Trade ideas

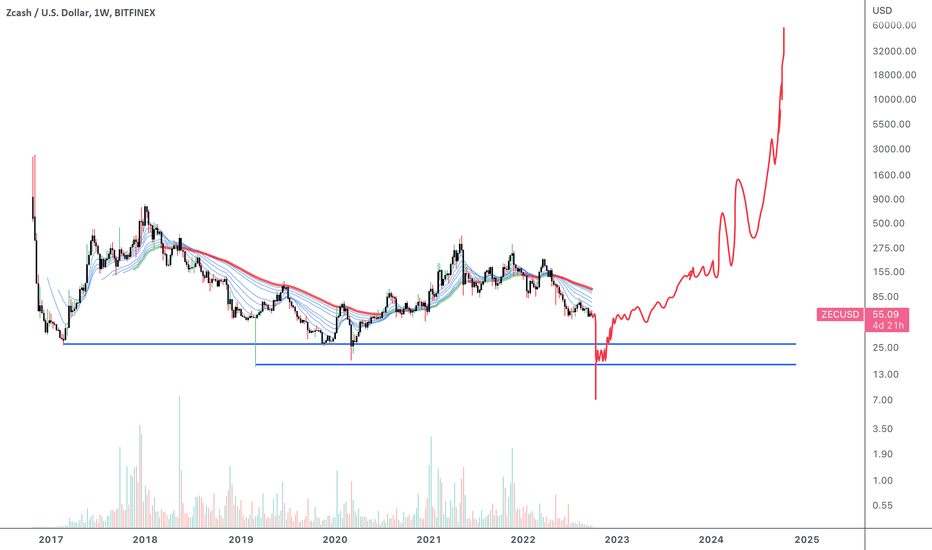

ZEC, forming a double head decline.The following content is machine translation:

In the 1-hour chart, after breaking through the 70 resistance, it pulled up and stepped back to 70 and continued to rise sharply to 82. At present, it has formed a double-headed decline near 82, and there is support at 75.

The top of the indicator macd diverged from the bearish trend and the top of the RSI indicator diverged below the neutral 50 to reach bearish territory.

Summary: The double-headed falling pattern and bearish indicators have a high probability of continuing to fall. Operationally, below 75 support and look around 70.

ZECUSD broke above the 1D MA100, first time since April.Zcash (ZECUSD) broke today above its 1D MA100 (green trend-line) for the first time since April 29. Coupled with the emerging Bullish Cross on the 1W time-frame, this is most likely a bullish extension signal, targeting the 1D MA200 (orange trend-line) and the 0.618 Fibonacci retracement level (122.00).

It would be best to wait for a 1D candle close above the 1D MA100 to have a confirmed signal, otherwise we may get one last pull-back to the 1D MA50, presenting the best buy opportunity.

--------------------------------------------------------------------------------------------------------

Please like, subscribe and share your ideas and charts with the community!

--------------------------------------------------------------------------------------------------------

ZEC, breaking the resistance.The following content is machine translation:

In the 4-hour chart, since mid-June, it has repeatedly tested the resistance near 70 and has fallen back. It has now broken through the 70 resistance mark and is rising.

The bullish trend of the indicator macd refuses to fork, the RSI indicator reaches the overbought area, and the bulls are strong.

Summary: The pattern breaks through the resistance and the indicator is bullish. Next, it will rise and fall to the vicinity of 70 to grasp the low and more, and look at the vicinity of 80.

ZTC, is close to the previous low.The following are machine translations:

In the 4-hour chart, the front head and shoulders fell, forming a downtrend line.

Indicator macd golden fork, RSI indicator rose from the oversold zone.

Summary: The pattern rebounded from the previous low and reached the downtrend line, and the indicator was golden fork and uptrend. It is expected to break through the downtrend line, break through to do more, and fall back to the vicinity of 52 if it is blocked.

ZEC, a head and shoulders pattern.The following content is machine translation:

On the 4-hour chart, a head-and-shoulders pattern, currently below the neckline, is bearish.

The indicator macd has a bearish trend, and the fast and slow lines have fallen to the zero axis. The RSI indicator fell below the neutral 50 and the rally was capped at 50, continuing the bearishness.

In operation, grasp the high altitude and look down at the vicinity of 56.