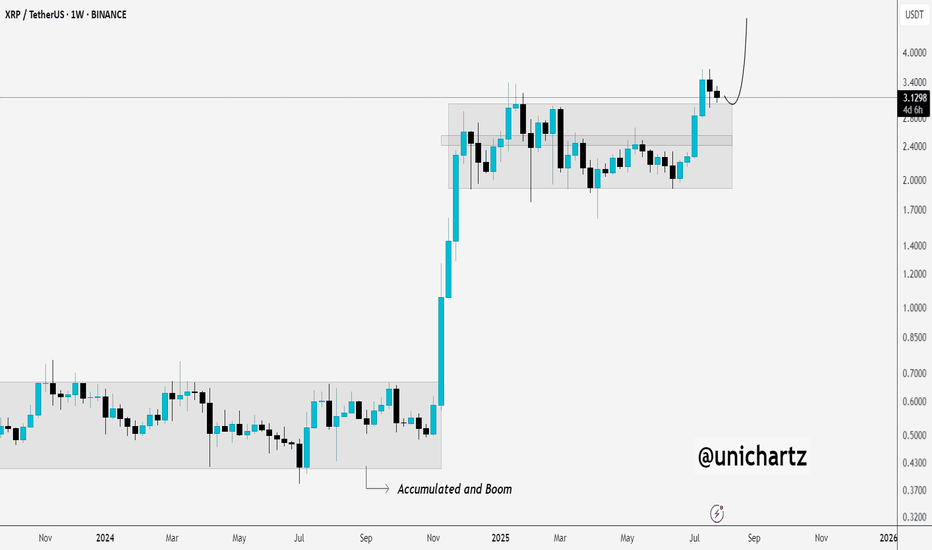

Healthy Retest After Explosive Move – XRP Eyes More UpsideCRYPTOCAP:XRP broke out of a long accumulation range and is now coming back to retest that breakout level, a classic and healthy move.

If this retest holds, we could see the next leg up kick off soon.

Accumulated. Broke out. Now confirming.

DYOR, NFA

Trade ideas

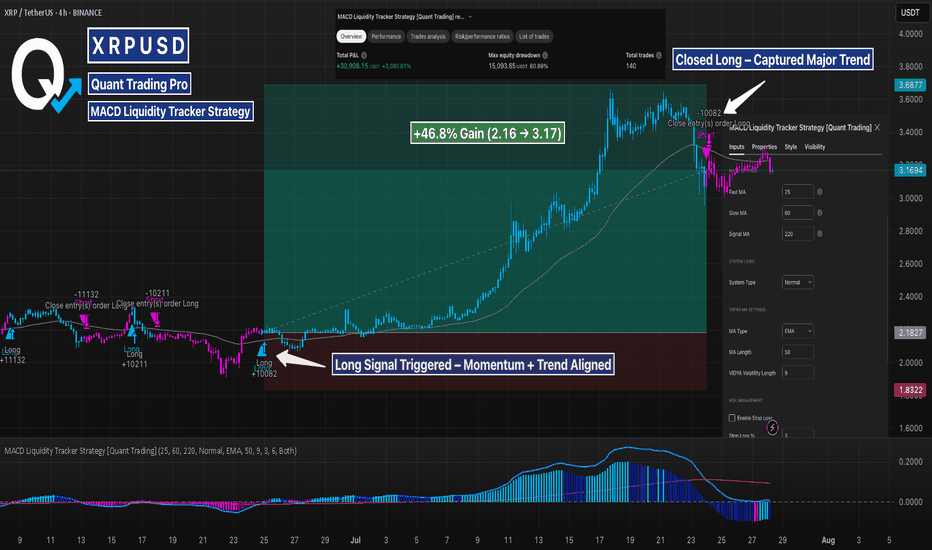

XRP 4H – This Strategy Nailed the Breakout & Tracking SupportThis XRP chart is a textbook example of the MACD Liquidity Tracker Strategy in action. After flipping bullish in late June, the system triggered a clean long and stayed in the move for over 100% before flipping bearish near the local top.

The system didn’t chase or guess — it followed clear logic:

MACD momentum confirmed

Trend aligned with EMA

State flipped blue → long triggered

Exit near top when momentum shifted

Now, XRP is in a bearish state, retesting its prior breakout zone. The MACD histogram remains below zero, and price is below the trend filter — indicating caution. But this is exactly where strategy traders prep for reversals or continuation.

🔍 Highlights:

Clean +100% trend catch

Momentum shift = smooth exit

Currently respecting support = decision zone

Still in “wait” mode — no guessing

This system shines when volatility expands. Perfect for trend traders who want clarity and control — and ideal to backtest.

XRP/USDT Potential Reversal Zone — “Bottom Tested,Bullish Flag!📉 Chart Analysis Summary

The divided chart indicates XRP trading between a critical support zone near $3.05–$3.09 and overhead resistance around $3.19–$3.23, forming what could be a bullish pennant or descending wedge setup on the 30-minute timeframe:

Support Zone (~$3.05–$3.09):

Price retested this level multiple times (labeled as “$$$” and “c”), clearly identifying a demand zone.

Ichimoku cloud support lies nearby, adding technical relevance to the floor.

Resistance Trendline & Green Line (~$3.19–$3.23):

A descending trendline is visible, showing lower highs and building compression.

A breakout above this resistance zone is necessary to signal bullish continuation.

Projected Path:

The schematic arrow suggests a bounce off support, followed by consolidation, and then a breakout above resistance, targeting the $3.25–$3.30+ zone and potentially higher.

🔍 Context from Recent Market Commentary

Support Holding Above $3.11–$3.15: Analysts highlight strong support around $3.11–$3.15, where institutional and retail interest appears concentrated

TradingView

+13

TradingView

+13

CoinCentral

+13

.

Resistance & Consolidation at $3.30: While XRP briefly surpassed $3.30, it encountered rejection and remains rangebound. A confirmed break beyond this level could validate the bullish carry-forward

CryptoPotato

CoinDesk

.

Wave-Elliott Bull Case: Various Elliott Wave scenarios forecast targets as high as $5.25, $6.85, or even $10–$15 should Wave 5 materialize, though this depends on market strength and momentum

CoinCentral

.

✅ Trading Outlook

Bullish Scenario:

Bounce off $3.05–$3.15 support.

Break above $3.23–$3.30 resistance.

Potential upside targets:

Near term: $3.30–$3.40.

Medium term: $4.64 or $5–$6, with strong case for $6.85 if momentum and on-chain demand strengthen

CryptoPotato

+15

TECHi

+15

CoinGape

+15

.

Bearish Scenario:

Failure to hold $3.05–$3.11 risk retest toward $2.95 or lower zones ($2.30–$2.70)

TECHi

.

🧭 What to Watch

Key Level Role

$3.05–$3.11 Critical support/demand zone

$3.19–$3.23 Short‑term resistance/framing compression

~$3.30+ Confirm bullish breakout — key trigger for Wave 5 and higher targets

🧠 Overall Take

This chart is painting a classic consolidation near strong support with a visible descending upper boundary. If XRP holds the ~$3.05 zone and breaks above $3.23–$3.30 with conviction, it could initiate a bull move toward $3.40–$4.00, and potentially even $5–$6+ depending on volume and momentum.

However, breaks below $3.11 may open deeper downside risk. For many traders, this is a simple risk-reward setup: entry near the lower channel with a stop under $3.05 and initial profit targets at $3.30–$3.40.

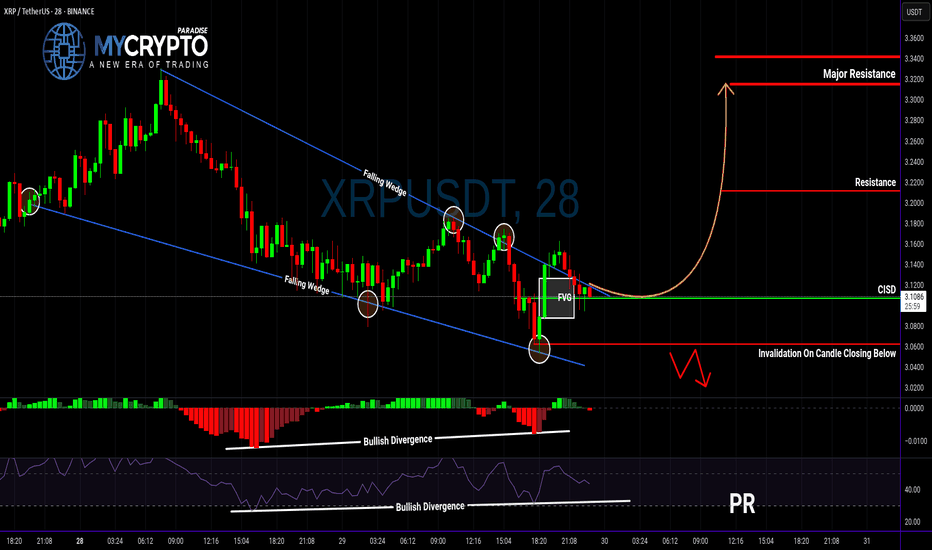

XRP Breakout Could Be a Trap… Or the Start of Something Big?Yello, Paradisers — are you about to buy into a fake breakout or position yourself right before a major move? Let’s break it down before emotions take over.

💎XRPUSDT has officially broken out of a falling wedge — a classic bullish reversal structure. What makes this breakout even more interesting is that it's supported by bullish divergence on both MACD and RSI, plus a Change In State of Delivery (CISD). All these technical signals combined significantly increase the probability of a bullish continuation.

💎Now, if you’re a disciplined trader looking for a safer entry with a higher risk-to-reward ratio, the smart move is to wait for a potential pullback to the CISD level. That would set up an opportunity offering a risk-to-reward of over 1:2.55 — not something you want to ignore.

💎But don’t get too comfortable…

💎If the price breaks down and closes below our invalidation level, the entire bullish idea is off the table. In that case, it’s wiser to stay patient and wait for clearer price action to develop. No emotional entries — only strategic moves.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. That’s how you’ll get inside the winner circle.

MyCryptoParadise

iFeel the success🌴

XRP held the support line ┆ HolderStatBINANCE:XRPUSDT is holding above $0.685 support after a correction from recent highs. Price is stabilizing inside a horizontal channel, with buyers defending the bottom of the range. A clean push above $0.70 would reopen the path toward $0.75. The market is at a decision point with strong reactions at both ends of the range.

XRP 4H — Resistance Flipped to Support, Will Bulls Step In?XRP is pulling back into a key structure zone — the same area that acted as breakout resistance during the July rally is now being retested as support. With momentum resetting and price consolidating on top of this level, the next move could set the tone for the rest of August.

📊 Technical Breakdown:

Structure Retest:

Price is holding between ~$3.00–$3.15 — a major former resistance zone now acting as support after July’s vertical move. Buyers previously stepped in hard above $3.00, and this is the first proper retest since the breakout.

Stochastic RSI:

Deep in oversold territory on the 4H timeframe. Any bullish crossover from this zone would align with a bounce scenario from support.

Volume Context:

Declining volume on the pullback suggests a lack of aggressive selling — a common characteristic before continuation if the level holds.

🔍 What to Watch:

✅ Bullish Setup:

Hold and bounce from this support zone

Break above local highs at ~$3.45 could trigger fresh upside

❌ Invalidation:

Clean close below $3.00 support would shift structure short-term and suggest a deeper retracement (e.g. $2.75–2.85 zone)

XRP often moves in bursts — and this chart has the same setup vibes as the last big leg. If support holds here, don’t be surprised if it’s the ignition point for another breakout.

XRP-Liquidity Sweep Incoming on XRP? Bulls May Be Loading Up! XRP 2H chart is shaping up a classic liquidity sweep play:

📉 Price hunting for sell-side liquidity around $2.90

💰 Equal lows = potential magnet for stop hunts

💎 Expectation: liquidity grab → displacement → aggressive reversal toward $3.65+

XRPUSDT Bullish Breakout Setup – 4H Chart, Fibonacci golden areaEntry: 3.16 (current level)

🛡️ Stop Loss: 2.9 (below range support)

🎯 Targets:

• TP1: 3.39 (local resistance)

• TP2: 4.50

• TP3: 5.40

• TP4: 5.90 (final target from wedge breakout – +75%)

🔍 Setup Details:

XRP is forming a bullish pennant after a strong rally. Price has held key Fibonacci retracement levels and is currently consolidating inside a wedge. A confirmed breakout could lead to a 75% move toward the $5.9 target. Volume confirmation and breakout candle close above $3.39 can accelerate the move.

⚠️ High volatility expected. Use proper risk management.

#XRPUSDT #CryptoAnalysis #Altcoins #TechnicalAnalysis #BreakoutAlert

XRP Update · What To Expect Short-TermRetraces should be considered a buy opportunity. It is the only time when prices are not rising. Whenever there is a stop, a retrace, that is an opportunity to enter or buy more before the continuation of the bullish trend.

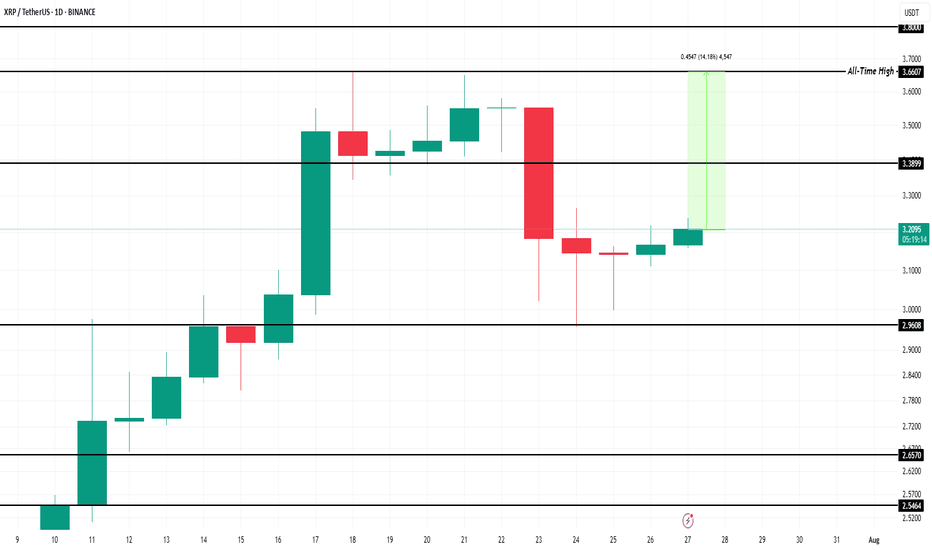

XRP started its latest major advance 22-June growing for 26 days straight peaking 18-July. there were only two red days in the entire move. This is certainly a strong advance and resulted in a new all-time high. More than 90% growth. After a strong move, there is always a pause, or correction or retrace.

A retrace can last a few days. Seeing this chart, here it can even last for weeks as I see no hurry on this chart. Prices can consolidate at support before the next advance. Some small swings are expected but nothing big and always knowing that the end result will be an advance going further toward $4.44. The bigger picture.

Do not try to SHORT within a retrace or even correction. It can lead to disaster. It is better to wait for support to show up and once confirmed buy LONG. The upside has no limitations while the downside is limited. It is harder and carries more risk, even more now that the market is bullish and people are starting to wake up. People can see the development of a major rise now, people are becoming aware and soon there will be a rush. This rush will fuel the next wave of growth.

XRP can consolidate for a little while after finding support before reaching higher. Market conditions remain strongly bullish for this pair. If support breaks, things can change.

Namaste.

XRP MACD Liquidity Tracker Strategy – Clean Trend Catch (4H)This backtest showcases how the MACD Liquidity Tracker Strategy handled a major trend shift on XRP’s 4H chart. The long was triggered once MACD momentum aligned with the 60/220 EMA trend filters — clean confirmation without noise.

The system stayed with the move through a multi-day rally and exited as momentum began to fade. Visual bias (blue = long, pink = short) made trend context easy to follow, and the settings ensured no premature signals during consolidation.

📊 Strategy Inputs:

MACD: 25 / 60 / 220

Trend Filter: 60 & 220 EMA

System Type: Normal

A great example of how combining momentum + trend confirmation filters can remove second-guessing. This is Backtest Idea #1 in a 10-post strategy series.

XRP Bulls Returning We have seen XRP take some dips to 2.99 and reject strong. 3.00 support has been formed and we could see XRP moving to $4 this week if the higher low point is on the charts. Fundementals say that XRP banking is in a pending state, also rumor says that their Lawsuit will be dropped completely this week by SEC. Price action tells its all, we shall wait for come bullish hourly candles until we click the buy button

Ripple (XRP): Seeing Smaller Bullish Movement To AccumilateRipple coin has extended itself heavily since november but what we noticed is how close the 200EMA line on the daily timeframe has come to the market price, which is our main point of interest as of now.

More in-depth info is in the video—enjoy!

Swallow Academy

$500 Million XRP Accumulation To Drive 15% Price Rise to ATHBINANCE:XRPUSDT is currently trading at $3.20, which places it 14% away from reaching its ATH of $3.66. The support at $3.38 is crucial, and securing it could lead to further gains.

BINANCE:XRPUSDT has been seeing significant inflows in the past three days. Over 163 million XRP, worth around $519 million , have been accumulated by investors. This buying surge suggests that a wave of optimism is returning to the market, signaling that investors are positioning themselves for a potential price increase.

If BINANCE:XRPUSDT can reclaim support at $3.38 , it will be well-positioned to push past its ATH and reach new highs. This would mark a significant milestone for the altcoin, setting the stage for further price gains.

However, should the investor sentiment shift and selling pressure increase, BINANCE:XRPUSDT could face a decline. If the price falls below $3.00, it could slide to $2.96 or lower , invalidating the bullish thesis.

XRP Range-Bound After Breakdown — Compression Before Expansion?XRPUSDT 30m chart paints a neutral picture after a strong rejection from mid-range support last week. Price flushed into the $3.03 demand zone and bounced hard — but has since stalled and formed a tight sideways range between $3.03 and $3.25.

Momentum has reset (Stoch RSI near midline), and the market is clearly undecided. Structure currently favors neither bulls nor bears — and volume is thinning. Traders watching for a breakout from this compression box may catch the next directional move.

Key zones:

$3.25 = Range resistance

$3.03 = Demand zone

Mid-range chop = No-man’s land — best to wait for confirmation

Neutral bias until range breaks.

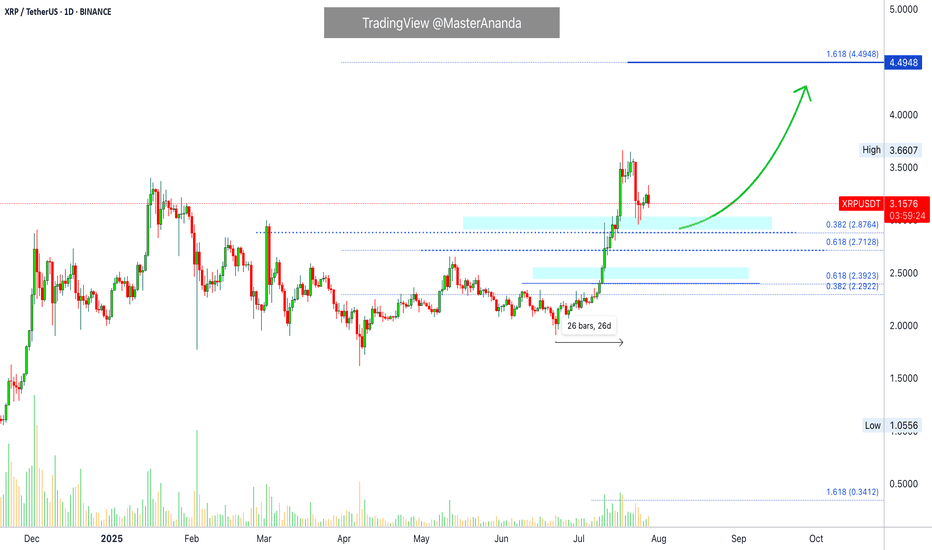

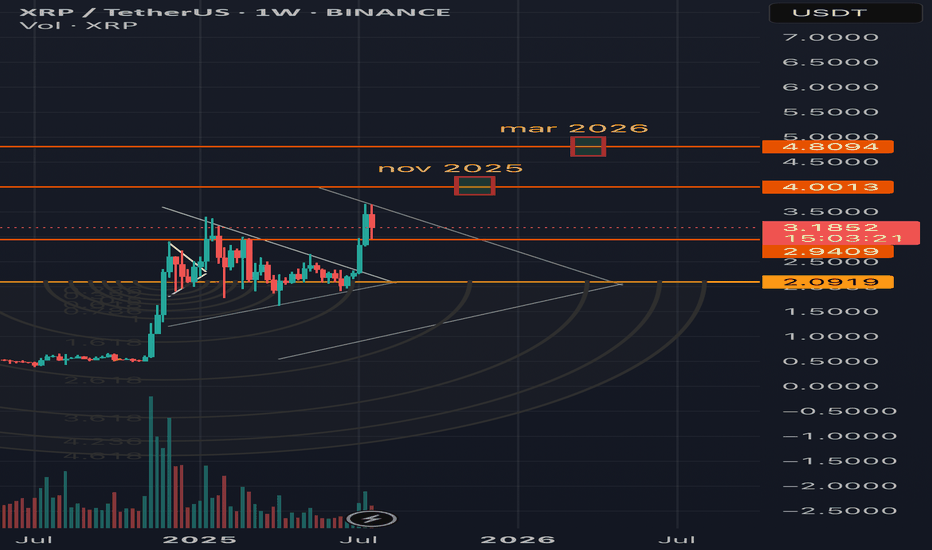

XRP prediction🔍 XRP/USDT Weekly Analysis

📊 Technical Overview:

• XRP recently broke out of a long-term descending trendline with strong bullish momentum.

• Key support zone now rests around $2.09 – previous resistance turned support.

• Price is currently consolidating around $3.18 after a strong impulse move.

🎯 Targets:

• First target:

🔸 $4.00 expected around November 2025

• Second target:

🔸 $4.80 expected around March 2026

These targets align with Fibonacci arc projections and historical resistance levels.

📈 Trend Strength:

• Breakout backed by strong volume suggests momentum is sustainable.

• If price holds above $2.94, bullish continuation is likely.

⚠️ Risk Levels:

• Losing support at $2.09 could invalidate the bullish setup and push price back to the lower range.