ZKUSDT — Descending Triangle Key Support, Breakout or Breakdown?Full Analysis

On the 2-day timeframe, ZKUSDT is forming a very clear descending triangle pattern:

Downtrend line (yellow) shows sellers’ dominance with consecutive lower highs.

Horizontal support zone (yellow box 0.0366 – 0.0531) is still being defended multiple times, showing that buyers are not giving up.

Price is now moving near the triangle apex, meaning a major decision point is approaching soon.

📉 Traditionally, descending triangles lean bearish, but in crypto markets, bullish fakeouts often happen when buyers step in strongly around critical demand zones.

---

Pattern and Market Dynamics

1. Volatility Compression: Price range is narrowing, volume decreasing — a build-up phase before an explosive move.

2. Buyer Defense: The 0.0366 – 0.0531 support zone has become a crucial demand area. Each dip has been absorbed by buyers.

3. Seller Pressure: Meanwhile, sellers consistently push price lower, creating the descending trendline.

4. Apex Zone: The convergence of trendline and support will decide the next major direction.

---

Bullish Scenario

If price closes a 2D candle above the descending trendline with strong volume, then:

Immediate upside targets:

0.0653 (minor resistance)

0.0800 (psychological level & supply zone)

0.0943 (strong resistance)

Extended targets:

0.1094 → if the altcoin market recovers further

0.1451 → confirmation of a medium-term reversal

From the current level, upside potential could reach +170% if the bullish scenario fully plays out.

---

Bearish Scenario

If price closes below the support box (0.0366 – 0.0531) and confirms with selling volume, then:

Initial target: 0.0366 (recent low)

Next target: around 0.0200 (psychological zone)

Extreme case: down to 0.0100 if panic selling occurs

From current levels, downside risk could be as deep as −80% in a worst-case breakdown scenario.

---

Pattern Conclusion

Descending Triangle = Neutral–Bearish bias, but no breakout yet.

Price is entering the “last squeeze” phase — the market is about to decide direction in the coming weeks.

Breakout or breakdown with volume will be the ultimate confirmation.

---

Strategy & Risk Management

Conservative traders: Wait for breakout/breakdown confirmation on the 2D close, enter on the retest with a tight stop-loss.

Aggressive traders: Can start accumulating near support with SL below 0.0366, targeting 0.0653–0.0800.

Reminder: Fakeouts are common in descending triangles — do not over-leverage without confirmation.

---

ZKSync (ZKUSDT, 2D) is standing at a major crossroad. A descending triangle is nearing its apex, with sellers pressing down and buyers defending the key 0.0366 – 0.0531 support.

Bullish case: breakout above trendline → targets 0.0653 – 0.1451

Bearish case: breakdown below support → targets 0.0366 down to 0.0200 or even 0.0100

🚨 The next move will decide: is ZK ready for a major rally, or a deeper fall?

Watch the 2D close + volume for confirmation.

#ZKSync #ZKUSDT #CryptoAnalysis #Altcoins #DescendingTriangle #CryptoBreakout #SupportResistance

ZKXUST trade ideas

ZKUSDT | Range Defined by Blue and RedOn ZKUSDT, the blue box is acting as demand support while the red box marks firm resistance. For now, the structure is capped within this range.

I’m specifically watching the order flow:

Volume footprint shows clear absorption inside the blue box buyers quietly stacking bids.

CDV is still flat; I want to see it tilt upward before trusting the breakout.

If price pushes through the red box with volume, and CDV confirms the move with positive divergence, then a retest of that level becomes a clean long setup. Until that happens, patience is the edge.

Smart trades come from volume confirmation, not guessing the breakout.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ZK Secondary trend.-82% Wedge. Reversal zones. 01 05 2025Logarithm. Time frame 3 days. Decrease from listing about -82%. For cryptocurrencies of such liquidity and capitalization, this is not the maximum decrease (-90-96%). But sometimes from such values as now (-82-85%), taking into account the news hype during the listing "whales $ 458 million", a reversal and strong pumping can occur under the market as a whole. For example, like another hype project of "hanging noodles" - Flare (distributed to XRP holders). Decrease by -82% and then pumping slightly above the listing price under the next alt season of the cycle + 560%.

This does not necessarily mean that this will happen, this is an example of what happens from such values of decline with such liquidity and hype. In some ways, not only in the structure of the TA formation, but in the hype and disappointment of "investors", the projects are identical.

Main trend , and the previously shown zone, in which the price is now.

ZkSync Main trend. L2 for ETH. $458 million funds 21 02 2025

Main trend now in the moment (full trading history).

There is no need to guess the minimums and maximums. It is important to know these zones and have an acceptable average price, from the position of the trend and its potential. It is regulated by the distributed entry volume (in advance) at potential reversal zones.

ZK Breakout PotentialGiven its recent uptrend and second attempt to break resistance, BINANCE:ZKUSDT shows strong potential to decisively overcome its downtrend and initiate a significant upward wave. A closer look at the chart provides a more detailed perspective.

⛔ Disclaimer: No Guarantee of Profit or Loss

Please be aware that all investments, trading, and financial decisions involve risk. The information provided is for general informational purposes only and should not be considered as financial advice. We do not guarantee any specific outcomes, profits, or returns.

You are solely responsible for your own investment decisions. The past performance of any investment or strategy is not a reliable indicator of future results. We recommend conducting your own research and consulting with a qualified financial advisor before making any financial decisions.

By using this information, you acknowledge that you will not hold us liable for any losses or damages incurred as a result of your financial activities.

ZKUSDT - your capital will be doubled on thisIf you want to double your capital in a short period, then ZK is the coin to focus on.

-It’s still at the bottom.

-It formed a symmetrical triangle and already broke out, now doing a retest.

-There’s also an inverse head & shoulders pattern in play.

-Currently sitting right on the 25 EMA support on the daily timeframe.

Buy it spot, and you’ll thank me later.

Best Regards:

Ceciliones🎯

ZKUSDT 1D#ZK has broken above the descending trendline and completed a successful retest on the daily chart. It has also broken above the daily SMA200, which is a strong bullish sign. In case of a successful retest of the SMA200, the potential targets are:

🎯 $0.08057

🎯 $0.09415

🎯 $0.10773

🎯 $0.12707

🎯 $0.15170

⚠️ As always, use a tight stop-loss and apply proper risk management.

ZKUSDT Long Setup – Aug 15, 2025

ZKUSDT Long Setup – Aug 15, 2025

Entry: 0.06431

Target: 0.0733 (+15.2%)

Stop: 0.0620 (-3.5%)

R:R: 4.32

I'm currently in this after profiting from the peak formation short and then reversing for the longer term trend.

Why Long?

• Multi-timeframe structure: Higher lows forming on 4H, daily, and weekly after long

downtrend.

• Volume profile: Bullish volume spikes on rallies, light volume on pullbacks.

• Indicators: MACD bullish crosses, CCI > 100, RSI divergence across higher TFs.

• Market context: Price breaking out of accumulation zone (0.062–0.064), aiming for next liquidity pocket near 0.073.

•. bullish ETH and other coins many follow with a lag behind

Execution

• Entry after London pullback to demand zone and BOS confirmation.

• Stop below demand zone 0.0614.

• Target set at prior daily supply zone.

Risk Plan

• 4.32 Risk to reward potential.

• Monitor 0.067–0.068 zone; partial profits if strong rejection.

Bulls have taken short-term control, with potential to push toward 0.073–0.075 before major resistance.

#ZK/USDT Trendline Break #ZK

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is poised to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.05688.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward move.

There is a key support area (in green) at 0.05628, which represents a strong basis for the upward move.

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend of stability above the Moving Average 100.

Entry price: 0.05665

First target: 0.05866

Second target: 0.5982

Third target: 0.06144

Don't forget one simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

ZKUSDT Forming Symmetrical triangleZKUSDT has just broken out from a symmetrical triangle pattern, a technical formation that often signals a strong continuation move once resistance is breached. This breakout, supported by good trading volume, reflects growing bullish momentum as buyers step in with conviction. The projected potential gain of 60% to 70% makes this setup particularly attractive for swing traders and investors looking for short- to mid-term opportunities in the altcoin market.

The chart indicates that ZKUSDT has been consolidating within this pattern for several weeks, gradually tightening price action and building pressure for a decisive move. The breakout candle has closed above the resistance trendline, which is a strong confirmation signal for further upside movement. If bullish momentum continues, the next significant resistance levels could be reached quickly, aligning with the expected gain target.

Investor sentiment toward ZKUSDT is turning increasingly positive, driven by the technical breakout and solid market participation. With momentum on its side and market attention growing, ZKUSDT is positioned for a potential extended rally in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ZK/USDT — Testing Long-Term Downtrend: Breakout or Rejection at?Summary

The daily chart shows a clear long-term downtrend from the previous highs — the descending trendline (yellow) has been capping price action, forming a sequence of lower highs and lower lows. Currently, price is hovering around 0.0591 USDT, testing both the trendline resistance and a key horizontal resistance at ~0.06173 (red dashed). Since the low at ~0.0366 (June), the market has been slowly forming higher lows, suggesting potential accumulation, but the main downtrend structure is still intact until a confirmed breakout occurs.

---

Pattern Overview

Descending trendline (yellow) = downtrend structure remains valid until a daily close above it.

Accumulation signs from the 0.0366 low → forming several higher lows.

Key resistance: 0.06173 (decision zone).

Next resistances (yellow dashed): 0.07999 → 0.11475 → 0.15566 → 0.22443 → 0.26273 → 0.27270.

Key support: ~0.042 (intermediate) → structural low at 0.03660.

---

Bullish Scenario (confirmation needed)

1. Breakout confirmation: A daily close above the descending trendline and above 0.0617 with stronger-than-average volume.

2. Post-breakout behavior: Potential retest of the broken trendline as support — a conservative entry point.

3. Upside targets:

Target 1: 0.07999 (~+29% from 0.06173; ~+35% from current price 0.05907)

Target 2: 0.11475 (~+86% from 0.06173)

Extended targets: 0.15566 → 0.22443 → 0.26273 → 0.27270

4. Risk management: Initial stop-loss under retest zone or, for aggressive entries, just below breakout candle’s low.

---

Bearish Scenario (rejection/failure)

1. Rejection at 0.0617 / trendline: If price fails to break and closes bearish with upper wicks, a pullback toward support is likely.

2. Support watch: ~0.042 (intermediate) → 0.03660 (structural low).

Downside from 0.0617: ~−29% to 0.042, ~−38% to 0.0366.

3. Further risk: A daily close below 0.0366 could trigger continuation of the major downtrend.

---

Key Levels (Quick View)

Current: 0.05907

Breakout trigger: 0.06173

Targets: 0.07999, 0.11475, 0.15566, 0.22443, 0.26273, 0.27270

Supports: ~0.042 → 0.03660

#ZK #ZKUSDT #Crypto #Altcoin #TechnicalAnalysis #TA #Trendline #Breakout #PriceAction

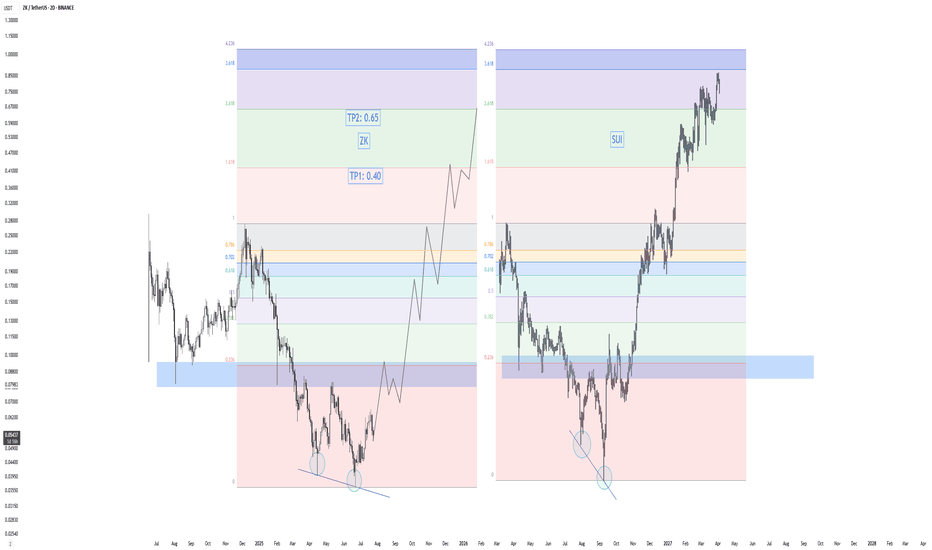

ZK - Golden opportunity? 0.40? Hello everyone, here’s my new analysis on ZK.

Recently, the price surged nearly 80%, followed by an 18% pullback over the last two days. From its all-time high, ZK is currently down about 80%, which in my opinion presents a golden opportunity.

Based on my research, the peaks of altseasons often occur between December–January or April–May. After analyzing the Others Market Cap dominance chart, I believe we’re setting up for a strong altseason in the next 5 months. Over the last few years, BTC has significantly outperformed altcoins—but recently, I’ve noticed a major shift in market dynamics, indicating that capital might be rotating back into alts.

On the chart, ZK is showing a classic crypto crash-recovery pattern. For example, SUI dropped around 80–85% before rallying over 1000% in just 4 months. I see a strong structural similarity between the bottoming pattern of SUI and the current structure of ZK.

If ZK breaks the resistance zone at 0.080–0.095, I expect a rapid move up toward 0.22–0.26. After that, a healthy correction around the previous ATH would be expected—before potentially heading to 0.40 as Take Profit 1 (TP1).

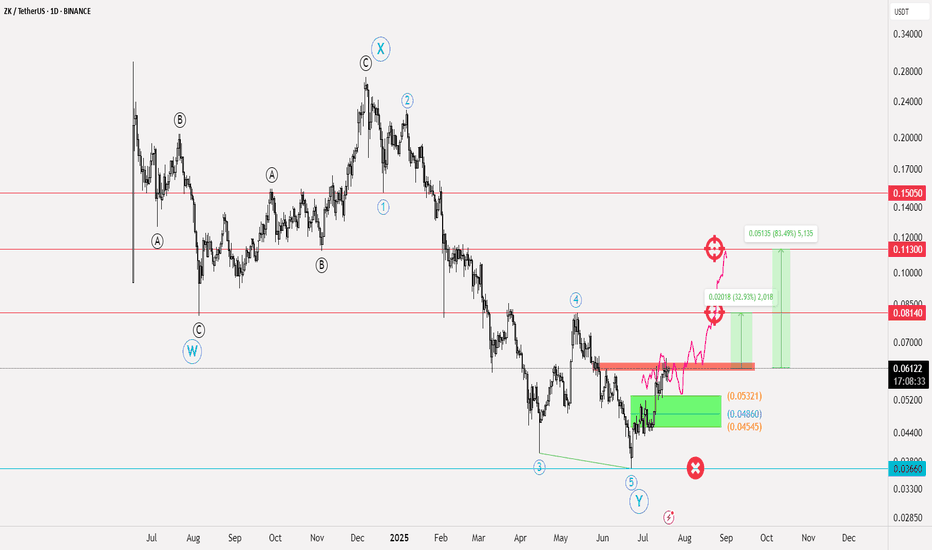

ZKUSDT Elliott Waves analysis📝 Currency NYSE:ZK

✅ Entry points for the currency: at the current price of 0.06135, the reinforcement should be within the range of 0.05321 - 0.04860

🔴 Stop loss is below 0.03660

💹 Potential targets: first target 0.08140 and if the currency enters a bullish wave, the target will be towards 0.1130, reaching up to 0.150

📊 The profit-to-loss ratio is 5:1

📝 This idea is based on Elliott Waves analysis, especially since the beginning of the currency's listing, where a WXY pattern formed, and this pattern was confirmed after the upward rebound from 0.03660, which we considered as our stop loss. The liquidity range is the range we defined for reinforcement; its stability will give momentum and strength to the currency to complete an upward path, at least achieving a trend towards the peak of wave 4

❤️ Good luck to everyone - do not enter any currency before studying the risk ratio you will undertake

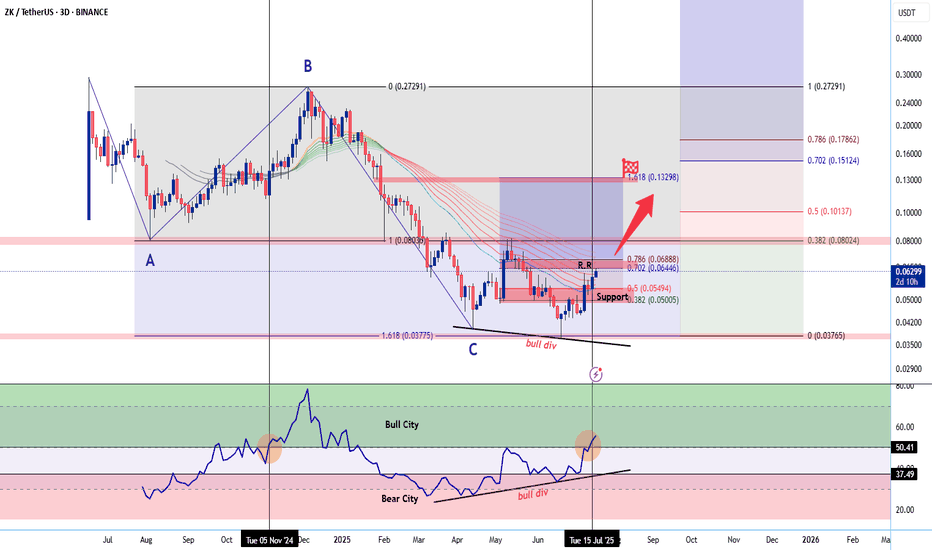

ZK/USDT📢 ZK/USDT Swing Trade Plan – July 18, 2025

🧭 Bias: Macro reversal confirmed (3D/1W)

• OB reclaim ✅

• Bullish divergence on RSI ✅

• Volume uptick + clean invalidation structure ✅

• 1W TD Sequential reset complete

⸻

🎯 Entry Zone (Spot Accumulation):

✅ $0.0585 – $0.0635

→ 3D OB zone + 0.5 Fib + previous demand flip

🧪 Panic Add Zone:

⚠ $0.0540 – $0.0500

→ Key macro HL + 0.5–0.382 Fib cluster (do not miss if wick flush)

⸻

🚫 Stop-loss:

• Hard SL: Daily close < $0.0500

• Structure invalidated + macro HL failure

⸻

🎯 Targets (Fib extension + structure-based):

🎯 TP1: $0.0688 → 0.786 Fib + last supply tap

🎯 TP2: $0.0803 → structure resistance + fib pivot

🎯 TP3: $0.1013 → 1.0 Fib extension (cycle mid-target)

🚀 TP4: $0.1329 → 1.618 Fib extension (macro swing)

Once TP 4 cleared we reevaluate

⸻

📊 Structure Notes:

• Macro HL printed

• 3D RSI hidden bull div confirmed

• Volume and OBV recovering

• 1W TD reset (expect continuation toward TP2+)

⸻

🧠 Mindset:

This is not breakout chasing — it’s macro HL spot positioning.

Let time + structure work.

Final entries are optimal, stop is clean, upside is 2–4x.

📛 Invalidation = Daily close < $0.0500

No excuses if that breaks.

zkSynch · 988% in the Coming Months · 2025 Bull MarketHere is another pair that is safely trading above EMA55. Notice that after this level was initially conquered 10-July what followed was a retest. Two red candles pushed prices lower and the level held as support. With this, EMA55 is now confirmed and zkSync can easily grow. Mid-term.

When the trading goes above EMA89 we say the long-term bias is active, and only when the close happens above the next EMA (or MA) we can say the long-term bias is confirmed. Just some technicalities but please, follow me.

We can theorize about the bottom low, the correction & retrace or, we can go straight to just what you want to know. Let me guess... How far up can ZKUSDT (zkSynch) go? Right? Of course!

The new all-time high targets, conservative targets, sit at $0.41 (598%) and $0.65 (988%). There is an easy target before reaching a new ath at $0.18 for 208%. You can use this one if you like to trade more based on the short-term but if you want higher profits you need to aim higher. You have to wait.

The wait is not long because bullish action is already on. It is already happening and will continue to happen; growth will intensify; momentum will grow. Market hype, prices shine, aiming high, ride the ride of your life to a new all-time high.

The timing is right you can't go wrong. There is nothing better than buying today and tomorrow seeing your portfolio 100% up, that's only the start. Expect 20-30X grow by the time the bull market is set and done.

2 months only? I don't think so. Crypto is set to grow long-term.

Plan now, prepare now and reap the reward. Persistence, perseverance and consistency pay. Work hard and smart. Do you what you want. You are blessed and you deserve the best.

Namaste.

ZK — Trendline Break & FVG RetestHTF sweep + FVG retest + trendline break — clean R/R setup. Enter after confirmation, main target $0.0806, stop below $0.043.

1. Buy zone: $0.043–0.049 (FVG + trendline retest)

2. Enter after clean reclaim above trendline

3. Main target: $0.0806

4. Stop: below $0.043

If fails to reclaim — stay flat

ZKUSDTCryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn

VETUSDTCryptocurrency Futures Market Disclaimer 🚨🚨🚨

Trading cryptocurrency futures involves high risks and is not suitable for all investors.

Cryptocurrency prices are highly volatile, which can lead to significant gains or losses in a short period.

Before engaging in crypto futures trading, consider your risk tolerance, experience, and financial situation.

Risk of Loss: You may lose more than your initial capital due to the leveraged nature of futures. You are fully responsible for any losses incurred.

Market Volatility: Crypto prices can fluctuate significantly due to factors such as market sentiment, regulations, or unforeseen events.

Leverage Risk: The use of leverage can amplify profits but also increases the risk of total loss.

Regulatory Uncertainty: Regulations related to cryptocurrencies vary by jurisdiction and may change, affecting the value or legality of trading.

Technical Risks: Platform disruptions, hacking, or technical issues may result in losses.

This information is not financial, investment, or trading advice. Consult a professional financial advisor before making decisions. We are not liable for any losses or damages arising from cryptocurrency futures trading.

Note: Ensure compliance with local regulations regarding cryptocurrency trading in your region.

thanks for like and follow @ydnldn

Need to be careful.A new downward wave may occur. Need to pay attention.

The market is very enthusiastic about Ethereum, we need to be cautious in these exciting moments.

* The purpose of my graphic drawings is purely educational.

* What i write here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose your money.

ZK/USDT Buy the Silence?A familiar cycle:

▪️ Hype peak

▪️ -80%+ crash

▪️ Silence

▪️ Consolidation

We're likely somewhere between phase 3 and 4.

Retail has moved on. Volume is dead.

But the chart is quietly forming a structure.

This is when real positions are built — the kind people tweet about after the breakout.

While ETH is stuck in sideways motion, L2 narratives remain asleep.

But not forever.

Sooner or later, big players will return to the scalability game.

And when they do — low-cap L2 tokens like this one get their second chance.

The only question is:

Will you be the one who sold the bottom,

or the one who bought the silence?

ZKUSDT breakdown alertZKUSDT breakdown alert

ZKUSDT has broken down from a triangle pattern, signaling potential bearish momentum. The price has slipped below the triangle’s lower support line, suggesting that sellers are gaining control and further downside could follow if the move holds.

This kind of pattern breakdown often leads to increased volatility and downward continuation. However, if ZKUSDT reclaims the breakdown zone quickly, it might invalidate the move and trap late sellers.

Key levels to monitor:

* Breakdown zone (previous support)

* Immediate lower support areas

* Volume confirmation

Watch closely — if the breakdown holds, ZK could continue its decline in the coming sessions.