of tokenization—XRP could emerge as a cornerstone digital asset commodity, potentially soaring to triple-digit valuations by 2030 and fundamentally redefining its role in the global financial ecosystem.

XRP breaking wedge2 for 2 on here now. IH&S went according to plan. Rested on the daily pivot and now its off on good news for their appeal drop.

Now were breaking out of the falling wedge. Next target is 3.56 supply then 3.74, daily r1 pivot.

Watch inflow for support. Could see some shake downs. Remember, this bad boy, and others like it are ONLY MOVED by institutions. Market Makers. You and me, we don't have the capital to drive them one red cent. So, any real quick move was for a reason. And its not for the sake of retail.

Follow for more bangerz

XRP/USDNew chart following the spike.

Currently battling at previous 2 week high around the 3.31 mark. I see a retract back to the 3.11 mark with a return to 3.76 region.

If we are lucky enough to reach the 3.57 mark i am planning to do a healthy profit grab with anticipation of a possible quick drop.

This is my second chart. I have enjoyed learning and observing everyone's charts. I am open to any suggestions on how to improve accuracy.

kdm62692

XRP/USDNew chart following the spike.

Currently battling at previous 2 week high around the 3.31 mark. I see a retract back to the 3.11 mark with a return to 3.76 region.

If we are lucky enough to reach the 3.57 mark i am planning to do a healthy profit grab with anticipation of a possible quick drop.

This is my second chart. I have enjoyed learning and observing everyone's charts. I am open to any suggestions on how to improve accuracy.

RippleHow we feeling? This chart is very bullish. We didn't even get a retrace of the two prior peaks, so the price wants higher. Way higher. When you look at it in log, it's clear that $30 is in the headlights. It's kind of hard to deny.

I got into VVPR, and sold half in the profit, but the other half is lagging. I'll probably go heavier.

Good luck out there, and peace be with you.

XRP Settlement August 15th, 2025 $33.00 & $1,031 May 23, 2026XRP is positioned for a major move on August 15th, 2025

when XRP reaches $30.00 - $33.00, it has two algorithmic delivery paths:

Path 1 (blue): Targeting $300 by August 23, 2026.

Path 2 (red): Parabolic extension to $1,031 by May 23, 2026.

“By the time you hear about it, it’s already too late.”

"News is the excuse for the moves."

You will ask yourself "how did he know Xrp would do that?Here's a simplified summary of my prediction made on 7/23 & 7/28 for my ideal entry.

Feel free to review my Xrp charts on those days to confirm.

I keep stats on my accuracy and so should you.

How else would you know what influencer to actually follow?