Trade ideas

Short ZEC at $173.76 I drew this line years ago at $173.76. I doubt late buyers are going to get rewarded buying ZEC after such a big week. ZEC has been around since 2016 and the fundementals have not changed significactly. What makes you think ZEC is going to make new highs? People say they love privacy but in reality, never use it. The people who actually need privacy for illegal things use XMR. You won't find any of them using ZEC. Sentitment is also very high. There's never been so much talk about ZEC.

However I'm bullish on alts in general, and I think we could eventually see $800 ZEC this cycle, but shorting this nearly decade long resistence is worth the risk/reward.

ZCASH Wave Analysis – 9 October 2025- ZCASH broke key resistance level 174.20

- Likely to rise to resistance levels 200.00 and 220.00

ZCASH cryptocurrency recently broke above the key resistance level 174.20 (which stopped the previous minor impulse wave i at the start of this month).

The breakout of the resistance level 174.20 follows the earlier upward reversal from the support level 120.00 coinciding with the 38.2% Fibonacci correction of the upward impulse from August.

Given the clear daily uptrend, ZCASH cryptocurrency can be expected to rise to the next resistance levels 200.00 and 220.00 (target price for the completion of the active impulse wave (C)).

Zcash Breaks 2018 Downtrend: Confirming a Multi-Year Bull Run Zcash has just broken a trendline that had been in place since 2018. Even though the movement of the last few days might seem exaggeratedly wide, in reality, it's just the confirmation of the start of a bullish trend that will likely last for years. From both a technical and fundamental analysis perspective, it's one of the 5 most interesting coins in absolute terms. It has been undervalued for years due to fears of delisting and FUD, but institutional investors have bet heavily on it while retail investors were discouraged. That said, I wouldn't enter a position at this price, but possibly around $80-100. Personally, I've accumulated for years below $40, but on this confirmation, I'd definitely add capital. The next important resistance is the last reversal point from the previous cycle, so around $300. Dips around $100 are to be bought if they are granted. Thanks to everyone for the attention.

ZEC PERPETUAL TRADE SELL SETUP Short from $159ZEC PERPETUAL TRADE

SELL SETUP

Short from $159

Currently $159

Targeting $151 or Down

(Trading plan IF ZEC

go up to $176 will add more shorts)

Follow the notes for updates

In the event of an early exit,

this analysis will be updated.

Its not a Financial advice

Zcash working on filling out right shoulder for next breakout Zcash appears to be forming a special inverse head and shoulders pattern I like to refer to as the sweet dreams or sleepy head inverse head and shoulders as the trendline you draw to highlight the head and shoulders take on a smile face with its eyelids closed. I anticipate even though I already drew the hypothetical length of the right shoulder fairly s that there’s a chance it could break above the neckline after forming an even shorter right shoulder based on some of the recent tiny right shoulders we’ve seen fro the likes of digibyte, atom, cardano and others. Always a chance since it’s left shoulder was tiny that the right one could buck the trend and form a regular sized right shoulder too, either way I’m confident with market conditions how they currently are theat probability favors this pattern breaking out and up eventually. *not financial advce*

Zcash Wave Analysis – 30 September 2025

- Zcash broke key resistance level 76.75

- Likely to rise to resistance level 100.00

Zcash cryptocurrency recently broke above the key resistance level 76.75 (former yearly high from last year, which also reversed the price in the middle of 2022).

The breakout of the resistance level 76.75 accelerated the active intermediate impulse wave (C) of the primary ABC correction 2 from the start of 2025.

Given the multi-month uptrend and the strongly bullish sentiment seen across the cryptocurrency markets, Zcash cryptocurrency can be expected to rise to the next round resistance level 100.00.

ZEC Bout to Flex and Bust Out - Targets on ChartConfirmed a close above an ascending triangle following a decade long destruction of bagholder capital.

Even the tattoo motorcycle guy probably got his ZEC tat from 2017 erased from his arm.

We also closed a substantial level in this multi year sideways chop range that just today confirmed.

280 first then 1750.

20k in the cards SEED_DONKEYDAN_MARKET_CAP:ZEC

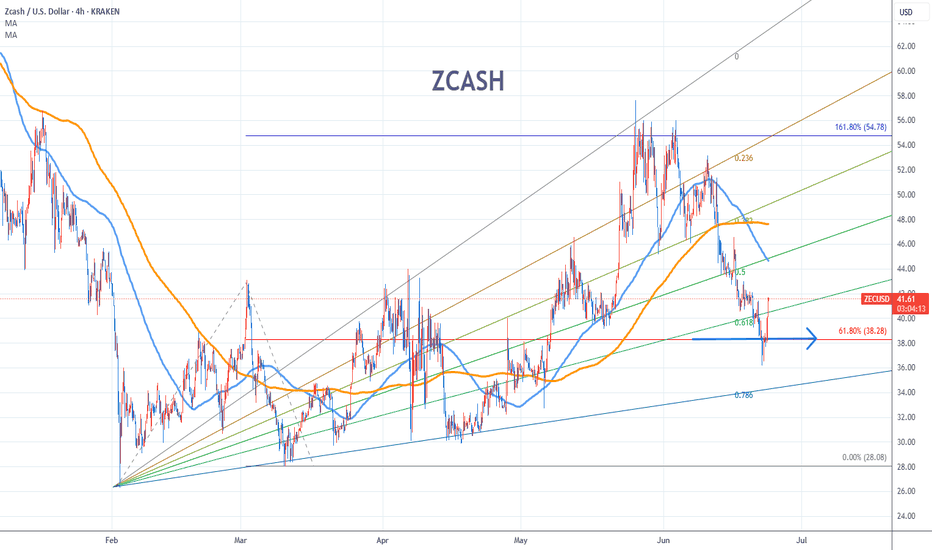

Mr.Zecash Loves 61.8Zcash has provided us with a very rare pattern

its 3 cup and handles inside one another.

we now know that it loves to hold support at the 61.8 % fib level on the previous 2

retracements.

so we have to wait and respect its wishes and join it at the 61.8 % fib level.

the target on this move is pretty decent .

ZECUSD is testing crucial support at $22.50 after breaking belowZECUSD is testing crucial support at $22.50 after breaking below its 200-day moving average. Daily chart shows a descending triangle formation with volume declining consistently, indicating weakening bullish momentum. The next key support level awaits at $21.80, which coincides with the March 2023 low.

RSI sits at 38, approaching oversold territory but not yet signaling reversal. MACD lines remain below zero with bearish divergence, though the histogram shows minor convergence, suggesting selling pressure may be moderating. Immediate resistance appears at $24.20 (previous support turned resistance), with stronger resistance at $25.80.

The privacy coin sector continues facing regulatory headwinds, particularly affecting ZEC's institutional adoption prospects. Trading volume remains below average for the third consecutive week, reflecting lack of conviction. A break below $21.80 could trigger accelerated selling toward $20.00 psychological level.

Zcash Stock Chart Fibonacci Analysis 082225Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 38.9/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If you want to prefer long term range trading, you can set the time frame to 1 hr or 1 day

Zcash Stock Chart Fibonacci Analysis 062325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 38.3/61.80%

Chart time frame:C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Falling Wedge Pattern For ZCash??When a security's price has been falling over time, a wedge pattern can occur just as the trend makes its final downward move.

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline.

Before the lines converge, the price may breakout above the upper trend line.